Crypto Market Update: Industry Moves Toward Tokenization, On-chain Equities

Elsewhere in the crypto sector, US lawmakers introduced the SAFE Crypto Act after FBI data showed Americans lost about US$9.3 billion to crypto investment scams in 2024.

Here's a quick recap of the crypto landscape for Wednesday (December 17) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

Bitcoin (BTC) was priced at US$86,016.06, down by 1.9 percent over 24 hours.

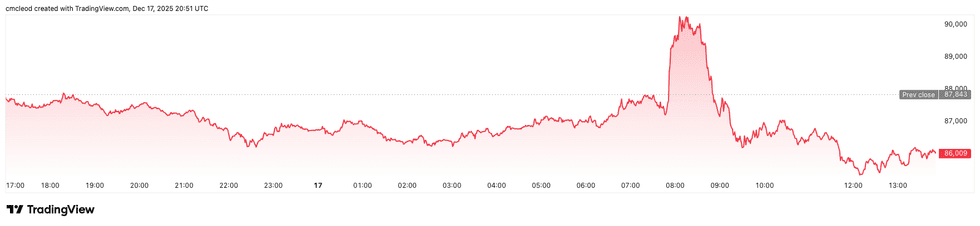

Bitcoin price performance, December 17, 2025.

Chart via TradingView.

Bitcoin spiked to US$90,000 in early trading, then whipsawed down to around US$86,400, showing volatile liquidity grabs and rejection at overhead supply. Weak spot demand indicates a bearish tilt, but institutional dip-buying hints at stabilization near supports between US$85,000 and US$86,000.

Price dips near the critical US$81,500 true market mean support risks a bear market plunge if lost.

ETH (ETH) was priced at US$2,820.64, down by 4.5 percent in 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.88, down by 2.6 percent over 24 hours.

- Solana (SOL) was trading at US$123.07, down by 4 percent over 24 hours.

Today's crypto news to know

Solana to test quantum-resistant cryptography with Project Eleven

Solana has partnered with Project Eleven to test quantum-resistant cryptography on a working testnet.

Current blockchains like Solana use encryption vulnerable to quantum computers, expected as a threat to DeFi in 5-15 years. Project Eleven, a cybersecurity firm specializing in post-quantum cryptography, ran a full threat assessment on Solana's wallets, validators and signatures, and has built a prototype testnet using post-quantum digital signatures, showing end-to-end transactions stay fast and scalable without performance hits.

Depository Trust, Digital Asset, Canton Network partner to tokenize US treasuries

Depository Trust & Clearing has announced a partnership with Digital Asset Holdings and the Canton Network. Together they will work to enable tokenization of a subset of US treasury securities custodied at Depository Trust & Clearing's subsidiary on the permissioned Canton blockchain.

This news follows last week's announcement that the US Securities and Exchange Commission (SEC) has issued a no-action letter approving Depository Trust & Clearing's three year pilot to custody tokenized stocks, bonds, exchange-traded funds and treasuries on approved blockchains.

Securitize launches compliant on-chain platform for tokenized equities

Securitize announced it is launching the first compliant, on-chain platform for trading tokens representing actual legal ownership of a public stock in Q1 2026. The tokens will be recorded directly on the company’s official cap table and carry full shareholder rights such as dividends and voting. Investors will be able to buy, sell and self-custody them 24/7 on-chain via a DeFi-style swap interface, using stablecoins, while staying compliant through whitelisted wallets and KYC.

Unlike wrappers or offshore proxies, which add counterparty issues, Securitize plans to issue the tokens natively as regulated securities via its SEC-registered transfer agent and broker-dealer arms.

This method enables instant settlements, as well as programmability for DeFi uses like collateral; it also bridges traditional stocks to Web3 without losing legal protections.

Hut 8 jumps after securing Google-backed AI deal

Bitcoin miner Hut 8 Mining (TSX:HUT,NASDAQ:HUT) is leaning harder into artificial intelligence (AI) infrastructure after locking in a 15-year, US$7 billion lease tied to its River Bend campus in Louisiana, US.

The agreement covers 245 megawatts of IT capacity and includes a financial backstop from Alphabet's (NASDAQ:GOOGL) Google, which guarantees lease payments for the duration of the base term.

While Google will not operate the facility or run workloads on-site, its backing significantly lowers counterparty risk and boosted investor confidence. Hut 8 shares rose nearly 4 percent in regular trading before surging more than 21 percent in premarket action, extending year-to-date gains to roughly 79 percent.

The deal ranks among the largest AI infrastructure commitments ever secured by a publicly listed Bitcoin miner.

US senators push new task force as crypto scams cost Americans US$9.3 billion

A bipartisan pair of US senators has introduced legislation aimed at tightening the federal response to cryptocurrency-related fraud after reported losses surged last year. The SAFE Crypto Act would require the Department of the Treasury to form a dedicated task force focused on detecting and preventing crypto scams.

Lawmakers cited FBI data showing Americans lost about US$9.3 billion to crypto investment fraud in 2024, a 66 percent jump from the previous year. Older investors accounted for a disproportionate share of those losses, according to federal officials. The proposed task force would bring together agencies including the treasury, Department of Justice, FinCEN and the Secret Service, alongside state and local law enforcement.

Russian regions back expanded crypto-mining bans

Energy officials in parts of eastern Russia are welcoming plans to extend seasonal crypto-mining bans into year-round prohibitions, the Russian newspaper Kommersant reported.

Authorities are expected to block all mining activity in southern Buryatia and Zabaykalsky Krai starting in 2026, citing chronic strain on local power grids. Regional officials said electricity shortages across several Siberian regions have approached 3,000 megawatts, making mining restrictions a necessary stabilizing measure. The move would also expand an existing winter-only ban that runs from mid-November through mid-March.

The decision marks a reversal from earlier government signals that no additional mining bans were planned.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.