Overview

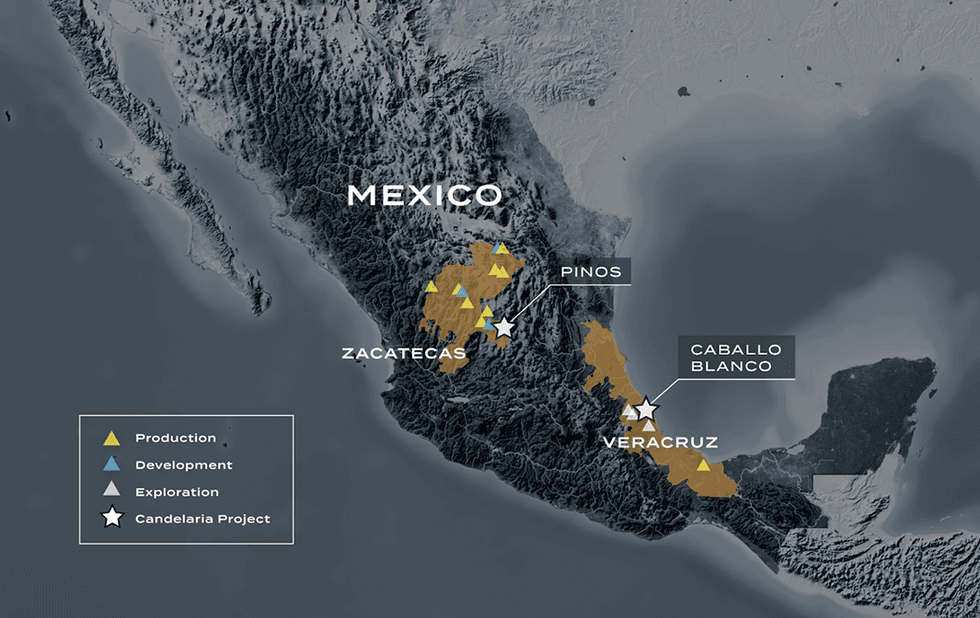

Candelaria Mining Corp. (TSXV:CAND) is a Canadian precious metals exploration and development mining company advancing two 100-percent-owned gold projects in Mexico: Caballo Blanco and Pinos

Strongly supported by major gold mining company and strategic investor Agnico Eagle, Candelaria Mining has the potential to become a 150,000 oz/year gold producer, buoyed by these two high-grade assets.

The company is led by a management team highly experienced in working with major mining companies. CEO Mike Struthers brings an impressive 40 years of experience, having worked for companies such as Lundin Mining (TSX:LUN), where he was projects director for seven years, working on a variety of capital projects and mine expansions; international mining firm AMC Consultants, where for 15 years with he worked with an impressive client list including majors such as Rio Tinto and BHP Billiton. Non-executive chairman Neil O'Brien was also part of Lundin Mining, helping grow the company from a three-person team in Stockholm until retiring as a senior VP exploration and new business development.

The Caballo Blanco District contains a variety of low- and high-sulphidation epithermal gold targets, in three to four mineralized centers, together with porphyry copper-gold targets in the south, and has six high-priority drill-ready targets. The most advanced project in the district, La Paila, had a preliminary economic assessment (PEA) completed in 2012 (using $1,150/oz gold price) which envisaged an open-pit/heap leach project producing an average of 100 koz gold per year over an eight-year mine life. La Paila has an initial indicated resource of more than 521 koz gold and inferred resource of more than 95 koz gold.

The district is adjacent to Azucar Minerals' El Cobre Property, which has demonstrated five porphyry systems to date.

Strategic investor Agnico Eagle recognizes the potential of the district and is strongly supportive of Candelaria. It is also worth noting that gold mining major Newcrest Mining owns 19 percent of Azucar Minerals.

Pinos, on the other hand, is a fully permitted historical epithermal gold vein complex that is construction-ready. It has a construction timeline of 12 to 14 months and will commence upon finalizing project financing. The project has a positive PEA that states an average yearly production of 12,700 gold equivalent ounces during the initial seven years of the mine life.

Company Highlights

- Candelaria Mining Corp. is an exploration and mining company focused on developing two high-grade gold projects in Mexico

- Agnico Eagle is a strategic investor with 16 percent stake in the company

- Both of Candelaria Mining's projects target high-grade gold assets that could see the company evolve into a 150,000-oz/year gold producer.

- Caballo Blanco District contains one PEA-level project and three to four centers of gold mineralization with multiple drill-ready high-priority targets;

- Caballo Blanco is adjacent to Azucar Minerals' El Cobre Property which has demonstrated five porphyry systems to date. Newcrest Mining owns 19 percent of Azucar Minerals.

- Pinos is fully permitted with a 12- to14-month construction schedule.

- Management team has decades of experience with major and junior mining companies in a variety of jurisdictions throughout the world.

Get access to more exclusive Gold Investing Stock profiles here