Silver Reserves: Top 5 Countries

Overview

Copper is now referred to as “the new oil” and the “metal of the future” because its durability, recyclability and superior conductivity make it a valuable resource as the world transitions towards sustainability. Electric vehicles (EVs) contribute to a more sustainable future and copper is a major component in the production and use of green mobility. In the US alone, 7 million EVs will be required by 2025. As the world travels the road to sustainable energy, the demand for copper increases.

Copper prices surged in late 2020, which reached US$6,800 per MT, the best rate since June 2018. The trend has continued into 2021, with prices rising 11 percent in Q1, in line with commodities surging across the board.

C3 Metals Inc. (TSXV:CCCM,OTCQB: CUAUF) is an ambitious exploration company focused on creating shareholder wealth through the identification, acquisition, and exploration of large-scale copper-gold exploration opportunities in mining-friendly jurisdictions like Peru, which is recognized as the second-largest copper exporter in the world.

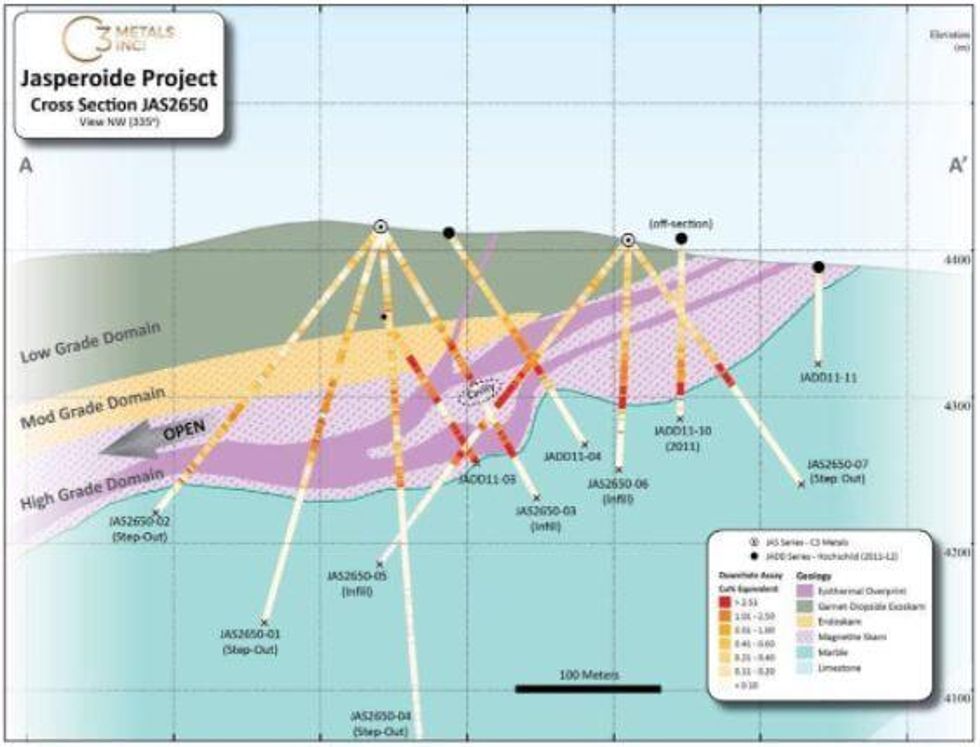

C3’s most exciting venture is their acquisition of the Jasperoide project, covering 57 square meters in the heart of ‘elephant country’ in Southern Peru. This project is located just 50km from notable copper-gold deposits like Las Bambas (1.2 BT at 0.61 percent Cu), Constancia (534 MT at 0.31 percent Cu) and Haquira (569 MT at 0.56 Cu). Additionally, past exploration results have revealed that high-grade mineralization exists at the surface, containing 14g/t gold and 18.5 percent copper in rock chips.

Preliminary drilling on the Jasperoide project has already provided good news for the company. According to a May 2021 press release, “Results from seven holes on the first drill section intersected broad zones of high-grade copper-gold mineralization within a larger low-moderate grade envelope. The drill program will now proceed to its planned 10,000m looking to expand the near-surface copper-gold footprint.”

Another advantage of the Jasperoide project is the fact that the initial infrastructure is already in place. This should simplify the logistical processes required to ramp up future production. In addition to Jasperoide, the company has 100 percent control over five mineral exploration licenses covering 207 square kilometers of highly prospective copper-gold terrain in Jamaica.

C3 Metals also operates in Jamaica, a country that is recognized as a diverse mining region that boasts unique mineralogy. Historically, Jamaica was best known as a producer of bauxite, but more recently, has seen the discovery of gold and copper porphyry occurrences. C3 Metals’ early entry into Jamaica means it should benefit from first-mover advantage and be best positioned to capitalize on these opportunities.

One of the company’s two BC copper – gold projects is under JV to Tocvan Ventures (TOC:CSE) who has the ability to earn 80% by spending on exploration and issuing shares. The other project in BC – Mackenzie – is currently available for option or sale.

C3 Metals’ management team has a proven track record of returning value to shareholders. Management brings decades of experience in mineral exploration, resource development and project management, providing the needed industry expertise to oversee complex mining projects.

Company Highlights

- C3 Metals is an ambitious exploration company focused on creating shareholder wealth through the identification, acquisition, and exploration of large-scale copper-gold exploration opportunities in mining-friendly jurisdictions.

- The company’s flagship project is the acquisition of the Jasperoide project, covering 57 square meters in the heart of ‘elephant country’ in Southern Peru.

- Preliminary drilling on the Jasperoide project has shown high-grade gold-copper deposits, and the company will move forward with drilling to 10,000 m.

- The company also has 100 percent control over five mineral exploration licenses covering 207 square kilometers of highly prospective copper-gold terrain in Jamaica.

- CCCM’s 52-week performance is +230 percent, and the recent confirmation of high-grade mineral deposits in their flagship project means that the strong performance can be expected to continue into the future.

- C3’s management team has decades of experience in mineral exploration, resource development, and project management. This lends C3 expertise and understanding of the industry which they have leveraged for strategic positioning in Peru and Jamaica.

- C3 acquired 100 percent of Hochschild Mining PLC’s interest in the Company’s flagship Jasperoide Copper-Gold Project1, Peru held by Compañia Minera Ares S.A.C., a wholly owned subsidiary of Hochschild (the “Acquisition”).

Get access to more exclusive Copper Investing Stock profiles here