Investor Insight

Boab Metals is well-positioned to capitalize on the rising demand for lead and silver, delivering value to shareholders and supporting the global transition to sustainable energy systems.

Overview

Boab Metals (ASX:BML) is an ASX-listed base and precious metals explorer and developer with a flagship project poised for near-term production. Boab Metals is progressing toward a final investment decision (FID) on its Sorby Hills project, a world-class lead-silver deposit, underpinned .

Strategically located 150 km from Wyndham Port, the Sorby Hills project benefits from excellent infrastructure, including access to green power from the Ord River hydroelectric plant. The company's strategy combines technical expertise, sustainable practices, and robust financial planning to advance the Sorby Hills project, which is slated to produce high-grade lead-silver concentrate through conventional open-pit mining.

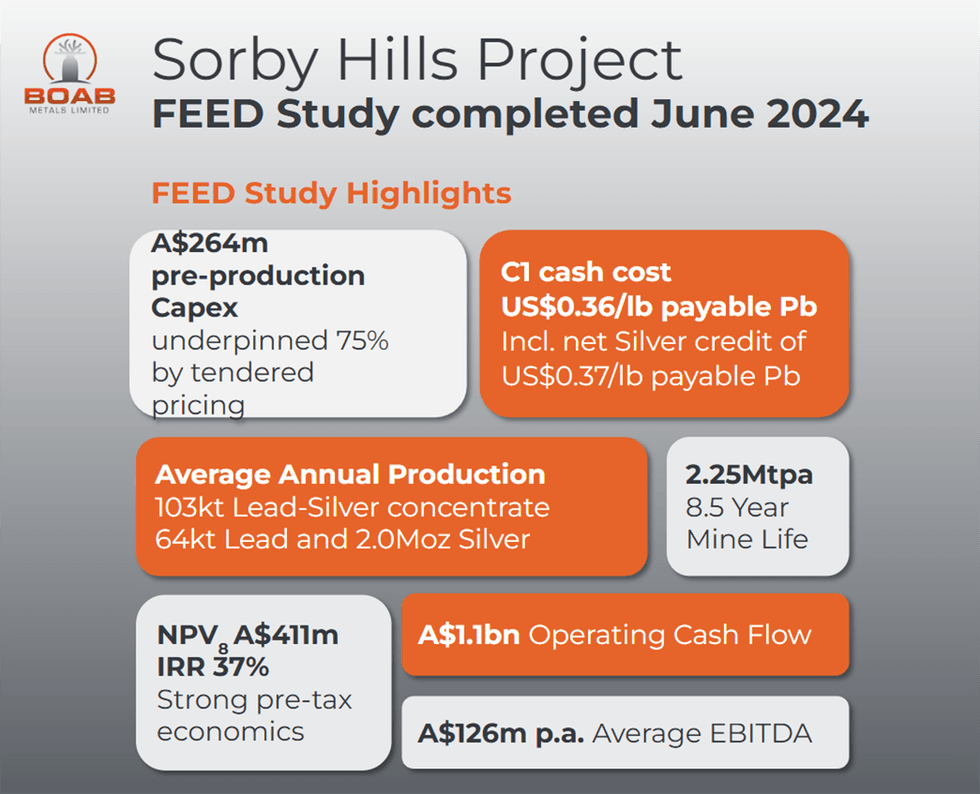

Strong economics underpin the project with a net present value (8 percent) of AU$411 million and a 37 percent internal rate of return, as confirmed by the completed front-end engineering design (FEED) study. Life-of-mine operating cash flow is pegged at AU$1.1 billion with an average annual EBITDA of AU$126 million. It boasts a competitive C1 cash cost of US$0.36/lb payable lead (after considering silver credits).

Further boosting the prospects of the Sorby Hills project a binding offtake and prepayment agreements with Trafigura, which ensured 75 percent of the lead-silver concentrate produced at Sorby Hills is pre-sold, providing a cornerstone financial foundation.

Get access to more exclusive Silver Investing Stock profiles here