Aluminum Price Forecast: Top Trends That Will Affect Aluminum in 2023

What’s the aluminum forecast for 2023? Read on to find out experts’ thoughts about the market next year in this overview.

Aluminum prices trended up for most of the first quarter of 2022 as the Russia-Ukraine war increased market volatility.

High energy costs also impacted the metal, which saw prices decline in the second half of the year.

With 2023 now in full swing, investors interested in this industrial metal are wondering about the aluminum outlook for next year. Here the Investing News Network (INN) looks back at the main trends in the sector and what’s ahead for aluminum.

How did aluminum perform in 2022?

At the end of 2021, market watchers were expecting a deficit in the aluminum sector, with a higher environment for prices.

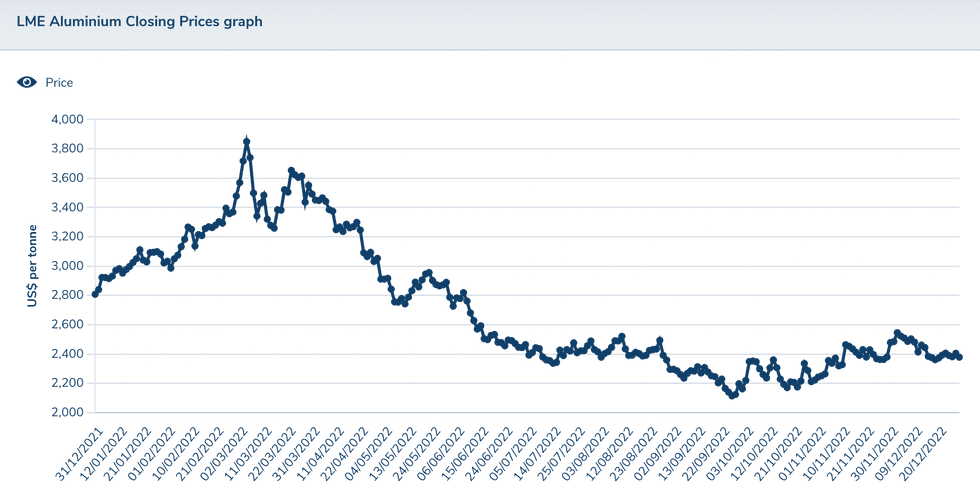

But after increasing steadily in the first few months of the year, aluminum was unable to hold onto its gains. The London Metal Exchange aluminum price plummeted from a high of US$4,000 per metric ton (MT) in March to a low of US$2,079 in September.

“It’s been a turbulent year for the aluminum market,” Ami Shikvar of Wood Mackenzie told INN. “The impact of the Russia-Ukraine conflict, power shortages in Europe and China and fears of a recession have dominated price direction.”

Aluminum's price performance in 2022.

Chart via the London Metal Exchange.

High energy prices have led to numerous production cuts in China and Europe since the start of the war — Europe's energy crisis paired with hydropower shortages in China have impacted nearly 4.5 million MT per year capacity, as per Wood Mackenzie.

“Supply was falling, but as fears of a recession gripped the market, the London Metal Exchange aluminum price fell as demand was falling faster than supply,” Shikvar explained. “The closure of the Nikolaev alumina refinery in Ukraine and the Australian alumina export ban also pushed the London Metal Exchange aluminum price higher.”

Wood Mackenzie was expecting prices for aluminum to average US$2,900 in 2022 against a backdrop of smelting cuts in Europe in late 2021 and a rebound in demand for the metal.

“The Russia-Ukraine conflict meant that prices were prone to volatility and largely headline driven in March,” Shikvar said.

What factors will move the aluminum market in 2023?

As the new year begins, there are a few factors investors interested in the aluminum industry should consider.

Wood Mackenzie anticipates a muted global recovery as improved Chinese demand due to the relaxation of strict COVID-19 restrictions offsets the still-weak demand growth seen elsewhere.

“However, Q1 2023 will likely remain weak due to the lackluster property market in China,” Shikvar said.

In terms of supply, for Shikvar there may be light at the end of the tunnel despite the fact that aluminum output in Europe is at its lowest level since 1988. “European power prices have softened, and some smelters may consider restarting capacity if power prices fall further,” she said. “Nonetheless, marginally low energy prices in spring won’t last for long.”

The risk of disruption in Europe remains, with nearly 400,000 MT of capacity vulnerable to closures if power prices spike again, according to Wood Mackenzie data.

“Conversely, there are too many variables that could alter our supply estimates for China,” Shikvar said. “Over the years, the National Development and Reform Commission and the provincial government have mandated smelting and refining cuts to deal with oversupply, weak Shanghai Futures Exchange prices, pollution and energy shortages. This may well continue in 2023 as some provinces grapple with intermittent energy shortages.”

Looking ahead, aluminum supply is poised to grow marginally as greenfield projects, expansions and restarts add to supply.

“Higher energy costs and potential hydropower shortages in the dry season could suppress supply,” Shikvar said. “Nevertheless, a deteriorating economic environment could push the market into a surplus.”

Making aluminum requires around 40 times more energy than copper, making it the most energy-intensive base metal to produce.

“Despite the recent weakness in energy prices, we do not expect capacity to come back online in the short term with Europe heading into the winter months and the war with Russia raging on,” Ewa Manthey of ING said in a November 2022 note. “Further smelter closures and curtailments in production are highly likely given the uncertainty over energy prices through next year.”

With visible inventories at historically low levels, supply risks in China and Europe and the potential for lower power availability and high energy costs, 2023 could be another interesting year for aluminum.

“An uncertain macroeconomic outlook will further add to the aluminum market risk,” Shikvar said. “As such, we are forecasting prices to average around US$2,350 in 2023.”

ING believes that in the short term the market will focus on larger macroeconomic and demand-side problems. The firm sees prices trending down further this year, hitting US$2,150 in the first quarter.

“We believe a recovery in price should start in 2Q 2023, although any recovery is likely to be slow,” Manthey said.

Panelists recently polled by FocusEconomics see aluminum prices remaining around current levels through Q4 2023. They expect prices to average US$2,395 in Q4 2023 and US$2,332 in Q4 2024.

“Demand will likely be determined by the rate at which China’s economy rebounds, especially the highly-indebted but aluminum-hungry construction sector,” FocusEconomics states in its latest report.

“On supply, lower average energy prices than in 2022 should limit further closures of smelters, while the London Metal Exchange's November decision not to ban Russian metals has further alleviated supply fears.”

For investors interested in aluminum, it will be important to watch for any signs of a rebound in demand, which could push premiums higher, according to Shikvar. “Also, any further alumina cuts could boost aluminum prices,” she said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Tin Stocks: 10 Biggest Producers in 2023 ›

- Top 10 Aluminum-producing Countries ›

- Aluminum Applications: Car and Aircraft Manufacturing ›

- How to Invest in Aluminum ›

- A Very Brief Overview of Commodities Investing Today ›