Aluminum Outlook 2022: Analysts Bullish on Prices, Deficit Ahead

What’s the aluminum outlook for 2022? Read on to find out experts’ thoughts about the market next year in this overview.

Click here to read the previous aluminum outlook.

Aluminum trended up for most of 2021 after a 2020 that saw the effects of COVID-19 hit every market.

Vaccination rollout plans paired with the reopening of economies globally supported aluminum prices, which hit their highest levels in 13 years.

With 2022 now in full swing, investors interested in the industrial metal are wondering about the aluminum outlook for next year. Here the Investing News Network (INN) looks back at the main trends in the sector and what’s ahead for aluminum, with commentary from expert market watchers.

Aluminum trends 2021: The year in review

At the end of 2020, a year that was marked by the uncertainty brought by COVID-19, market watchers were expecting a surplus in the aluminum sector, with a lower environment for prices.

But in 2021 prices increased steadily, thanks in part to China's robust industrial recovery and optimism over healthier global demand conditions as economies reopened and lifted lockdown restrictions.

“2021 was an extraordinary year for aluminum,” Ami Shivkar of Wood Mackenzie told INN. “While we were expecting demand to rebound sharply, the scale of cuts in China exceeded our initial estimate at the start of 2021.”

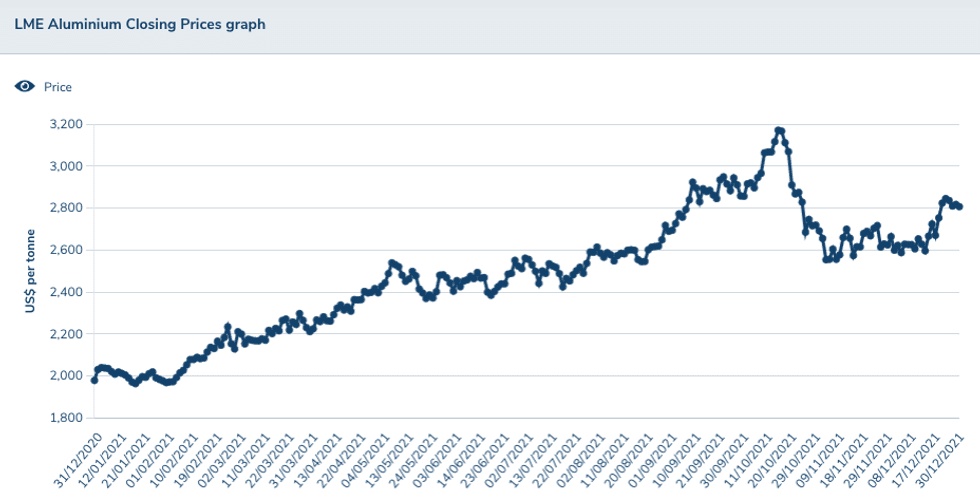

Aluminum's 2021 price performance.

Chart via the London Metal Exchange.

Speaking with INN about how aluminum performed, Angelina Valavina of Fitch Solutions said there was a strong rebound in all commodities in 2021, with aluminum seeing a similar trend.

“The power disruptions in China, which impacted production capacity, together with a delay in ramp ups of projects and restarts, led to a bigger deficit than previously expected in 2021,” she said.

The metal started 2021 trading just below the US$2,000 per tonne mark and ended the first half of the year at a three year high of above US$2,550 — but it didn't end its rise there. Aluminum’s highest price of the year came in October, when it broke the US$3,000 level to hit nearly US$3,200, rallying to a 13 year high.

“The increase in prices in October came as escalating output concerns from top producer China further weighed on the supply outlook,” FocusEconomics said. “On top of this, higher energy costs globally have made the energy-intensive production of aluminum even pricier. This, coupled with still-strong demand, has further buoyed prices.”

But aluminum was unable to sustain its gains throughout the last quarter, pulling back in November. As of December 22, aluminum prices were trading at US$2,824.50 — up more than 40 percent since January 1, 2021.

Aluminum outlook 2022: What’s ahead

Most commodities took an upward turn in 2021, but what will 2022 bring for metals such as aluminum?

Looking at demand, Fitch Ratings is calling for it to be strong outside China. “Last year, global demand growth, excluding China, was up about 14 percent,” Valavina said. “This year, we expect it to be less than 4.5 percent, hindered by shortages of semiconductors, and some alloying components, such as magnesium.”

In China, the analyst expects better power availability. “We have already seen an improvement in the last couple of months of 2021, but we have assumed a relatively flat demand in China this year of around 0.2 to 0.3 percent.”

Wood Mackenzie expects demand to expand by 4.6 percent in 2022 following last year's rapid post-pandemic bounce. “We expect some easing of semiconductor shortages for the key automotives,” Shivkar said. “Front loading of stimulus policies aimed at shoring up the property market could generate higher-than-forecast demand.”

Looking over to the supply side of the story, Shivkar said that if the dual control policy and power shortage in China dominated headlines in 2021, this year the focus will be on Europe’s power markets.

“Power constitutes nearly 35 percent of the cost of making aluminum, or in the case of some European smelters, much higher,” she said. “We expect energy prices to come off their highs during spring due to lower demand for heating, but aluminum companies will be competing with other industries such as zinc, fertilizers, steel and cement to secure power at competitive prices.”

Once an energy supply agreement is in place, it could take up to three months to fully restart operations.

“As such, there is a remote possibility of smelter restarts in 2022,” Shivkar said. “The key determinant of when smelters will restart will be driven by energy prices, along with gas storage and hydro reserves across Europe.”

Wood Mackenzie calculates that an additional 400,000 tonnes per year of capacity is at risk of shutting down if energy prices escalate further. Europe accounted for 15 percent of ex-China aluminum supply in 2021.

“We now forecast global aluminum output to grow by 2.7 percent to reach 69.6 million tonnes this year, assuming there are no further cuts,” Shivkar said.

In 2022, Fitch Ratings anticipates that Chinese production will contract around 2 percent because of the spillover effect of the power shortages.

“Last year, around 2.7 million tons of aluminum capacity was curtailed, and the restarts and new projects were delayed to effectively this year, with most of the supply responses likely to occur in the second half,” Valavina said.

Meanwhile, production outside of China is forecast to continue growing at around 4 percent, driven mainly by production restarts.

All in all, in 2022, Fitch Ratings sees a deficit of slightly less than 2 million tonnes. “The deficit will be potentially wider than in 2021,” Valavina said. “It is a very tight supply and demand balance, which will support prices.”

Despite new project commissioning and restarts, Wood Mackenzie is also forecasting a deficit of 2.2 million tonnes this year due to robust global demand, smelter cuts in Europe and slower expansions in China.

For prices, the question is whether the story will stay the same after 2021's stellar performance. The London Metal Exchange aluminum price could trade on either side of US$2,900 in the near term, according to Wood Mackenzie.

“While supply disruptions are supporting prices now, there is also a possibility of prices softening a bit due to lower seasonal demand in China ahead of the Spring Festival,” Shivkar said.

Similarly, due to the very strong fundamentals in the market, Fitch Ratings has revised its 2022 price forecast from US$2,000 to US$2,500.

Commenting on factors investors should pay attention to in 2022, Valavina said eyes should be on what happens in China, from environmental policies to the power crisis.

“Also aluminum smelting is very electricity intensive,” she said. “That's why any developments in this area might affect both the production dynamics and even potentially the pricing.”

For Shivkar, a factor to keep an eye out for is persistently high inflation, which could lead to a hike in interest rates.

“The Federal Reserve has already indicated it is willing to increase rates to tame inflation,” she said. “This could dent industrial activity and aluminum demand growth.”

Another catalyst is what will happen with the semiconductor shortage. Wood Mackenzie assumes it will ease from H2 2022, which will allow for a full resumption of automotive production. “However, if semiconductor shortages persist, then aluminum demand from the automotive sector will remain subdued,” Shivkar said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.