Zinc Price Update: H1 2021 in Review

Here’s an overview of the main factors that impacted the zinc market in H1 2021, and what’s ahead for the rest of the year.

Click here to read the latest zinc price update.

Zinc prices finished last year on a bright note, rebounding from lows seen in the first few months of 2020 to start 2021 with strong demand hopes.

The base metal declined during Q1, but went on to hit its highest point so far this year in the second quarter, surpassing the US$3,000 per tonne mark.

With the first half of the year now over, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for zinc supply, demand and prices.

Zinc price update: H1 overview

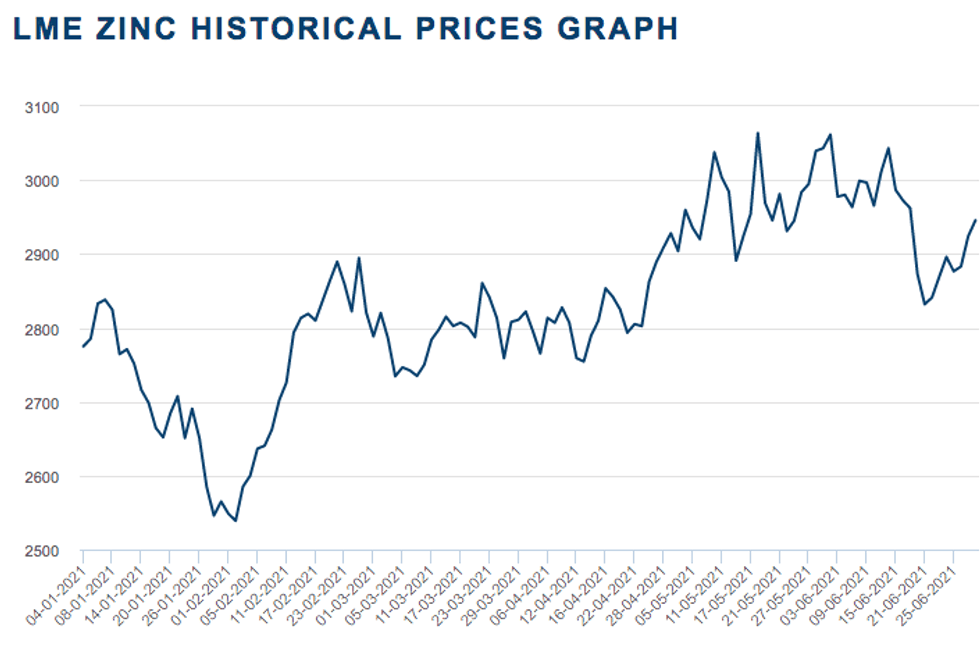

Zinc prices started the year trading at U$2,775 after posting a more than 18 percent increase in 2020. Despite falling in the first three months of trading — hitting a low of U$2,539 — zinc prices later rebounded, experiencing volatility throughout the next few months.

H1 2021 zinc price performance. Chart via the London Metal Exchange.

At the start of this year, Dan Smith of Commodity Market Analytics was looking for zinc prices to average US$2,853. “The market has broadly performed as expected,” he said.

In Q2, the base metal hit its highest point of the first half of the year, trading at US$3,063.50 on May 18. By the end of June, zinc prices had pulled back, but were still trading north of US$2,900.

“Zinc prices performed much more strongly than we were expecting in H1,” Helen O’Cleary of CRU Group told INN. “Although the concentrates market remained tight, the refined metal market surplus continued to build,” she said about the base metal, which is used to galvanize steel.

“Fundamentals took a back seat and prices were driven higher by stimulus and bullish sentiment.”

Zinc price update: Supply and demand

As economies started to reopen, a recovery in demand from the steel sector took place, with China seeing the most growth. However, construction and steel activity in China is likely to slow down in the second half of this year, which will weigh on global zinc demand.

“Overall, we still see growth, but at a more moderate pace than the robust expansion which took place in many countries in H1 2021,” Smith said.

CRU also expects zinc demand to continue to recover in H2, driven by strong steel mill orders and infrastructure stimulus.

“Global demand will more than recover last year’s losses due to a strong rebound in China, although we do not expect demand in the world ex-China to recover fully until 2022,” O’Cleary said.

In terms of supply, global zinc mine production in 2020 was estimated to be 12 million tonnes, a 6 percent decrease from 2019.

Government-mandated lockdowns and a decrease in zinc prices following the onset of the global COVID-19 pandemic resulted in lower zinc mine production in many countries, particularly in South America.

But zinc mine output is expected to more than recover last year’s losses this year, according to CRU. “That said, we do not expect the concentrates market to return to surplus until 2022,” O’Cleary said.

Mining was hit hard by the pandemic last year, but 2021 is expected to bring a strong rebound.

“New capacity is being added or ramped up, and the impact of the virus is fading as countries are becoming better at coping and inflection levels are trending down in places like Peru,” Smith said.

Peru is a top zinc producer, coming in third at 1.2 million tonnes, with China and Australia taking first and second place with a total of 4.2 million tonnes and 1.4 million tonnes of zinc, respectively.

Looking at the refined zinc space, total refined zinc production in 2020 was estimated to increase slightly to 13.6 million tonnes, according to the International Lead and Zinc Study Group.

On the smelter front, Smith said smelters in China continue to be impacted by structural problems, including a shortage of coal and low water levels in places like Yunnan. “These problems are likely to persist through the summer, which is likely to result in volatile zinc prices,” he added.

CRU expects annual Chinese smelter output growth of 2.8 percent in 2021. “We expect emissions-related disruptions to smelter output in China to ease in H2 and for utilization rates to pick up,” O’Cleary said.

A key factor to consider is that zinc treatment charges are now rising, which confirms that the market is becoming better supplied, according to Smith.

“This year supply growth is predicted to be stronger than demand growth, which will keep the metal market in oversupply.”

Zinc price update: What’s ahead?

Looking ahead, CRU is expecting zinc prices to decline in H2, averaging U$2,775.

Meanwhile, Commodity Market Analytics is now forecasting that the second half of this year will be weak, with a pullback to US$2,720 in Q4 and an average price of US$2,810 in H2.

In terms of factors to watch out for, O’ Cleary said further attempts by China to rein in commodity prices could lead to price weakness.

“An increase in taxes on mineral resources in Peru could lead to higher zinc prices,” she added.

China’s attempt to control commodity prices by selling stockpiles was a key theme during the second quarter, and will be a factor to watch as the year unfolds.

“So far, only 30,000 tonnes have been tendered for sale by China’s State Reserve Bureau, but if this continues on a monthly basis throughout H2 it could lead to weaker sentiment and downward price pressure,” O’Cleary said.

Smith sees this as a short-term sticking plaster for a long-term problem.

“China needs to adjust its own supply and demand balance, rather than trying to bring down prices by selling from stockpiles,” he said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top Zinc Stocks on the TSX | INN ›

- Zinc Outlook 2022: Small Refined Zinc Deficit Ahead | INN ›

- Understanding the Zinc Spot Price and Zinc Futures | INN ›