Lead Price Forecast: Top Trends for Lead in 2026

Overview

The world is charging towards a future powered by clean energy. Batteries are a vital part of that transition, as they are essential in electric vehicles (EVs) and for storing the electricity generated by renewable technologies. The global battery market is expected to grow by a compound annual growth rate (CAGR) of 8.2 percent between 2019 and 2027 as it grows from US$11.3 billion to US$20.5 billion in 2027. A more recent forecast indicates that global demand will reach US$32 billion by 2028, growing by a CAGR of 12.9 percent.

People tend to think of lithium as the main element for future technologies. While important, we’ll need a diverse range of metals to manufacture the sophisticated batteries green technologies require. Nickel is one such element that has catalytic and electromagnetic properties that make it a valuable element in battery technology. In addition, nickel, cobalt and platinum group metals are now considered critical minerals by the Canadian government for their importance in clean technologies. Both the United States and Canada are significantly investing in building a domestic supply of the critical metals used in battery manufacturing.

Voltage Metals (CSE:VOLT, OTCQB:VLTMF) is a Canada-based exploration company focused on the metals necessary for batteries, including nickel, copper, cobalt and platinum group metals. Nickel is an essential metal for the company, as it understands its crucial role in the future of EVs and other green technologies. In general, nickel-focused mining companies typically choose whether to pursue high-grade or high-quantity nickel resources. Voltage Metals is pursuing high-grade nickel that surpasses its peers.

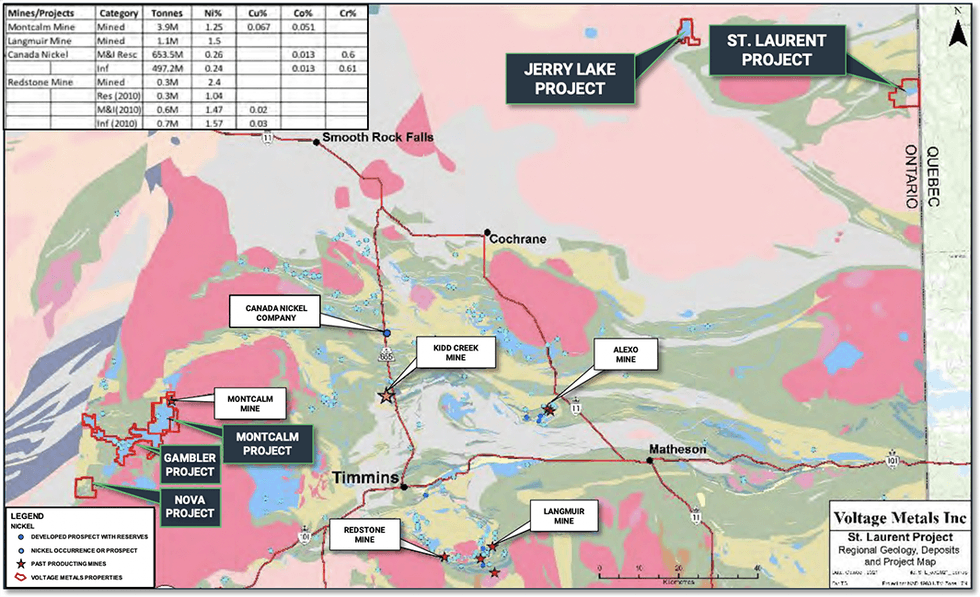

The company has a diverse portfolio consisting of three primary and four secondary assets. Voltage Metals’ flagship property is the St. Laurent Project near Timmins, Ontario, in proximity to notable mines: 20 kilometers southwest is Hecla Mining’s Casa Berardi Mine, 50 kilometers south is Kirkland Lake Gold’s Detour Lake Mine, and 100 kilometers southwest is Wallbridge

Mining’s Grasset nickel-copper-cobalt-platinum-group-elements deposit. The St. Laurent Project encompasses massive sulfide targets that contain high-grade deposits of nickel, copper, cobalt, and platinum group metals. Additional airborne exploration has indicated the presence of an anomalous nickel deposit that will be the focus of future exploration initiatives.

Wheeler and Montcalm, Voltage Metals' other primary assets, show additional promise for exciting battery metal discoveries. The Wheeler Project located in southwestern Newfoundland and Labrador hosts mineralization containing nickel, copper, cobalt and chromium deposits. Meanwhile, the Montcalm Project in Timmins, Ontario, covers a large land area that encompasses a past-producing nickel, copper and cobalt mine. Combined, all three projects have the potential to help build a domestic supply of critical battery metals.

Voltage Metals is led by a management team of experienced explorers and geologists. Bob Breese, CEO and director, has firsthand experience managing mining operations in Nevada and Falconbridge’s Montcalm mine. Jay Freeman, chairman and director, specializes in corporate and commercial law and corporate financial management. Along with a technical team of geologists, Voltage Metals has the right leaders to capitalize on its promising assets.

Company Highlights

- Voltage Metals is a Canada-based exploration company targeting nickel and other battery metals that have been deemed critical by the Canadian government.

- The company has a diverse portfolio of three primary and four secondary assets.

- St. Laurent is Voltage Metals’ flagship project, and past exploration has indicated the presence of high-grade nickel. In addition, airborne survey results indicate an anomalous deposit that may contain additional high-grade nickel and will be the focus of future exploration.

- The Montcalm and Wheeler projects contain promising historical exploration data that indicate high-grade battery metal deposits.

- Management has experience ranging from operations to corporate finance. The management team has all the expertise necessary to lead the company to explore its exciting properties.

Get access to more exclusive Nickel Investing Stock profiles here