December 27, 2023

Gladiator Resources Ltd (ASX: GLA) (Gladiator or the Company) is pleased to announce assay results for trenches at the SWC Target within its 724km2 Mkuju Uranium Project. The trenches have high-grade uranium mineralisation and support GLA’s model of gently dipping uraniferous sandstone layers with considerable strike extent. The next step is to drill-test the potential depth extension of these layers. No drilling, other than shallow auger holes, has been previously completed at the two identified zones which have a combined ‘strike-length’ of ~3km. The results affirm the Company’s view that there is potential for a significant sandstone-hosted uranium deposit at SWC, which is within the same geological basin as the Mantra/Uranium One’s world class “Nyota” deposit which has a Measured and Indicated MRE of 187 Mt at 306ppm U₃O₈ containing 124.6 Mlbs U₃O₈.

- Assay results for SWC target trenches received and confirm high-grade uranium in 4 of the 5 trenches and one of the mineralised layers is interpreted to be at least 6 m thick.

- Results include intervals above the upper detection limit of analytical method (4245ppm U₃O₈). These samples are being re-analysed by another method that has higher detection limits.

- Results indicate gently dipping layers of mineralised sandstone. The exposed part of the layer in Trench 4 layer has an average grade of 1727 ppm U₃O₈ and includes one sample above the upper detection limit of analytical method (4245ppm U₃O₈). This is the only trench on the north side of the target.

- The recentradiometric data and the trench and auger data define a combined ‘strikelength’ of the north and south zones of approximately 3 km.

- The excellent work by the geology team means that SWC is now drill-ready. No drilling other than shallow auger holes (in 2008) has been carried out at Gladiator’s targets.

- The trenches support the 2008 augerresults which included 8m @ 1,273ppm U₃O₈ from surface, including 2m@ 3,825ppm.

Trenching Program and results

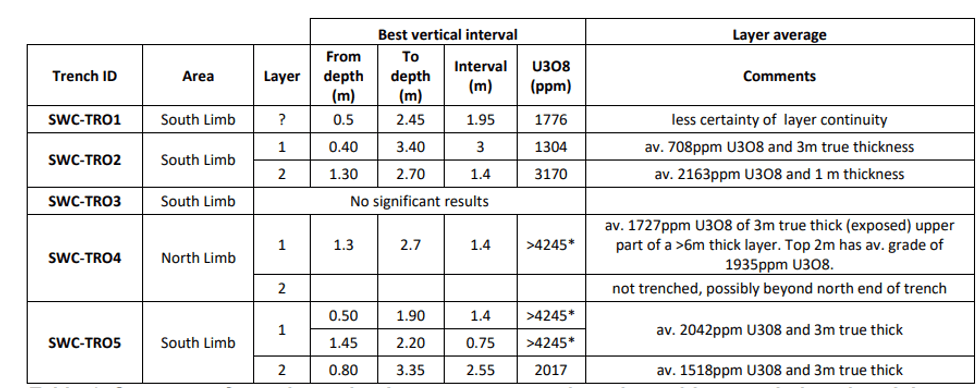

Gladiator completed 5 trenches at the SWC target in October 2023; four at the ‘South Limb’ zone and a single trench at the ‘Nouth Limb’ zone (Figure 1). A total of 454 metres of trenching was completed and the trenches were between 3.0 and 3.9 metres deep. Sampling was taken from vertical channels at 4.0 metre intervals along one sidewall of each trench. Table 1 provides the highest-grade vertical intervals from each trench and Figures 2 and 3 illustrate the results more comprehensively. Where average grades are reported these were calculated by length-weight averaging of the sample grades within each layer.

Of particular interest is trench 4 at the ‘North Limb’ zone:

- Gently northward dipping coarse-grained arkose sandstone layer with visible high-grade uranium (Figure 4).

- In the trench the upper part of the layer (~2 m true thickness) has an average grade of 1935ppm U3O8. The material lower in the trench has an average grade of 676ppm U3O8.

- A 1.4 m sample from this layer has over 4245 ppm which is the upper detection limit for the pressed powder analytical method and will be re-analysed using the fusion method to obtain the actual value.

- Based on a nearby 2008 auger hole (MRSA6, 30 m to the east) the layer in the trench may be the upper part of a layer at least 6 m in thickness - the auger hole ended in mineralisation (510 ppm U3O8) at 7 metres depth.

- This trench is the only one at the ‘North Limb’ zone of SWC. It would have been ideal to have more trenching completed but the onset of the wet season prevented further work. It is clear that drilling is needed to follow the layer ‘down-dip’.

Trench 2 and 5 at the ‘South Limb’ zone:

- These trenches are 650 m apart and both intersect what may be two southward dipping mineralised layers approximately 4m apart, hosted in coarse-grained sandstone.

- In Trench 5 the first (southernmost) layer has an average grade of 2042ppm U3O8 and has an approximate (true) thickness of 3m. Within this are 2 samples with over 4245 ppm, the upper detection limit for the analytical method. In Trench 2 the same layer has an average grade of 708ppm U3O8 and a similar average (true) thickness.

- The second and northernmost mineralised layer in Trench 5 has average grade of 1518ppm U3O8 and has an approximate (true) thickness of 3m. The same layer in Trench 2 has an average grade of 2163ppm U3O8 and is approximately 1.0 m thick

Click here for the full ASX Release

This article includes content from Gladiator Resources , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

12h

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00