Overview

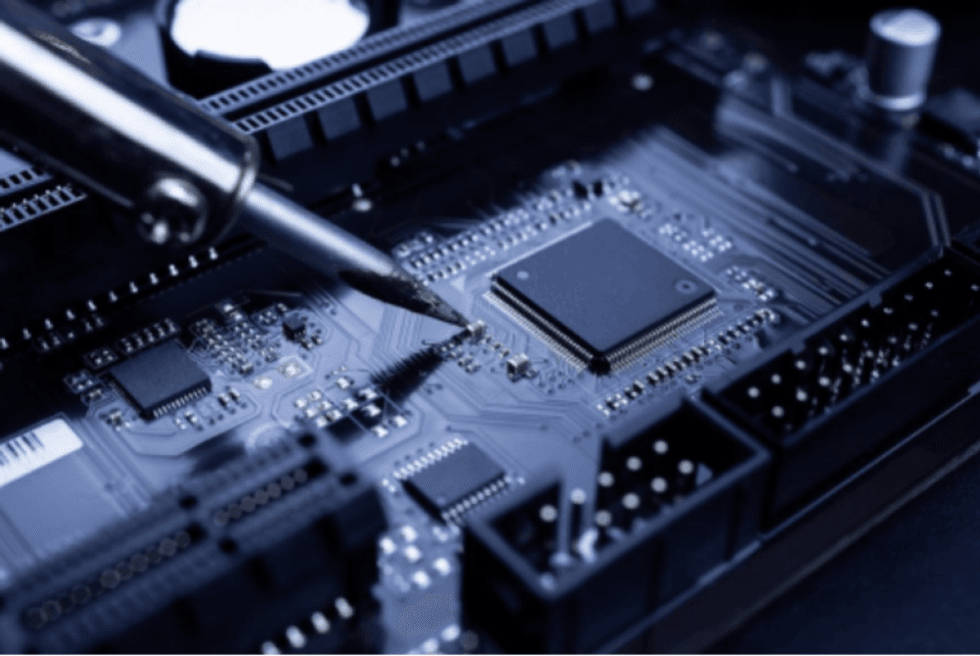

Tin is the hidden hero of electrification and the transition to clean energy. The underrated metal is used as solder to connect electrical components and create corrosion-resistant alloys. These vital but straightforward applications are necessary for every emerging green technology, from electric vehicles to wind turbines.

S&P Global Commodity Insights dubbed tin as one of the metals important for future technologies and has noted that with the use of tin in electronics, demand continues to climb but inventories are trending low. In fact, the global tin market size was US$ 6.61 million and it is expected to grow to an estimated US$ 8.21 million by the end of 2027.

At the end of 2019, the world’s reported tin resources totalled around 15.4 Mt, including 5.5 Mt of reserves. According to the International Tin Association, Australia is one of the top five countries containing global compliant resources.

TinOne Resources (TSXV:TORC, OTCQB:TORCF, FRA: 57Z0) is uniquely positioned with tin assets in a tier-one jurisdiction and an increasing demand for this important metal. It owns a portfolio of key tin assets in Tasmania: Great Pyramid, Aberfoyle and Rattler Range. A member of the International Tin Association, TinOne Resources is one of only ten companies focused primarily on tin. The company has an experienced management team of experts and technical advisors to lead the projects’ exploration programs and take them to production.

Tin recently experienced a massive price appreciation and is expected to remain at or near historic highs through 2030. These market changes build excitement for TinOne’s portfolio of undervalued and underexplored assets. The Great Pyramid Tin Project is the company’s flagship project and has promising historical data in an area that has not been explored with modern techniques. The company is in the process of completing a 5,500-meter drill program aimed at confirming and testing zones for resource expansion.

The Aberfoyle Tin Project has also received little modern exploration but is a significant past-producing tin district. A surface drilling program conducted in 2022 returned 44 samples with tin values greater than 0.1 percent.

TinOne began acquiring its tin assets when the market for the metal was low. Now, it's benefiting from the increased demand that previously saw tin prices increase by 77 percent. The company’s foresight has given them a first-mover advantage, creating tremendous upside potential for investors. In addition to its tin assets, the company balances its portfolio with gold-focused assets that may receive additional exploration and development in the future.

In 2022, TinOne acquired a 100 percent undivided interest in the Rattler Range tin project in northeastern Tasmania. Rattler Range is a highly prospective tin project located only 64 kms from the city of Launceston. Historical records indicate the presence of 47 individual-named tin occurrences across a 12-km-long, northwesterly-oriented mineralized trend that has seen very little on-ground exploration since the 1980s. The district contains hard rock greisen and vein mineralization in a cupola zone of highly fractionated, evolved granite.

A strong management team with directly relevant experience leads the company to success. Craig Parry, technical advisor, has over 20 years of experience in the resource sector and was directly involved in developing mining companies by leveraging his training as a geologist. Michael Konnert, director and interim CEO, has years of experience making profitable deals, managing corporate finances, and developing effective corporate strategies. The company complements this with a team of several experts in their respective fields, covering corporate management, geology and international finance.

Company Highlights

- TinOne is an exploration and development mining company focused on undervalued tin assets in Australia.

- Experienced management leads the company with expertise ranging from corporate administration to professional geologists.

- TinOne’s key assets are located in Tasmania, Australia, all with encouraging historical exploration results, yet have been underexplored with modern techniques.

- Additionally, the company has a gold-focused asset that may be accretive.

- TinOne has completed the acquisition of 100 percent undivided interest in the Rattler Range tin project, consisting of a 32-km2 exploration licence in northeastern Tasmania.

Get access to more exclusive Industrial Metals Investing Stock profiles here