TSX.V: TORC OTCQB: TORCF

TinOne Resources Inc. (TSXV: TORC) (" TinOne " or the " Company ") is pleased to announce that further to its news release on August 30, 2022 the Company has now acquired a 100% undivided interest in the Rattler Range tin project (" Rattler Range ") in northeastern Tasmania, Australia .

" With the completion of the acquisition of the Rattler Range tin project, TinOne now controls five out of the seven primary tin occurrences in Northeast Tasmania ," stated Chris Donaldson , TinOne's Executive Chairman. "The Company's experienced geological team will apply modern techniques at Rattler Range with the goal of unlocking value in an area that has seen limited recent exploration."

Upon closing, the Company issued 1,000,000 common shares (the " Consideration Shares ") at a deemed issuance price of $0.10 per Consideration Share. The Consideration Shares are subject to a hold period expiring four months and one day from the date of issuance.

Additionally, the Company has agreed to grant the vendor a 2% net smelter returns royalty over the project (the " NSR "). The Company will have the right, at any time upon notice being given to the NSR holder, to repurchase 1/2 of the NSR for C$1,000,000 in cash.

About Rattler Range

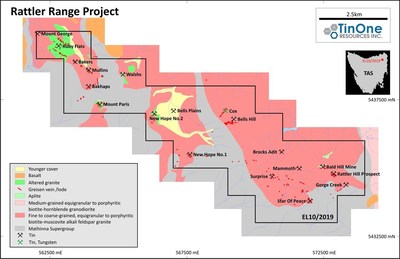

The Rattler Range project, consisting of a 32km 2 exploration license (EL10/2019), is a highly prospective tin project in northeastern Tasmania, Australia and located only 64km from the city of Launceston. Historical records 1 indicate the presence of 47 individual named tin occurrences across a 12km long, northwesterly oriented mineralized trend that has seen very little on-ground exploration since the 1980s. The district contains hard rock greisen and vein mineralization in a cupola zone of highly fractionated, evolved granite.

High priority initial targets include Bells Hill where multiple mineralized lodes, 1.5 to 6 metres wide, occur over an area of at least 500m of strike length. No systematic exploration has been conducted and only 2 drill holes have been completed at the prospect. Other priority targets include the multi-kilometer scale tin-bearing alteration zones at Ruby Flats, Walsh's , Mammoth and Mt Paris.

| ______________________________ |

| 1 Source: Mineral Resources Tasmania www.mrt.tas.gov.au |

About TinOne

TinOne is a TSX Venture listed Canadian public company with a high-quality portfolio of tin and gold projects in the Tier 1 mining jurisdictions of Tasmania and New South Wales, Australia . The Company is focussed on advancing its highly prospective portfolio through aggressive exploration programs.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward‐Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward‐looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the development of the Company's projects, including drilling programs and mobilization of drill rigs; future mineral exploration, development and production; and completion of a maiden drilling program.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of TinOne, future growth potential for TinOne and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; TinOne's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect TinOne's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and TinOne has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on early stage mineral projects; metal price volatility; risks associated with the conduct of the Company's mining activities in Australia ; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in TinOne's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although TinOne has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. TinOne does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE TinOne Resources Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2022/23/c7208.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2022/23/c7208.html