Investor Insight

Following its business combination with Summa Silver, Silver47 Exploration is now uniquely positioned as a leading US-focused silver explorer and developer. With a diversified portfolio of high-grade silver projects in Alaska, Nevada and New Mexico, and an inferred resource base of over 236 million ounces of silver equivalent, the company offers significant exposure to rising silver demand amid a projected global supply deficit.

Overview

Silver47 Exploration (TSXV:AGA,OTCQB:AAGAF) is a US-centric silver company with a portfolio of high-grade assets located in mining-friendly jurisdictions. Silver47 recently underwent a transformative merger with Summa Silver (TSXV:SSVR), positioning the combined entity as a premier US-focused high-grade silver explorer and developer.

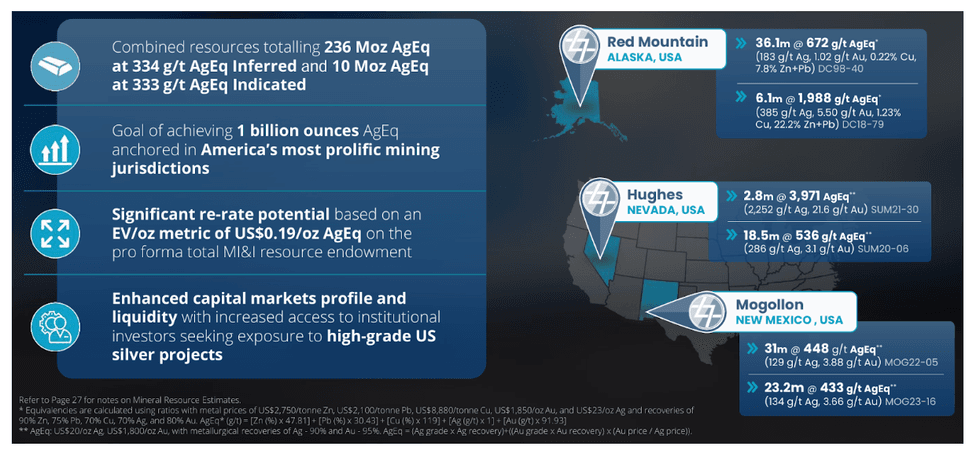

This strategic consolidation brings together Silver47's flagship Red Mountain VMS project in Alaska with Summa's high-grade Hughes project in Nevada and Mogollon project in New Mexico.

The merger, announced on May 13, 2025, is structured as an at-market transaction, wherein Summa shareholders will receive 0.452 common shares of Silver47 for each Summa share held. Post-transaction, existing Silver47 and Summa shareholders will own approximately 56 percent and 44 percent of the combined company, respectively. The unified company will continue under the name "Silver47 Exploration Corp." and will be led by an experienced management team, including Gary R. Thompson as executive chairman, and Galen McNamara as CEO.

This merger significantly enhances Silver47's resource base, consolidating approximately 10 million ounces (Moz) of indicated silver equivalent (AgEq) resources at an average grade of 333 grams per ton (g/t) AgEq and 236 Moz of inferred AgEq resources at 334 g/t AgEq across its US projects. The combined entity is well-capitalized, with approximately C$10 million in cash and a concurrent C$5 million private placement underway, positioning it to aggressively advance its exploration and development programs.

Silver47's strategy is focused on aggressive drilling to expand resources, updating economic studies, and pursuing accretive M&A opportunities to build toward its long-term vision of a 1 billion ounce AgEq resource platform.

Get access to more exclusive Gold Investing Stock profiles here