Overview

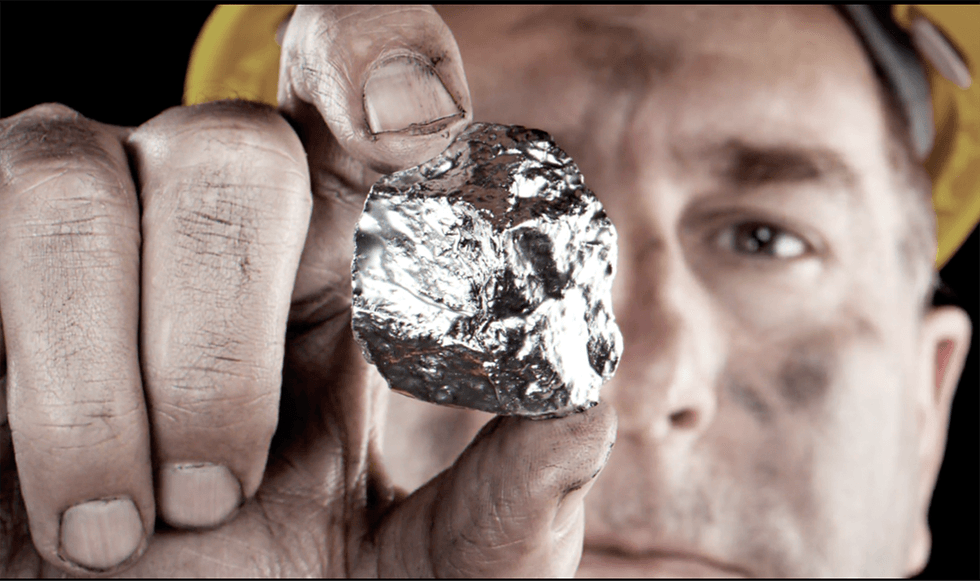

Silver Hammer Mining (CSE:HAMR; OTCQB:HAMRF; FWB:7BW0) is a mineral exploration company with a pure-play silver portfolio focusing on assets within the western United States. The company’s assets are located in Idaho and Nevada, both industry-recognized tier-1 jurisdictions. Silver Hammer’s flagship asset, Silver Strand, is a brownfields silver project in an established silver mining district that is known for producing more than 1.2 billion ounces of silver.

Analysts expect global demand for silver to rise by 16 percent in 2023, reaching 1.21 billion ounces. Existing industries are creating much of this growing demand, but the rise of electric vehicles and other clean technologies has escalated this further, as silver is a necessary component for emerging renewable tech, including solar panels and EVs.

Silver Hammer Mining’s flagship Silver Strand is a brownfield project located in Idaho within one of the world’s most prolific silver districts. Idaho consistently ranks among the top jurisdictions in Fraser Institute’s investment attractiveness index. Silver Strand comprises 78 contiguous claims along a 5.8-kilometer strike near Coeur D’Alene, Idaho.

The company’s other two projects are in Nevada, another tier-1 jurisdiction frequently in the top ten of Fraser Institute's Survey of Mining Companies for both the policy perception and investment attractiveness indexes. The Eliza silver project comprises 98 claims covering 5.5 square kilometers within the Hamilton district of Nevada, an area from which over 40 million ounces of silver was produced in the late 1800s. The Silverton project, consisting of 31 claims, has received little to no modern-day exploration, presenting discovery potential as exploration commences.

An expert leadership team with a proven track record in precious metals exploration, development, production, M&A and capital markets leads Silver Hammer toward fully realizing the potential of its portfolio.

Peter Ball, president and CEO, has led and assisted in raising more than US$250 million of capital in the mineral resources sector. Donald Birak, board advisor, is the former senior vice-president of exploration for Coeur Mining from 2004 to 2013 and was responsible for global greenfields and brownfields exploration. The rest of the management team brings additional experience and expertise to lead the company toward improving shareholder value.

Get access to more exclusive Gold Investing Stock profiles here