Why 2020 Was a Record Year for Capital Raisings on the ASX

2020 saw ASX-listed companies raise AU$66 billion, the largest amount of capital in the last decade.

The world took an unexpected turn in 2020 as COVID-19 broke out and spread around the four corners of the globe early in the year.

As the year unfolded, companies from all countries and sectors had to take resolute steps to ensure they would be able to survive the impact of the pandemic.

In Australia, many looked for ways to increase liquidity and ensure healthy balance sheets by raising capital, leading to the highest level of activity seen in the past 10 years.

Here, the Investing News Network (INN) looks back at the main 2020 trends in equity capital market activity from companies listed on the Australian Securities Exchange (ASX).

Capital raising on the ASX in 2020

Reaching a total of AU$66 billion, 2020 saw ASX-listed companies raise the largest amount of capital in the last decade. Furthermore, in terms of the number of transactions, more companies raised capital on the ASX in 2020 than on any other global exchange, according to Baker Mckenzie.

Speaking with INN, Antony Rumboll, partner at the firm, said last year ASX companies raised cash for different reasons. “Some to shore up balance sheets in the face of the COVID-19 pandemic and the economic disruption it has caused,” he said. “Others were able to raise cash to accelerate growth initiatives or as a ‘war chest’ for future opportunities.”

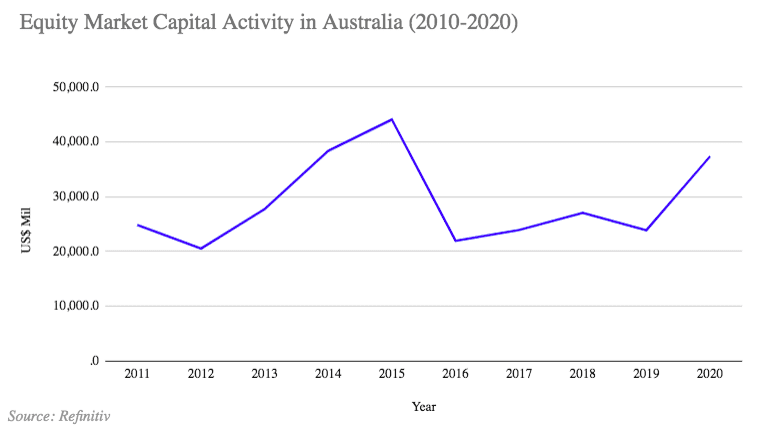

According to Refinitiv, 2020 was undoubtedly a historic year for equity capital raisings in Australia, with the highest total activity seen in the country since 2015 and a record high number of equity issuances.

“Equity capital market activity in Australia was dampened during the first quarter of 2020 as the nation battled bushfires and then COVID-19 hit the markets,” Refinitiv’s Elaine Tan explained to INN.

“However, with unprecedented monetary and stimulus injections and a favourable interest environment, activity rebounded (in the second quarter) as companies shored up cash to protect their balance sheets and improve liquidity,” added Tan, who is senior analyst at the market data firm.

On the initial public offering (IPO) front, in line with global trends, IPO activity in Australia witnessed a slow start in 2020 as the coronavirus began to make its mark, but eventually rebounded, bolstered by economies emerging from lockdown and by extensive market liquidity.

“IPO activity ended the year with a strong finish, as total proceeds during the second half of 2020 reached US$3.6 billion from 73 listings in Australia, a significant increase compared to only US$65.7 million raised in the first half of 2020 from 10 IPOs,” Tan said.

Meanwhile, follow-on offerings in Australia hit a five year high in 2020 and totaled US$33.4 billion, up 52.4 percent from a year ago.

“The COVID-19 crisis made a lot of companies reassess their business models and reconfigure their operations. One of the areas that has seen massive growth and acceleration is digitization,” Tan commented to INN. “Technology companies, as well as those that utilized artificial intelligence-driven solutions across various sectors, have attracted rising investor appetite that could encourage a positive outlook for those in the pipeline.”

The senior analyst at Refinitiv added that issuers from Australia and New Zealand were not the only ones tapping the Australian market. Foreign issuers listing their IPOs in Australia were from the UK, the US, Ireland, Israel and Singapore.

Companies that debuted on the ASX last year have been faring quite well, with resource and tech companies seeing their share prices increase significantly since going public.

Commenting on trends seen in equity capital raising in 2020, Timothy Toner, managing director and founder at Vesparum Capital, said the temporary collapse in share prices and increase in market volatility at the start of the COVID-19 period resulted in a much larger than normal number of companies raising capital to ensure they were well capitalised to navigate such uncertainty.

“The most successful companies generally raised capital opportunistically for growth-related purposes,” he commented to INN.

Companies from all sectors and industries were successful in their efforts to increase cash to face the uncertainty brought by the coronavirus pandemic.

“The ability of ASX-listed entities to raise so much capital was testament to the depth of the Australian superannuation/pension system, which is amongst the largest in the world,” Baker Mckenzie’s Rumboll explained. “(This) allied to the flexible capital raising framework in Australia, which allows listed companies to raise capital from institutional investors and shareholders without the need for a prospectus, provided they ‘cleanse’ the market at the time of the offer.”

Additionally, the ASX and the Australian Securities and Investments Commission, which is the Australian securities regulator, temporarily relaxed rules to reflect the urgency of the situation, he said.

“The framework had proven itself in the global financial crisis of 2008/2009 and proved itself again in 2020,” Rumboll added.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.