Overview

Decentralized finance, or DeFi, is an emerging multi-billion dollar industry that is expected to revolutionize the financial industry. Globally, the FinTech Market was valued at US $7301.78 billion in 2020 and is projected to grow at a CAGR of 26.87 percent to 2026. Although the market is still in its early stages, DeFi has seen explosive growth from $2 billion in total locked value in May 2020 to $250 billion in total locked value in November 2021.

DeFi encompasses various financial services such as earning interest, borrowing, lending, purchasing insurance, trading derivatives, trading assets and more on public blockchains. Unlike traditional banking, DeFi is much faster and doesn’t involve a third party or any paperwork. DeFI is similar to crypto as it is a global, peer-to-peer and open to all system.

Prophecy DeFi (CSE:PDFI) is diving into the FinTech market by bringing together technology start-ups in the blockchain and DeFi sectors to fund innovation, elevate industry research and create new business opportunities in a coherent ecosystem.

“Prophecy DeFi, through its operating company, Layer2 Blockchain, provides investors with exposure to the fastest-growing segment of the fastest-growing asset class in the world, and possibly even in history. Cryptocurrencies have gone from zero to $3 trillion in the span of a handful of years, which I believe would probably be the biggest single wealth creation event in human history. And this is the leading edge of that entire ecosystem,” said Prophecy DeFi’s CEO John McMahon.

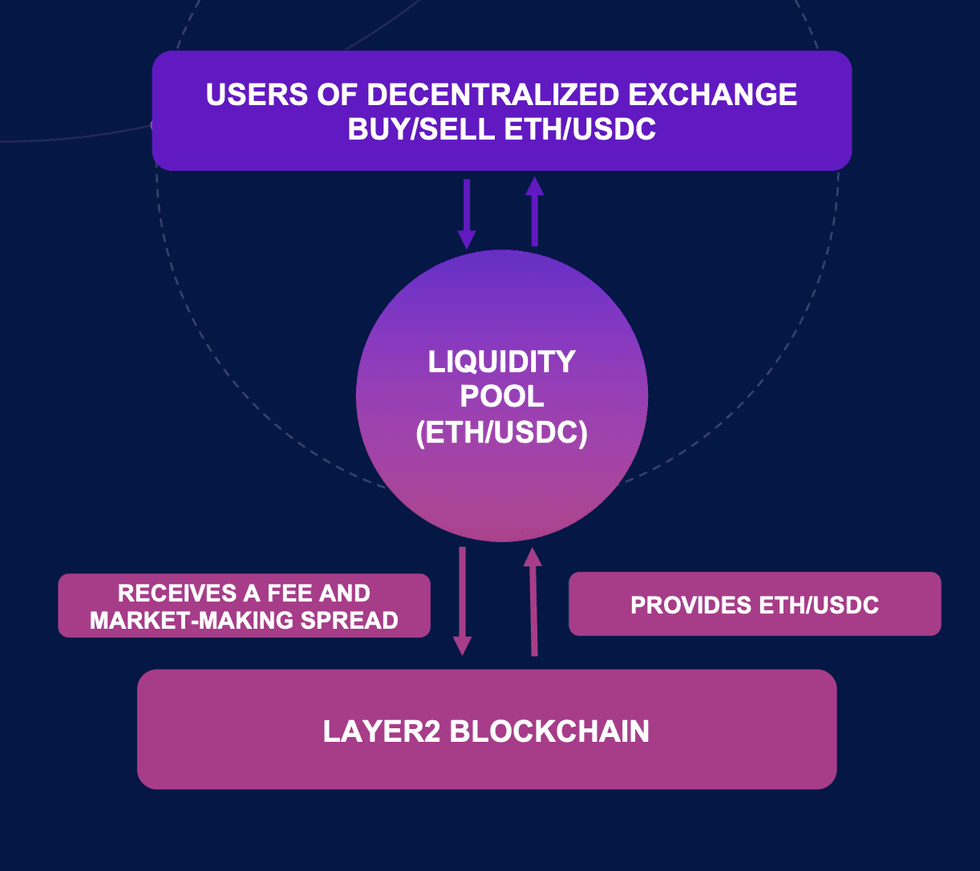

Prophecy DeFi’s 100 percent owned Layer2 Blockchain is a multi-platform solution that solves the issues of lack of capital and lack of expertise in the cryptocurrency and crypto exchange markets. Layer2 Blockchain is primarily involved in liquidity mining through forming partnerships with and providing liquidity to newly-formed and emerging automated market making (AMM) DeFi pools to earn protocol tokens and absolute returns. Layer2 Blockchain also engages in cross-chain lending and partakes in network staking and validation.

Layer2 Blockchain leverages first-mover advantage as one of the first publicly-listed companies focused on bridging the new Layer Two Decentralized Finance industry with traditional capital markets. Layer2 Blockchain is leading the way in automated market making where cryptocurrencies can be traded all over the globe and has already partnered with exchanges and deployed capital. As a result, Layer2 Blockchain plays a critical role in creating liquidity within emerging DeFi protocols.

In June 2021, the company announced that it became a member of the Blockchain Research Institute. The Blockchain Research Institute has a member community that includes more than 90 world-leading enterprises, governments, associations and technology platforms. The partnership grants Prophecy DeFi access to a research library consisting of more than 100 projects as well as entrance into the blockchain community.

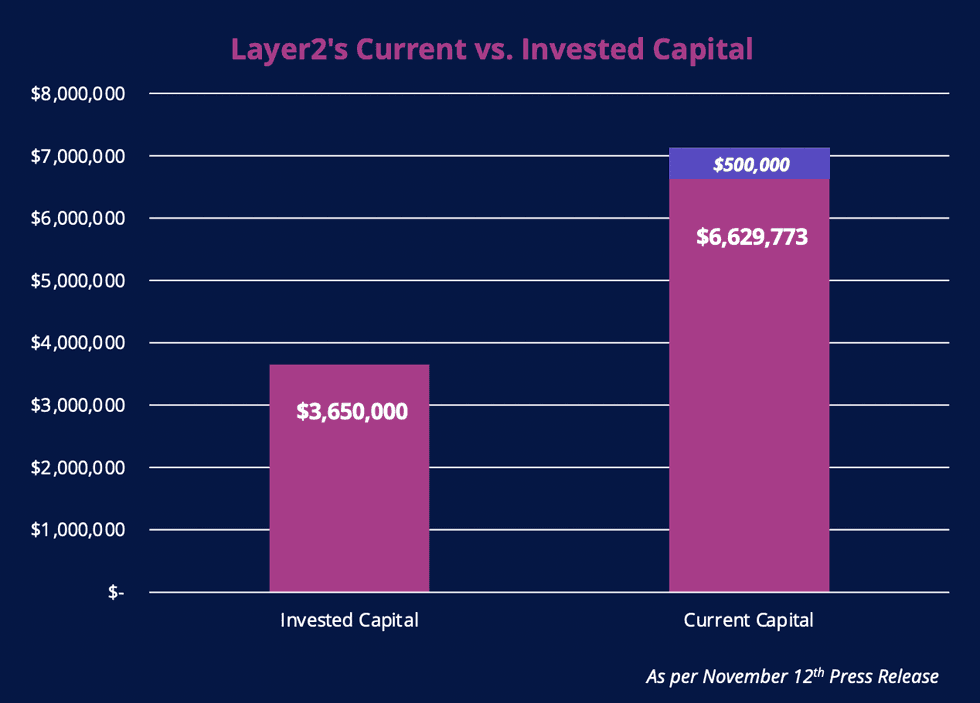

Prophecy DeFi has a track record of strong revenue generation. In November 2021, the company generated yield and capital gains of $2.98 million in 120 days. The significant return comes after Layer2 Blockchain purchased a total of $3.65 million in digital assets and deployed these assets across 11 positions. Layer2 Blockchain generated an annualized rate of return of 492.5 percent from these digital assets in just 90 days.

Prophecy DeFi strongly believes that its Layer2 Blockchain subsidiary has strong potential and scalability as decentralized finance revolutionizes the finance industry and public markets.

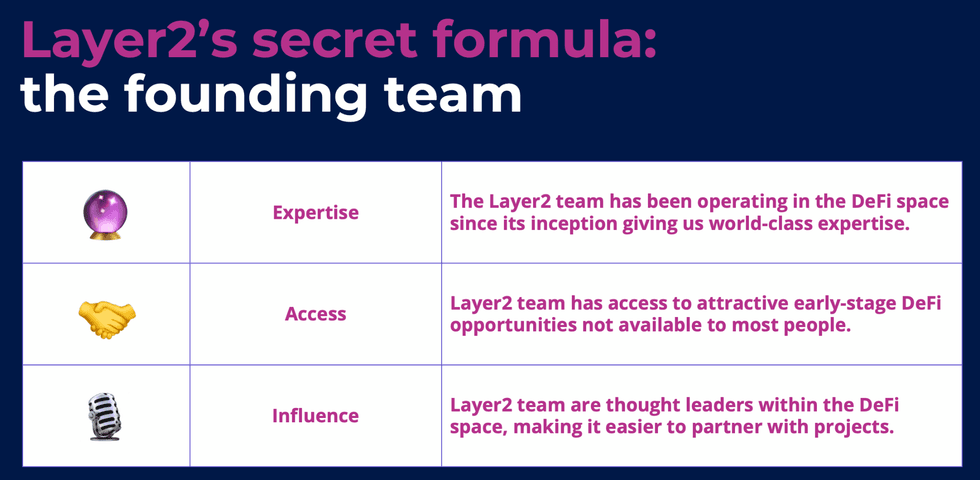

The company is led by a highly experienced management team with a history of success in cryptocurrency and shareholder value creation. Prophecy DeFi’s advisors include a co-founder of one of the most successful blockchains, Polygon, which has a current market capitalization of $10 billion.

Company Highlights

- Provides investors with exposure to a growing multi-billion dollar segment with a total locked value of over $250 billion

- Layer2 Blockchain has first-mover advantage as one of the first publicly-listed companies focused on bridging the new Layer Two Decentralized Finance industry with traditional capital markets

- Fully-owned Layer2 Blockchain mainly focuses on forming partnerships with and providing liquidity to newly-formed and emerging automated market making (AMM) DeFi pools

- In November 2021, the company generated yield and capital gains of $2.98 million in 120 days after purchasing a total of $3.65 million in digital assets.

Get access to more exclusive Blockchain Investing Stock profiles here