Palladium Price Update: H1 2024 in Review

With supply strong and demand from the auto sector staying low, palladium prices trended down in the first half of the year. What could be next for the precious metal?

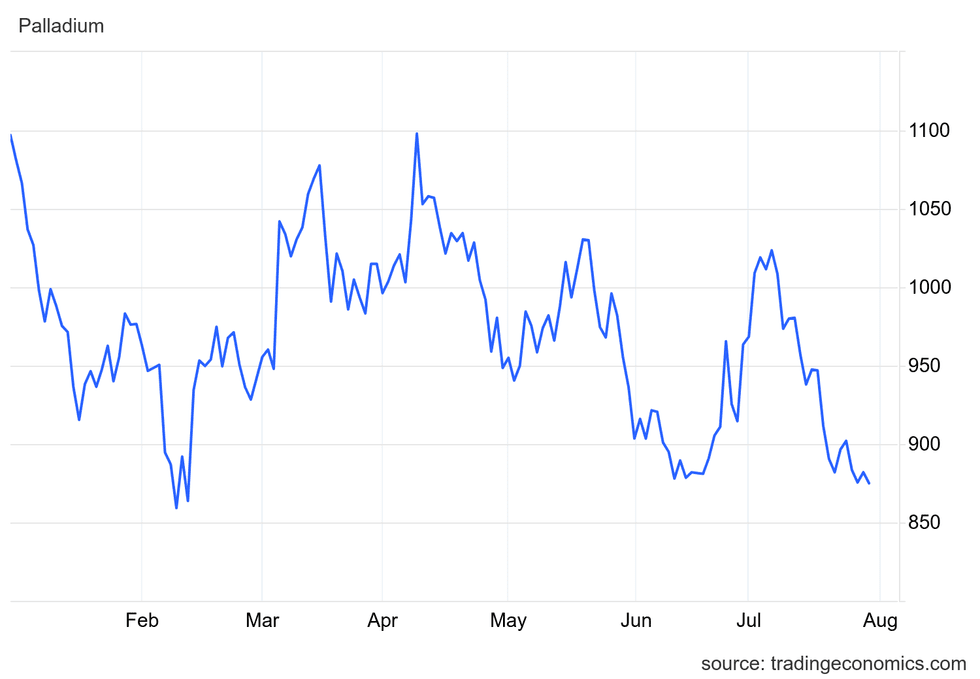

The palladium price has experienced a great deal of volatility in 2024, starting the year at US$1,096 per ounce on the back of a long-term downward trend that began all the way back in 2022.

The metal declined steeply through the first two months of 2024, reaching a yearly low of US$859.15 on February 9. However, palladium saw momentum in March, trending upward alongside gold, silver and platinum.

At the start of April, the price of palladium was US$996.28, and it quickly accelerated to reach a year-to-date high of US$1,098 on April 9. However, the metal once again pulled back after hitting that level, plunging below the US$900 mark at the start of June. Palladium then surged to end the second quarter at US$963.50 on June 28.

The price has since regressed again, approaching a near yearly low of US$881 on July 29. Read on to learn what's been driving palladium so far this year, and what factors may impact its performance moving forward.

Auto sector demand key for palladium price

Palladium and platinum are both used for investment, but have important industrial uses that claim the majority of demand. Auto sector demand has a strong impact on palladium in particular as it has few other uses.

According to a May report from the World Platinum Investment Council (WPIC), auto demand for palladium will remain steady in 2024 at 8.45 million ounces, while demand from all sources is projected to be 10.03 million ounces.

Palladium price chart, January 1 to July 30, 2024.

Chart via Trading Economics.

The WPIC is expecting palladium mine supply to remain relatively stable, with around 6.5 million ounces per year entering the market over the next five years. Meanwhile, the organization predicts that palladium recycling supply will increase from 2.64 million ounces in 2024 to 3.83 million ounces in 2028.

Overall, the WPIC is calling for palladium demand to outstrip supply in 2024 by 1.28 million ounces, and by 234,000 ounces in 2025 before entering surplus territory.

What factors drove palladium supply and demand in H1 2024?

The WPIC says the increase in recycled palladium supply is coming as a higher number of "PGM-rich vehicles" reach the end of their lives. These are expected to boost annual palladium recycling by over 1.3 million ounces by 2028.

Because platinum and palladium are interchangeable, manufacturers will often swap one out for the other as they try to find the best price. After breaking above US$3,000 in February 2022, palladium has been on a downward slide as auto manufacturers did exactly that, opting to use platinum, which was trading at around the US$1,000 per ounce level.

Though the two metals are now trading at near parity, there hasn’t been any desire to swap the two, even as platinum begins to edge higher. These dynamics are creating further headwinds in the palladium market.

In a mid-July platinum-group metals webinar hosted by CPM Group, Rohit Savant, CPM’s vice president of research, explained that given the costs associated with changing chemistries, the disparity between palladium and platinum prices will need to increase and be sustained before manufacturers consider a swap.

Savant went on to say that even though vehicle sales are expected to remain strong in 2024, gas-powered cars continue to lose market share to electric vehicles (EVs), which don’t require palladium.

This has been particularly impactful in the Chinese market, where there is higher EV demand.

“Even though you are seeing a substantial increase in vehicle sales, it may not necessarily translate into stronger demand for palladium," Savant commented during the webinar. "That’s primarily because of the ongoing strength in the EV market share in China, and also the government incentivizing the Chinese market to either buy EVs or to buy smaller passenger vehicles, both of which are not supportive of palladium demand."

What will happen to the palladium price in 2024?

Although some palladium demand comes from electronics production and investment, the auto industry is the metal's primary driver. As increased recycling and higher supply begin to take hold, the price is not likely to increase; in addition, substitution isn't likely to occur unless the price of platinum rises more substantially.

However, while near-term prospects don't look strong, palladium's low price may provide less risk-averse investors with opportunities, especially if the precious metal's price continues to retreat.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

- Top 5 Palladium- and Platinum-producing Countries ›

- How to Invest in Palladium ›

- What is the Best Precious Metal to Invest In? ›