Palladium Price Forecast: Top Trends That Will Affect Palladium in 2024

The palladium price continued its decline through 2023 as automotive demand shifted to platinum. The metal faces more headwinds heading into 2024 as stockpiles remain high while demand is low.

At the start of 2023, experts were looking to the automotive sector for clues on the palladium price outlook.

Wilma Swarts, director of platinum-group metals at Metals Focus, said at the time, “The health of the automotive sector will remain palladium's leading barometer — after all, the sector accounts for over 80 percent of demand.”

Sector participants were also keeping an eye on retail investment demand for the metal. Swarts noted that after contracting by 11 percent in 2022, this segment of the market was expected to decline further in 2023.

What ended up happening to palladium in 2023, and what's coming in 2024? Read on to find out.

How did palladium perform in 2023?

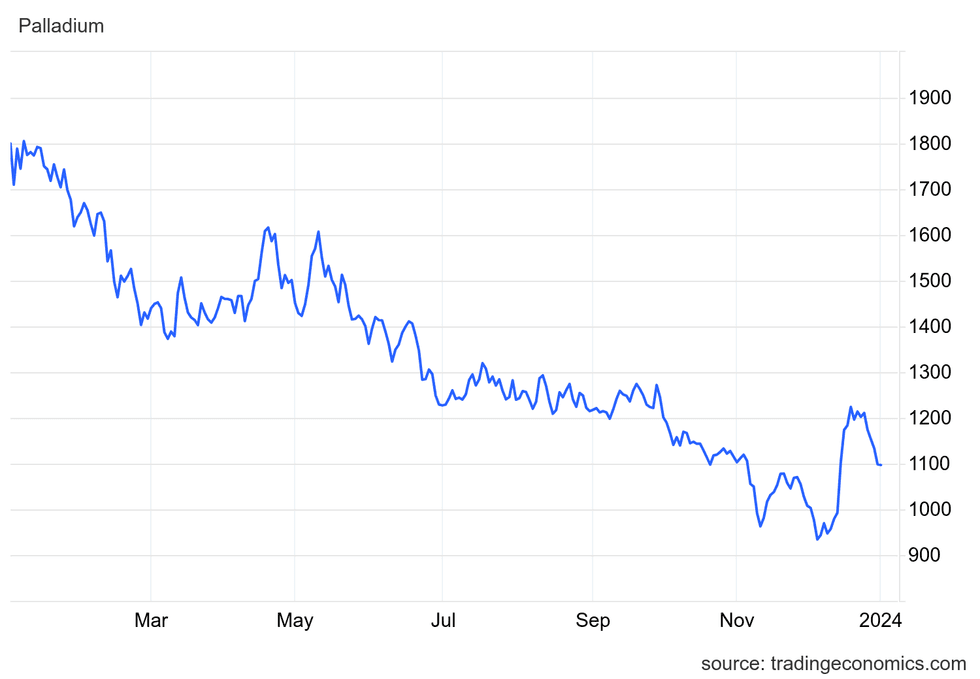

The price of palladium was under constant pressure in 2023. Starting the 12 month period at US$1,800.08 per ounce on January 2, the precious metal slid throughout the year to finish at US$1,098.49 on December 29.

This poor performance came on the back of a stellar few years for the metal, which remained above US$2,000 for much of the early 2020s, trading at around double platinum’s price. Palladium peaked in March 2022, when it climbed to US$3,180 as fears over supply shortages took hold after Russia's invasion of Ukraine.

“While Russian production remained primarily unaffected during 2022, the self-sanctioning action of equipment suppliers could rein in 2023 production and should be closely monitored,” said Swarts at the start of 2023.

Palladium price from January 1, 2023, to December 31, 2023.

Chart via Trading Economics.

However, these persistent highs led the automotive sector to start shifting toward the less expensive platinum for use in catalytic converters. As 2023 wore on, palladium supply deficits deepened and platinum shifted into deficit, but shortfalls for both were offset by large aboveground stockpiles, which helped keep pricing suppressed.

In a January 2024 email to the Investing News Network (INN), Rohit Savant, vice president of research at CPM Group, said the price of palladium has also been impacted by the growing number of electric vehicle sales as more consumers shift away from gas engines that require catalytic converters to control emissions.

Aside from that, palladium has been facing headwinds as manufacturers restructure their supply chains to decrease their reliance on Russia, which accounts for over 40 percent of global palladium supply. They have done so either by substituting the metal with platinum when possible, or looking to other countries for supply.

What will happen to the palladium price in 2024?

The expectation for 2024 is that palladium will continue to be dogged by excess aboveground supply.

Savant suggested that falling basket prices will continue to affect miners going into 2024, and may have a negative impact on palladium supply. However, he doesn’t see much relief coming for prices.

“For prices to rise in any meaningful way, there would need to be some sort of supply reduction or disruption,” Savant explained to INN. “While mining companies are expected to be challenged by the weakness in prices cutting production, especially in South Africa, this year is likely to be difficult. Especially since it is an election year, and so much of South African employment and GDP is dependent on the mining sector.”

Metals Focus also expects continuing palladium price pressure in the coming year. In a January 2024 report, the firm suggests that existing stockpiles and significant investor shorting will be themes that carry over from 2023, although weakening demand will lead to a smaller deficit in the space.

Like Savant, Swarts said declining demand puts mine supply at risk. “Given the inflationary costs of wages, power and the weakening rand, more than 50 percent of mines in South Africa are loss-making at the spot basket price,” she said. “We can expect production curtailment and mine closure if prices remain at current levels over the next two to five years.”

In addition, Metals Focus is predicting a boost in recycled palladium owing to a 16 percent increase in autocatalyst scrap supply as consumers replace aging cars following a two year decline during the pandemic. Many of these vehicles have higher palladium loadings, and this is expected to push overall supply up 1 percent.

Investor takeaway

Palladium is not expected to see a substantial recovery in 2024, and investors considering investing in the sector should take note of the metal's short-term challenges and long-term outlook when weighing opportunities.

Substitution for platinum is anticipated to continue — according to a report issued by CME Group (NASDAQ:CME), in the long term, increased substitution of palladium for platinum will be needed to reduce bottlenecks that will arise from supply deficits in the platinum market, freeing up platinum supply for use in the growing hydrogen market. The firm expects “a period of palladium-for-platinum ‘reverse’ substitution beginning from 2025.”

Given the ongoing conflict between Russia and Ukraine, manufacturers continue to look for alternative suppliers of the metal. Edward Sterck, director of research at the World Platinum Investment Council, suggested palladium will start to move into a surplus situation starting in 2025, in part due to autocatalyst recycling.

“The outlook for palladium is dependent upon a significant increase in the supply of recycled metal; the shortage of end-of-life vehicles could push out the tipping point for palladium to later in the decade,” he said.

Looking even further, many countries plan to phase out sales of internal combustion engine vehicles between 2030 and 2040 in favor of electric vehicles and other new energy vehicles, which don’t require palladium.

This fall in demand from declining use of palladium in the auto sector will have long-term implications for the metal, but new technologies being developed by Norilsk Nickel could see palladium’s use extended as part of the energy transition. The company is testing how palladium works as a catalyst in hydrogen power systems, as well as in the production of solar cells. Results from testing are expected to be delivered by the end of 2024.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top 5 Palladium- and Platinum-producing Countries ›

- How to Invest in Palladium ›

- What is the Best Precious Metal to Invest In? ›