Cadia expansion & Lihir recovery improvement projects approved

Today the Newcrest Board approved two projects moving to the Execution phase, being Stage 2 of the Cadia Expansion Project and the Lihir Front End Recovery Project. Key Points Cadia Expansion Project – Stage 2 1 2 Primarily comprises the addition of a second Coarse Ore Flotation circuit in Concentrator 1 and equipment upgrades in Concentrator 2, which are projected to result in: Plant capacity increasing from 33mtpa …

Today the Newcrest Board approved two projects moving to the Execution phase, being Stage 2 of the Cadia Expansion Project and the Lihir Front End Recovery Project.

Key Points

Cadia Expansion Project – Stage 2 1 , 2

- Primarily comprises the addition of a second Coarse Ore Flotation circuit in Concentrator 1 and equipment upgrades in Concentrator 2, which are projected to result in:

- Plant capacity increasing from 33mtpa to 35mpta

- LOM gold recoveries increasing by 3.5%

- LOM copper recoveries increasing by 2.7%

- AISC 3,4 reducing by an estimated $22 per ounce

- Estimated capital cost for Stage 2 is $175m , $5 million lower than the October 2019 estimate

- Timing for delivery remains on schedule, with completion expected in late FY22

- Attractive project economics, with a projected:

- IRR of 21% 3,4

- Payback of 4.2 years 3,4

Lihir Front End Recovery Project 5 , 6

- Primarily comprises the installation of flash flotation and additional cyclone capacity, as well as cyclone efficiency upgrades, to improve grinding classification and reduce gold losses through the flotation circuits. This is projected to result in:

- LOM gold recoveries increasing by 1.2%

- Incremental LOM gold production increasing by 244koz 7

- Estimated capital cost of $61 million

- Attractive project economics, with a projected:

- IRR of 32% 6,7

- Payback of 2.6 years 6,7

Newcrest Managing Director and Chief Executive Officer, Sandeep Biswas said “It is an exciting time at Newcrest as we advance our growth pipeline with both of these projects adding value to our existing large scale, long life operations while we pursue the development of Red Chris and Havieron and exploration opportunities globally.”

“Stage 2 of the Cadia Expansion Project increases plant capacity to 35mtpa, enabling an increase in gold and copper recoveries, an increase in production and a reduction in unit costs. Cadia is one of the largest, lowest cost, long life gold mines in the world due to the application of Newcrest’s industry leading block caving technology, and this investment helps Cadia maintain this industry leading position.”

“The Lihir Front End Recovery Project is expected to deliver additional production through an improvement in gold recoveries over the life of the mine. Lihir’s long reserve life makes this improvement in gold recoveries particularly valuable to our shareholders.”

“I am pleased that Newcrest is able to generate well paying jobs for people in Australia and Papua New Guinea over the next two years. Stages 1 and 2 of the Cadia Expansion Project are expected to generate direct employment in Australia of approximately 860 people at its peak, whilst the Lihir Front End Recovery project is expected to generate direct employment of approximately 150 people at its peak.”

Mr Biswas further said “Both projects demonstrate how we are using innovation and our technical expertise to continually improve our operations. With a strong balance sheet, low cost production, a range of organic growth options and a strong exploration portfolio, Newcrest is well positioned for the future.”

Cadia Expansion Stage 2 1, 2

Stage 2 of the Cadia Expansion comprises a further expansion of nameplate capacity of the plant to 35mtpa, which is achieved by:

- Increasing throughput capacity in Concentrator 2 ( Con 2 ) from 7mtpa to 9mtpa through crushing, grinding, cyclone, pumps and flotation upgrades; and

- Installation of a second Coarse Ore Flotation circuit on Concentrator 1 ( Con 1 ) and additional upgrades to Con 1 to facilitate an increase in throughput capacity to up to 26 mtpa.

These works are scheduled for completion in late FY22, prior to the completion of PC2-3 mine development.

Stage 2 – Key financial metrics 3,4 | ||

Key Project Metrics | Units | Value |

NPV | US$m Real | 325 |

IRR | % | 21% |

Capex | US$m Real | 175 |

Payback | Years | 4.2 |

AISC reduction | US$/oz | 22 |

Target LOM gold recovery | % | 80.3 |

Target LOM copper recovery | % | 85.2 |

Stage 1, which is already in execution, was designed to maintain production continuity at Cadia through the development of PC2-3 and increase the processing capacity to 33mtpa. Stage 1 comprises an upgrade to the materials handling system and debottlenecking of the Con 1 comminution circuit.

The rate of ore mined from Cadia is expected to vary over time according to draw rates, cave maturity and cave interaction as further caves are developed. From FY27 onwards, life of mine ( LOM ) Cadia mining rates are generally expected to be in the range of 33-35mtpa 8 , with an average of 34mtpa used for financial evaluation purposes. Higher mine production rates may be possible, subject to further studies.

At throughput rates of 34mtpa, gold recovery improvements from Stages 1 and 2 are expected to achieve LOM gold recoveries of 80.3% and LOM copper recoveries of 85.2% compared to Stage 1 baselines of 76.8% for gold and 82.5% for copper.

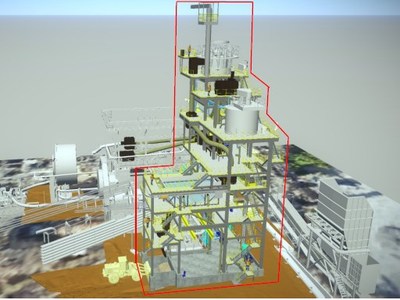

Lihir Front End Recovery Project 5

The Lihir Front End Recovery Project aims to increase the overall Lihir processing plant gold recovery by improving grinding classification and reducing gold losses through the flotation circuits, through the installation of flash flotation and additional cyclone capacity on the High Grade Ore One ( HGO1 ) circuit, as well as cyclone efficiency upgrades of the Flotation Grade Ore ( FGO ) circuit.

The flash flotation and cyclone upgrades target the following process improvements:

- Implement flash flotation to reduce mineral fines generated from overgrinding and send the higher-grade concentrate stream to the autoclaves

- Improve cyclone efficiency to achieve a reduction in unliberated coarse mineral particles entering the cyclone overflow, which are not recovered in conventional flotation.

Lihir Front End Recovery Project – Key financial metrics 6,7 | ||

Metric | Units | Value |

Incremental NPV | US$m Real | 94 |

IRR | % | 32 |

Payback | Years | 2.6 |

Expansion capital expenditure | US$m Real | 61 |

LOM average processing recovery improvements | % | 1.2 |

LOM Incremental gold production 9 | koz | 244 |

Forward Looking Statements

This release includes forward-looking information and forward-looking statements under applicable securities laws. Forward-looking information and forward looking statements can generally be identified by the use of words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, “outlook” and “guidance”, or other similar words and may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs. The Company continues to distinguish between outlook and guidance. Guidance statements relate to the current financial year. Outlook statements relate to years subsequent to the current financial year.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to differ materially from statements in these materials. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on the Company’s good faith assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of the Company. Readers are cautioned not to place undue reliance on forward looking statements, particularly in the current economic climate with the significant volatility, uncertainty and disruption caused by the outbreak of COVID-19. Forward looking statements in these materials speak only at the date of issue. Except as required by applicable laws or regulations, the Company does not undertake any obligation to publicly update or revise any of the forward looking statements or to advise of any change in assumptions on which any such statement is based.

Non-IFRS Financial Information

Newcrest results are reported under International Financial Reporting Standards ( IFRS ). This release includes non-IFRS financial information, including All-In Sustaining Cost and All-In Cost (both determined in accordance with the updated World Gold Council Guidance Note on Non-GAAP Metrics which was released in November 2018 ). These measures are used internally by management to assess the performance of the business and make decisions on the allocation of resources and is included in this release to provide greater understanding of the underlying performance of the Company’s operations. When reviewing business performance, this non-IFRS information should be used in addition to, and not as a replacement of, measures prepared in accordance with IFRS, available on Newcrest’s website and on the ASX platform. Non-IFRS information has not been subject to audit or review by Newcrest’s external auditor. Newcrest Group All-In Sustaining Costs and All-In Costs will vary from period to period as a result of various factors including production performance, timing of sales, the level of sustaining capital and the relative contribution of each asset.

Ore Reserves and Mineral Resources Reporting Requirements

As an Australian Company with securities listed on the Australian Securities Exchange ( ASX ), Newcrest is subject to Australian disclosure requirements and standards, including the requirements of the Corporations Act 2001 and the ASX. Investors should note that it is a requirement of the ASX listing rules that the reporting of ore reserves and mineral resources in Australia comply with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code ) and that Newcrest’s ore reserve and mineral resource estimates comply with the JORC Code.

Newcrest has been conditionally approved for listing on the Toronto Stock Exchange ( TSX ). Newcrest will be subject to certain Canadian disclosure requirements and standards, including the requirements of National Instrument 43-101 ( NI 43-101 ). Investors should note that it is a requirement of Canadian securities law that the reporting of mineral reserves and mineral resources in Canada and the disclosure of scientific and technical information comply with NI 43-101. We note that the Annual Mineral Resources and Ore Reserves Statement referenced in this report was prepared prior to Newcrest’s listing on the TSX and accordingly was prepared and presented in accordance with the JORC Code and not presented in accordance with NI 43-101. The mineral resource estimates set out in the Annual Mineral Resources and Ore Reserves Statement differ from mineral resource estimates disclosed in accordance with NI 43-101. In particular, NI 43-101 does not allow for inferred resources to be added to other mineral resource categories and the mineral resource estimates in the Annual Mineral Resources and Ore Reserves Statement include inferred mineral resources in the total resource figures.

Competent Person’s Statement

The information in this release that relates to Cadia Ore Reserves is based on information compiled by the Competent Person, Mr Geoffrey Newcombe , who is a member of The Australasian Institute of Mining and Metallurgy. Mr Geoffrey Newcombe , is a full-time employee of Newcrest Mining Limited or its relevant subsidiaries, holds options and/or shares in Newcrest Mining Limited and is entitled to participate in Newcrest’s executive equity long term incentive plan, details of which are included in Newcrest’s 2020 Remuneration Report. Mr Geoffrey Newcombe has sufficient experience which is relevant to the styles of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code 2012. Mr Geoffrey Newcombe approves the disclosure of scientific and technical information in this report relating to Cadia and consents to the inclusion of material of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Lihir Ore Reserves is based on information compiled by the Competent Person, Mr David Grigg , who is a member of The Australasian Institute of Mining and Metallurgy. Mr David Grigg , is a full-time employee of Newcrest Mining Limited or its relevant subsidiaries, holds options and/or shares in Newcrest Mining Limited and is entitled to participate in Newcrest’s executive equity long term incentive plan, details of which are included in Newcrest’s 2020 Remuneration Report. Mr David Grigg has sufficient experience which is relevant to the styles of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code 2012. Mr David Grigg approves the disclosure of scientific and technical information in this report relating to Lihir and consents to the inclusion of material of the matters based on his information in the form and context in which it appears.

The technical and scientific information contained in this disclosure relating to Lihir and Cadia was reviewed and approved by Kevin Gleeson , Newcrest’s Head of Mineral Resource Management, FAusIMM and a Qualified Person as defined in NI 43-101.

Authorised by the Newcrest Disclosure Committee

This information is available on our website at www.newcrest.com

1 | Stage 2 of the Cadia Expansion Feasibility Study has been prepared with the objective that its findings are subject to an accuracy range of ±10-15%. The findings in the Study and the implementation of the Cadia Expansion Project are subject to all the necessary approvals, permits, internal and regulatory requirements and further works. The estimates are indicative only and are subject to market and operating conditions. They should not be construed as guidance. | |

2 | As Cadia’s functional currency is AUD, the Studies have been assessed in AUD. The outcomes for the Cadia Expansion Project – Stage 2 in this market release have been converted to USD using the following exchange rates: FY21 0.70, FY22 0.71, FY23 0.72, FY24 0.73 and FY25+ 0.75. | |

3 | The production targets underpinning the estimates are shown on Page 3 in the graphs titled “Cadia’s estimated gold and copper production”. | |

4 | The production targets underpinning the estimates are based on the utilisation of 100% of the Cadia East Ore Reserves, being 20moz Probable Reserves as at 31 December 2019 (see release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2019” dated 13 February 2020), but subject to depletion for the period since 1 January 2020. | |

5 | The Lihir Front End Recovery Project has been prepared with the objective that its findings are subject to an accuracy range of ±10-15%. The findings in the Study and the implementation of the Lihir Front End Recovery Project are subject to all the necessary approvals, permits, internal and regulatory requirements and further works. The estimates are indicative only and are subject to market and operating conditions. They should not be construed as guidance. | |

6 | The production targets underpinning the estimates are based on the utilisation of 100% of the Lihir Ore Reserves, being 23moz Probable and Proven Reserves as at 31 December 2019 (see release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2019” dated 13 February 2020), but subject to depletion for the period since 1 January 2020. | |

7 | The production targets underpinning the estimates are shown on page 5 in the graphs titled “Estimated incremental gold production”. | |

8 | The production targets shown are based on the utilisation of 100% of the Cadia East Ore Reserves, being 20moz Probable Reserves as at 31 December 2019 (see release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2019” dated 13 February 2020), but subject to depletion for the period since 1 January 2020. The targets shown are indicative only and should not be construed as guidance. Achievement of targets is subject to market and operating conditions. | |

9 | The production targets shown are based on the utilisation of 100% of the Lihir Ore Reserves, being 23moz Probable and Proven Reserves as at 31 December 2019 (see release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2019” dated 13 February 2020), but subject to depletion for the period since 1 January 2020. The targets shown are indicative only and should not be construed as guidance. Achievement of targets is subject to market and operating conditions. | |

SOURCE Newcrest Mining Limited

News Provided by Canada Newswire via QuoteMedia

![Cadia’s estimated gold and copper production [8] (CNW Group/Newcrest Mining Limited) Cadia’s estimated gold and copper production [8] (CNW Group/Newcrest Mining Limited)](https://mma.prnewswire.com/media/1309808/Newcrest_Mining_Limited_Cadia_expansion___Lihir_recovery_improve.jpg)

![Estimated incremental gold production [9] (CNW Group/Newcrest Mining Limited) Estimated incremental gold production [9] (CNW Group/Newcrest Mining Limited)](https://mma.prnewswire.com/media/1309811/Newcrest_Mining_Limited_Cadia_expansion___Lihir_recovery_improve.jpg)