How to Invest in Magnesium Stocks

Wondering about ways to invest in critical metal magnesium? We've put together a brief guide for those interested in the market.

With important roles in healthcare and industrial applications, magnesium is worthy of investor consideration.

Not to be confused with manganese, which is also crucial for the development of a healthy body, magnesium, along with sulfur and calcium, is one of three secondary plant nutrients found in abundance on land and in water.

Necessary for over 300 biochemical reactions, magnesium is vital for healthy bones and good circulation. Magnesium oxide is produced when magnesium and oxygen combine, and is commonly used in heartburn and indigestion remedies.

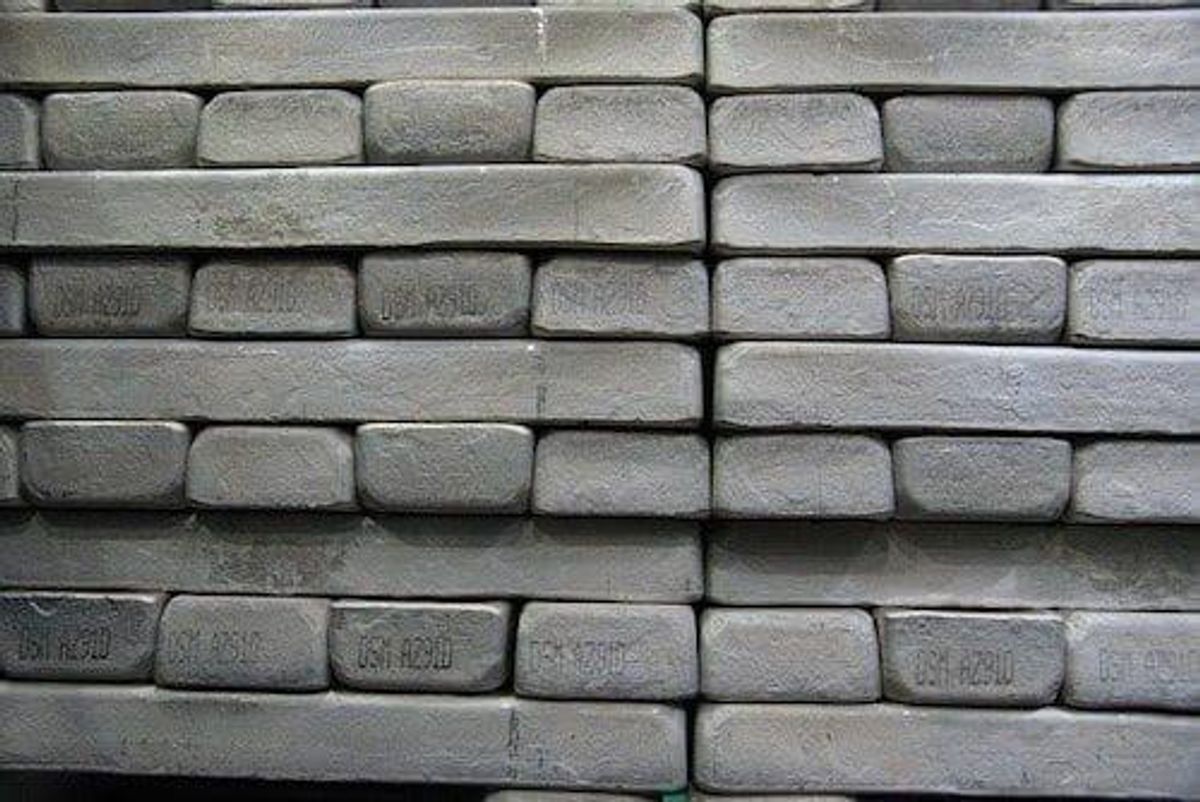

Magnesium metal plays a key role in various industrial applications. The metal is 40 percent lighter than aluminum, but as strong as steel, making it crucial for strengthening aluminum alloys.

Magnesium alloys can be found in airplanes, automobile parts and in electronic devices that benefit from being lightweight. Magnesium is also used to remove sulfur when iron and steel are produced and to inoculate cast iron. Magnesium carbonate salts are primarily used in calcining, as well as in the agricultural and construction sectors.

Magnesium’s wide array of high-tech applications make it a compelling investment, but it's often difficult for investors to find information about the magnesium metal market. Here’s a quick overview of magnesium industry supply and demand dynamics, as well as a brief introduction to investing in magnesium.

What drives magnesium supply and demand?

Demand for magnesium has grown steadily in recent years, driven largely by the car parts industry, where magnesium is used for die casting. Specifically, magnesium can be found in components like car steering wheels and support brackets.

According to IndustryARC, the CAGR in the global magnesium metal market is expected to average 6.7 percent between 2022 and 2027 to reach US$7.5 billion. In the forecast period, the firm expects magnesium alloys to display stronger market growth over more traditional uses such as steel desulfurization. This is mainly due to environmental pressures as vehicle makers view alloys as a means of reducing vehicle weight and, in turn, emissions.

China is experiencing the greatest growth in market share versus the rest of the world. It is the largest global vehicle market, and the Chinese government has predicted that its automobile output will reach 35 million units by 2025.

In terms of supply, magnesium is the eighth most abundant element in the Earth’s crust and the third most abundant element dissolved in ocean water. Around 87 percent of magnesium production in the world comes from Chinese mineral deposits. Other major high-purity magnesium-producing countries include Israel and Russia; Russia also holds the highest magnesium compound reserves in the world at 2.3 million metric tons.

How to invest in magnesium stocks?

As with many other critical metals, there is no formal magnesium market. For that reason, it is difficult to gain exposure to the metal. However, one way to do so is to invest in magnesium mining companies.

A few options are below; all companies are listed on Canadian, US and Australian exchanges:

- Inomin Mines (TSXV:MINE)

- Latrobe Magnesium (ASX:LMG)

- Karnalyte Resources (TSX:KRN)

- Korab Resources (ASX:KOR)

- Magontec (ASX:MGL)

- MGX Minerals (CSE:XMG,OTC Pink:MGXMF)

- Western Magnesium (TSXV:WMG,OTCQB:MLYF)

- West High Yield Resources (TSXV:WHY,OTC Pink:WHYRF)

This is an updated version of an article originally published by the Investing News Network in 2011.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Inomin Mines and West High Yield Resources are clients of the Investing News Network. This article is not paid-for content.

- Magnesium Uses ›

- 10 Top Countries for Magnesite Mining | INN - Investing News ›

- How Magnesium Alloys are Making Planes Lighter | INN - Investing ... ›

- Magnesium Bike Frames: A Challenge and Opportunity | INN ›