September 03, 2024

C29 Metals expands Ulytau Uranium Project with new tenement (~39km²), strong local support, and a Social Support Agreement signed. Exploration Approvals Advancing.

C29 Metals Limited (“C29” or the “Company”) is pleased to announce that its application for the northern tenement has been granted in 48 calendar days.

HIGHLIGHTS

- C29 Metals has received notification that’s its application for the northern tenement for the Ulytau Uranium Project located in Kazakhstan has been granted.

- The tenement granting process has been completed in 48 calendar days further demonstrating the efficiency of the Government agencies and their support for the Company’s activities.

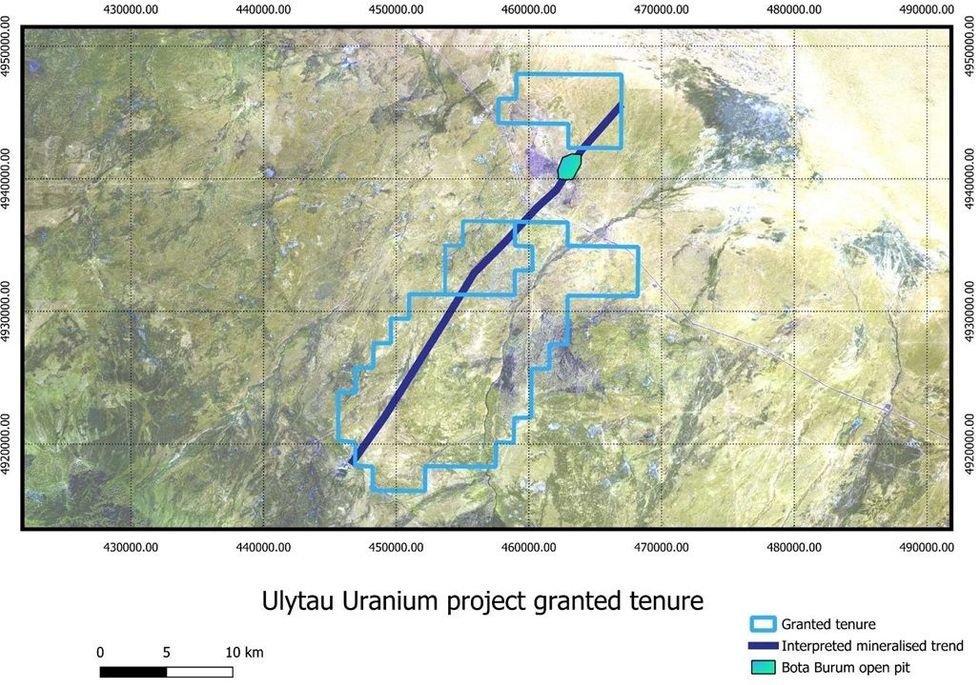

- The northern tenement sits to the north of the Ulytau Uranium Project tenement and immediately north of the historic Bota Burum Uranium mine.

- The northern tenement is interpreted as having a similar mineralised trend to that of the existing Ulytau Project area1.

- C29 Metals will immediately commence the exploration approval process for this new northern tenement.

- The approval for the Company’s planned exploration drilling programs at the Ulytau Uranium Project is at an advanced stage & is on track.

The Northern application sits to the north of the Ulytau Uranium project tenement and immediately North of the historic Bota Burum Uranium mine. The Northern licence application area is ~39 km2.

The northern tenement is interpreted as having a similar mineralised trend to that of the existing Ulytau Project area1.

C29 Metals Managing Director, Mr Shannon Green, commented:

“Another very exciting step in executing our stated strategic plan for rapid growth with this highly prospective application being granted in such a rapid timeframe. Continuing to demonstrate the positive operating environment in Kazakhstan and the support the Company is receiving”.

Figure 1 below shows the interpreted mineralised uranium trend with the newly granted tenement.

Project Location and History

The Ulytau Uranium Project is located in the Almaty Region of Southern Kazakhstan approximately 15 km southwest of the Bota-Burum mine, one of the largest uranium deposits mined in the former Soviet Union. Exploration for uranium has been carried out in the area since 1953. Production of Uranium at the Bota Burum mine next to the village of Aksuyek commenced in 1956 and continued until 19912.

Total mined reserves of Bota Burum are quoted at 20,000 tonnes of Uranium (44 million pounds)2,3.

Click here for the full ASX Release

This article includes content from C29 Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

C29:AU

The Conversation (0)

21 October 2025

C29 Metals to drill Sampsons Tank Copper Project

C29 Metals (C29:AU) has announced C29 Metals to drill Sampsons Tank Copper ProjectDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

C29 Metals (C29:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

01 July 2025

C29 Metals shifts focus to Mayfield Copper Project

C29 Metals (C29:AU) has announced C29 Metals shifts focus to Mayfield Copper ProjectDownload the PDF here. Keep Reading...

11 May 2025

Multiple New Multi-Commodity Targets

C29 Metals (C29:AU) has announced Multiple New Multi-Commodity TargetsDownload the PDF here. Keep Reading...

04 May 2025

C29 Signs Binding HOA to Drive Growth

C29 Metals (C29:AU) has announced C29 Signs Binding HOA to Drive GrowthDownload the PDF here. Keep Reading...

22h

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00