What You Should Know About Graphite and the Automobile Industry

In order to meet its 2025 EV sales targets, Volkswagen needs 300 GWh of lithium-ion battery production,Tesla needs 350 GWh, Daimler needs 200 GWh and China needs at least 250 GWh.

In order to meet its 2025 EV sales targets, Volkswagen needs 300 gigawatt (GWh)hours of lithium-ion battery production, Tesla needs 350 GWh, Daimler needs 200 GWh and China needs at least 250 GWh. On top of that are all the other automobile manufacturers plus the grid storage market.

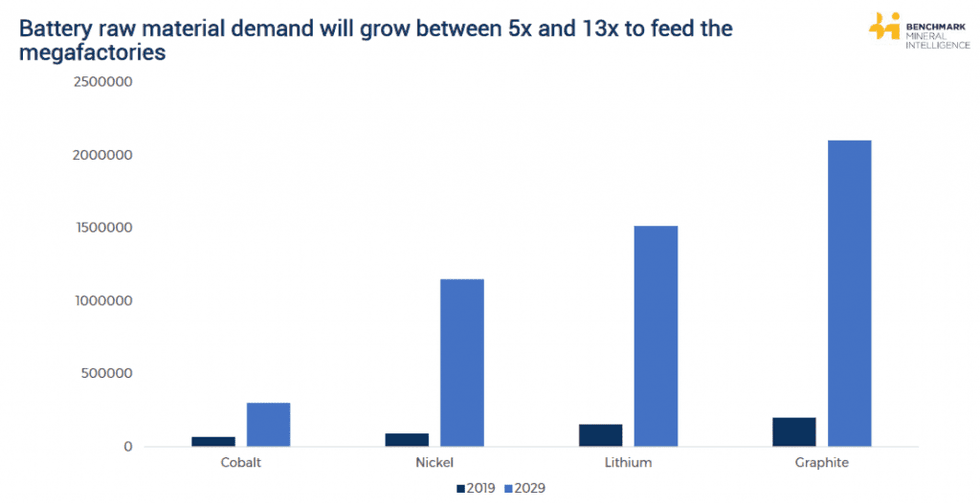

For automobile manufacturers to execute their business plans, these figures translate into a requirement to invest billions of dollars in multiple new graphite mines and upgrading facilities. Graphite requires the largest production increase of all the battery minerals, and almost all of it currently comes from China.

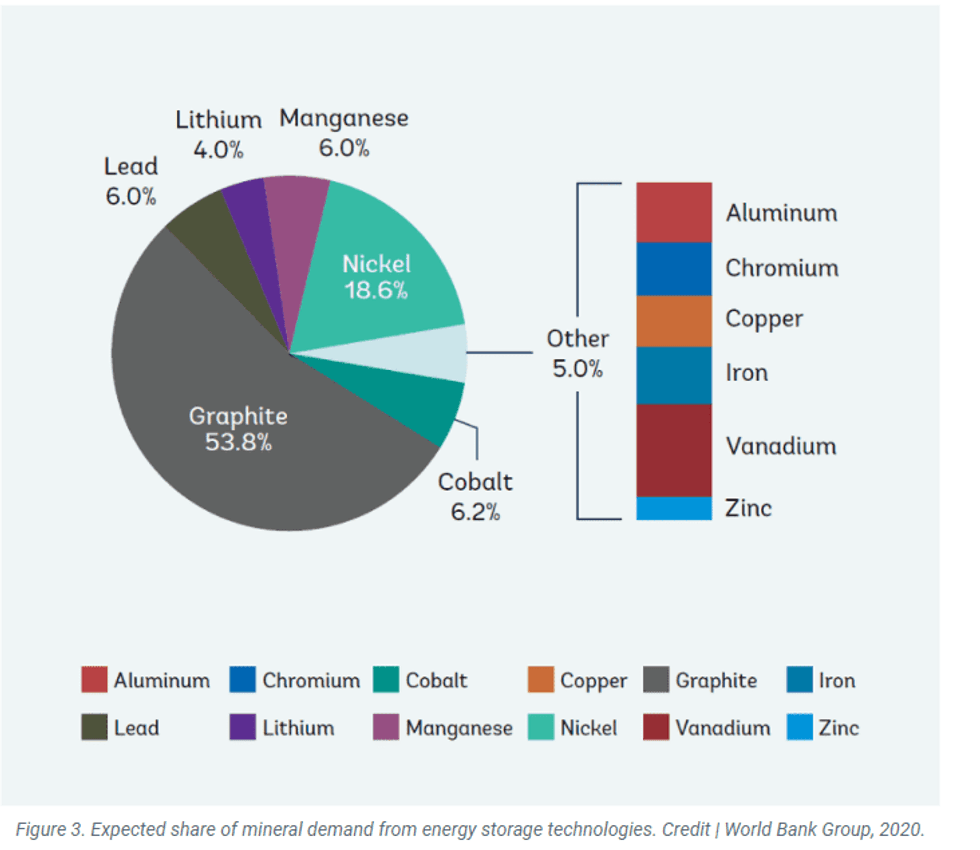

Share of Mineral Demand from Energy Storage

(source:IEA)

While there is an ongoing debate with respect to using natural versus synthetic graphite to make lithium ion battery anode material (BAM), it really doesn’t matter. The potential demand is so large and the supply challenges so great that a lot of both will be required. The automobile/battery manufacturers are saying little about this issue, perhaps because they do not want to draw attention to the massive problem they face. Synthetic graphite is made from petroleum coke, the residue of oil production and refining. Plants require a huge investment, have a very large environmental footprint and have substantial energy requirements, much of which comes from coal.

None have been built outside of China for many years and doing so will be a permitting/environmental challenge. China also dominates natural graphite production and supplies almost 100 percent of natural graphite based BAM.

Gregory Bowes, CEO of Northern Graphite commented that, “It is incumbent on all participants in the supply chain to contribute to an open and transparent discussion about the environmental and social governance issues associated with greatly increasing the production of both natural and synthetic graphite. Northern is demonstrating its commitment by initiating a study of the footprint of its Bissett Creek Project and BAM related processes so that mitigation and offset strategies can be developed.”

Automobile manufacturers and their battery suppliers are betting that China, which has the largest EV market in the world, will continue to have the resources and the desire to supply the rest of the world with battery anode material. They are also betting that the market will finance new mines in the west. That bet is not looking so good as none are currently under construction due to low prices and the clock is ticking faster and faster – new production does not happen overnight.

There are approximately 20 junior public graphite mining companies with advanced stage, feasibility study level projects. Fourteen are in Africa with varying degrees of security/stability risk. Many have weathered deposits which can be (but not always) metallurgically challenging. There have been two recent attempts to bring new deposits into production, but both had serious, and in one case, fatal financial/metallurgical issues. Not all graphite is “battery grade” which is more difficult for the average investor to determine. Strong, independent third party validation is recommended. Finally, many years of low graphite and share prices have left most graphite juniors with hundreds of millions, or even over a billion, shares outstanding with mine construction yet to be financed.

The number of advanced stage graphite mining projects located in politically stable countries is also limited. Only four are in North America: Nouveau Monde (TSXV:NOU,OTCQX:NMGRF, Frankfurt:NM9), Northern Graphite (NGC:TSXV,NGPHF:OTCQB), Focus Graphite (TSXV:FMS) and Mason Graphite (TSXV:LLG,OTCQX:MGPHF).

Graphite prices are a function of flake size and purity with the larger, high purity material commanding a premium. A recent independent study by Benchmark Mineral Intelligence estimated that Northern Graphite’s Bissett Creek Project will have the highest margin of any existing or proposed graphite deposit, largely due to it having the best flake size distribution (as well as a very favorable location and simple metallurgy). Concentrate purity should be over 94 percent graphitic carbon (Cg), and a premium is paid if it is higher and prices are discounted if it is less. Northern Graphite, Nouveau Monde and Focus Graphite have all demonstrated the ability to produce 96-98 percent concentrates.

The economics of most graphite projects are not great at current prices which have remained frustratingly low despite rising battery demand. Many expect that to change dramatically. And while a rising tide may lift all boats, some will float better than others.

This INNSpired article was written as part of an advertising campaign for a company that is no longer a client of INN. This INNSpired article provides information which was sourced by INN, written according to INN's editorial standards, in order to help investors learn more about the company. The company’s campaign fees paid for INN to create and update this INNSpired article. INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled. If your company would benefit from being associated with INN's trusted news and education for investors, please contact us.