April 10, 2022

Valor Resources Limited (Valor) or (the Company) (ASX:VAL) is pleased to announce that the Company’s maiden drilling program at the Hook Lake Uranium Project has been completed. The drilling program comprised eight drill holes for 1,757m, with six holes at the S-Zone and two at V-Grid.

HIGHLIGHTS

- Eight hole, 1,757m diamond drilling program completed at Hook Lake Project at the S-Zone and V-Grid targets

- Elevated radioactivity 1 and alteration zones encountered in several holes at S-Zone target, assays pending

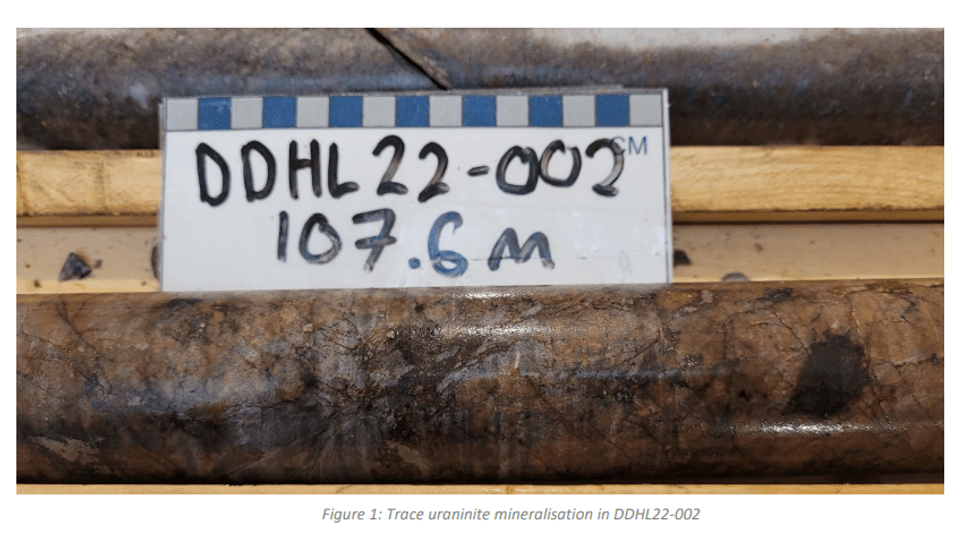

- Uraninite mineralisation recorded in drill hole DDHL22-002 at S-Zone within a 3.5m 2 subvertical zone of elevated radioactivity and alteration

- Airborne gravity survey to commence at Cluff Lake and Hook Lake in May to identify new drill targets

- Follow-up on-ground exploration program for Hook Lake currently being planned

- To include on-ground follow up of targets such as West Way where surface sampling in 2021 returned assays up to 0.64% U3O8 and Nob Hill with assays up to 1.01% TREO

Three of the drillholes at S-Zone encountered elevated radioactivity and associated alteration of varying widths. DDHL22-002 intersected a zone from 104.3m to 108m downhole depth of elevated radioactivity (up to 900 cps measured with a handheld RS-125 scintillometer and a peak of 1,131 cps in the downhole gamma survey) and alteration, with traces of uraninite mineralisation noted in some of the fractures (see Figure 1). This zone can be correlated between three holes on the drill section and potentially represents a sub-vertical structure. The two holes (DDHL22-001 and 005) drilled closest to the Hook Lake trench, where surface sampling conducted by Valor returned assays of up to 59.2% U3O8, intersected a zone of albitite alteration and elevated radioactivity in hole DDHL-005 (up to 878 cps in the downhole gamma survey).

A total of 305 samples have been collected from the program which will be submitted for assay with results expected in early May. A follow-up on-ground summer field program is currently being planned, which will occur following the completion of the airborne gravity survey, which is expected to commence in May.

Executive Chairman George Bauk commented “We are encouraged by the alteration and elevated radioactivity seen in several of the holes drilled at S-Zone. This is the Company’s maiden drilling program at Hook Lake and the data gathered from this program, in conjunction with upcoming gravity survey data, will assist us in defining the next round of drill targets. The area clearly has the potential to host high-grade uranium mineralisation as evidenced by the S-Zone surface sampling from 2021”

“We have an exciting year ahead in Canada as we work through all the historical data across our seven projects. We plan to commence work at the Cluff Lake project shortly and look to undertake field work on our five other properties in 2022. The team has done a great job at Hook Lake and following assay results, final interpretation and the upcoming gravity survey, we plan to be back drilling again at Hook Lake soon. Our team is planning to be on the ground in the next quarter and hope to be following up some of the other uranium targets along with some interesting REE results uncovered in 2021”.

“Uranium is now over US$60/lb and continuing to be part of the energy mix required to head to a zero carbon emission society. Valor has a great portfolio of uranium projects in the highest-grade uranium province in the world and are working towards being part of the solution”.

Click here for the full ASX Release

This article includes content from Valor Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00