Gold Price Update: Q3 2022 in Review

What happened to gold in Q3 2022? Our gold price update outlines key market developments and looks ahead to what may be next.

Click here to read the latest gold price update.

Gold continued to battle headwinds over the third quarter, shedding 6.15 percent. Catalysts that were expected to add to its value were unable to buoy the yellow metal over the summer months thanks to a strong US dollar.

Considered a hedge against inflation, gold struggled to retain any gains over the three month period. Rising interest rates and geopolitical instability also offered no support for the metal, even though it is also often bought during times of uncertainty.

The gold price started the quarter at US$1,809.30 per ounce, which ended up being the highest value the metal achieved over the 90 day session. Price pressures pushed gold to a two year low by the end of September, when values sank to US$1,620.30.

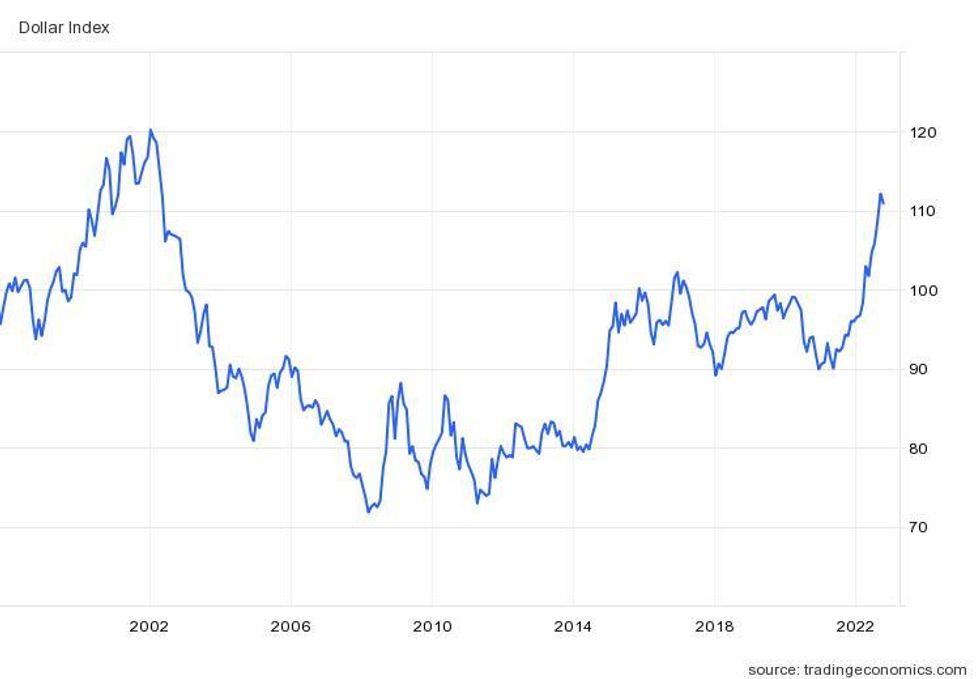

Although tailwinds that usually propel gold higher were in place, the metal was overshadowed by strength in the US dollar, which has exhibited its best performance since 2002.

22 year US Dollar Index performance.

Chart via TradingEconomics.

In late September, the US Dollar Index, which weighs the greenback against a basket of other global currencies, hit a 20 year high of 114.78. Gold and the US dollar tend to have an inverse correlation, and this was in full force in Q3.

Gold price update: Values flatline despite inflationary pressures

The yellow metal’s predictable reaction to a strong dollar came as little surprise to market watchers; however, gold’s disappointing performance amid so many traditional tailwinds has been unexpected.

Most notable was the rapid inflation seen in the first half of 2022. Reaching four decade highs, costs for energy, food and transportation soared as a result of pandemic monetary stimulus, supply chain disruptions and Russia's invasion of Ukraine.

As mentioned, inflation and uncertainty are usually prime gold price catalysts. But as Joe Cavatoni, head of the Americas region at the World Gold Council, explained to the Investing News Network (INN), gold found itself caught between the rising equity values of 2020 and 2021, along with a market correction and economic turmoil.

“What we saw at the beginning of the year was another systemic issue. Russia-Ukraine war uncertainty kicked gold into positive return territory in the first half of the year,” he said at the Gold Forum Americas.

In fact, gold marked its highest value ever on March 8, when levels topped US$2,074.60. “But now the … monetary fiscal policy, (the) shifting in rates to try and manage the inflationary pressures that we've got (is) starting to put up headwinds,” he said.

Although the yellow metal slipped to its lowest point since April 2020 during the final days of Q3, Cavatoni pointed to the cyclicality of the market and the opportunity cost of holding gold.

“In the case of gold short term, when rates are moving, opportunity cost means that people are looking for asset positioning, so they sell and look where the opportunities are — bond markets, for example,” he said. “And they start to use gold as a liquid asset to be a source of some of that income.”

Gold price update: Interest rate increases prevent growth

As inflation in the US held steady at roughly 8 percent from August through September, across the ocean the UK saw inflation spike above 10 percent in July; it has remained in the 9 percent range since then.

Global inflationary pressures have prompted central banks to raise interest rates, and the US Federal Reserve is the most-watched of all. It hiked the federal funds rate five times between January and October, bringing the target to 3 to 3.25 percent.

The Fed’s most recent rate hike coincided with gold’s end-of-quarter decline to US$1,698.10 at the close of September.

Gold’s position as a hedge against inflation has left many wondering why it hasn’t performed positively, something Juan-Carlos Artigas, head of research at the World Gold Council, attributes to opportunity cost and perspective.

He explained that there are four key drivers for gold: economic expansion, risk and uncertainty, opportunity cost and momentum.

“In recent months, gold has also had to contend with much higher opportunity costs, both from continuously increasing interest rates and the strongest US dollar for 20 years,” he said. “This has offset some of the support gold has had from greater risk and uncertainty, the most obvious coming from geopolitical tensions.”

The lead researcher also touched on why inflation has not added more upside to gold’s value.

“High inflation has also been a contributing factor, but its effect has been more muted given that not all investors have perceived inflation risks in the same way,” he said. “This is illustrated by the stark difference between the US consumer price index and long-term inflation expectations implied by the bond market.”

By September 30, gold had shed 5.7 percent from January. That's still markedly better than both of the main US indexes, which declined 20 percent or more in the same timeframe.

“In reality, gold has outperformed most major assets so far in 2022, including inflation-linked bonds both in the US and elsewhere,” Artigas said. “The fact that gold has performed as well as it has, all things considered, is a testament to its global appeal and more nuanced reaction to a wider set of variables.”

Gold price update: Producers feel the inflation crunch

For companies that mine and find gold, the precious metal’s sizeable decline from its Q1 high to its year-to-date low has been impactful, especially when paired with rising energy cost and overhead expenses.

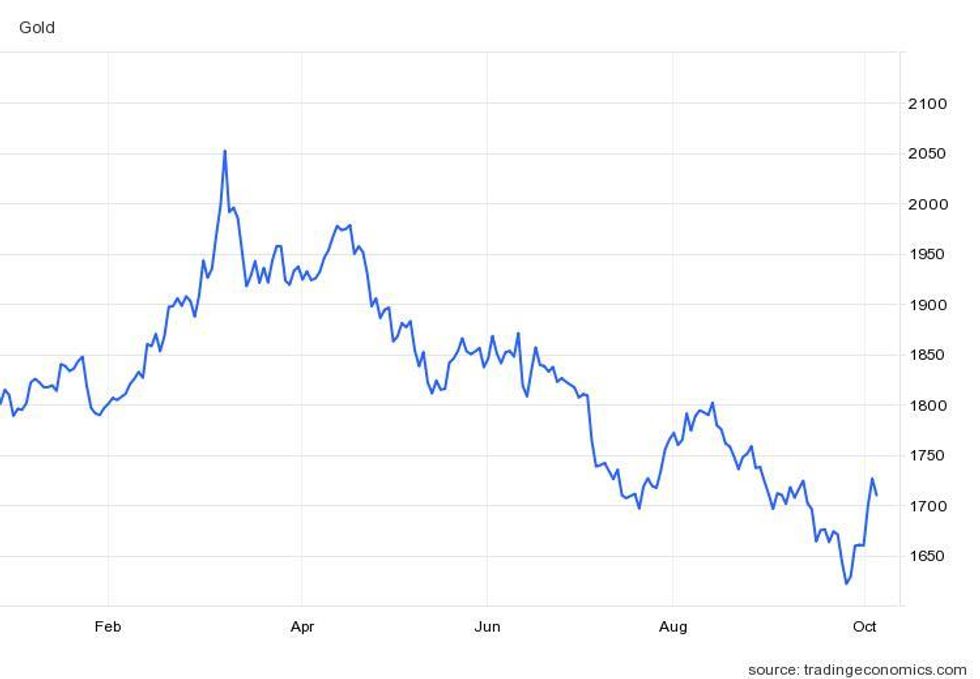

Gold's 2022 price performance.

Chart via TradingEconomics.

Geopolitical uncertainty and the effects of inflation were key topics at this year’s Gold Forum Americas, held in late September.

“We continue to monitor the impact of cost inflation,” said Sandeep Biswas, CEO of Newcrest Mining (TSX:NCM,ASX:NCM), during his presentation. Speaking about the company's 2023 fiscal year, he commented, "We estimate the inflationary pressures will increase our cost base between 6 to 8 percent, though the short-term outlook cost forecasts are obviously quite unpredictable.”

Newcrest, which is one of the world’s top 10 gold-producing companies, plans to use the jurisdictions of its projects to its advantage to help counter inflationary pressures.

“From a geographic perspective, we expect inflationary pressures to be lower at our Canadian sites, largely driven by consumables, maintenance and parts,” Biswas said. “We also expect continued pressure on our capital costs given the competition for labor from other infrastructure projects in all jurisdictions, and high steel prices.”

The mining executive also explained that he expects some of the latter price drivers to decline; regardless, he believes Newcrest remains “well-positioned and well-structured to match these constant pressures.”

At South America-focused Aura Minerals (TSX:ORA,OTC Pink:ARMZF), CEO Rodrigo Barbosa has been able to combat rising costs despite mounting inflationary pressures across Latin America, which he credited to the miner’s spending stance.

“We've seen the impact of inflation in the countries that we operate — 5, 6, 8 and 10 percent, sometimes,” he told INN at the Gold Forum Americas. “But the fact is that we've been able to fight back … we have been very well-aligned and cautious about costs.”

Aura has been able to mitigate the rapidly growing cost of energy at its projects in Brazil, Mexico and Honduras through the use of green energy. “We use renewable energy in Brazil, we use renewable energy in Honduras; most of the energy that we buy comes from a plant that is just 1 kilometer from our mine,” he said. “We plan to do wind or solar in Mexico.”

The use of renewables has helped keep overhead in check; however, Barbosa admitted that the company is not immune to the rising energy costs. “It's going up, mostly on oil; electricity is also going up in Mexico,” he said. “Brazil is fortunate to have over 70 percent of its electricity produced by hydroelectric power plants. So we don't see that huge impact on electricity (prices) in Brazil.”

Despite being somewhat insulated from inflationary pressures, Barbosa acknowledged the impact of the Fed's interest rate hikes on the market. “(Interest rate increases) will affect gold prices,” he said. “However, we are a low-cost producer — our cash costs are US$900 per ounce or below that, so it will affect us less than the average company.”

Gold price update: Can gold retain its value?

After ending Q3 at the US$1,660 level, gold has crept higher to hold above US$1,700. Whether the metal will continue to trend higher or slip lower is hard to determine, leaving many to warn market participants to stay cautious.

“We know that we need to prepare for a lower gold price and hope for higher prices,” Barbosa said.

In early October, the Fed again signaled its commitment to beat down inflation with continued interest rate hikes.

“If we do our jobs well, and we communicate to the public why we are doing what we are doing and why the interest rate path we are taking is necessary to get inflation down, and that price stability for us is extremely important, as is doing it as gently as possible so that the economy can be in a balanced state as easily as possible — whatever that looks like, we are going to take the easiest path we can find,” San Francisco Federal Reserve Bank President Mary Daly told Reuters.

Rates have the potential to surpass 4.6 percent next year, so the Fed’s ability to push down inflation without causing a recession — or worse, stagflation — is becoming increasingly important.

“Looking forward, while we expect interest rates and the US dollar to continue to weigh on gold's performance, we remain cautiously optimistic,” said the World Gold Council's Artigas. “For one, given how much tightening has occurred so far — including recent rate hikes by the US Fed, Bank of England and Swiss National Bank — we would expect monetary policy to slow down, allowing some of gold’s other supporting factors to play a more important role."

The head of research went on to point out that the defensive stance central banks, aside from the Fed, are taking is aimed partially at curbing inflation and also at defending their currencies, which should weigh on the US dollar.

For Aura’s Barbosa, two of the three main gold drivers — geopolitics and inflation — have already taken root, and he is now awaiting the third to take hold: real interest rates.

“If by any chance the Fed doesn't catch up with what they're promising in terms of rate hikes, then we will see a significant increase in gold prices,” he said.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- A Guide to Physical Gold as an Investment | INN ›

- What Was the Highest Price for Gold? | INN ›

- What is the Gold Spot Price? | INN ›

- An Overview of Gold Investing and Prices | INN ›