Overview

Lithium supply security has become a top priority for battery suppliers and vehicle manufacturers, and establishing strategic alliances and joint ventures with exploration companies has been essential in ensuring a reliable and diversified supply of lithium. As the push for green energy powers on, demand for electric vehicles has risen significantly from 2.1 million units sold in 2020 to 4.5 million the following year, according to LMC Automotive. The electric vehicle market cap exceeded that of the internal combustion engine for the first time in late 2021, hitting C$1.52 trillion compared to C$1.47 trillion. The US government has also announced plans to target a 50 percent electric vehicle sales share by 2030, mirroring similar efforts in other countries

The new “Inflation Reduction Act” passed into law by the US on August 17, 2022, represents the most aggressive action in US history to address climate change concerns. Crucial for critical battery minerals, it implements a $7,500 EV credit tax offer. To qualify for this EV tax credit, the critical minerals inside the battery must be at least 40 percent of the value extracted or processed in any country with which the United States has a free trade agreement (FTA) in effect or be "recycled in North America”, and this value will increase gradually to 80 percent by 2027. In addition, the IRA would prohibit the application of the above tax credit where a vehicle's battery contains "any" critical minerals sourced from countries such as China or Russia or is not an FTA partner.

This law puts Canada at an advantage and will deepen investment with lithium exploration companies as EV manufacturers and other suppliers scramble to source and secure their critical minerals with an FTA partner. In April 2022, Canada announced its own C$3.8 billion initiative toward a critical minerals strategy. The country is replete with opportunities for lithium mining.

Foremost Lithium Resource & Technology Ltd. (CSE:FAT,OTCQB:FRRSF,FWB:F0R0) is a Canadian hard-rock lithium exploration and development company focused on the production of ethically produced battery-grade lithium hydroxide. The company owns six hard rock lithium projects in Canada, each of which is in early phase exploration. However, preliminary geology and initial exploration discoveries suggest significant potential for securing millions of tons of lithium oxide.

The objectives of its business activities are to initially target the extraction of lithium oxide (Li2O) from the project sites and to subsequently play a role in the production of high-quality lithium hydroxide (LiOH). Foremost Lithium aims to seek out strategic partnerships with lithium-battery manufacturers or suppliers to fuel the ever-growing global electric vehicle and battery storage market. Together with their Winston Gold/Silver Project in New Mexico, US – the company has a diversified portfolio.

Foremost Lithium is the second largest lithium exploration company in Snow Lake, Manitoba, with a business model that strives to use best-in-class methods to produce lithium in accordance with Canadian mining and exploration standards, while reducing environmental impact, wherever possible.

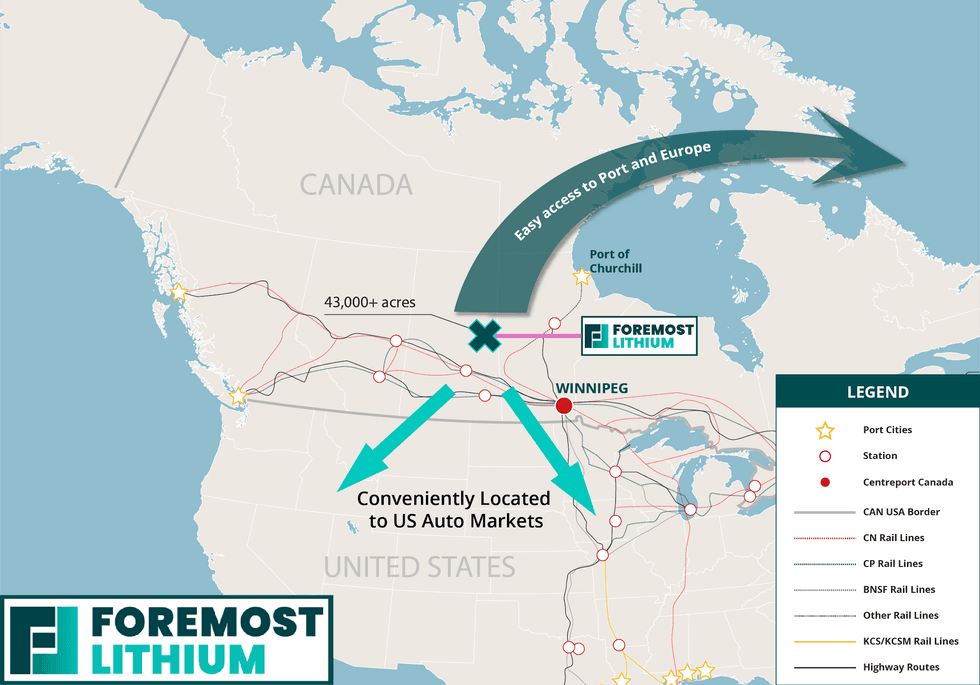

Foremost’s Manitoba projects are strategically located at the tip of the NAFTA “superhighway” with easy access to North American battery and EV manufacturing sites Stellantis and LG Chem's LG Energy Solution (LGES) officially announced an over C$5 billion (US$4.1 billion) investment into the creation of a battery gigafactory joint venture in Ontario, Canada, with production expected to start in 2024. Foremost’s land position connects with Snow Lake Lithium (NASDAQ:LITM) and 1911 Gold (TSXV: AUMB) and is geographically close to “Auto Alley,” which contains the strategic infrastructure needed to streamline production and logistics. On September 23, 2022, Snow Lake Lithium announced a memorandum of understanding with LG Energy Solution to develop a domestic supply chain for the North American electric vehicle market. The partnership seeks that Snow Lake Lithium will provide lithium hydroxide to LG Energy Solution in 2025.

Foremost Lithium currently manages five lithium properties: Zoro, Peg North, Jol, Jean Lake and Grass River which are adjacent to the mining-friendly town of Snow Lake, Manitoba. In December, it sold its 60 percent ownership of its Hidden Lake property, located in the Northwest Territories, for $3.5 million, adding cash without dilution to the company's treasury.

Foremost Lithium's current ground position totals 43,031 acres (17,414 hectares) and is ideal for current and future exploration with over 95 percent of the land coverage remaining to be explored. The company is in its early stages of focused and ongoing exploration in Manitoba, with 39 discovered spodumene-lithium bearing pegmatite dykes, and 30 follow-up drill targets with massive upside potential.

Company and Industry Highlights

- Foremost Lithium is ready to accelerate operations at an ideal time when lithium demand will skyrocket thanks to the growing electric vehicle market. A recent report by the IEA states that to meet global net carbon emission goals by 2030, the world will require an additional 50 lithium mines.

- Lithium carbonate prices have risen from US$5,000 per ton in July 2020 to US$70,000 per ton two years later, citing rapid demand with supply shortfalls as the primary price driver --Kwasi Ampofo, BNEF.

- Foremost holds five lithium properties: Jean Lake, Peg North, Jol, Grass River and Zoro, located in Snow Lake, Manitoba.

- The company has increased its land portfolio in Snow Lake by nearly 500 percent, growing from 8,900 acres to more than 43,000 acres, and has uncovered 39 spodumene-bearing pegmatite dykes for future exploration and resource potential.

- Foremost also owns the Winston Gold and Silver Project, located in New Mexico, which had sampling results that included 66.5 g/t gold and 4,619 g/t silver. It comprises 2,780 acres and showcases the company’s prudent diversification strategy.

Get access to more exclusive Lithium Investing Stock profiles here