Market Pain, Strategic Gain: Pilbara Minerals' Dale Henderson on Today's Lithium Paradox

Pilbara Minerals CEO Dale Henderson spoke at this year's Fastmarkets event about how the lithium industry can navigate through market pain to find strategic opportunities.

“(Lithium) is not for the faint-hearted. It demands resilience, foresight and leadership,” said Pilbara Minerals (ASX:PLS,OTC Pink:PILBF) Managing Director and CEO Dale Henderson.

He was speaking at Fastmarkets’ Lithium Supply & Battery Raw Materials Conference, held this week in Las Vegas.

Henderson touched on three main points: current lithium market dynamics, how Pilbara Minerals is navigating the lithium landscape and his recommendations for the global lithium industry.

Lithium's strong long-term fundamentals

Henderson began by going over key numbers relevant to the lithium sector. According to the CEO, there was a 26 percent year-on-year increase in demand for electric vehicles (EVs) from 2023 to 2024.

Lithium plays a vital role in the production of EVs, as it is a key component of the batteries that power them.

Alongside that EV demand increase, mass energy storage also saw a 51 percent leap.

“I don’t think there’ll be any deniers around the long-term prospects of lithium, but it's worth reflecting on how quickly it’s changing," Henderson told the Fastmarkets audience.

Henderson speaks on stage at the Fastmarkets event.

Image via Georgia Williams.

Looking at areas connected to lithium, Henderson mentioned solar, saying it now surpasses all power-generation technology investment combined. Solar falls under the clean energy umbrella, which receives more than $2.2 trillion in investment per year — twice the amount of investment made in fossil fuels.

“We are witnessing and (are) part of an incredible period. Technology, policy (and) consumer sentiment can continue to drive what is a structural shift towards electrification," he said. "Lithium remains at the center of this shift."

The paradox, according to Henderson, is that while scaling up is happening, prices have been cycling down.

“We’re 12 months into a period of curtailments and reset. And where we are now — we sit deep into the cost curve with price levels, of course, at unsustainable levels for many operators," he noted.

"But these cycles, or these resets, offer a fantastic reset for market, albeit they're painful.”

The Pilbara CEO emphasized that while lithium prices have fallen to “clearly unsustainable” levels, the long-term demand and strategic relevance of lithium will survive it.

“This is not a short-term trend. This is a structural transformation, and lithium remains at core.”

Pilbara Minerals' lithium strategy

Looking over to Pilbara Minerals, Henderson went over its recent achievements and future plans.

“We’re keeping our lives absolutely committed to our strategy,” he said about the company, adding that the past year was Pilbara Minerals' “most transformational year for business.”

Highlights from the period include the acquisition of Latin Resources and its flagship Salinas lithium project in Brazil, which was announced in August 2024 and closed this past February.

The CEO also discussed the company’s flagship Pilgangoora operation, which he described as a globally significant tier-one lithium asset with a mine life of 33 years. Pilgangoora is located 140 kilometers from Port Hedland in Western Australia and is one of the world’s largest hard-rock lithium operations.

Pilbara Minerals has completed two expansions, including the buildout of the world’s largest hard-rock ore-sorting plant, which aims to improve lithium recovery, increase final product quality and reduce energy consumption.

In addition to that, Henderson said Pilbara Minerals boosted its reserves by 23 percent last year.

Furthermore, the company became a lithium hydroxide producer via its partnership with POSCO Holdings (NYSE:PKX,KRX:005490), and is working on a demonstration plant for its midstream project.

In January, the Western Australian government’s Investment Attraction Fund contributed AU$15 million for work at the plant, which is a joint venture with Calix (NYSE:CALX,ASX:CXL).

Henderson said the demonstration plant is currently under construction.

Last year, Pilbara Minerals contributed approximately 8 percent to global lithium supply. The company’s cash balance currently stands at AU$1.1 billion.

Lithium industry must align for success

According to Henderson, certainty and efficient operations are everything in today’s lithium market.

“Government policy is forcing change, both in sticks and carrots, and supply chain diversification is underway, but largely the processing remains very much concentrated," he said.

Henderson highlighted coordination and collaboration as key points, saying that thriving in this environment means building deeper integration across the supply chain.

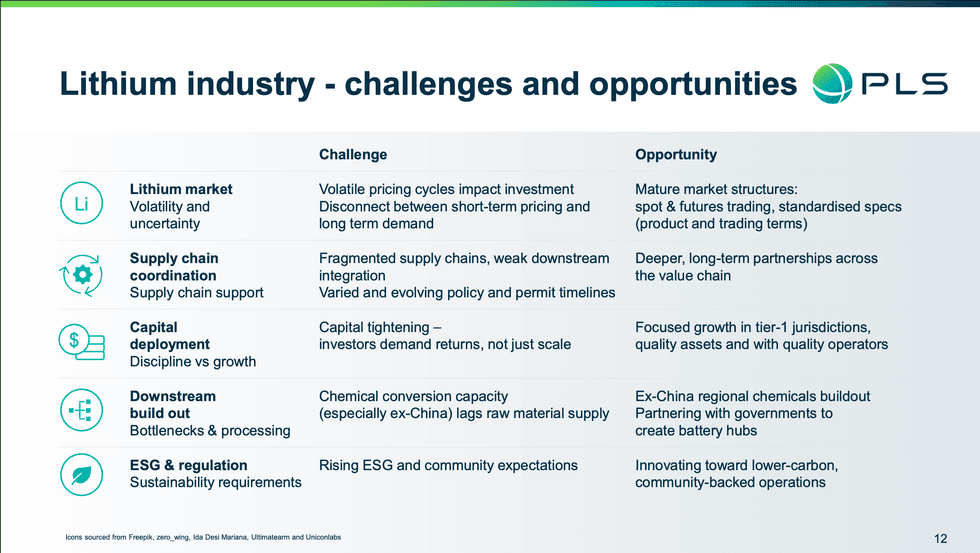

Lithium industry challenges and opportunities.

Chart via Pilbara Minerals.

He added that the lithium industry is not the first sector to grow from a small base and has yet to mature on a number of dimensions. Henderson summarized his key recommendations into four points:

- Support a central and efficient spot market trading location

- Put a trusted futures exchange in place

- Align on specifications across the lithium product site

- Align on standardized trading terms

He also presented a list of challenges and corresponding opportunities regarding the lithium market, saying that while there’s a lot of pain in the industry, it's also the time for great partnerships to be forged.

“This industry will evolve with or without our stewardship. This is a call to leadership across our group,” he concluded. “The challenge is ours. The opportunity is real. Let's build it together and turn this market pain into a strategic avenue.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.