MGX Minerals Completes Archaeological Impact Assessment for Driftwood Creek Magnesium Oxide Project

MGX Minerals Inc. (“MGX” or the “Company”) (CSE:XMG, OTCQB:MGXMF, FSE:1MG) announced today that third-party engineering firm Tipi Mountain Eco-Cultural Services (“Tipi”) has completed a comprehensive Archaeological Impact Assessment (“AIA”) on the Driftwood Creek magnesium project (“Driftwood Creek” or the “Project”) located in southeastern British Columbia.

MGX Minerals Inc. (“MGX” or the “Company”) (CSE:XMG, OTCQB:MGXMF, FSE:1MG) announced today that third-party engineering firm Tipi Mountain Eco-Cultural Services (“Tipi”) has completed a comprehensive Archaeological Impact Assessment (“AIA”) on the Driftwood Creek magnesium project (“Driftwood Creek” or the “Project”) located in southeastern British Columbia.

Tipi reported that no evidence of archaeological sites or areas of High Archaeology Potential (“HAP”) were found within the Project area. Additionally, the north and south access roads to Driftwood follow existing Forest Service Roads (FSR), which could be utilized to avoid existing HAP areas identified previously to the north. Tipi’s findings will be now be passed along to First Nations as well as the British Columbia Archaeology branch.

The AIA is part of a larger, ongoing work program to complete a N.I. 43-101 Pre-Feasibility Study (“PFS”) at Driftwood. The PFS will build on the positive N.I. 43-101 Preliminary Economic Assessment (“PEA”) completed in March 2018 (see press release dated March 6, 2018). That PEA study was independently prepared for MGX by AKF Mining Services Inc. (AKF), Tuun Consulting Inc. (Tuun) and Samuel Engineering Inc. (Samuel) in accordance with CIM guidelines and National Instrument 43-101 Standards of Disclosure for Mineral Projects. Highlights included:

- Life of Mine Pre-Tax Cash Flow during Production of $1,051 million

- Pre-tax NPV@5% of $529.8 million, IRR of 24.5% with a 3.5-year payback

- Post-tax NPV@5% of $316.7million, IRR of 19.3% with a 4.0-year payback

- Initial capital costs of $235.9 million (Total life-of mine (“LOM”) – $239.8 includes sustaining/closure costs of $3.9 million and contingency costs of $40.0 million)

- Conventional quarry pit mine with a 1200 tonne per day (“tpd”) process plant using conventional crushing, grinding, flotation upgrading, calcination, and sintering to produce a saleable DBM product

- Average annual MgO production of 169,700 tonnes during a 19-year mine life

- LOM average head grades of 43.27% MgO

- LOM MgO recoveries of 90%

- LOM strip ratio of 2.4 to 1 of rock to mineralized material

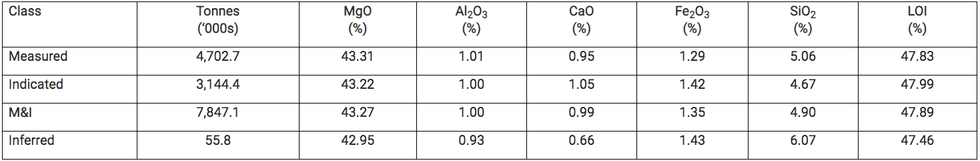

The tonnage and grades of the Driftwood Creek Project mineral resource at a 42.5% MgO cut off are shown in the table below:

Notes and assumptions:

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into Mineral Reserves.Notes and assumptions:

- The Lerchs-Grossman (LG) constrained shell economics used a mining cost of US$8.82/t, processing+ g&a costs of US$106/t, and a commodity price of US$600.00/t 95%MgO DBM.

- Mineral resources are reported within the constrained shell, using a cutoff grade of 42.5% MgO (based on a 20-year LOM) to determine “reasonable prospects for eventual economic extraction.”

- Mineral Resources are reported as undiluted

- Mineral Resources were developed in accordance with CIM (2010) guidelines

- Tonnages are reported to the nearest kilotonne (kt), and grades are rounded to the nearest two decimal places

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade, and contained metal.

M&I = Measured and Indicated.

About MgO

Magnesium Oxide (magnesia) is a widely used industrial mineral that comes in various forms including dead burned magnesia (DBM) and fused magnesia (FM). End uses include fertilizer, animal feed, and environmental water treatment as well as industrial applications primarily as a refractory material in the steel industry. The majority of refractory grade MgO used in the US and Canada is imported from China. MGX aims to provide a stable, secure, long term supply of MgO to the North American market with quality MgO products of consistent grade and purity.

Qualified Person

Andris Kikauka (P. Geo.), Vice President of Exploration for MGX Minerals, has prepared, reviewed and approved the scientific and technical information in this press release. Mr. Kikauka is a non-independent Qualified Person within the meaning of National Instrument 43-101 Standards.

About MGX Minerals

MGX Minerals is a diversified Canadian resource and technology company with interests in global advanced material, energy, and water assets. Learn more atwww.mgxminerals.com.

Contact Information

Jared Lazerson

President and CEO

Telephone: 1.604.681.7735

Web: www.mgxminerals.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains forward-looking information or forward-looking statements (collectively “forward-looking information”) within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: “believe,” “expect,” “anticipate,” “intend,” “estimate,” “potentially” and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking information provided by the Company is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Company’s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Company’s profile on SEDAR at www.sedar.com.

Click here to connect with MGX Minerals (CSE:XMG) for an Investor Presentation.

Source: www.accesswire.com