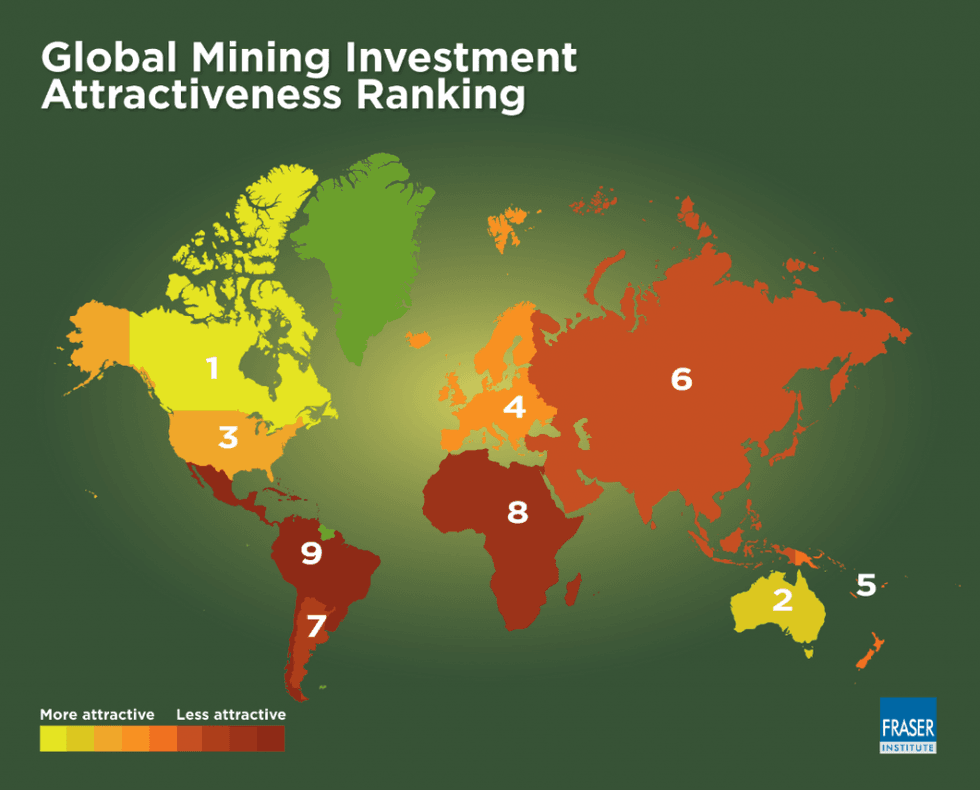

The province was beaten only by Finland in an annual survey conducted by the Fraser Institute. Canada is the top region in the world overall.

The Fraser Institute has ranked Saskatchewan as the second-best place for mining investment in the world.

The Canadian think tank determines rankings based on survey results from mining executives. They are asked to rate 91 jurisdictions on their geologic attractiveness for metals, and the extent to which government policies deter or encourage exploration and investment.

Kenneth Green, senior director of Fraser Institute energy and resource studies, said Saskatchewan’s “[r]ich mineral reserves, competitive taxes, efficient permitting procedures and certainty around environmental regulations will still attract significant investment — even with slumping commodity prices.”

The province, which was bested only by Finland, is known for its uranium deposits in the Athabasca Basin, and for its production of agricultural products such as potash. Saskatchewan hosts the headquarters of major fertilizer producer Nutrien (TSX:NTR,NYSE:NTR).

Within Canada, Saskatchewan is the most attractive jurisdiction for mining investment, with Quebec coming in second and Ontario coming in third. Globally Quebec and Ontario rank sixth and seventh, respectively. BC and Alberta trail behind in 20th and 49th place, respectively, due to regulatory uncertainty and disputed land claims, which have kept their marks lower.

Chart via the Fraser Institute.

After considering the rankings of each Canadian province and territories, the Fraser Institute has dubbed Canada the world’s most attractive region for investment, just ahead of Australia.

“Capital is fluid and one province’s loss can be another province’s gain because mining investors will flock to jurisdictions that have attractive policies. Sound regulatory regimes are an absolute must for policymakers who want to attract increasingly precious commodity investments,” said Green.

Infographic via the Fraser Institute.

Future looks bright for Canadian mining

The Fraser Institute’s annual list coincides with the release of the EY Canadian Mining Eye Index, which suggests that there is a bright future ahead for Canadian mining.

The index looks at performance in the country for Q4 2017, and EY notes that it rose 2 percentage points from the previous quarter to reach 4 percent. The value of transactions in Canada increased by 26.5 percent year-over-year in 2017 compared to 15 percent globally.

“Market indicators suggest we’re entering a new phase of growth in the Canadian mining and metals sector,” said Jim MacLean, EY’s Canadian mining and metals leader. “Resource depletion is a top of mind issue for the sector and gold miners, in particular, face greater urgency to build up reserves. Those that delayed exploration spend during the height of commodity price volatility are turning their attention back to growth. We’re starting to see that play out in the form of increased transaction activity.”

EY also highlights a gold price increase of 2 percent in Q4 2017 following a 3-percent gain in Q3, mostly due to geopolitical risks. Base metals prices gained on favorable supply/demand conditions, with nickel rising 22 percent, copper by 12 percent and zinc by 4 percent in Q4. The firm notes that year-over-year, copper, nickel and zinc prices grew by 30 percent, 28 percent and 30 percent, respectively.

The report forecasts a continued rise in gold for 2018 on the possibility of three rate hikes and on continued geopolitical volatility. EY has an optimistic outlook for base metals, and copper in particular.

EY Canadian Mining and Metals Transactions Leader Jay Patel said the world is entering an “interesting period of new resource demand,” noting that battery technology and electric vehicles are two influences shaping the commodities market.

“Companies must carefully consider their portfolios and have the flexibility to change track when new opportunities inevitably emerge,” Patel said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.