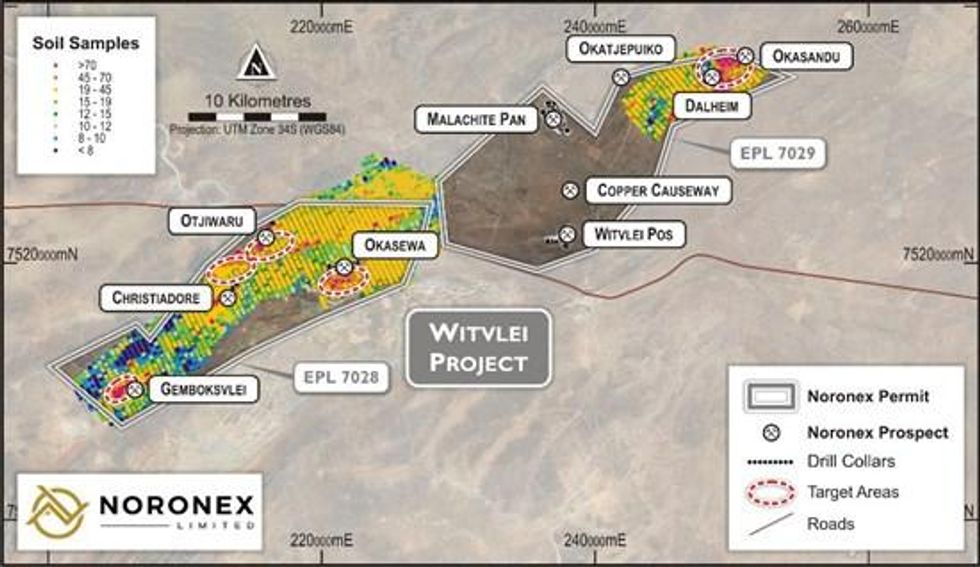

White Metal Resources Corp. (TSXV: WHM) (FSE: CGK1) (OTC Pink: TNMLF) ("White Metal" or the "Company") is pleased to provide an exploration update from its Australian joint venture partner Noronex Limited (ASX: NRX) ("Noronex") on the DorWit Copper-Silver Project (the "Project"), located in the Kalahari Copperbelt of central Namibia (see Noronex news release dated November 16, 2021). The Namibian Project comprises three Exclusive Prospecting Licences (EPLs) that cover 72,000 hectares, referred to as the Witvlei (EPL 7028 and EPL 7029) and Dordabis (EPL 7030) properties. The Project is prospective for sedimentary-hosted Cu-Ag mineralization within the prolific Kalahari Copper Belt that spans Namibia and Botswana. The focus of the current exploration efforts will be on the Witvlei Property that comprises EPL 7028 and 7029 (Figure 1).

Highlights

Initial assays received for first 10 holes (~1,900 m) of a ~60 hole (~12,000 m) reverse circulation ("RC") drilling program at the Witvlei Property.

Maiden drilling at the greenfields Otjiwaru Property intersected anomalous Copper confirming the soil geochemistry is reflecting underlying bedrock anomalies with one drilling intercept of 7.0 m grading 0.5% Cu - further results are pending.

Two rigs are currently finalising the drilling program at the Gemboksvlei Property (21 holes for 4,200 m) and next move to the Okasewa South Property to test high priority copper geochemical soil and geophysical IP chargeability targets. Okasewa South is located directly south of the known Okasewa Cu deposit which has an existing JORC (2012) mineral resource of 4.4 Mt at 1.2% Cu (see Noronex news release dated March 8, 2021).

Over 7,000 m of the 12,000 m planned drilling program have now been completed at the Otjiwaru, Christiadore and Gemboksvlei properties.

Drilling is planned to continue in coming weeks at Okasewa South and then move to the high priority targets at the Dalheim Property.

Michael Stares, President & CEO of White Metal, stated, "We are very pleased with the progress that the Noronex technical team has made in the early stages of exploration and drilling programs on the DorWit Copper-Silver Project in the Kalahari Copperbelt of Namibia. In a very short time, we have seen Noronex establish a significant presence in country, build a high-quality team, explore aggressively and rapidly grow our copper project portfolio. The recent addition of a second rig has accelerated drilling at Witvlei and we are looking forward to providing further updates on the Witvlei exploration program as Noronex continues to explore the Project."

Background

The Namibian Projects, comprise three Exclusive Prospecting Licences (EPLs 7028, 7029 and 7030) covering 72,000 hectares that are prospective for sedimentary Cu-Ag mineralisation along the prolific Kalahari Copperbelt that spans Namibia and Botswana. The Namibian Project contains a current JORC (2012) Inferred Mineral Resource of 10 MT grading 1.3% Cu (see Noronex news release dated March 8, 2021). The focus of the current exploration efforts is the five targets on the Witvlei Cu-Ag Project (EPL 7028 and 7029).

Figure 1. Plan map showing the copper-in-soil geochemistry anomalies and high priority targets being drill tested at the Witvlei Cu-Ag Property (Noronex, 2021).

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5364/104808_4bb67d70f432b8d4_004full.jpg

Otjiwaru Drilling

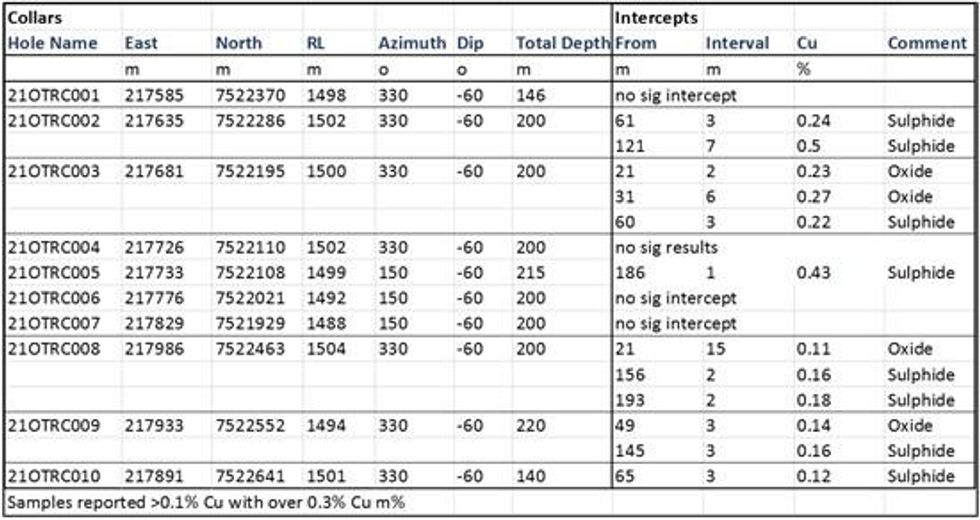

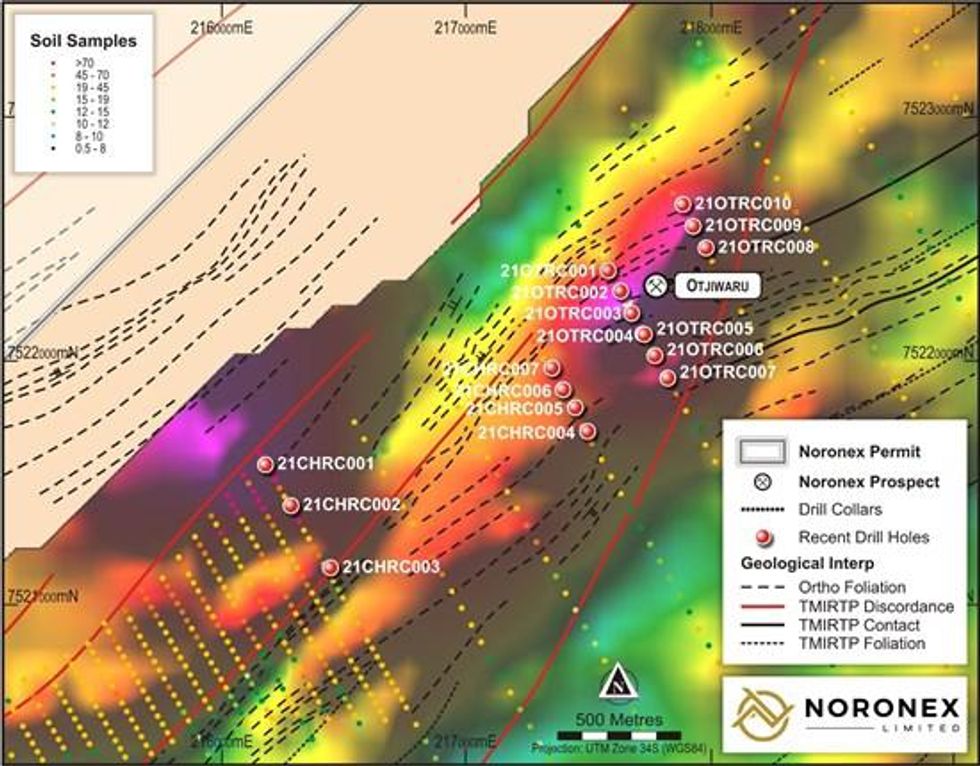

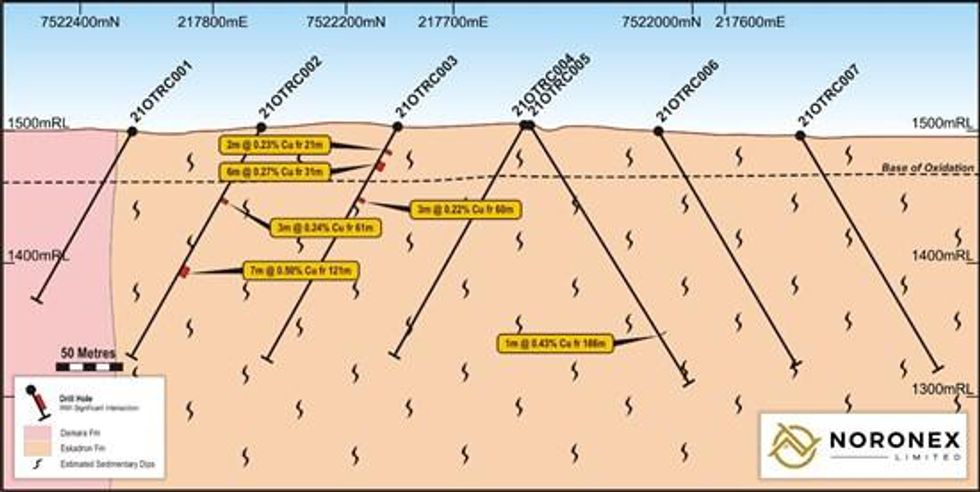

First assay batches have been returned from drilling at Otjiwaru with results received. A program of ten holes drilled for 1,927 m were completed at Otjiwaru (Figure 2 and Table 1). The zone targeted has sub-cropping sediments with malachite stains and a significant geochemical target. The holes intersected the Eskadron sequence containing brown siltstone and interbedded sandstones with debris flow. Minor malachite staining was intercepted down to approximately 25 m with fine pyrite and chalcopyrite developed in the siltstone horizons below. The northernmost holes, 21OTRC001 and 21OTRC010, were drilled north across a major structure into the older metamorphosed phyllites of the Damara, Duruchaus Formation and across a major regional shear that was unmineralized (Figure 3).

RC chip samples were collected at 1.0 m intervals in mineralized intersections and composited to 3.0 m where mineralisation was not visually noted. Samples were prepared in the ALS sample preparation facility in Namibia and assayed at their laboratory in South Africa. Anomalous copper concentrations were intersected in the preliminary investigatory drilling confirming the soil geochemistry, reflecting underlying bedrock anomalies. The best RC drill hole intercept was 7.0 m grading 0.5% Cu from 121.0 m in siltstone with fine chalcopyrite and pyrite noted in the logging.

Table 1. Summary of RC drilling chip intercepts from the first 10 holes at Otjiwaru (Noronex, 2021).

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/5364/104808_whitemetaltable1.jpg

Figure 2. Location of RC drill hole collars for completed holes at Otjiwaru and Christiadore, overlain on copper-in-soil geochemistry and geological interpretation (Noronex, 2021).

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5364/104808_4bb67d70f432b8d4_006full.jpg

Figure 3. Western drill fence at Otjiwaru showing northwest-southeast (looking northeast) cross-section of drilling completed and anomalous copper intersected in the RC drill holes (Noronex, 2021).

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/5364/104808_4bb67d70f432b8d4_007full.jpg

Current Drilling

First pass drilling is nearing completion at Gemboksvlei with 21 holes being completed for 4,200 metres. Highly ranked priority targets and follow up are being finalised for the remaining program and will be at:

- a 2.5 by 1.2 km copper-in-soil anomaly in an altered structural zone south of Okasewa.

- sub-cropping copper at Dalheim with a 2 km strike extent.

Okasewa South

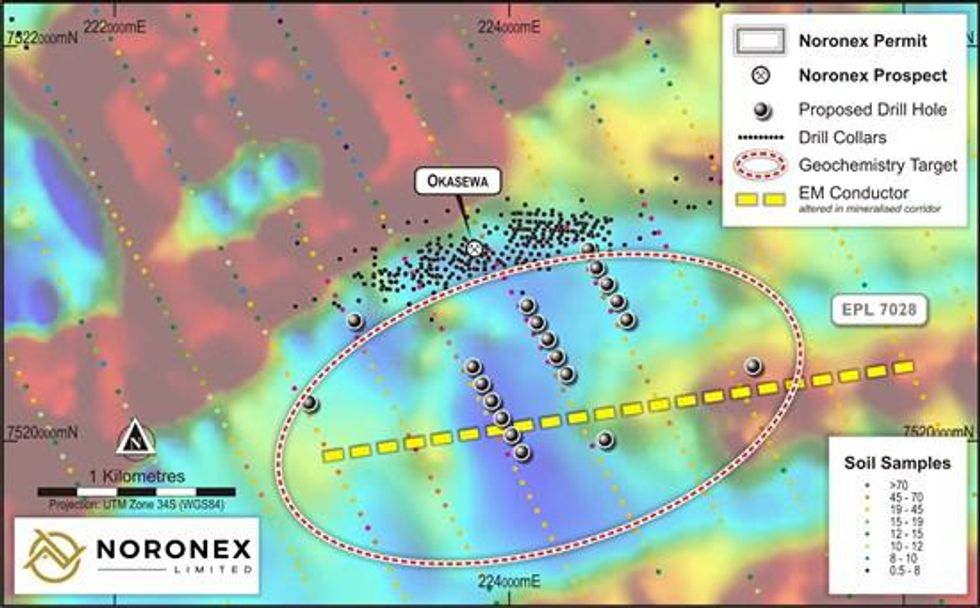

Directly south of the Okasewa Inferred Mineral Resource of 4.36 Mt grading 1.15 % Cu (see ASX news release dated 8 March 2021), a large copper geochemical anomaly has been defined over an area of 2.5 by 1.2 kilometres (Figure 4). The anomaly lies on an altered EM conductor in a major mineralised cross structure and is highly prospective for a large scale sedimentary hosted copper deposit.

A trial IP survey was completed over the known mineralised resource and a chargeability anomaly defined at the eastern end of the deposit. Drilling will commence shortly to test the geochemical anomaly and geophysical targets with twenty-one holes planned for 4,000 metres.

Figure 4. Xcite EM airborne survey ch1 z component image with overlying copper soil samples locations and resource drilling at Okasewa. Location of potential altered EM conductor with oxidising fluids altering reduced stratigraphy in the mineralised corridor (Noronex, 2021).

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/5364/104808_4bb67d70f432b8d4_008full.jpg

Diamond drilling is expected to follow up on these regional RC drill hole fences to define the style and character of the geology and mineralisation next year.

About Noronex Limited

Noronex is an ASX listed copper company with advanced projects in the Kalahari Copper Belt, Namibia and in Ontario, Canada that have seen over 170,000 m of historical drilling. Noronex plans to use modern technology and exploration techniques to generate new targets at the projects and grow the current resource base.

Qualified Person

Technical information in this news release has been reviewed and approved by Dr. Scott Jobin-Bevans P.Geo., Vice President Exploration and a Director of White Metal, who is a Qualified Person under the definitions established by the NI 43-101. Information and data in this news release has been largely extracted from Noronex news release dated November 16, 2021.

About White Metal Resources Corp.:

White Metal Resources Corp. is a junior exploration company exploring in Canada and southern Africa. The Company's two key properties are the Flagship Tower Mountain Gold Project in Thunder Bay, Ontario, Canada and the Okohongo Copper-Silver Project in Namibia, Africa. For more information about the Company please visit www.whitemetalres.com.

On behalf of the Board of Directors

"Michael Stares"

President & CEO

For further information contact:

Michael Stares

President & CEO

White Metal Resources Corp.

684 Squier Street

Thunder Bay, ON P7B 4A8

Phone: +1 (807) 358-2420

Nancy Massicotte

Investor Relations

White Metal Resources Corp.

Phone: +1 (604) 507-3377

TF: +1 (866) 503-3377

Email: ir@whitemetalres.com

Thomas Do

Investor Relations Manager

CHF Capital Markets

Phone: +1 (416) 868-1079 x 232

Email: thomas@chfir.com

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/104808