Resource Investing News Survey Reveals Surprising Results

Dig Media recently conducted its Resources Investing News 2010 Survey to gauge the interests of its readers and gain insight into investors’ perception of the markets. The Survey results held some surprises, especially when compared to the previous survey conducted at the end of 2009.

Dig’s Resource Investing News Survey Reveals Surprising Results

Dig Media recently conducted its Resources Investing News 2010 Survey to gauge the interests of its readers and gain insight into investors’ perception of the markets. The Survey results held some surprises, especially when compared to the previous survey conducted at the end of 2009.

Gold Survey Results

Uranium Survey Results

Oil & Gas Survey Results

Copper Survey Results

Not surprisingly, this most recent survey showed investors are slightly more apprehensive about the future of the markets. Europe’s on-going sovereign debt crisis, staggering unemployment rates in the US and indications China’s economic growth may be slowing are creating a heavy cloud of uncertainty in the stocks and commodities markets worldwide.

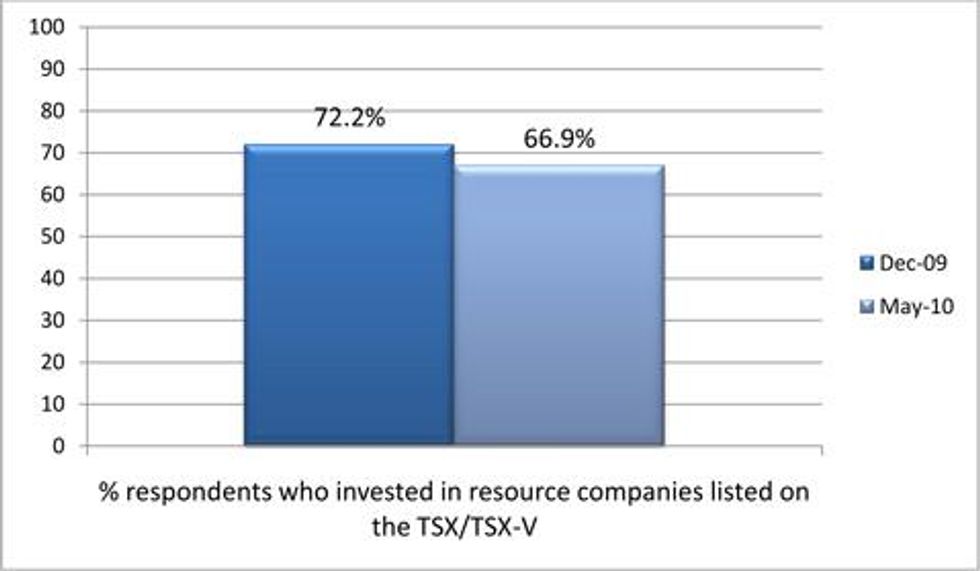

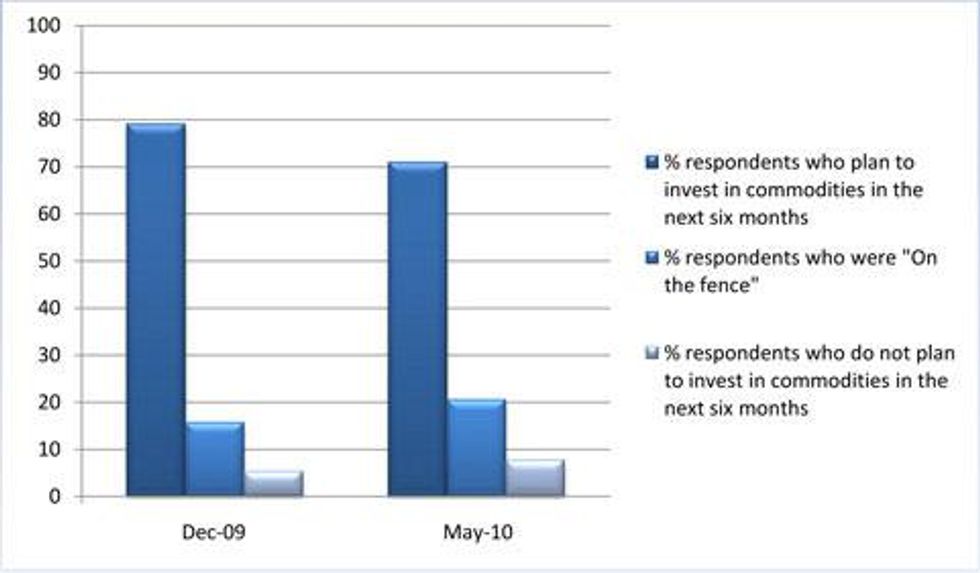

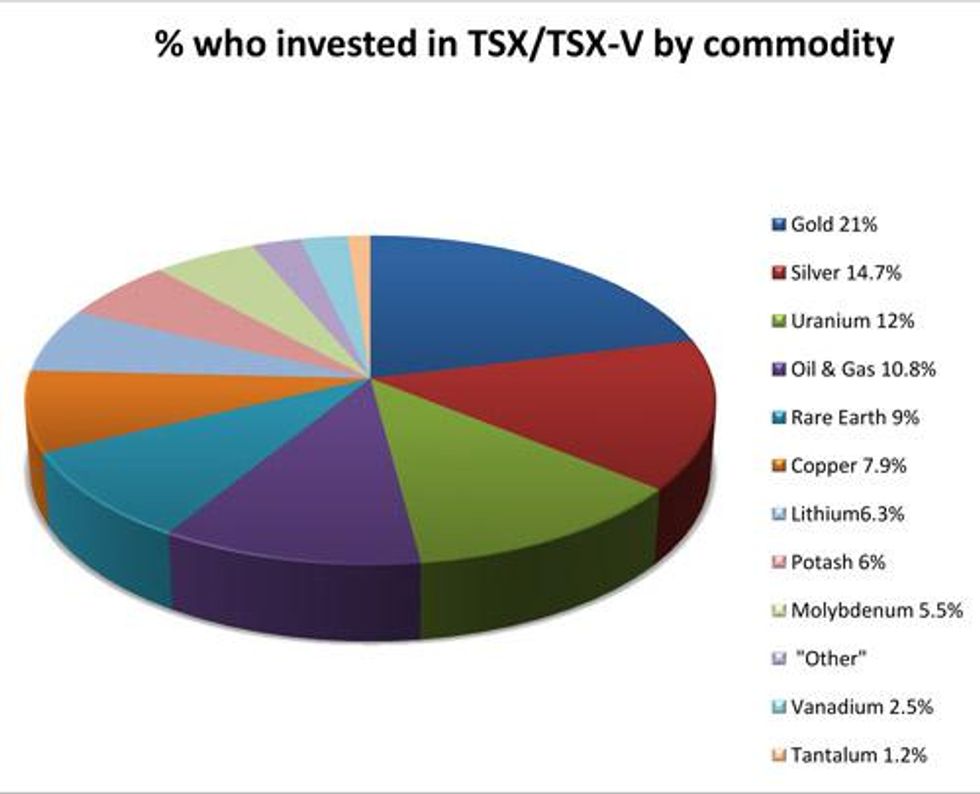

The percentage of respondents who have invested in resource companies listed on the TSX/TSX-V for the year is down from 72.2 percent in the previous survey to 66.9 percent and the number of respondents who indicated they plan to invest in commodities in the next six months fell 7.3 percent points to 71.7 percent.

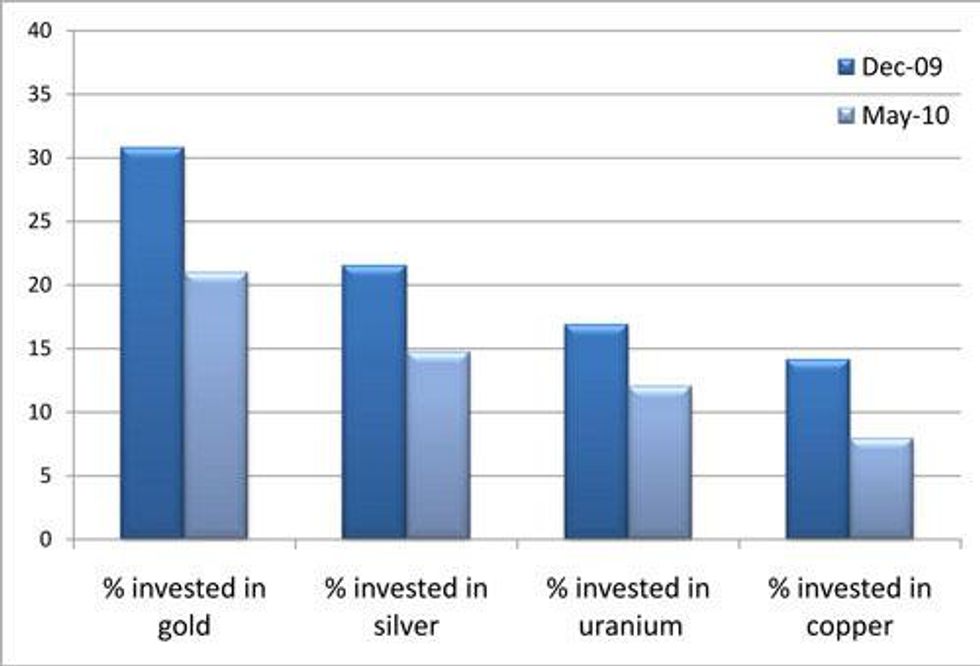

Unexpectedly, fewer investors were placing their bets on gold and silver than in the previous survey. The number of respondents who said they had invested in gold and silver this year is down from 30.8 and 21.5 percent in the previous survey, respectively, to 21 percent for gold and 14.7 percent for silver. Uranium investing is down as well, although slightly less, to 12 percent from 16.9 percent at the end of 2009.

The biggest shocker is the nearly 44 percent drop in copper investing with only 7.9 percent of respondents stating they’ve invested in the red metal in 2010 compared with 14.1 percent in 2009. Commonly referred to as Dr. Copper because of its status as a gauge of health for the industrial sector, the loss of interest may be a sign investors are losing confidence in global economic recovery.

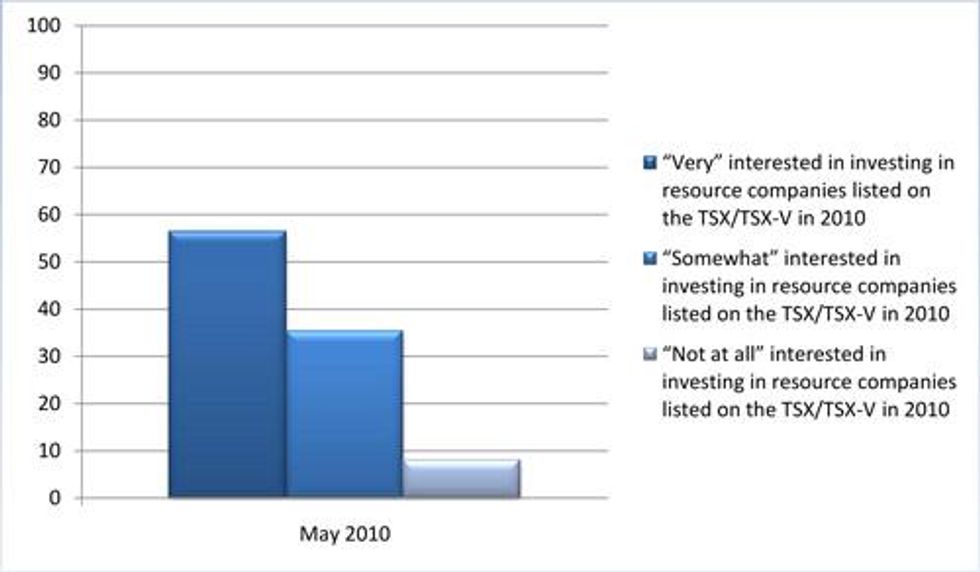

However, despite the slight drop in investor confidence, bullish sentiment still remains. When asked to state their interest in investing in resource companies listed on the TSX/TSX-V this year, 91.7 percent of respondents were either “very” interested (56.4 percent) or “somewhat” interested (35.3 percent).

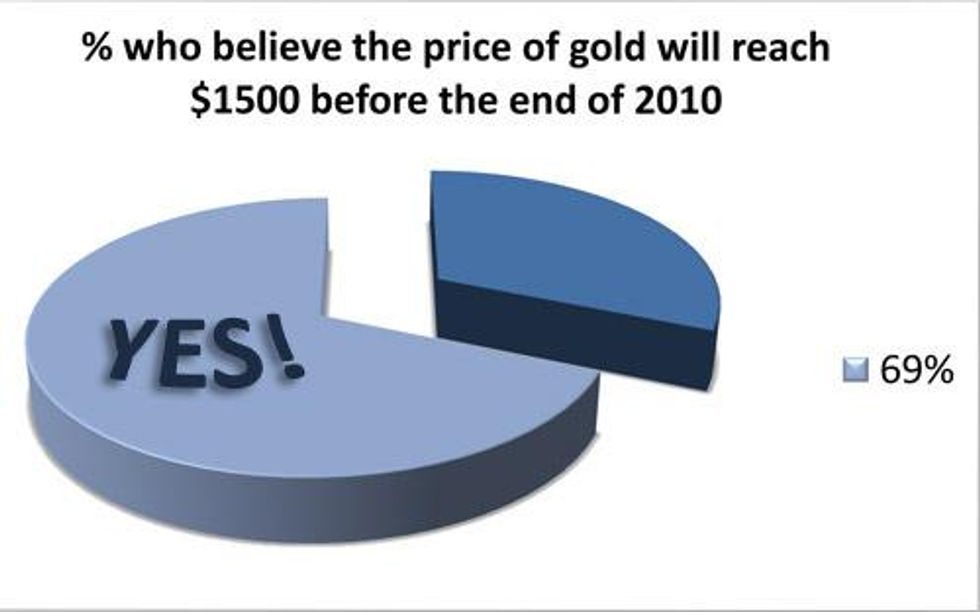

Perhaps most telling was the high number of respondents (68.7 percent) who believe the price of gold will reach $1500 before the end of 2010.

Some of the other commodities respondents have invested in for 2010 include: