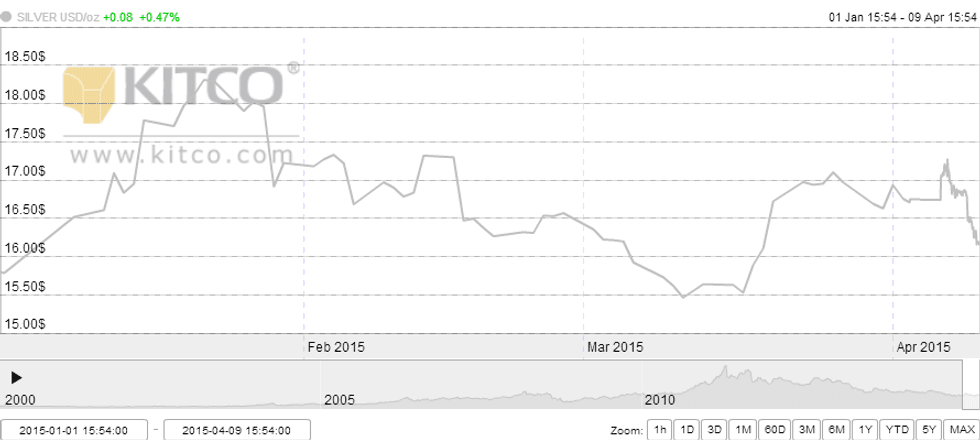

Q1 was fairly bumpy for silver, which reached a low of $15.47 per ounce and a high of $18.31 for the quarter. It might thus surprise investors to learn that overall the white metal saw the biggest gain among the precious metals during the quarter.

Q1 was fairly bumpy for silver, which reached a low of $15.47 per ounce and a high of $18.31 during the quarter. It might thus surprise investors to learn that overall the white metal saw the biggest gain among the precious metals during the quarter.

According to a recent Reuters article, silver rose 6 percent, while palladium fell 7.6 percent and platinum sank just over 5 percent. The news outlet doesn’t mention gold‘s performance, but a quick glance at Kitco’s gold price chart shows that the yellow metal recorded a first-quarter gain of 0.61 percent.

In terms of what buoyed the silver price to the top of the list, the metal saw the most gains in January, when investors were concerned about the global economy. That said, the strong US dollar kept a cap on the metal, and then began to push it down later on in the quarter. Silver has also faced pressure from worries about the impending interest rate increase from the US Federal Reserve.

It’s tough to say what’s next for silver, but the consensus seems to be that 2015 won’t bring any drastic changes. Even silver guru David Morgan, who’s known for his optimism about silver, told Resource Investing News at PDAC that while he believes the silver price bottomed last year and anticipates better prices in 2015, “it’s going to be a grind higher.”

More recently, Deutsche Bank (NYSE:DB) referred in a note to the fact that “so far this year there has been a shift in the relative performance with gold and silver outperforming the PGM complex.” The firm describes gold and silver’s resilience as “impressive” due to the fact that it’s been “accompanied by a rapid appreciation in the US dollar since the end of last year.” That said, for Q2 it’s predicting that silver will average just $16, then $17 in both Q3 and Q4. Overall for 2015 it believes the white metal will average $17.

According to Forbes contributor Jesse Columbo, factors investors might consider watching for silver price clues include the US Dollar Index, the euro and the crude oil price.

Company news

The silver space has been fairly quiet so far this week, but a few companies have put out news. For instance, Coeur Mining (NYSE:CDE) and Endeavour Silver (TSX:EDR,NYSE:EXK) both released their production results for Q1. The former announced preliminary production of 3.8 million ounces of silver and 69,734 ounces of gold; meanwhile, Endeavour’s silver production came in at 1,820,050 ounces, while gold output came to a total of 15,808 ounces.

Thursday saw Tahoe Resources (TSX:THO,NYSE:TAHO) declare its fourth monthly dividend for 2015. Shareholders of record at close of day April 23, 2015 will receive US$0.02 per common share.

Finally, GoGold Resources (TSX:GGD) said the same day that commercial production officially began at its Parral heap leach facility in Mexico on March 1, 2015. The facility processes material from the nearby Parral tailings project, which has a measured and indicated resource of 12.6 million silver equivalent ounces.

The company also said that during 2015′s first quarter the facility put out 315,804 silver equivalent ounces, up 37 percent over the previous quarter. Cash cost per ounce of silver was an average of $5.01 (net of gold credits), while cash cost per ounce of silver equivalent was $5.64. GoGold anticipates that Parral will continue to be one of Mexico’s lowest-cost silver producers moving forward.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading: