Drill Tracker Weekly: NGEx Expands Filo del Sol Silver Footprint

NGEx Resources announced results from the first eight reverse-circulation drill holes on the Filo del Sol project in Argentina.

NGEx Resources (TSX:NGQ)

Price: $1.09

Market cap: $204 million

Cash estimate: $28 million

Project: Filo del Sol

Country: Argentina

Ownership: 60 percent

Resources: 11.8 million tonnes at 105 g/t silver, 0.4 g/t gold, 0.45 percent copper

Project status: Additional RC drilling

- NGEx Resources announced results from the first eight reverse-circulation drill holes on the Filo del Sol high-sulfidation/copper-gold-silver porphyry project in Argentina. The project is a joint venture with Pan Pacific Copper (66 percent JX Nippon and 34 percent Mitsui Mining and Smelting (TSE:5706)), with NGEx holding a 60-percent interest.

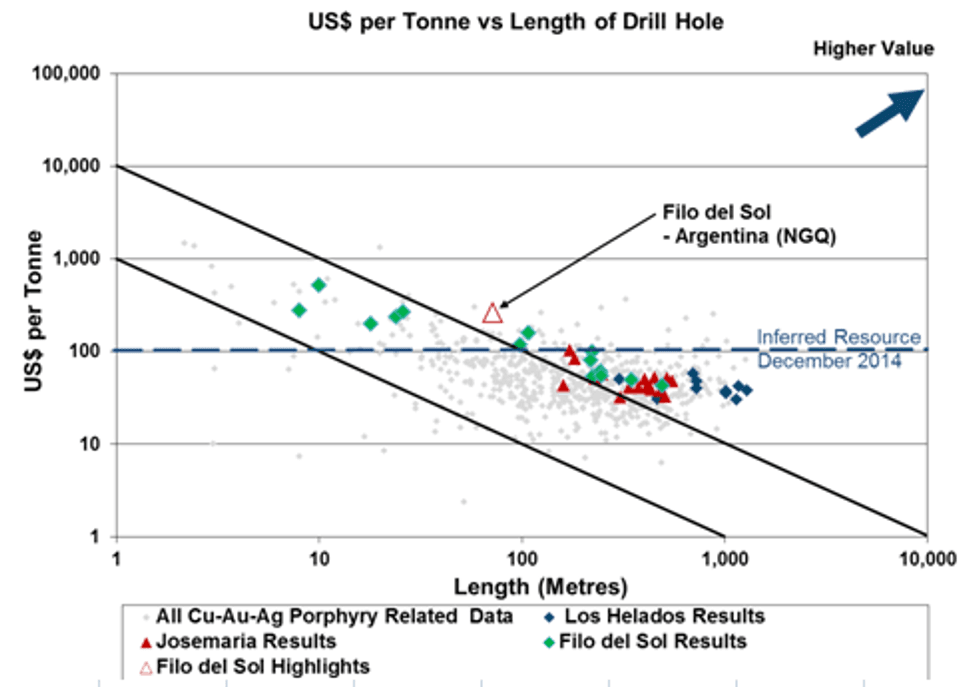

- Highlights include 72 meters (68 meters true width) grading 339 g/t silver, 0.34 g/t gold and 0.43 percent copper starting at a depth of 248 meters; that has extended the mineralization 140 meters to the west of the current resource. An additional hole ending in mineralization returned 26.3 meters grading 3.87 percent copper, 0.24 g/t gold and 2.3 g/t silver from 204 meters depth.

- In December 2014, the company announced the initial resource estimate for the silver zone with an inferred resource of 11.8 million tonnes grading 105.5 g/t silver, 0.4 g/t gold and 0.45 percent copper using a 50 g/t silver cut off. The report also includes an inferred resource for the copper zone of 38.3 million tonnes grading 0.85 percent copper, 0.36 g/t gold and 12.8 g/t silver using a 0.5-percent copper cut off. Metallurgical work will be critical in determining the valuation of the mixed mineral zones.

- The Filo del Sol project is part of a much larger mineralized system complicated by the international border between Chile and Argentina. The company has outlined two nearby resources at Josemaria and Los Helados in Chile. Josemaria has an indicated resource of 789 million tonnes grading 0.35 percent copper and 0.24 g/t gold, while the Los Helados joint venture hosts an estimated indicated resource of 1.395 billion tonnes at 0.42 percent copper, 0.16 g/t gold and 1.37 g/t silver using a cut off of 0.44 percent copper equivalent.

Early discovery holes (Tenke 2001): 118 meters at 0.51 percent copper, 81 g/t silver, 0.38 g/t gold

Current holes: 72 meters at 339 g/t silver, 0.34 g/t gold, 0.43 percent copper

Disclosure: I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable, but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. At the date of this release the author, Wayne Hewgill, owns no shares in the companies in this report.

This report makes not recommendations to buy sell or hold.

Wayne Hewgill is a geologist with extensive knowledge of the global mining industry gained through 30 years of diversified experience in mineral exploration and new business development in Canada, as well as 10 years living in Africa, New Zealand and Australia. He was previously senior research officer at BHP Billiton, an executive with an exploration company working in Argentina and a mining analyst at three Vancouver-based financial groups where he developed the Drill Tracker database in 2006. He holds a B.Sc. in Geology from the University of British Columbia and is registered as a Professional Geoscientist (P.Geo) with APEGBC.