American CuMo Mining files Independent Preliminary Economic Assessment for the CuMo Project

American CuMo Mining Corporation is pleased to report on positive results from an independent Preliminary Economic Assessment of its CuMo Project.

American CuMo Mining Corporation (TSXV:MLY, OTCQX:MLYCF) (“CuMoCo” or the “Company”) is pleased to report on positive results from an independent Preliminary Economic Assessment (PEA) of its 100% owned CuMo Project, a large Copper-Molybdenum-Silver- Rhenium deposit located in Boise County, Idaho. The independent, third-party analysis was conducted by SRK Consulting (Canada) Inc., Sacré-Davey Engineering and Giroux Consulting.

“The CuMo Project is the largest Molybdenum, Silver, and Rhenium deposit in the United States and one of the world’s leading mining projects in terms of its size, cost, and potential economics,” said Shaun Dykes, President and Chief Executive Officer of CuMoCo. “The updated Preliminary Economic Assessment affirms projections and compels completion of the remaining environmental permitting aspects, pre-feasibility analysis, and feasibility initiatives to further advance our CuMo Project. The project design prioritises features that will provide the highest levels of environmental protection, workforce safety, and operating efficiency, while minimizing negative impacts on the community.”

This analysis marks the fifth report since 2008, revalidating the size, scope, and economics of the CuMo Project. Prior reports, which are available at www.sedar.com, were completed in 2008, 2012, 2015 and 2018.

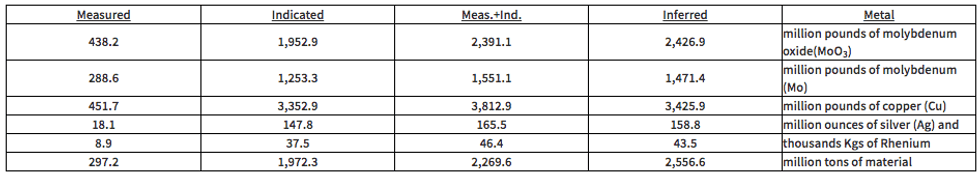

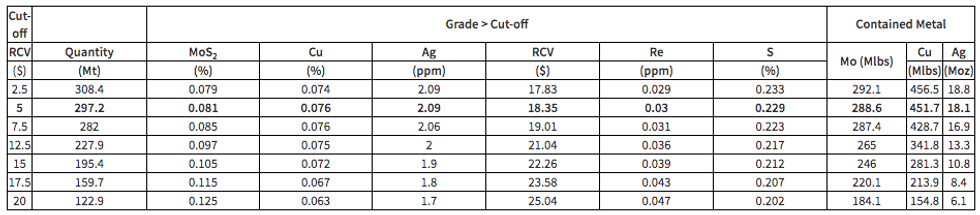

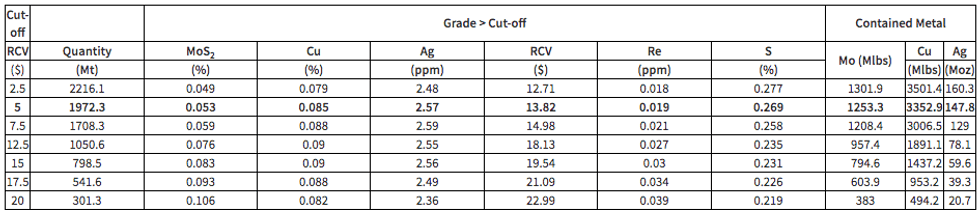

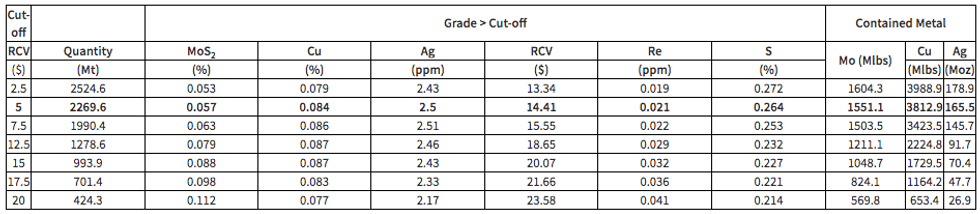

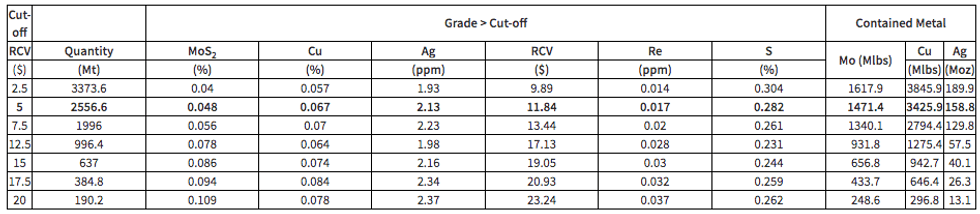

The following mineral resource estimation tables (Table1-1 to 1-4) confirm that the CuMo deposit contains, at a Recovered Metal Value (RCV) $5.00 cut-off (all dollar amounts are expressed in US dollars):

Medium long-term metal prices of $10 moly oxide ($15 moly metal Mo), $3 copper, $17.50 per ounce silver were used.

Table 1-1: Measured resource within pit shell

Table 1-2: Indicated resource within pit shell

Table 1-3: Measured and indicated resource within pit shell

Table 1-4: Inferred resource within pit shell

Notes: $5.00 RCV is the base-case cut-off for all mineral resource estimates. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

A minor change to the 2015 and 2018 reported resource estimate is noted as the Tungsten has been removed from the resource in order to maintain the overall classification of measured, indicated and inferred. No Tungsten recovery circuit has been included in the current process plant design as further work is required in order to determine the best way to recover the Tungsten.

The resource has been used to produce a new 30-year production pit and possible mill site, waste dump, and tailings locations.

The PEA is preliminary in nature. It includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

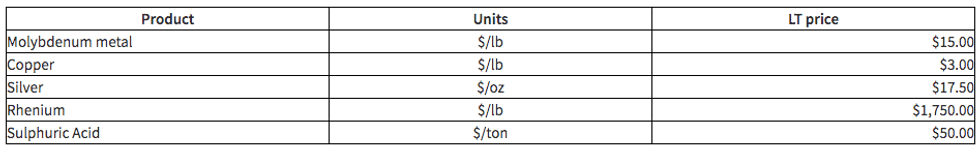

The potential project economics were evaluated using the following long-term metal prices:

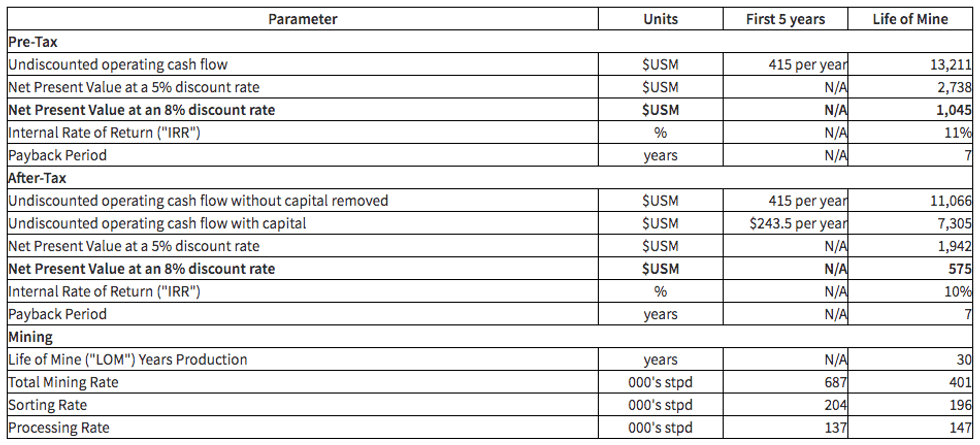

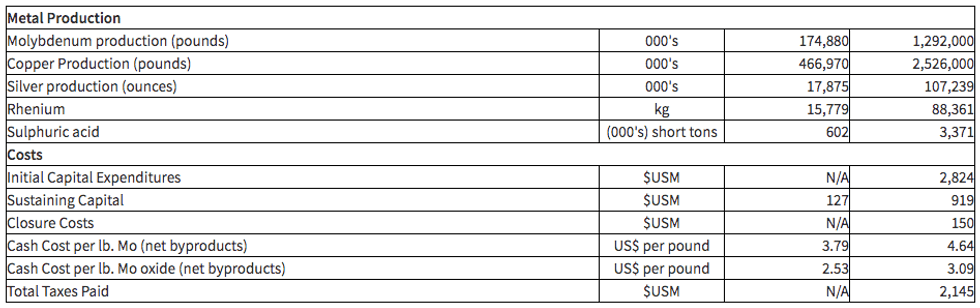

The following table shows the highlights of the potential economics from the report:

Note: 5-year cash flow projections are identical before and after tax as no tax is paid until capital has been recovered.

Notes:

Net present value (NPV), is also the discounted cash flow for the life of the mine.

No taxes are paid until payback of capital costs have been made and no state and federal government incentives/ grants that are available have been included in the tax calculation.

Molybdenum is sold as Molybdenum oxide (MoO3) but is paid according to the molybdenum metal (Mo) content of the molybdenum oxide.

Cost per lb. is based on all costs operating and treatment charges.

Mr. Shaun M. Dykes, President and CEO of the Company comments: “The results are extremely encouraging, especially indicating a potential total after-tax, prior to capital removal, undiscounted cash flow of US$11 billion dollars over a period of 30 years (US$368 million per year).

In comparing the potential economics of the previous 2018 report ( May 2018) with the current report, the following is noted:

A decrease in after-tax Cash flow (pre-capital) from US$18,196.7 million to US$11,066 million;

A decrease in Net Present Value (5%) from US$5,673 million to US$1,942 million;

An increase in the highlighted discount rate from 5% to 8% giving a current present value of US$575 Million;

A decrease in Internal Rate of Return from 25% to 10%;

A decrease in life of mine from 82 years to current 30 years;

A decrease in total capital expenditures, including sustaining, from US$5,273.6 million to US$3,893 million;

An increase in cost per lb, Mo (net by products) from $2.37 to $4.64.

Previous economics were calculated over a 40 year period while current economics are calculated over 30 years.

The main reasons for these changes are:

The use of coarse (10 foot) mineral sorting intervals instead of the finer (2 to 3 inch) intervals, which had a significant reducing effect on the mill feed grades used in the economics. The switch from fine to coarse sorting resulted in a decrease of approximately 31% in grades and thus recoverable metals.

An increase in operating cost per ton from US7.86 to US$9.25 is also noted.

For readers to fully understand the information in this news release, they are encouraged to read the complete PEA technical report, which the Company has filed on SEDAR (www.sedar.com). The report is also available on the Company’s website, including all qualifications, and assumptions that relate to the PEA. The technical report is intended to be read in its entirety and sections should not be read or relied upon out of context.

The Company and authors have identified several areas and opportunities that, in addition to the potential economics described above, may provide significant costs savings for the project, including the following:

Mining

– Further drilling to estimate grade of blocks not estimated in current model and assumed to be waste.

– Optimization of the pit designs and definition of a mineable reserve.

– Optimization of waste and stockpile haulage methodology. Considering possible implementation of conveyor-based systems to reduce the amount of trucking involved and thus costs.

– Detailed equipment costing to determine potential bulk purchase discounts compared to list price for all major components.

Sorting

– The current assessment is based on 10-foot assay sample intervals which are extremely coarse. The CuMo Project has potential for finer sorting to 2- to 3-inch size, which would result in grade improvements and thus improved economics.

– The impact of bulk sorting can be expected to be improved through further sampling and testing.

Milling

– Additional metallurgical work will help determine optimum grind size (the current assessment is based on the finest grind tested to date), analyze recoveries of the various metals, and analyze the effects of the higher grade coming from the mineral sorters on metal recoveries.

– Optimization reagents to reduce costs and improve metallurgy.

– Work on the potential for a tungsten recovery circuit is required (excluded from the current report).

Other

– Examination of alternative concentrate transportation from the mill to the railhead.

– Optimization of the roaster capital and operating costs.

“These optimizations and further studies will be examined in more detail as part of the Pre-Feasibility Study the Company will commence next year with the goal of continuing to further reduce overall capital and operating costs, and improve the already excellent economics of our CuMo Project,” stated Mr. Dykes.

Mr. Shaun M. Dykes, M.Sc. (Eng), P.Geo., President and CEO of the Company, is the designated qualified person for the CuMo Project and has prepared the technical information contained in this news release.

In other events, Joseph Baird has resigned as director of both Idaho CuMo Mining and CuMoCo due to a substantial increase in lawyers’ board liability insurance premiums. The Company wishes to thank Joseph for all his hard work done during difficult times.

About CuMoCo

CuMoCo is focused on advancing its CuMo Project towards feasibility and establishing itself as one of the largest and lowest-cost molybdenum producers in the world as well as a significant producer of copper and silver. For more information, please visit cumoco.com, idahocumo.com and cumoproject.com.

For further information, please contact:

American CuMo Mining Corporation

Shaun Dykes, President and Chief Executive Officer

Tel: (604) 689-7902

Email: info@cumoco.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this new release.

Cautionary statement regarding forward‐looking information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation including, but not limited to, statements that address activities, events or developments that the Company expects or anticipates will or may occur in the future, such the Company’s ability to move its CuMo Project to feasibility and production, and to become one of the largest and lowest-cost molybdenum producers in the world as well as a significant producer of copper and silver. Forward-looking information is based on a number of material factors and assumptions, including the result of exploration activities, the ability of the Company to raise the financing for a feasibility study and to put the CuMo project into production, that no labour shortages or delays are experienced, that plant and equipment function as specified that the Court will not intervene with the Company’s proposed exploration activities at the CuMo Project, and the ability of the Company to obtain all requisite permits and licenses to advance the CuMo Project and eventually bring it into production. Forward-looking information involves known and unknown risks, future events, conditions, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future prediction, projection or forecast expressed or implied by the forward-looking information. Such factors include, among others, the interpretation and actual results of current exploration activities; changes in project parameters as plans continue to be refined; future prices of molybdenum, silver and copper; possible variations in grade or recovery rates; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing, as well as those factors disclosed in the Company’s publicly filed documents, including the Company’s Management’s Discussion and Analysis for the period ended March 31, 2019. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information.