Unigold Intersects 17.0 Metres Averaging 7.3 g/t Au with 22.50 g/t Ag and 1.2 Percent Cu at Candelones Extension Deposit in the Dominican Republic

Unigold Inc. is pleased to announce results from two drill holes targeting gold-rich massive sulphide mineralization in the Dominican Republic.

Unigold Inc. (“Unigold” or the “Company”) (TSXV:UGD) is pleased to announce additional results from two drill holes targeting gold-rich massive sulphide mineralization at the Company’s 100 percent owned Neita Concession in the Dominican Republic. These holes were drilled primarily to collect sample material for a metallurgical test program to be completed in 2020 and to improve the confidence in the existing resource model. Exploration drilling, targeting the depth extensions of mineralization, commenced in mid-November.

LP19-133M intersected 17.0 m of massive sulphide that assayed 7.30 g/t Au with 22.50 g/t Ag and 1.2 percent Cu (Ref. Table 1.0). LP19-132M intersected 12.0 m of massive sulphide that assayed 6.95 g/t Au with 8.40 g/t Ag and 0.86 percent Cu within a 99.0 m package containing three distinct sulphide intervals that assayed 3.42 g/t Au with 2.8 g/t Ag and 0.3 percent Cu overall (Ref. Table 1.0). The sulphide mineralization within this larger package showed a distinct and separate lens grading 21.70 g/t Au over the final 3.50 m at the footwall.

Joe Hamilton, Chairman and CEO of Unigold notes: “These latest holes confirm the continuity of the massive sulphide mineralization. More importantly, the results show minimal grade variation within the massive sulphide which results in startlingly consistent gold and copper grades with no discernable nugget effect and little need for cutting assays. Both of our drills are now operating on a 24/7 basis. We completed 1400 meters of drilling in October with average drill productivities of 52 m per day and 25 m per day for sulphide and oxide drilling respectively. Now that the phase 1 drilling has been completed, both drills have shifted focus towards tracing the depth and strike extensions of this high-grade mineralization. Exploration will initially target the depth extensions and explore the footwall for stockwork and feeder zones before stepping out to probe the eastern extensions. Exploration drilling will continue until the late December. On behalf of the Board and all the shareholders of Unigold, I would like to thank our staff in the Dominican Republic for their dedication and persistence in commencing this exploration program in record time with a clear safety record. Their professionalism and commitment is our biggest asset.”

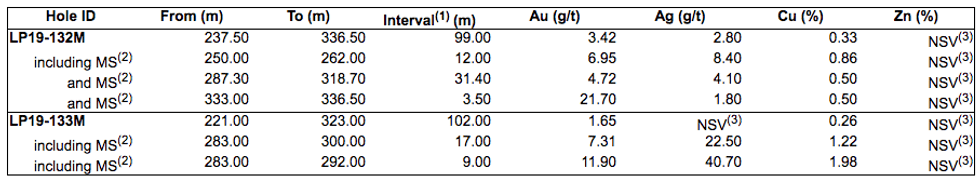

Table 1.0 – Summary of Results LP19-132M and LP19-133M

(1) All intervals are reported as drilled length not true width. There is insufficient data at this time to estimate true width.

(2) MS denotes massive sulphide mineralization.

(3) NSV denotes No Significant Values

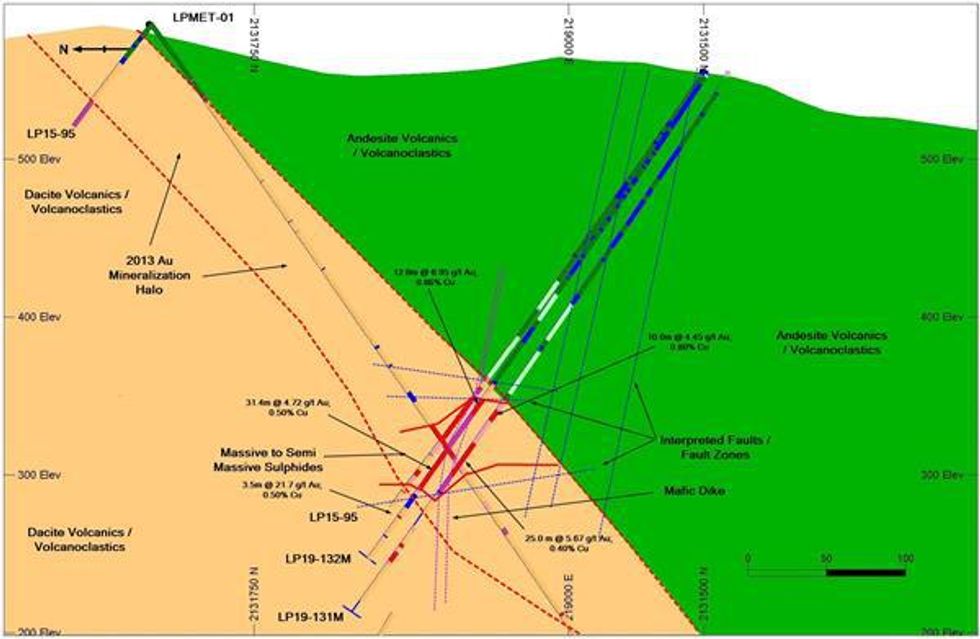

LP19-132M was drilled to bisect holes LP15-95 and LP19-131M (5.67 g/t Au and 0.4 percent Cu over 25 m; PR2019-10, Nov 12, 2019)(Figure 1). This hole intersected three distinct zones of massive sulphides. A broad, unmineralized, late mafic dike separates the upper two zones between 262.00 m and 287.30 m downhole. The dike has also been observed in holes LP15-95 and LP19-131M and is interpreted to be sub-vertical, likely emplaced along a sub-vertical fault. The massive sulphide mineralization appears reasonably flat lying and is disrupted by both flat lying and sub-vertical faulting.

Figure 1.0

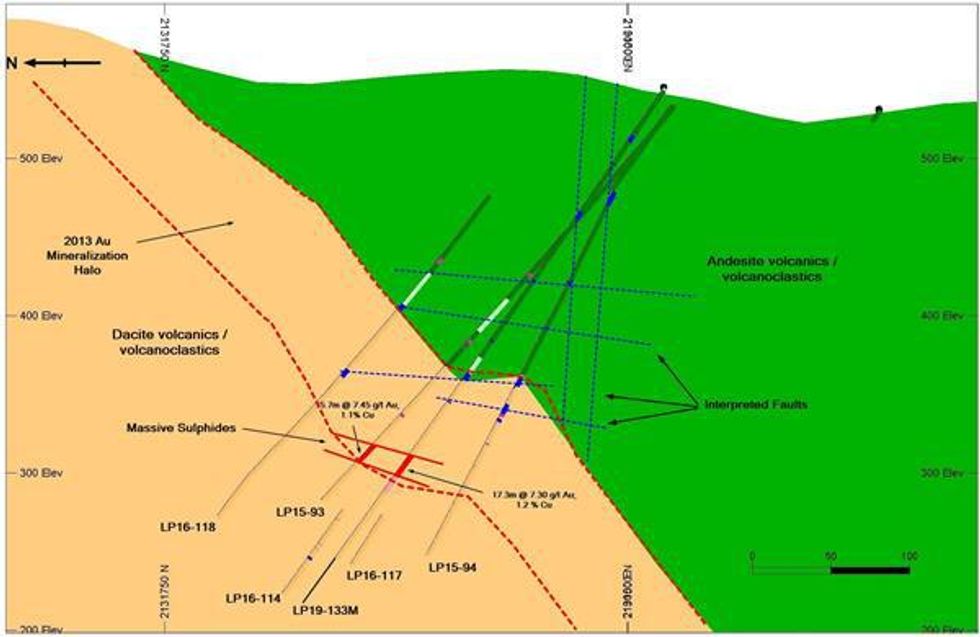

LP19-133M bisected holes LP15-93 and LP15-94 (Figure 2). The two holes were spaced approximately 50 meters apart on the same section. LP15-93 intersected 15.7m of massive sulphide returning grades of 7.45g/t Au and 1.1 percent Cu. LP15-94 intersected extensive faulting where the sulphide mineralization was anticipated suggesting that the down dip extent is displaced by faulting. There is no drilling below LP15-94 at this time. LP19-133M intersected massive sulphide mineralization over an interval similar to LP15-93 and returned identical gold and copper values. LP19-133M extended the massive sulphide mineralization 25 meters to the south. The mineralization appears to be relatively flat lying. Both flat lying and sub-vertical faulting is interpreted to disrupt both the mineralization and the lithology as demonstrated by the offset observed in the andesite dacite contact.

Figure 2.0

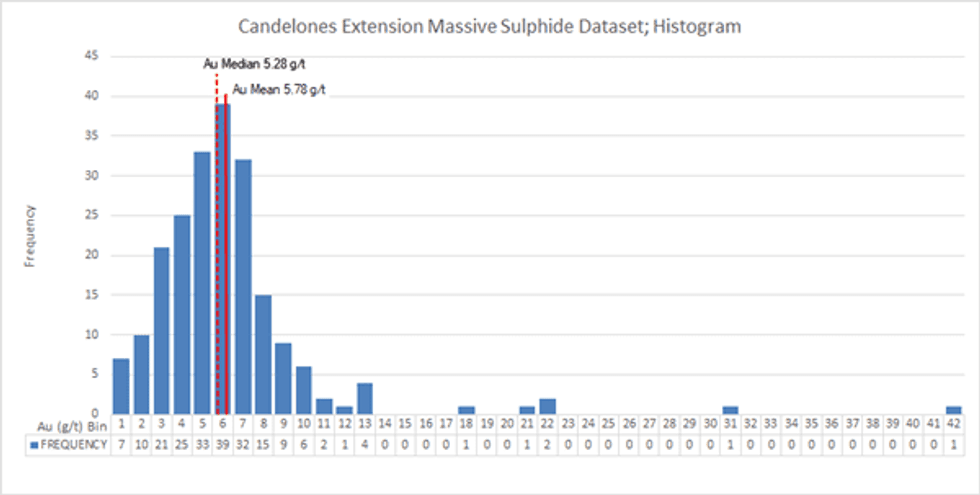

A histogram of the results to date indicates that gold within the massive sulphide defines a generally symmetrical population with the data evenly distributed about the median (Ref Figure 3.0). There is a slight tail of high grade results with six instances of gold grades greater than 15.0 g/t.

Figure 3.0

Outlier analyses suggests only one of the 210 results to date would be considered an outlier at 41.20 g/t Au.

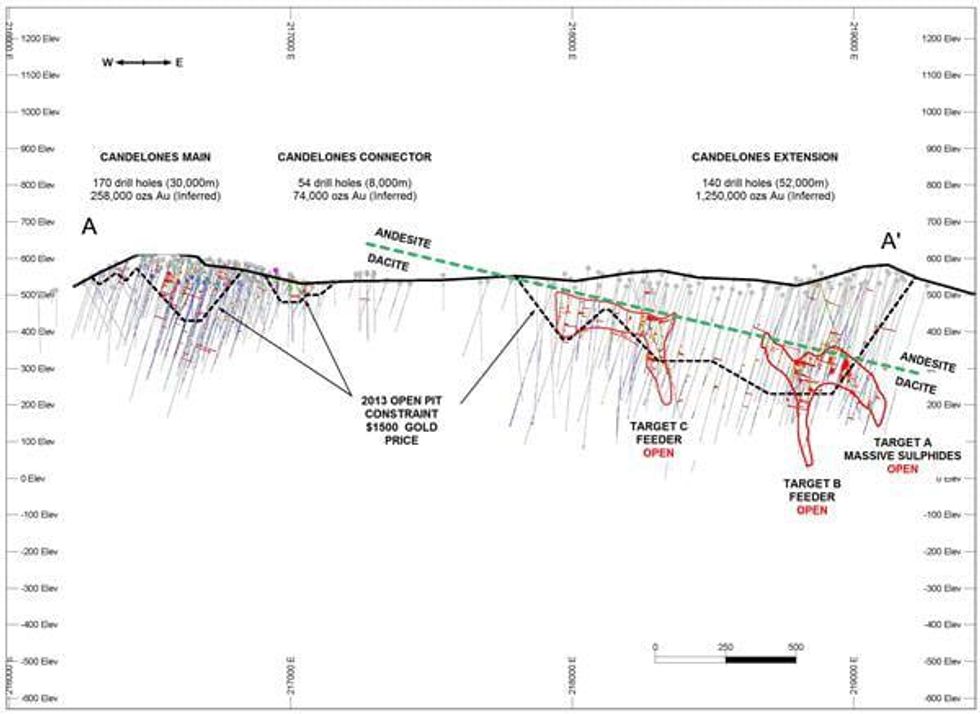

The interpreted mineralization envelope used to estimate the 2013 Inferred Resources is also shown Figures 1 and 2. Before the discovery of the massive sulphide lenses, gold mineralization was recognized as being related to disseminated sulphides along the andesite-dacite contact. Sulphide concentrations decreased with distance from the contact but anomalous gold grades of up to 1.5 g/t accompanied the disseminated sulphides up to 125 m into the footwall. This halo of disseminated sulphides with gold mineralization was the focal point of exploration from 2010 through 2013 and was traced by drilling over a 3 kilometre strike length and to a depth of 300 m below surface. This historical drilling was completed on a nominal 100 x 100 meter spacing and supports the 2013 mineral resource estimate (NI43-101 report available at www.unigoldinc.com or www.sedar.com ). The disseminated mineralization remains open along strike and to depth.

In 2015, the Company initiated a drill program targeting higher grade results within the resource footprint at the Candelones Extension deposit. This drilling intersected a pyrite-rich massive sulphide zone ranging in thickness between 10 to 30 meters with gold and copper grades 3 to 5x higher than the average grade of the surrounding disseminated mineralization. Grades were strikingly consistent, ranging from 2.0 to 10.0 g/t Au through the massive sulphide mineralization (Target A – Ref. Figure 4.0). The massive sulphides are currently interpreted to strike east-northeast and appear to be relatively flat lying with a plunge of 30° to the northeast. Drilling to date has traced the massive sulphide mineralization along a 350 meter strike length with holes spaced roughly 75 meters along strike. The massive mineralization remains open to the east and to depth.

Two additional anomalies (Target B and C – Ref. Figure 4.0) were also identified; both appear to be sub-vertical, polymetallic zones that returned highly anomalous zinc, silver, lead, copper and gold. Both of these targets show epithermal-style alteration signatures and remain open at depth.

The extensive gold-bearing disseminated mineralization, the massive sulphide lenses and the epithermal-style zones of mineralization are thought to be the expression of single, long-lived mineralizing event. Further exploration work will target the relationships between, and the extensions to, all three types of mineralization.

Figure 4.0

QA/QC

Diamond drilling utilizes both HQ and NQ diameter tooling. Holes are established using HQ diameter tooling before reducing to NQ tooling to complete the hole. The core is received at the on-site logging facility where it is, photographed, logged for geotechnical and geological data and subjected to other physical tests including magnetic susceptibility and specific gravity analysis. Samples are identified, recorded, split by wet diamond saw, and half the core is sent for assay with the remaining half stored on site. A minimum sample length of 0.3 meters and a maximum sample length of 1.5 metres are employed with most samples averaging 1.0 meters in length except where geological contacts dictate. Certified standards and blanks are randomly inserted into the sample stream and constitute approximately 5-10 percent of the sample stream. Samples are shipped to a sample preparation facility in the Dominican Republic operated by Bureau Veritas. Assaying is performed at Bureau Veritas Commodities Canada Ltd.’s laboratory in Vancouver, B.C. Canada. All samples are analyzed for gold using a 50 gram lead collection fire assay fusion with an atomic adsorption finish. In addition, most samples are also assayed using a 36 element multi-acid ICP-ES analysis method.

Wes Hanson P.Geo., Chief Operating Officer of Unigold Inc., has reviewed and approved the contents of this press release.

About Unigold Inc. – Discovering Gold in the Caribbean

Unigold is a Canadian based mineral exploration company traded on the TSX Venture Exchange under the symbol UGD, focused primarily on exploring and developing its gold assets in the Dominican Republic.

For further information please visit www.unigoldinc.com or contact:

| Mr. Joseph Hamilton | |

| Chairman & CEO | |

| jhamilton@unigoldinc.com 416.866.8157 |

Forward-looking Statements

Certain statements contained in this document, including statements regarding events and financial trends that may affect our future operating results, financial position and cash flows, may constitute forward-looking statements within the meaning of the federal securities laws. These statements are based on our assumptions and estimates and are subject to risk and uncertainties. You can identify these forward-looking statements by the use of words like “strategy”, “expects”, “plans”, “believes”, “will”, “estimates”, “intends”, “projects”, “goals”, “targets”, and other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. We wish to caution you that such statements contained are just predictions or opinions and that actual events or results may differ materially. The forward-looking statements contained in this document are made as of the date hereof and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ materially from those projected in the forward-looking statements. Where applicable, we claim the protection of the safe harbour for forward-looking statements provided by the (United States) Private Securities Litigation Reform Act of 1995.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.