Endurance Gold Corporation (TSXV: EDG) (the "Company") is pleased to report the first assay results from the 2021 diamond drilling program at the Reliance Gold Property (the "Property") in southern British Columbia. The Property is located 4 kilometres ("km") east of the village of Gold Bridge with year-round road access, and 10 km north of the historic Bralorne-Pioneer Gold Mining Camp which has produced over 4 million ounces of gold.

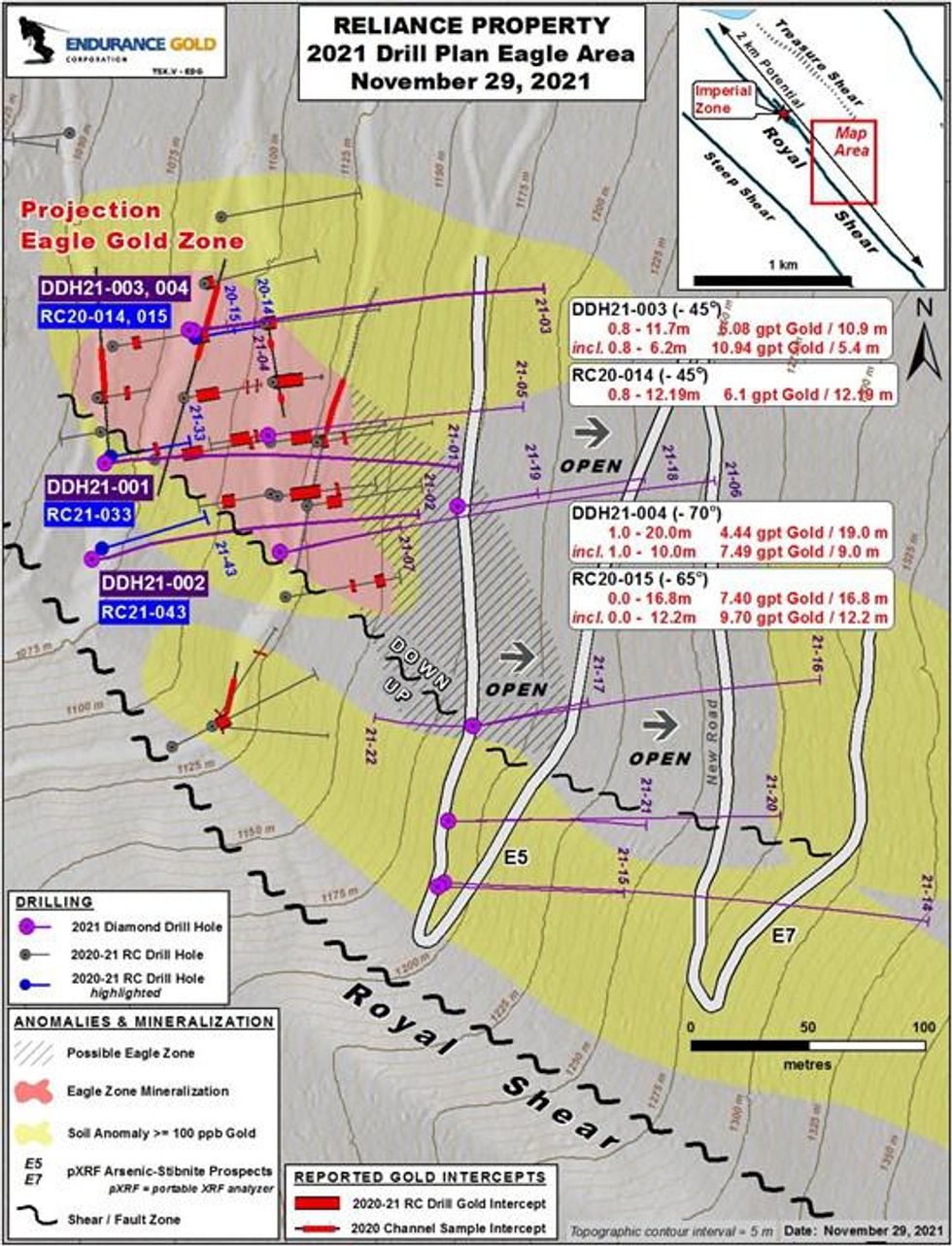

As announced on November 3, 2021, the Company completed 4,329 metres ("m") of diamond drilling in twenty-two (22) drill holes at the Eagle and Imperial Zones. Assay results have been received from the first four (4) diamond drill holes completed at the Eagle Zone and assays are pending for the remaining eighteen (18) holes. Locations of the reported diamond drill holes are shown on Figure 1.

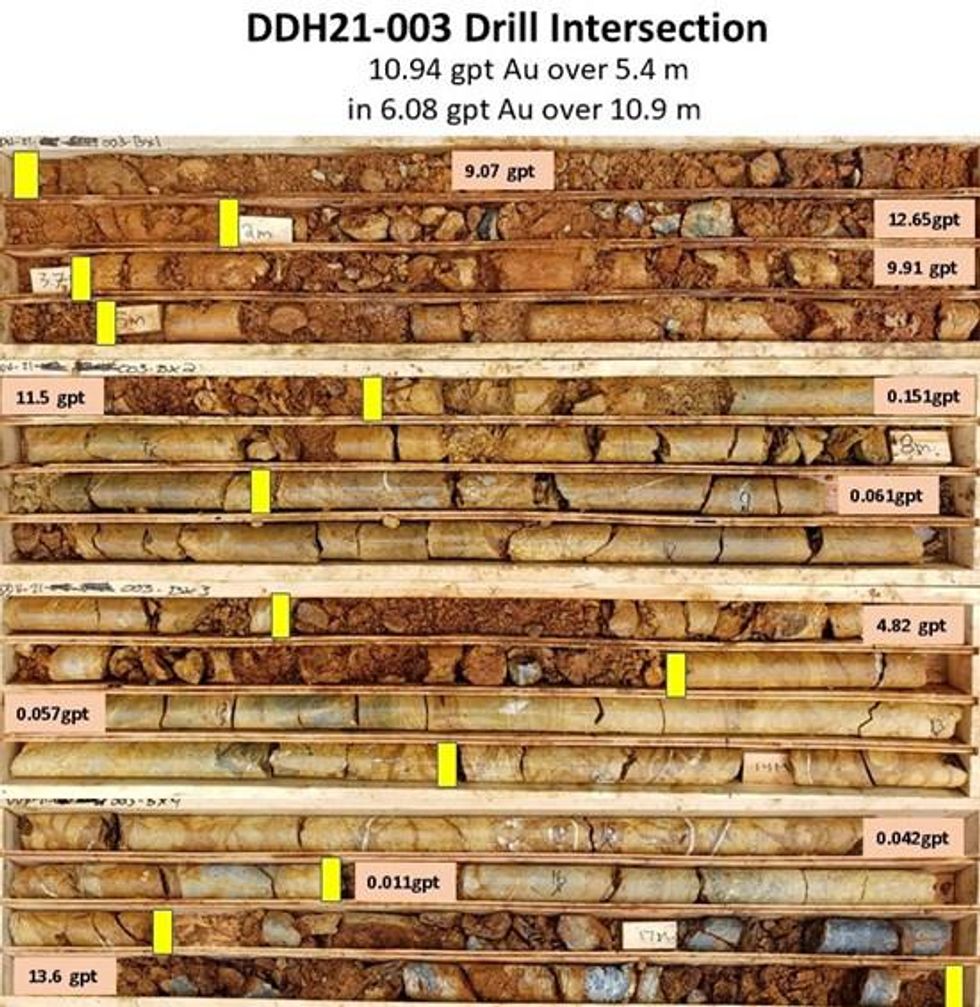

- DDH21-003 intersected gold mineralization from surface and returned 6.08 grams per tonne ("gpt") gold over an interval of 10.9 metres ("m") with a high-grade interval of 10.94 gpt gold over 5.4 m. The hole was drilled into the Eagle 1 outcrop where channel sampling, reported on October 26, 2020, averaged 5.89 gpt gold over 31.5 m. The hole was drilled at an azimuth of 080 degrees and angle -45 degrees. Core recovery averaged 78% over this mineralized interval. A photo of the oxidized drill core intersection is shown on Figure 2. This hole was extended to a total depth of 215.5 m to provide footwall geology, structural and alteration data.

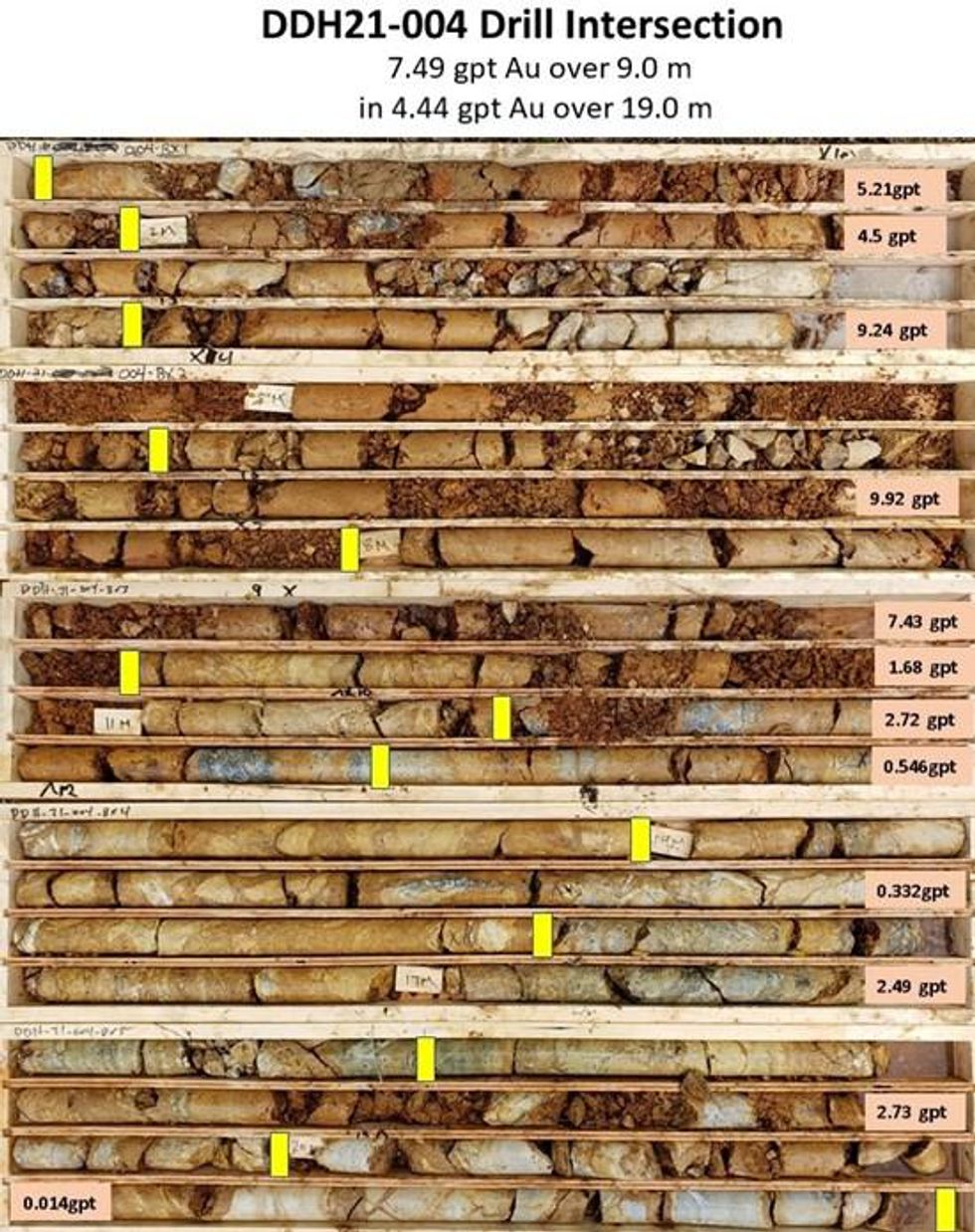

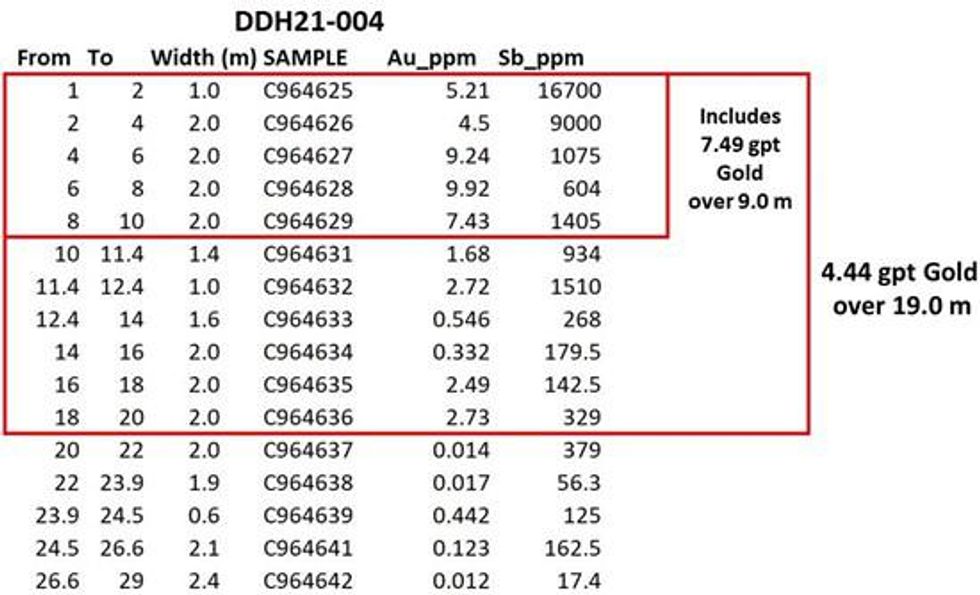

- DDH21-004 was drilled from the same setup as DDH21-003 at an azimuth of 080 degrees and steeper dip of -70 degrees. The hole also intersected gold mineralization from surface and returned 4.44 gpt gold over 19.0 m with a high-grade interval of 7.49 gpt gold over 9.0 m. Core recovery in this hole averaged 97% over the mineralized interval. A photo of the oxidized drill core intersection is shown on Figure 3 below.

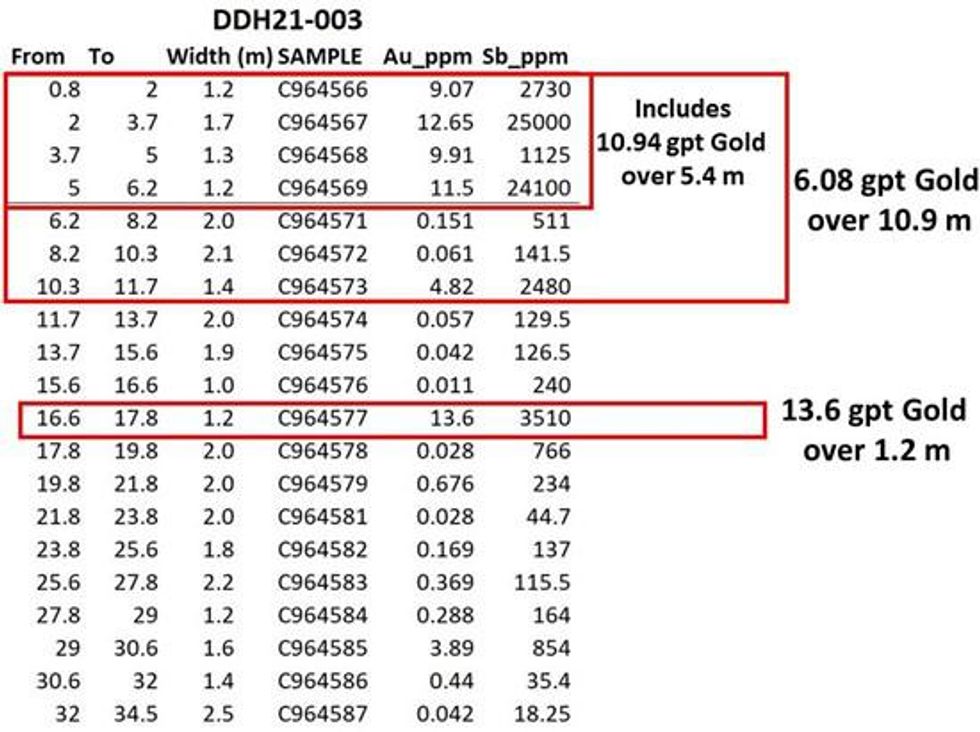

- Gold and antimony results for each of these diamond drill holes are summarized in Table 1 and Table 2 below.

Diamond drill holes DDH21-003 and DDH20-004 were drilled at the same location as two earlier reverse circulation ("RC") drill holes completed in late 2020 with results reported on February 2, 2021. These diamond drill holes were drilled for the purposes of quality assurance and quality control ("QAQC'') of the RC drill technique which recovers 100% of the bedrock in the form of comminuted bedrock and rock chips, and to obtain a better geologic examination of the oxidized portion of the newly discovered Eagle Zone mineralization. DDH21-003 was a diamond drill hole which twinned an earlier RC drill hole RC20-014 that had an intersection of 6.1 gpt gold over 12.19 m from the collar. DDH21-004 which twinned RC drill hole RC20-015 which had an intersection of 7.40 gpt gold over 16.8 m including a higher grade interval of 9.70 gpt gold over 12.2 m, with both RC intervals commencing at the RC drill collar.

The two other diamond drill holes DDH21-001 and DDH20-002, on which assays have been received, were drilled at an azimuth of 080 degrees and dip angle of -45 degrees as shown on Figure 1 to provide data for a more rigorous structural and geological control in areas where RC drilling results were difficult to interpret. Due to a steep fault offset interpreted from this drilling, both of these holes have undercut the shallow southwest dipping Eagle Zone which is now interpreted to be offset vertically on the southwest side of this interpreted steep fault as shown on Figure 1. On the southwest side of the interpreted fault the geology is structurally complex package of iron carbonate and sericite altered polymictic mélange, chert, as well as brecciated and sulphidized silicification. These holes continued through the offsetting fault to a total depth of 213 m and 188 m respectively to provide Eagle Zone footwall geology, structural and alteration data.

DDH21-001 returned a weak gold intersection of 2.02 gpt gold over 1.0 m which coincides with a similar intersection of 2.38 gpt gold over 1.52 m in RC21-033 as reported on June 17, 2021. DDH21-001 and RC21-033 were drilled from the same setup, with similar azimuth and dip of -45 degrees.

To date, assay results have been received for 212 of the 1,310 drill core samples that have been submitted for assay analysis. The remaining gold assay results are expected to be received through December and the first quarter of 2022 and will be reported when received.

Endurance Gold Corporation is a company focused on the acquisition, exploration and development of highly prospective North American mineral properties with the potential to develop world-class deposits.

Robert T. Boyd

FOR FURTHER INFORMATION, PLEASE CONTACT

Endurance Gold Corporation

(604) 682-2707, info@endurancegold.com

www.endurancegold.com

Diamond drill core was logged and evaluated on the Property and samples designated for collection under the supervision of a geologist at the property. Drilling was completed using a skid mounted Hydracore 2000 equipped with NQ size tools capable of collecting 4.76 cm diameter core. Diamond drill core was cut using a diamond drill saw with one half of the core sent for analysis and the remaining kept for future studies. Sample intervals were typically 2 metre core length and intervals were shortened for lithology or alteration changes. For drilled and sampled intervals of poor average core recovery, the complete core was sampled and sent to the laboratory for assay analysis. All diamond drill core samples have been submitted to ALS Global in North Vancouver, BC, an ISO/IEC 17025:2017 accredited laboratory, where they are crushed to 70% Endurance Gold monitors QA/QC by inserting blanks, certified standards and pulp duplicates into the sample stream.

Reverse Circulation ("RC") samples were collected under the supervision of a geologist at the drilling rig. Drilling was completed using a 3.5 inch hammer bit and rock chip samples were collected using a cyclone. Sample size were reduced to 1/8th size with a riffle splitter at the drilling rig. A second duplicate split and coarse chips were collected for reference material and stored. All RC samples were submitted to ALS Global in North Vancouver, BC and were processed with the same analytical methods as the diamond drill core samples summarized above.

The 2020 and 2021 work program is supervised by Darren O'Brien, P.Geo., an independent consultant and qualified person as defined in National Instrument 43-101. Mr. O'Brien has reviewed and approved this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of factors beyond its control, and actual results may differ materially from the expected results.

Figure 1: Reliance Property, Eagle Area Targets - 2021 Diamond Drill Plan

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/4976/105444_31e4a4a2641b8b54_002full.jpg

Figure 2: Reliance Property, DDH21-003 Drill Intersection

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4976/105444_31e4a4a2641b8b54_003full.jpg

Figure 3: Reliance Property, DDH21-004 Drill Intersection

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/4976/105444_31e4a4a2641b8b54_004full.jpg

Table 1: Reliance Property, DDH21-003 Assay Results Summary

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/4976/105444_31e4a4a2641b8b54_005full.jpg

Table 2: Reliance Property, DDH21-004 Assay Results Summary

To view an enhanced version of Table 2, please visit:

https://orders.newsfilecorp.com/files/4976/105444_31e4a4a2641b8b54_006full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105444