Drill Tracker Weekly: Novo Drills Witwatersrand-type Prospect in Western Australia

Novo Resources announced additional holes from its Beatons Creek project in Western Australia. Geologist Wayne Hewgill weighs in here.

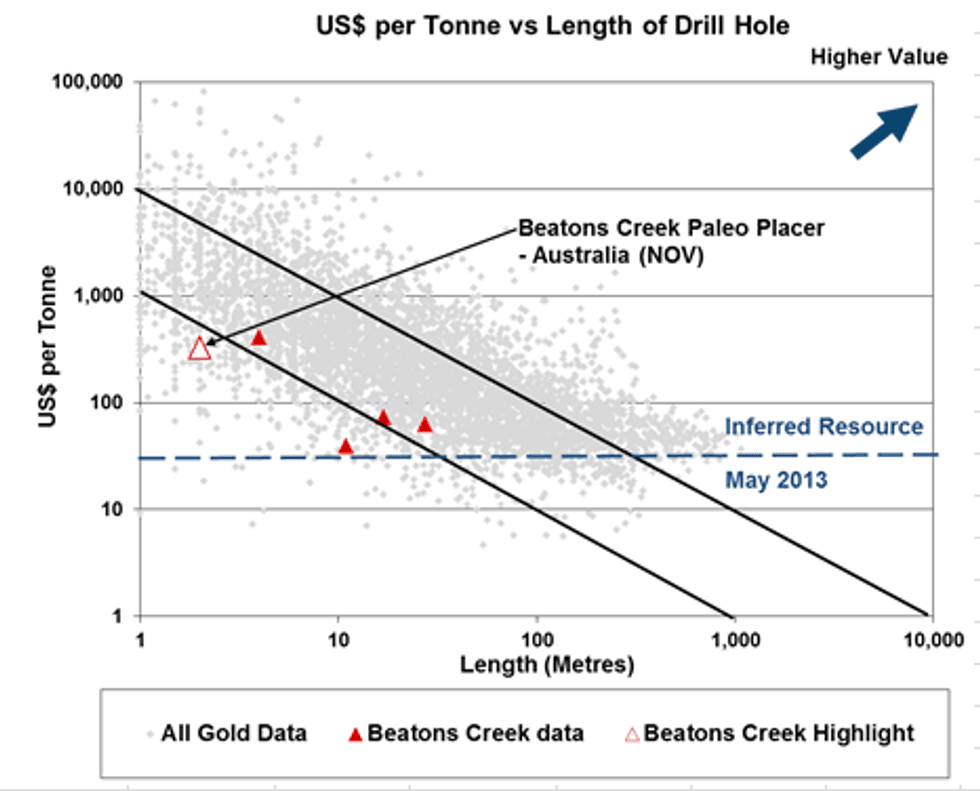

Drill Tracker Weekly highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Novo Resources (CSE:NVO)

Price: $1.23

Market cap: $76 million

Cash estimate: $11 million

Project: Beatons Creek

Country: Australia

Ownership: Option to earn 70 percent

Resources: 8.9 million tonnes at 1.47 g/t gold

Project status: Additional drilling

- Novo Resources announced additional holes from its Beatons Creek project in Western Australia. The company may earn a 70-percent interest in the project from Millennium Minerals (ASX:MOY) by issuing shares with a value of AU$500,000 and incurring expenditures of AU$1 million (completed). It is also required to complete a bankable feasibility study by August 2, 2016. The company is 28-percent owned by an affiliate of Newmont Mining (NYSE:NEM).

- The Beatons Creek prospect is a laterally continuous, near-surface, Witwatersrand-type gold prospect. The gold-bearing conglomerate mineralization was first confirmed with drilling in 1983 by Australia-based Metana and later Wedgetail Mining in 2007, and has now been outlined over an area of approximately 4 square kilometers with less than 20 percent of the area intensely drill tested. Highlights from current drilling include 2 meters of 8.12 g/t gold and 1 meter grading 11.32 g/t gold.

- In May 2013, the company announced an initial resource estimate outlining 8.9 million tonnes averaging 1.47 g/t gold using a cut off of 0.5 g/t gold. The shallow drilling resulted in an exploration discovery cost of $6-per-ounce gold. While the Beatons Creek grades are significantly lower than those from Witwatersrand, preliminary metallurgical work indicates that the gold may be liberated by low-cost gravity separation due to the almost complete oxidation of the near-surface material.

Early discovery holes: 2 meters at 10.8 g/t gold (Metana: 1983), 7 meters at 2.88 g/t gold (Wedgetail: 2007)

Current holes: 2 meters at 8.12 g/t gold, 1 meter at 11.32 g/t gold and 3 meters at 2.79 g/t gold

Disclosure: I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable, but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. At the date of this release the author, Wayne Hewgill, owns no shares in the companies in this report.

This report makes not recommendations to buy sell or hold.

Wayne Hewgill is a geologist with extensive knowledge of the global mining industry gained through 30 years of diversified experience in mineral exploration and new business development in Canada, as well as 10 years living in Africa, New Zealand and Australia. He was previously senior research officer at BHP Billiton, an executive with an exploration company working in Argentina and a mining analyst at three Vancouver-based financial groups where he developed the Drill Tracker database in 2006. He holds a B.Sc. in Geology from the University of British Columbia and is registered as a Professional Geoscientist (P.Geo) with APEGBC.