Monument Announces Feasibility Study on Selinsing Gold Mine Project

Monument Mining Limited (TSXV:MMY and FSE:D7Q1) (“Monument” or the “Company”) is pleased to announce the results of a positive feasibility study (FS) on its 100%-owned Selinsing Gold Mine in Pahang State, Malaysia, including the Selinsing deposit, and the adjacent Felda and Buffalo Reef deposits (“Selinsing Gold Mine Project”).

Monument Mining Limited (TSXV:MMY and FSE:D7Q1) (“Monument” or the “Company”) is pleased to announce the results of a positive feasibility study (FS) on its 100%-owned Selinsing Gold Mine in Pahang State, Malaysia, including the Selinsing deposit, and the adjacent Felda and Buffalo Reef deposits (“Selinsing Gold Mine Project”). The FS establishes the economic viability of the project for a six year life of mine through the extension of the existing oxide plant to incorporate additional sulphide ore extraction.

President and CEO Cathy Zhai commented, “We are excited to see the FS coming out supporting an additional six years life of mine with economic viability, which gives a green light to fund the conversion of the Selinsing Gold Plant to treat sulphide ore. The report has also analyzed opportunity to further improve production and potentially increase gold inventories in the future. While an execution plan is in place to start up construction of the Selinsing Gold plant upgrade, we continue to optimize the economic outcomes.”

The economic viability of the project described in the FS is primarily driven by adding flotation and BIOX® processes to the current Selinsing Gold Processing Plant to treat sulphide ore. The FS has focused on metallurgical testwork, metallurgical processing design and Front-End Engineering Design, along with geological review and mine planning studies. To sustain the Selinsing Gold Mine production from oxide through to sulphide ore operations, previously a NI 43-101 pre-feasibility study on the Selinsing Gold Sulphide Processing Project was filed in December 2016 (“Snowden 2016 TR”), supporting a bio-leaching processes to economically treat sulphide materials. The FS was initiated in May 2017 to demonstrate that the BIOX ® sulphide treatment technology is the most preferred bio-leaching method to achieve best economic outcomes at the Selinsing Gold Mine. A complete NI 43-101 Technical Report titled “Selinsing Gold Sulphide Project – NI 43-101 Technical Report” (Snowden 2019 TR) was filed on SEDAR (www.sedar.com) on January 31, 2019, describing the mineral exploration, development, and production area of the Selinsing Gold Mine. It was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects and is authored by Frank Blanchfield, BE (Min Eng), FAusIMM, Principal Mining Engineer, Snowden Mining Industry Consultants Pty Ltd (Snowden), the primary Qualified Person, and other independent Qualified Persons for geology, metallurgy and for engineering and costs.

Mineral Resources and Reserves Update

The updated sulphide and oxide Mineral Resources and Mineral Reserves in the Snowden 2019 TR are estimated with consideration of mining and stockpile depletions to March 2018, using the resource model from the 2016 estimate as a basis, however revised reporting of the Mineral Resource has resulted in a significant increase from Snowden 2016 TR, due to changes in reporting cut-off grades for transition and sulphide Mineral Resources from 0.7 g/t Au to 0.5 g/t Au and revised pit optimizations which are used to limit the reported Mineral Resource. A map showing the area locations is as follows (Figure 1):

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/756cf2e7-f341-4e34-8e5c-d1dc57288bf3

A significant increase of 48 koz or 24% for Indicated Resources and 45 koz or 69% for Inferred Resource can be observed for the Selinsing deposit, in relation to the previous Snowden 2016 PFS. For the Buffalo Reef deposit, Indicated Resources have decreased 4 koz or 2%, and Inferred Resources increased 31 koz or 15%.

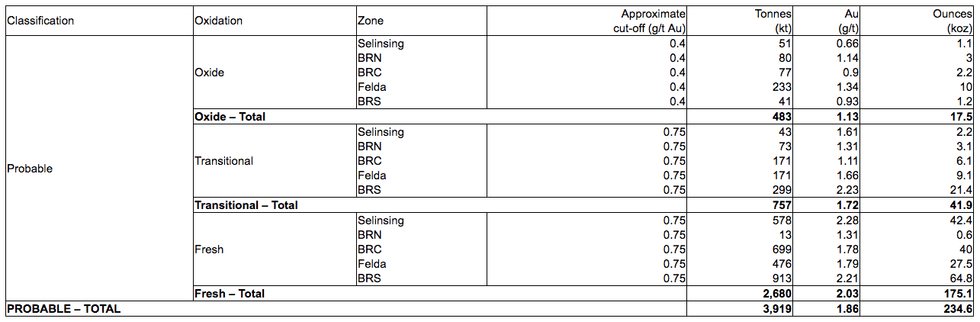

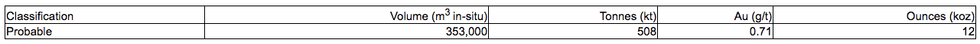

The Mineral Reserves were updated in March 2018, and comprise 235 koz of gold from 3,919 kilotonnes (kt) of ore at a diluted grade of 1.86 grams of gold per tonne (g/t) from the Selinsing and Buffalo Reef/Felda deposits (Table 1), along with a further 21 koz of gold from 1,312 kt of ore from stockpiles at a grade of 0.51 g/t Au (Table 2), plus 12 koz of gold from 508 kt of ore from old tailings (Table 3).

The updated Mineral Reserves are estimated using an average gold price of US$1,300 per ounce. To identify the Selinsing and Buffalo Reef Mineral Reserve, a process of optimisation using the Deswik Pseudo Flow, staged pit design, production scheduling and mine cost modelling was undertaken by Monument. Recent review of and new metallurgical testwork for processing has indicated treatment of transition and fresh ores by flotation and then bio oxidation BIOX® followed by carbon-in-leach (CIL).

Table 1 Mineral Reserves from deposits as at 31 March 2018

Notes: Tonnes and ounces have been rounded and this may have resulted in minor discrepancies.

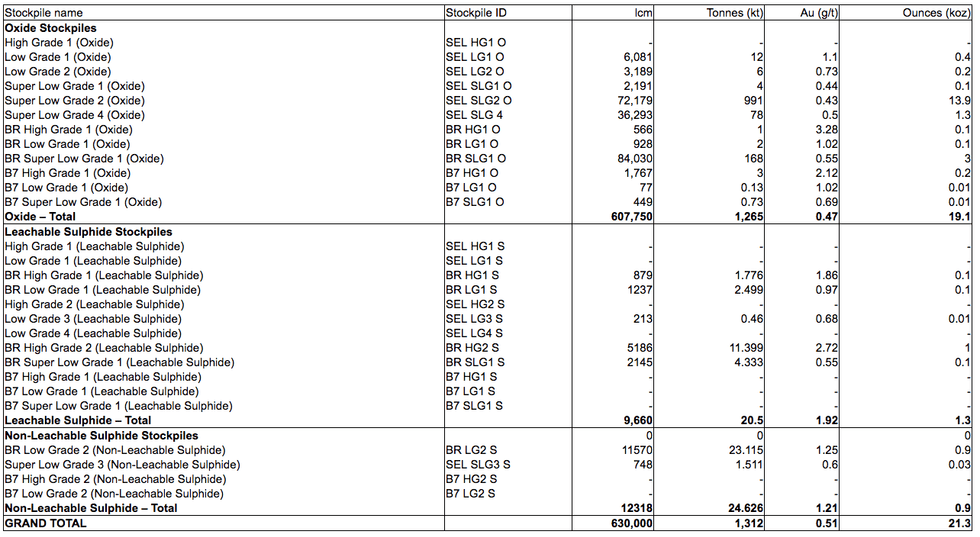

Table 2 Stockpile Proven Mineral Reserves, as at end of March 2018

Note: All stockpiles classified as Proven Mineral Reserves; lcm = loose cubic metres; SLG = super low grade (0.30–0.75 g/t Au); LG = low grade (0.75–1.50 g/t Au); HG = high grade (1.50–3.50 g/t Au).

Table 3 Old Tailings Mineral Reserves as at 31 March 2018

The Probable Mineral Reserves are within the updated Indicated Resources as reported under the Mineral Resources section of the Feasibility Study. The Proven Mineral Reserves comprise entirely of the Measured Mineral Resources from stockpiles.

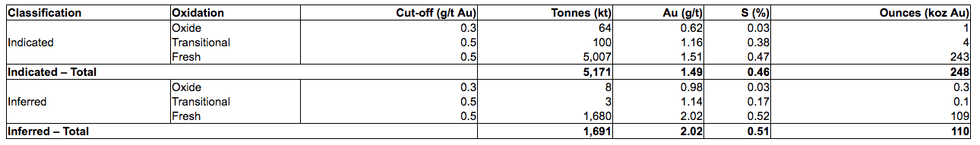

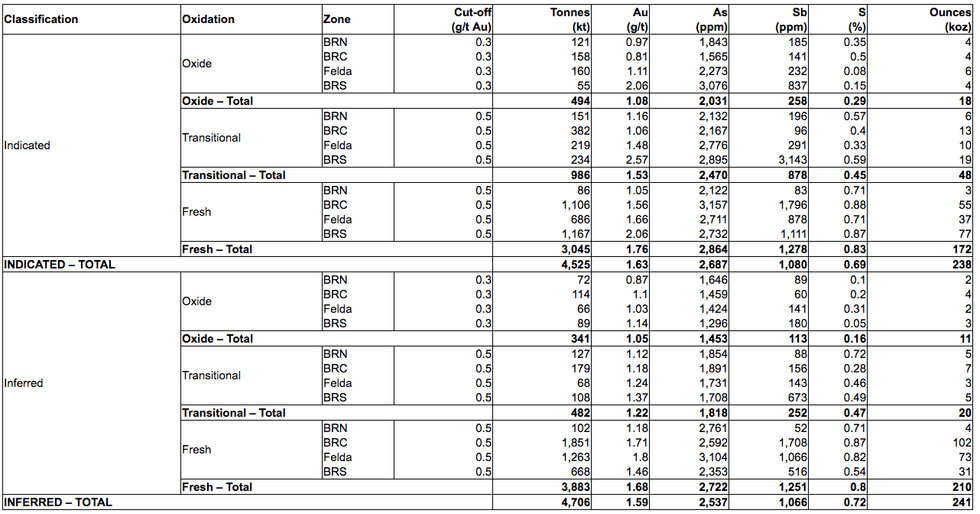

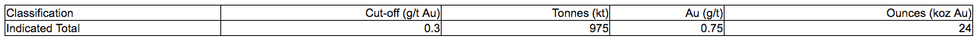

The Mineral Resources were updated as of March 31, 2018, as shown in Table 4 for Selinsing and include Indicated Resources of 248 koz of gold from 5,171 kt of material at a grade of 1.49 g/t Au, and Inferred Resource of 110 koz of gold from 1,691 kt of material at a grade of 2.02 g/t Au; and Table 5 for Buffalo Reef/Felda, including Indicated Resources of 238 koz of gold from 4,525 kt of material at a grade of 1.63 g/t Au, and Inferred Resource of 241 koz of gold from 4,706 kt of material at a grade of 1.59 g/t Au. Additionally, old tailings Indicated Mineral Resources as shown in Table 6, with 24 koz of gold from 975 kt of Inferred Mineral Resources at a grade of 0.75g/t Au.

Estimated Mineral Resources were limited to within a pit shell run based on a long-term gold price potential of US$2,400/oz gold price.

Table 4 Selinsing Mineral Resource statement for Selinsing deposit, inclusive of Mineral Reserves, depleted for mining to end of March 2018

Notes: Small discrepancies may occur due to rounding. The classification applies to the Au grades only; S grades are considered indicative only. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 5 Buffalo Reef/Felda Mineral Resource statement for Buffalo Reef deposit, inclusive of Mineral Reserves, depleted for mining to end of March 2018

Notes: Small discrepancies may occur due to rounding. The classification applies to the Au grades only; As, Sb and S grades are considered indicative only. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 6 Selinsing Old Tailings Mineral Resource, inclusive of Mineral Reserves, depleted for reclaiming to end of March 2018

Notes: Small discrepancies may occur due to rounding.

Economic Evaluation

Economic viability has been demonstrated for approximately six years of life of mine (LOM) with an NPV of US$27.56 million based on reported oxide and sulphide ore reserves as of March 2018. Over the six-year LOM, a total 5.7 million tonnage of ore would be treated at an average grade of 1.45g/t for 223 koz at US$863.67/oz. At a gold price of US$1,300 per ounce, the Selinsing Gold Mine Project would generate net cash flow after tax of US$97 million from operations, or US$45 million net of capital expenditure. Sensitivities show that the project can withstand well over a 35% increase in costs but is sensitive to gold price (US$1,100/oz breakeven) and process recovery (70% breakeven).

The above economic evaluation does not include Inferred Mineral Resources. Currently (i) The Inferred Mineral Resource inside the Reserve open pit designs contains an additional 20 koz of gold; (ii) Inferred Mineral Resource external to the open pit design contains 130 koz of gold. Recommendations have been suggested to initiate further exploration programs, aimed on conversion of Inferred Mineral Resources to Indicated Mineral Resources. Should those conversions be successful, the Mineral Reserves could potentially be significantly increased.

The Selinsing Gold Mine has a proven record in converting oxide Inferred Mineral Resources to recovered ounces in its 10-year production history, although the previous production history may not be used as an indicator for future production.

Other Discussions

Detailed studies were carried out in many areas as part of the FS. With the geological and mine planning details largely unchanged from the Snowden 2016 TR, most of the detailed work has been associated with the metallurgical study and evaluation as well as plant design and construction. This work demonstrated the feasibility of a plant capable to process the sulphide ores at Selinsing using flotation and BIOX® additions to the existing plant. The study work includes enough detail to proceed to final plant design stages.

The updated Mineral Resource estimate includes results from a total of 1,737 holes for 154,217 m (predominantly diamond and RC drilling) at the Selinsing and Buffalo Reef deposits, with assays received up to February 24, 2016. This drilling was previously used for the Au, Sb and As estimation for the 2016 resource model in the Snowden 2016 TR. An additional 6,342 m of drilling was included for sulphur estimation. Those additional drill results come from exploration work continued at Selinsing and Buffalo Reef after June 2016 to define mineralization at depth below the existing pits, within gap zones in between the known resources that contain little drill hole information, and to convert Inferred Mineral Resources to Indicated and/or Measured Mineral Resources.

Most of the additional drilling at Buffalo Reef comprised of diamond core metallurgical drilling (3,401 m or 60% of the total additional). The remaining 2,293 m of additional infill and extensional drilling at Buffalo Reef do not materially impact the global resource with respect to the gold grade estimates, which remain unchanged. At Selinsing, the additional drilling since 2016 comprised of 648 m and has confirmed the continuity of a high-grade zone beneath the Pit IV.

The majority of drillholes have been accurately collar surveyed and most of the diamond holes have been surveyed downhole. Sample recovery for diamond drilling conducted by Monument at both Selinsing and Buffalo Reef is considered good and provides suitable samples suitable for resource estimation. Half core diamond samples and riffle split RC samples formed the bulk of the samples used in the resource modelling.

Most samples were analysed for gold, arsenic, silver and antimony. Gold was analysed primarily by fire assay using a 50 g charge with an atomic absorption spectroscopy (AAS) finish. The RC and diamond drilling completed by Monument after 2007 includes independent QAQC samples with the sample batches, the results of which show reasonable precision and analytical accuracy have been achieved. Assay data in the database has been verified by Snowden with a random selection of original lab reports, with no major discrepancies identified.

The drillhole logging and assay data was used as the main basis for the geological interpretation. The gold mineralisation was interpreted on 20 m spaced east-west sections as a series of wireframe solids, based on a nominal threshold of 0.15 g/t Au along with the geological logging. The drillhole data was composited downhole prior to running the estimation process using a 1.5 m compositing interval to minimize any bias due to sample length.

Variograms have been modelled and the gold grade estimated by ordinary kriging, with top-cuts as appropriate, for the Buffalo Reef/Felda deposits, whereas for the Selinsing deposit, due to the strongly skewed nature of the gold grades, multiple indicator kriging (MIK) was used to estimate the block gold grades. A parent block size of 10 mE by 20 mN by 2.5 mRL was used to construct a block model for the Selinsing deposit, whereas an 8 mE by 20 mN by 2.5 mRL parent block size was used for the Buffalo Reef/Felda deposit. A slightly smaller block size of 8 mE was selected for Buffalo Reef due to the more selective nature of the geological interpretation and to ensure reasonable volume resolution. A three-pass search strategy was utilized for all grade estimates with the same search neighbourhood parameters applied to all domains. Due to the poor coverage of sulphur assay data, variograms showed very poor quality and the decision was made to estimate the sulphur grade using inverse distance squared (ID2).

Over 2,600 bulk density measurements were taken by Monument in the Selinsing and Buffalo Reef/Felda deposits using the Archimedes Principle, with wax-coating used to account for the porosity. Default bulk density values were assigned to the model blocks based on the oxidation state, separately for waste and mineralised zones.

The Mineral Resource estimate has been validated against the input samples and classified as a combination of Indicated and Inferred Resources in accordance with CIM guidelines. The Mineral Resources have been depleted for all mining as at the end of March 2018.

Snowden has verified the drill hole data used to support the technical and scientific information in this news release, including the sampling, sample security, analytical techniques, original assay certificates, and Quality Assurance/Quality Control procedures and has determined that CIM and NI 43-101 Industry Standards have been sufficiently followed. Snowden constructed a 3D model of the mineralized bodies using modeling software and estimated the June 30, 2016 Selinsing and Buffalo Reef/Felda in situ Mineral Resources and Mineral Reserves.

Mineral Reserves for the stockpiles, based on end of month surveyed volumes and grade control during mining informing the grade, at the Selinsing Project (including ore mined from the Selinsing and Buffalo Reef pits), as at the end of March 2018, are summarized in Table 2. The stockpile resources are classified as Measured Mineral Resources in their entirety with a 100% conversion of the stockpile Measured Mineral Resources to Proven Mineral Reserves.; A significant deposit of Old Tailings is located within the property. Old Tailings at the Selinsing project include the balance of the old tailings dam located next to Selinsing Pit V and Pit VI. Most of the current tailing material originated from the oxide mining operation by the local operator, Tshu Lian Seng Mining from 1987 until the operation ceased in late 1995. There are small amounts of tailings deposited from the Underground mining in the early 20th century but boundaries from underground tailings and tailings from the oxide operation are not clearly discernible.

A total of 201 holes totalling 1,503 m drilling assayed for gold were available and used for estimating the grades in the blocks coded as tailings in the Selinsing Resource block model. The blocks coded previously as tailings in the Selinsing block model were now estimated for gold with a simple Inverse of Square Distance (ISD) method, from 1.5 m composite samples originated from raw intervals located inside the reference wireframe.

The Mineral Resources contained in the Old Tailings at the Selinsing Project are classified as Indicated Resources in accordance with CIM guidelines.

The Mineral Resources for the Old Tailings balance as of March 31, 2018 at the Selinsing Project used the same lower cut-off of 0.30 g/t Au as for oxide Mineral Resource as well as a mining recovery factor of 80%. A mining recovery factor of 80% was applied for the likely practical limits of reclaim mining, accounting for losses associated with scattered waste material in the tailings, such as material used to construct bunds/walls between the ponds and the dam retaining wall on the west side.

The “Old Tailings” are processed by excavation and haulage to a dry stockpile, then transferred to a wet pond area for separation and slurry formation by water cannon. The material is then classified and fed to the CIL plant. Modifying factors include historical reconciliation to plant, pond bund depletion and removal of areas below designated treated water storage areas required for environmental management and legal responsibility. The modifying factors are applied to the resource model used for the Old Tailings Indicated Resource, inclusive of the Probable Old Tailings Reserve.

The mining method is conventional open pit drill and blast, load and haul on a 2.5 m mining flitch with a 10 m high blasting bench, reflective of semi-selective mining. The maximum excavator bucket size of 2.3 m3 is matched to this selectivity. A stripping ratio of approximately 6 was identified. Overall, dilution assumption used has reduced the recovered ounces by approximately 2% and marginally increased the ore tonnage processed by 2%.

As well as detailed metallurgical and engineering studies, the mining aspects of the Snowden (Dec 2016) study were reviewed and optimised by Monument with updated cost and revenue information. The mine design for the reserve pit shell was largely unchanged except for revision in the Selinsing Pit area from an updated geotechnical study in 2018 by Peter O’Bryan and Associates (POB). As part of the FS opportunities, there were also investigations for inclusion of Inferred material in life of mine (LOM) planning as well as underground mining potential.

Mine planning and pit optimization undertaken by Monument of the Indicated Resources in the block model used the Pseudo Flow algorithm in the DeswikCAD software. The model was not diluted prior to optimisation. Optimisation results were then compared to Snowden (Dec 2016) results. With very similar results obtained for optimisation in Buffalo Reef, the pits and waste dumps as designed by Snowden (Dec 2016) for Buffalo Reef were left unchanged.

The sulphide fresh and transition ore treatment has been discussed including process design criteria; process design and flow diagrams; engineering design criteria; mechanical and electrical equipment lists; process plant layout; capital cost estimates. The metallurgical factors for sulphide were developed by Monument from in-house and independent testwork by Outotec and reviewed by OMC. The oxide metallurgical factors are from site data. The metallurgical recovery parameters applied are 74% for Old Tailings, 75% for oxide, and 85% for transition and fresh/sulphide material.

The Selinsing Gold Processing Plant was originally developed on the basis of treating oxide ore via conventional crushing and ball milling followed by gravity recovery of free gold and cyanidation of gravity concentrate. Gravity tails are subjected to conventional carbon-in-leach (CIL). Final gold recovery from carbon strip solution and gravity concentrate leach solution is by electrowinning onto stainless steel cathodes. In 2009, mining operations commenced at Selinsing. Since then, Monument developed an open pit mine and construction of a 1,200 tonnes per day (t/d) Au treatment plant in three phases. From 2011, Monument has been engaged in Phase IV of the expansion, with key areas of evaluation being:

- Inspectorate of Vancouver, metallurgical test program on a selection of diamond drill core material collected from the Buffalo Reef deposit.

- Engineering study by Lycopodium of Brisbane, Australia, and reported by Lycopodium in “Selinsing Phase IV Study” (Feb 2013). This study is summarised in the Snowden (Dec 2016) PFS.

- FS work of 2018. This study replaces the previous Phase IV Study of Snowden (Dec 2016) NI 43‑101 Technical Report.

The Qualified Person has provided the summary and write-up for this section based on previous NI 43‑101 reports for oxide processing only. Additionally, the sulphide processing utilising the BIOX® and flotation processes is evaluated in the 2019 NI43-101 FS Technical Report. It is the Qualified Person’s opinion that the plant production numbers are accurate and correct. Given superior flotation response and bioleach response from metallurgical testwork conducted for Phase IV of the project, it is reasonable to assume that the results obtained, and design criteria and process flowsheet adapted for Phase IV are reasonable and adequate for a FS level of accuracy.

A potential underground desktop study was also carried out indicating potential in the Selinsing area but more inventories over a 3 g/t Au cut-off grade and sourcing an available and cost-effective contractor arrangement is required. Major follow-up work will be for further resource definition and conversion of the Inferred open pit potential as well as extensions for underground mining. The main emphasis will be in the Buffalo Reef area.

John Graindorge and Frank Blanchfield, of Snowden Mining Industry Consultants, are the independent Qualified Persons for Mineral Resources and Mineral Reserves and have reviewed and provided consent for this news release.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1) is an established Canadian gold producer that owns and operates the Selinsing Gold Mine in Malaysia. Its experienced management team is committed to growth and is advancing several exploration and development projects including the Mengapur Copper-Iron Project, in Pahang State of Malaysia, and the Murchison Gold Projects comprising Burnakura, Gabanintha and Tuckanarra in the Murchison area of Western Australia. The Company employs approximately 195 people in both regions and is committed to the highest standards of environmental management, social responsibility, and health and safety for its employees and neighboring communities.

Cathy Zhai, President and CEO

Monument Mining Limited

Suite 1580 -1100 Melville Street

Vancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web site at www.monumentmining.com or contact:

| Richard Cushing, MMY Vancouver | T: +1-604-638-1661 x102 | rcushing@monumentmining.com |

| Wolfgang Seybold, Axino GmbH | T: +49 711-82 09 7211 | wolfgang.seybold@axino.com |

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”

Forward-Looking Statement

This news release includes statements containing forward-looking information about Monument, its business and future plans (“forward-looking statements”). Forward-looking statements are statements that involve expectations, plans, objectives or future events that are not historical facts and include the Company’s plans with respect to its mineral projects and the timing and results of proposed programs and events referred to in this news release. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. The forward-looking statements in this news release are subject to various risks, uncertainties and other factors that could cause actual results or achievements to differ materially from those expressed or implied by the forward-looking statements. These risks and certain other factors include, without limitation: risks related to general business, economic, competitive, geopolitical and social uncertainties; uncertainties regarding the results of current exploration activities; uncertainties in the progress and timing of development activities; foreign operations risks; other risks inherent in the mining industry and other risks described in the management discussion and analysis of the Company and the technical reports on the Company’s projects, all of which are available under the profile of the Company on SEDAR at www.sedar.com. Material factors and assumptions used to develop forward-looking statements in this news release include: expectations regarding the estimated cash cost per ounce of gold production and the estimated cash flows which may be generated from the operations, general economic factors and other factors that may be beyond the control of Monument; assumptions and expectations regarding the results of exploration on the Company’s projects; assumptions regarding the future price of gold of other minerals; the timing and amount of estimated future production; the expected timing and results of development and exploration activities; costs of future activities; capital and operating expenditures; success of exploration activities; mining or processing issues; exchange rates; and all of the factors and assumptions described in the management discussion and analysis of the Company and the technical reports on the Company’s projects, all of which are available under the profile of the Company on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

Source: globenewswire.com