Drill Tracker Weekly: Lake Shore Continues to Define High-Grade Core of New 144 Gap Zone

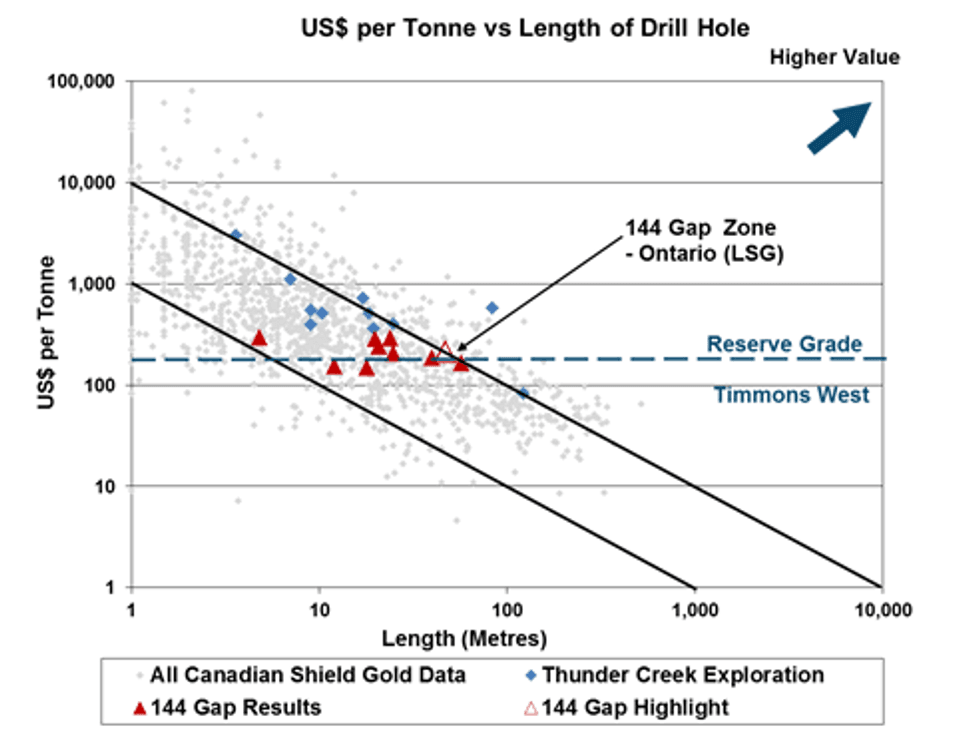

Drill Tracker Weekly highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Drill Tracker Weekly highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Lake Shore Gold Corp. (TSX:LSG)

Price: C$1.14

Market cap: C$495 million

Cash estimate: C$70 million

Project: 144 Gap

Country: Canada

Ownership: 100 percent

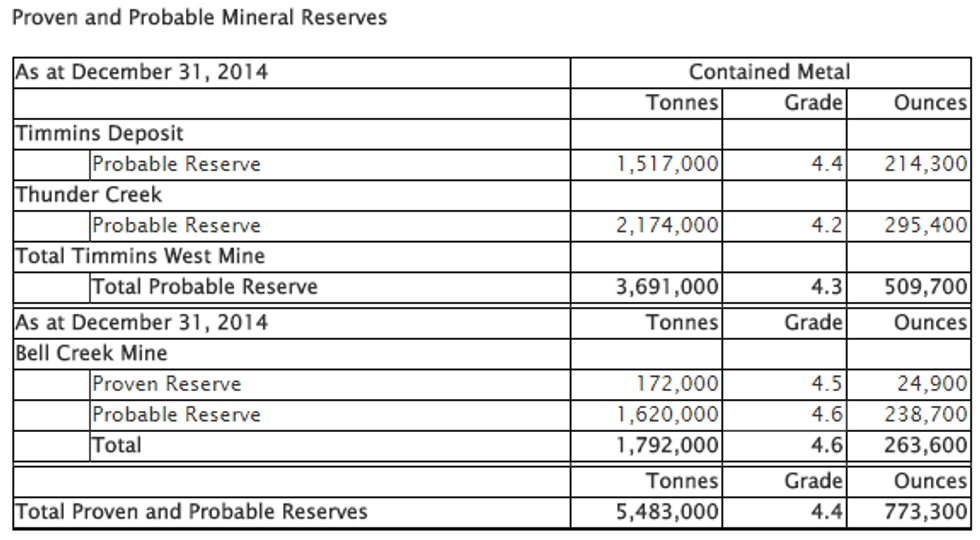

Resources: Timmins West : 3.33 million tonnes at 4.6 g/t gold

Project status: Underground drifting towards 144 Gap Zone

- Lake Shore Mining continues to define the high-grade core of the recently discovered 144 Gap Zone adjacent to the Thunder Creek deposit on its 100% owned Timmins West Mine in Ontario. Lake Shore acquired the Thunder Creek deposit in 2009 though the $319 million purchase of West Timmins Mines.

- Preliminary drilling into the high-grade core since the October 2014 discovery hole has now outlined a core zone extending 250 metres vertically with a width of 75 to 100 metres and 50-75 metres of strike. Highlights from the current drilling include 47.0 metres grading 5.36 g/t Au starting at a depth of 1,004 metres including 18.40 metres of 9.70 g/t Au.

- The mineralization is hosted within a similar syenite intrusion as the nearby Thunder Creek Deposit in association with the same volcanic / ultramafic / intrusive / sedimentary contacts. Gold mineralization is associated with quartz veining, pyrite, sheelite and/or galena with visible gold within the quartz veins.

- The 144 Gap Zone is within 500 metres from the Thunder Creek Deposit and to facilitate lower cost underground drilling, the company is currently developing an exploration drift from Thunder Creek which is expected to be completed by Q3/2015. The Company has budgeted $18 million to complete a 120,000 metre surface and underground drilling program for 2015 with the goal of replacing annual production with new upgraded resource ounces.

- In 2014, the Company exceeded production guidance by producing 185,600 ounces of gold at an all in sustaining cost of $875 per ounce well below their guidance of $1,050 per ounce.

144 Gap discovery Hole (October 2014): 46.0 meters at 5.37 g/t gold

Current Drilling: 47.0 meters at 5.26 g/t gold including 18.40 metres @ 9.70 g/t gold; 56.9 meters at 4.09 g/t gold including 5.4 metres at 13.94 g/t gold; 19.9 meters at 7.09 g/t gold

Disclosure: I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable, but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. At the date of this release the author, Wayne Hewgill, owns no shares in the companies in this report.

This report makes not recommendations to buy sell or hold.