HighGold Mining Drills 15.06 g/t Gold Equivalent over 59.2 meters at Johnson Tract, Alaska, USA

HighGold Mining is pleased to report assay results for five additional drill holes from the nine hole drill program at the Johnson Tract Gold property.

HighGold Mining Inc. (TSXV:HIGH) (“HighGold” or the “Company”) is pleased to report assay results for five (5) additional drill holes from the nine (9) hole drill program completed at the Company’s flagship Johnson Tract Gold (Cu-Zn) property (“Johnson” or the “Property”) in Southcentral Alaska, USA. The first two holes in this program were reported in a press release dated November 5, 2019. The drill program was designed to better define and expand the Johnson Tract deposit (“JT Deposit”) which was last drilled and explored more than 25 years ago. Highlight intersections of Au-Ag-Cu-Zn-Pb mineralization are reported below on a gold equivalent (“AuEq”) basis:

- 15.06 g/t AuEq over 59.2m in hole JT19-085, including

- 38.33 g/t AuEq over 10.9m

- 9.52 g/t AuEq over 47.6m in hole JT19-086

- 9.62 g/t AuEq over 97.5m in hole JT19-088, including

- 16.24 g/t AuEq over 22.5m

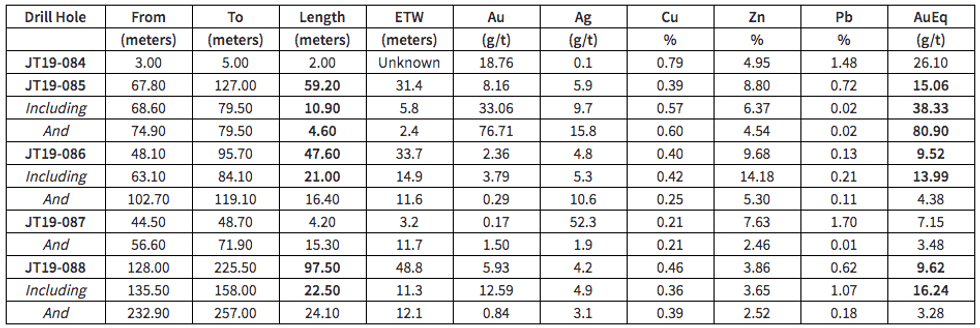

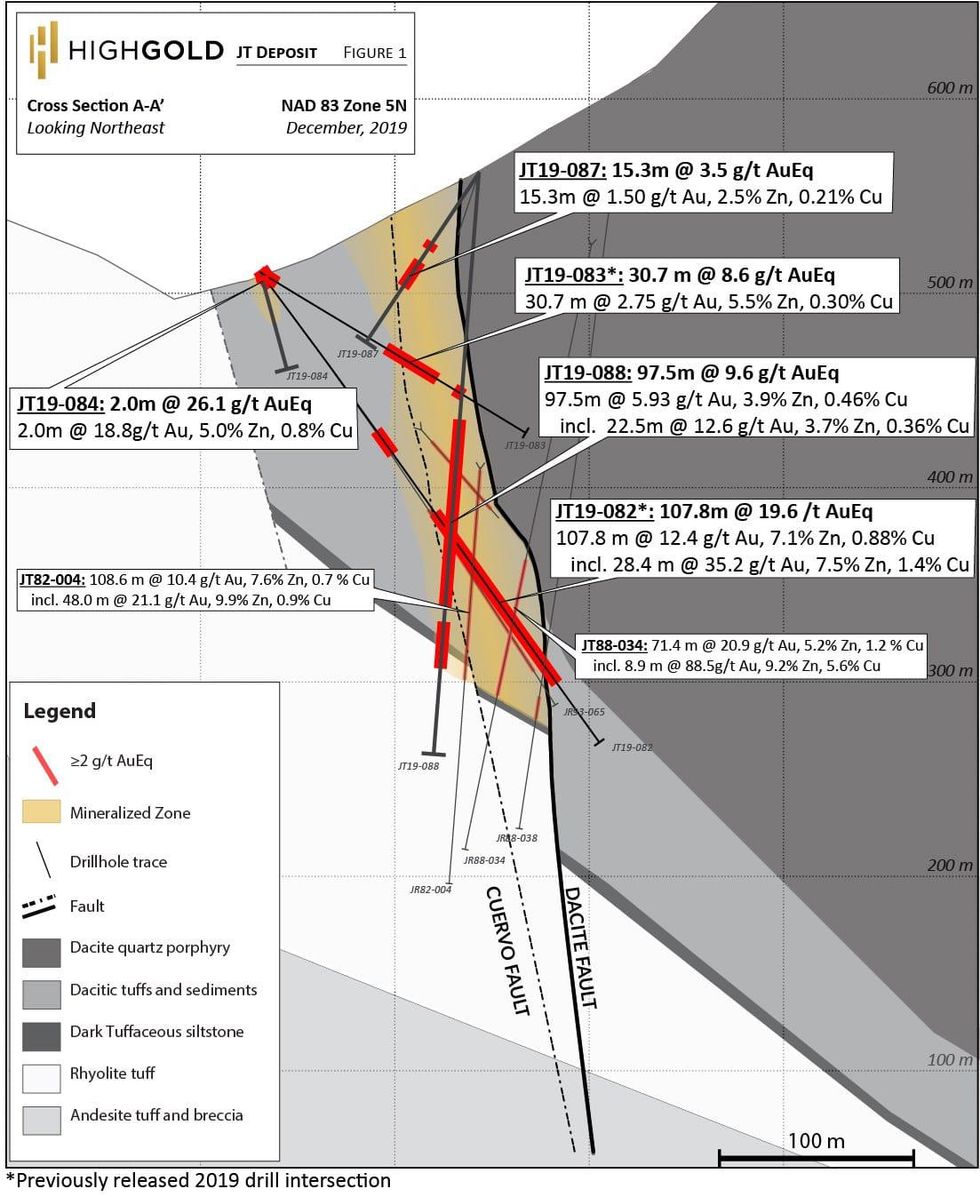

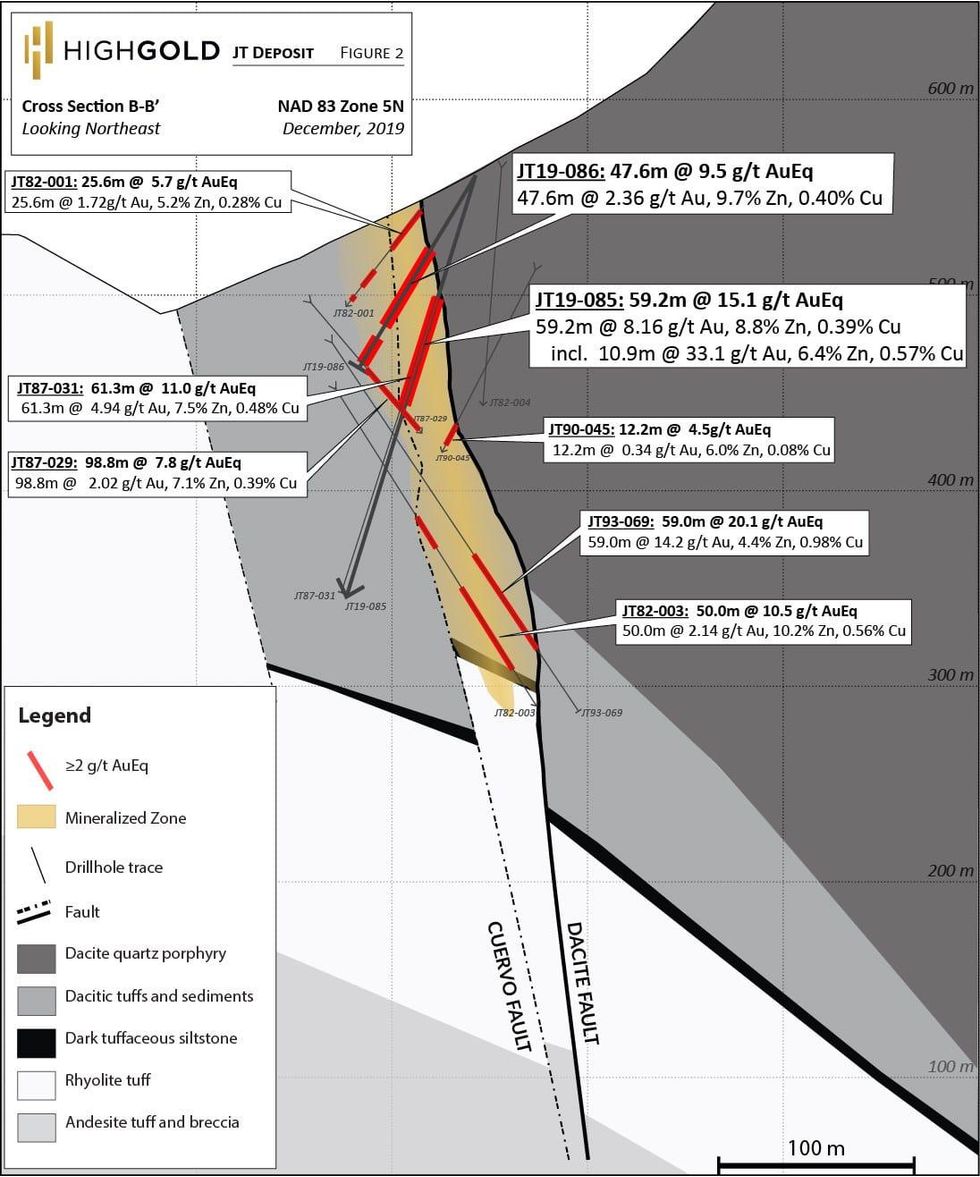

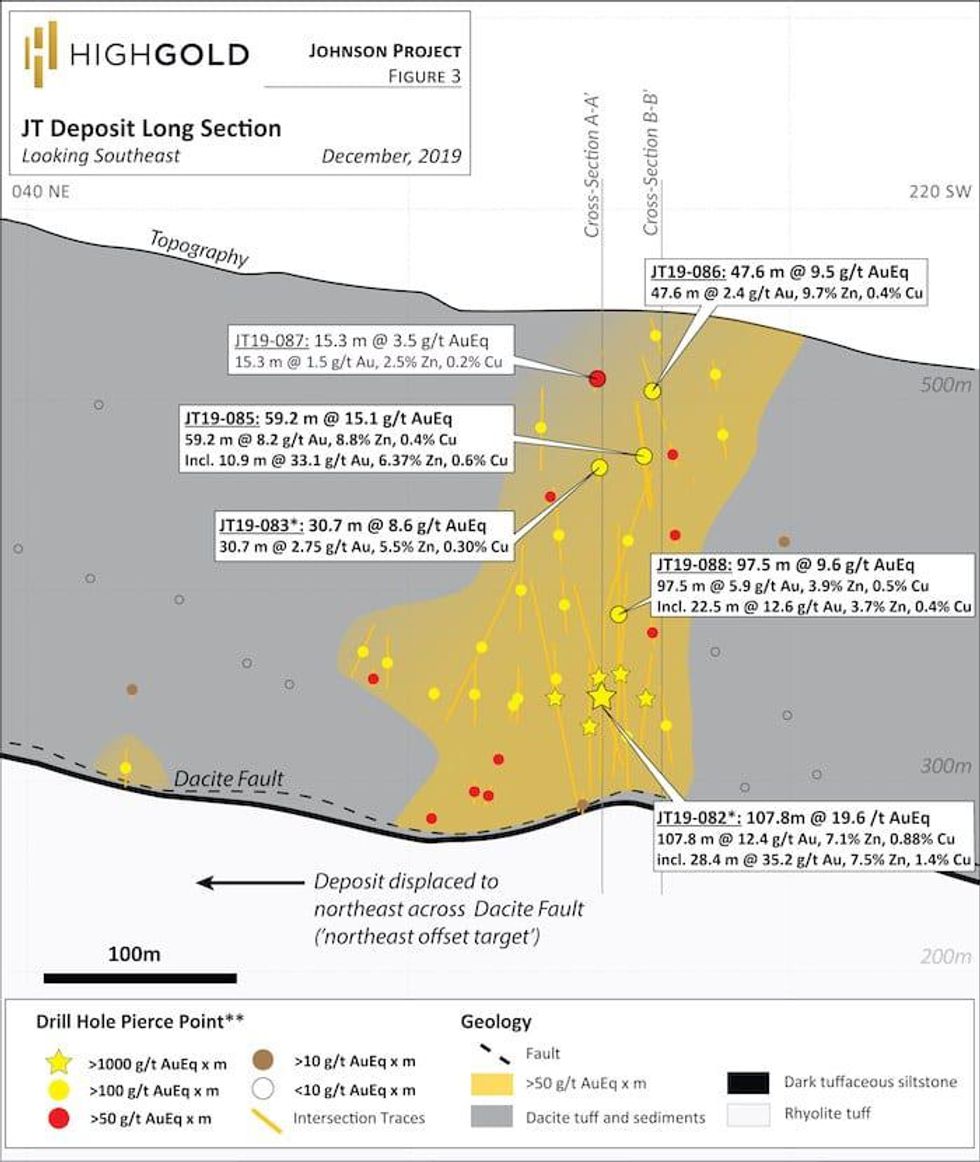

This set of assay results includes: i) one twinned hole (JT19-085), ii) three drill holes that filedl large gaps and expanded high-grade mineralization to the southwest and closer to surface (JT19-086, 087, 088), and iii) one drill hole that tested near-surface mineralization located 50 meters west of the JT Deposit (JT19-084). Full significant intersection assay results are presented below in Table 1 and Figures 1, 2 and 3. Assay results for the final two holes of the program are pending.

Table 1. Significant new Johnson Tract drill intersections

Notes: Estimated true width (“ETW”) is the width of the zone perpendicular to dip as measured from cross sections. Length-weighted intervals are uncapped and calculated based on a 2 g/t gold equivalent cut-off and less than 5 meters of dilution of below cut-off grade. Gold equivalent (“AuEq”) is calculated by the same formula and assumptions used to report intersections for the Johnson Tract NI43-101 Technical Report (dated June 27, 2019) with metal prices of $1250/oz gold, $16/oz silver, $3.00/lb copper, $1.20/lb zinc, $1.00/lb lead and does not consider metal recoveries.

“Drilling at Johnson continues to deliver impressive intersections and confirms the presence of a very robust mineralized zone,” commented HighGold President & CEO, Darwin Green. “The widely spaced drill holes tested the JT Deposit over a vertical extent of 250-meters with excellent widths of high-grade mineralization intersected throughout. In addition to incremental expansion of the mineralized zone, the new data helps refine lateral and vertical zonation of precious and base metals, in which both gold grade and zone thickness increase with depth. This bodes well for future exploration at the Northeast Offset target approximately 700 meters to the north, which we believe to be the off-set depth extension of the deposit.

“With a recently completed $9.3 million financing, HighGold is well funded to test the exceptional exploration upside at Johnson. The Company’s 2020 exploration strategy will be drill intensive, targeting JT Deposit expansion, the Northeast Offset and other exploration targets on the district scale property.”

Drill Program Details

The 2019 Johnson Tract drill program included nine (9) drill holes for 2,247 meters of core drilling, with seven (7) holes released to date. Collectively, the new results demonstrate excellent continuity of thick zones of high-grade mineralization over a vertical dip length of over 250 meters (see Long Section Figure 3). The new drilling both confirms and expands upon results of drilling completed from 1982 to 1993 by previous operators. Pending receipt of assay results for the final two holes, HighGold plans to develop a 3D geological model for the JT Deposit and initiate an initial NI43-101 compliant mineral resource estimate for Johnson.

Drill hole JT19-088 (9.62 g/t AuEq over 97.5m) expands the core zone of high-grade mineralization to the southwest (Figure 1). Mineralization remains open in this direction, with potential for additional expansion.

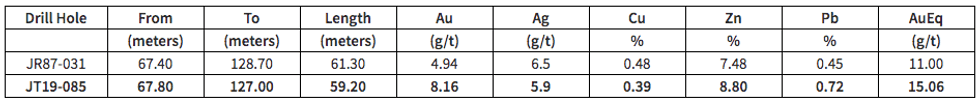

Drill hole JT19-085 was completed as a twin of historic drill hole JT87-031 for NI43-101 validation purposes. The location and extent of mineralization intersected in JT19-085 correlates well with JT87-031; however, the overall grade is significantly greater (+37% AuEq) in JT19-085 (Table 2). Higher grades were also documented in previously released twin drill hole JT19-082 (19.6 g/t AuEq over 107.8 m; see news release November 5, 2019). The 2019 program drilled larger diameter HQ core than historic holes, which provides for a 78% larger and more representative sample. Higher grades notwithstanding, the 2019 twin drill holes generally demonstrate very good correlation with the original historic holes and support the use of historic drill data in future resource estimation work.

Table 2. Comparison of JT19-085 assay intersections against twinned historic drill hole JT93-031

About Johnson Tract Property

The 21,000-acre Johnson Tract property is located near tidewater, 125 miles (200 kilometers) southwest of Anchorage, Alaska, USA. It includes the very high-grade Johnson Tract Gold (Zn-Cu) deposit along with excellent exploration potential indicated by several other prospects over a 12-kilometer strike length. This project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the Premier Mill near Stewart, British Columbia. HighGold acquired Johnson through a lease agreement with Cook Inlet Region, Inc. (“CIRI”) an Alaska Native regional corporation that is the largest private landowner within the Cook Inlet region.

About HighGold

HighGold is a mineral exploration company focused on premier high-grade gold projects located in North America. HighGold’s flagship asset is the high-grade Johnson Tract Gold (Zn-Cu) Project located in south-central Alaska, USA. The Company also controls a portfolio of quality gold projects in the greater Timmins gold camp, Ontario, Canada that includes the Munro-Croesus Gold property, which is renowned for its high-grade mineralization, and the large Golden Mile and Golden Perimeter properties. HighGold’s experienced Board and senior management team, are committed to creating shareholder value through the discovery process, careful stewardship of capital, and environmentally/socially responsible mineral exploration.

On Behalf of HighGold Mining Inc.

“Darwin Green”

President & CEO

Ian Cunningham-Dunlop, P.Eng., VP Exploration for HighGold Mining Inc. and a qualified person (“QP”) as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Samples of drill core were cut by a diamond blade rock saw, with half of the cut core placed in individual sealed polyurethane bags and half placed back in the original core box for permanent storage. Sample lengths typically vary from a minimum 0.5 meter interval to a maximum 2.0 meter interval, with an average 1.0 to 1.5 meter sample length. Drill core samples were shipped by air, transport truck and barge in sealed woven plastic bags to ALS Minerals laboratory facility in North Vancouver, BC for sample preparation and analysis. ALS Minerals operate according to the guidelines set out in ISO/IEC Guide 25. Gold was determined by fire-assay fusion of a 50 g sub-sample with atomic absorption spectroscopy (AAS). Samples that returned values >100 ppm gold from fire assay and AAS were determined by using fire assay and a gravimetric finish. Samples with visible gold or suspected of having exceptionally high grade were submitted for metallic screen gold analysis on a larger sub-sample. Various metals including silver, gold, copper, lead and zinc were analyzed by inductively-coupled plasma (ICP) atomic emission spectroscopy, following multi-acid digestion. The elements copper, lead and zinc were determined by ore grade assay for samples that returned values >10,000 ppm by ICP analysis. Silver was determined by ore grade assay for samples that returned >100 ppm.

For further information, please visit the HighGold Mining Inc. website at www.highgoldmining.com, or contact:

Darwin Green, President & CEO or Naomi Nemeth, VP Investor Relations

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: information@highgoldmining.com.

Website: www.highgoldmining.com

Twitter: @HighgoldMining

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding future Johnson Tract exploration, the Company’s Canadian gold projects and other future plans, objectives or expectations are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

Figure 1 – Geological cross section A-A’

Figure 2 – Geological cross section B-B’

Figure 3 – Geological long section

* Previously reported intersection

** Drilled length not true width. Gold equivalent (“AuEq”) assumes prices of $1250/oz Au, $16/oz Ag, $3.00/lb Cu, $1.20/lb Zn, $1.00/lb Pb and does not consider metal recoveries.