Great Bear Resources (TSXV:GBR) (the “Company” or “Great Bear”) today announced completion of drill hole planning and preparation for a Phase 2 drill program at the Dixie Lake gold project, located in the Red Lake district of Ontario.

Great Bear Resources (TSXV:GBR) (the “Company” or “Great Bear”) today announced completion of drill hole planning and preparation for a Phase 2 drill program at the Dixie Lake gold project, located in the Red Lake district of Ontario.

The drill program will focus on:

- Extending the strike length of known gold mineralization within the main gold-bearing structure,

- Testing high-grade gold mineralization at depths of up to 200 metres, and

- Testing additional gold zones and prospective geophysical targets within the main gold structure

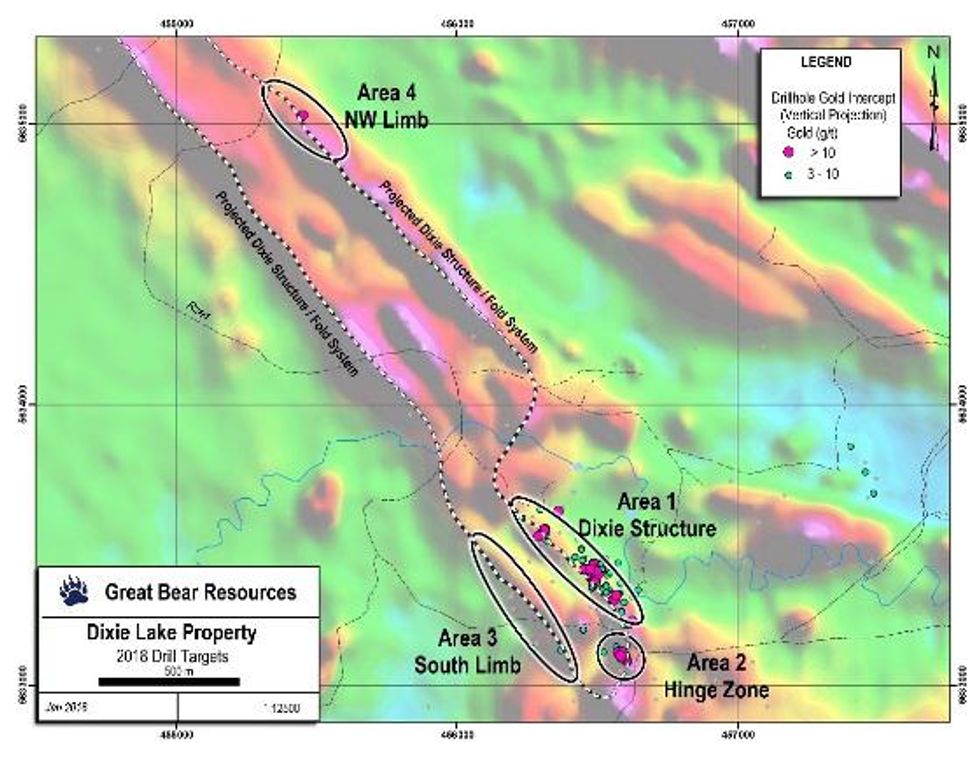

The program will consist of approximately 3,000 metres of diamond drilling in 15 – 20 drill holes across 2 kilometres of strike length. Four areas will be drill-tested, as shown on Figure 1 below.

Figure 1: Areas to be targeted with Phase 2 drilling

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5331/32029_a1516072020609_54.jpg

Four primary areas will be drill tested during Phase 2 drilling as described below.

Area 1 (Dixie Structure): Follow-up drilling along the main Dixie structure where the Company completed its 2017 drill program. The primary targets in this area are down-plunge extensions of high grade gold intercepts, including those disclosed by the Company on September 7 and November 2, 2017. The Company believes sufficient structural information has been collected to predict gold zone geometries and will test the continuity of higher grade gold mineralization at depths of up to 200 metres.

Current results suggest 3 – 5 zones of higher grade gold are present within a continuously gold mineralized structure defined by 70 drill holes to-date, along 500 m of strike length. Steeply-dipping structurally-hosted gold zones are common in Red Lake and can increase in grade with depth.

Area 2 (Hinge Zone): Drill test the “Hinge Zone” of the main Dixie structure. This area was drilled in 2007 and 2008 by previous explorers but has not yet been drilled by Great Bear. It may represent the hinge of the main Dixie Lake structure where the gold zone has been tightly to isoclinally folded. This area yielded the highest grade historical intercepts on the project, prior to Great Bear’s drilling. Highlights from the historical drilling are shown in Table 1 below.

Table 1: Historical drill results from the Hinge zone

| Hole Number | From (m) | To (m) | Width (m)* | Au (g/t) | |

| DC-10-07 | 181.83 | 182.30 | 0.47 | 163.75 | |

| DC-10-07 | and | 201.12 | 203.12 | 2.00 | 32.65 |

| DC-10-07 | including | 202.12 | 203.12 | 1.00 | 61.97 |

| DC-10-07 | and including | 199.30 | 203.12 | 3.82 | 17.22 |

| DC-08-01IR | 127.60 | 129.80 | 2.20 | 17.20 | |

| DC-08-01IR | including | 127.60 | 128.90 | 1.30 | 22.93 |

| DC-18-07 | 156.83 | 158.17 | 1.34 | 7.04 | |

| DC-18-07 | including | 157.80 | 158.17 | 0.37 | 24.41 |

Area 3 (South Limb): If the main Dixie Lake gold structure is tightly folded, the zone drilled by Great Bear during its Phase 1 program may be repeated on the other limb of this fold. The Company will now drill test the southern limb during Phase 2 drilling. Sporadic historical drilling returned a high value of 15.06 m of 2.23 g/t Gold including 1.0 m of 9.01 g/t gold. The geometry of gold mineralization in this area will inform the Company whether gold mineralization pre- or post-dates the folding, which will be critical to later defining total mineralized volumes in Areas 1, 2 and 3.

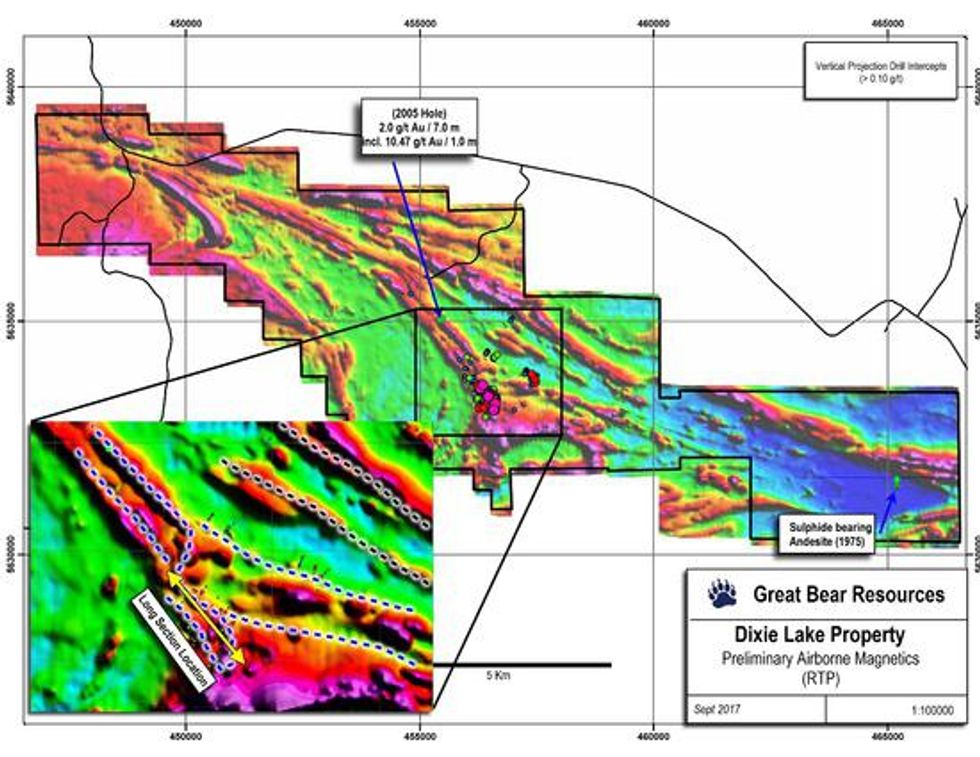

Area 4 (Northwest Limb): The Company recently extended its claims into this area to control the on-strike extension of the main Dixie Lake gold structure, as disclosed on September 5, 2017. Great Bear will now drill test the area around a historical drill hole which returned 7.0 m of 2.0 g/t gold including 1.0 m of 10.47 g/t gold. Recent analysis by Great Bear strongly suggests that this interval has the same mineralization characteristics, and matching host rock descriptions to holes drilled by the Company within the main Dixie Lake structure, approximately 2 kilometres away. The 2017 airborne geophysical survey carried out by the Company shows a continuous magnetic anomaly between the main Dixie Structure and this 2005 drill hole. Successful confirmation of gold mineralization in this area would suggest significant on-strike potential for gold mineralization along the Dixie structure, which has been geophysically interpreted to extend for over 20 kilometres on Great Bear’s claims, as disclosed by the Company on November 2, 2017, and as shown on Figure 2.

Figure 2: 20 kilometres of the Dixie gold structure as interpreted from a high-resolution geophysical survey completed by Great Bear in 2017. Area of Phase 2 drilling shown in inset.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5331/32029_a1516072020734_64.jpg

Drilling will begin in Areas 1, 2 and 3, and will proceed to Area 4 when approvals are received for an extended drill area. Drilling is expected to begin in the first two weeks of February and will proceed for 4 – 8 weeks once underway.

About Great Bear

Great Bear is earning a 100% royalty-free interest in the Dixie Lake property which consists of 7,106 hectares in the Red Lake district covering a drill and geophysically defined multi-kilometre gold mineralized structure like that hosting other producing gold mines in the district. The project has seen over 160 drill holes to-date and has yielded high grade near-surface gold results including 10.40 m of 15.89 g/t gold. In addition, Great Bear is also earning a 100% royalty-free interest in its West Madsen properties which total 2,725 hectares and are contiguous with Pure Gold Mining Inc.’s Madsen property. All of Great Bear’s Red Lake projects are accessible year-round through existing roads.

Mr. R. Bob Singh, P.Geo, Director and VP Exploration for Great Bear, is the Qualified Person as defined by National Instrument 43-101 responsible for the accuracy of technical information contained in this news release.

For further information please contact Mr. Chris Taylor, P.Geo, President and CEO at 604-646-8354, or Mr. Knox Henderson, Investor Relations, at 604-551-2360.

ON BEHALF OF THE BOARD

“Chris Taylor”

Chris Taylor, President and CEO

Inquiries:

Tel: 604-646-8354

Fax: 604-646-4526

info@greatbearresources.ca

www.greatbearresources.ca

About the Assay Techniques

Drill core was logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program were cut in half, using a diamond cutting saw, and were sent to Activation Laboratories Ltd. in Ancaster Ontario, an accredited mineral analysis laboratory, for analysis. All samples were analysed for gold using standard Fire Assay-AA techniques. Samples returning over 3.0 g/t gold were analysed utilizing standard Fire Assay-Gravimetric methods. Certified gold reference standards, blanks and field duplicates were routinely inserted into the sample stream, as part of Great Bear’s quality control/quality assurance program.

Selected samples of coarse reject splits from intervals that included visible gold were subjected to additional metallic screening protocols consisting of a representative 1000 gram split sieved at 100 mesh (149 micron), with assays performed on the entire +100 mesh and 2 splits of the -100 mesh fraction. A final assay was calculated based on the weight of each fraction.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This new release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements.

We seek safe harbor

Source: www.newsfilecorp.com