Granada Gold Mine Intersects 11.45 g/t Gold Over 33 Meters, Supports Continuity of High-Grade Structures

Granada Gold Mine Inc. is pleased to provide assays results from the last hole in the latest drill program at its Granada gold deposit in Rouyn-Noranda.

Granada Gold Mine Inc. (TSXV:GGM) (the “Company” or “Granada”) is pleased to provide assays results from the last hole in the latest drill program at its 100%-owned Granada gold deposit in Rouyn-Noranda. Unexpected near-surface, high-grade mineralization has been discovered within the recently explored two-kilometer LONG Bars Zone of the five and half kilometer Granada Shear zone which trends east-west on the property.

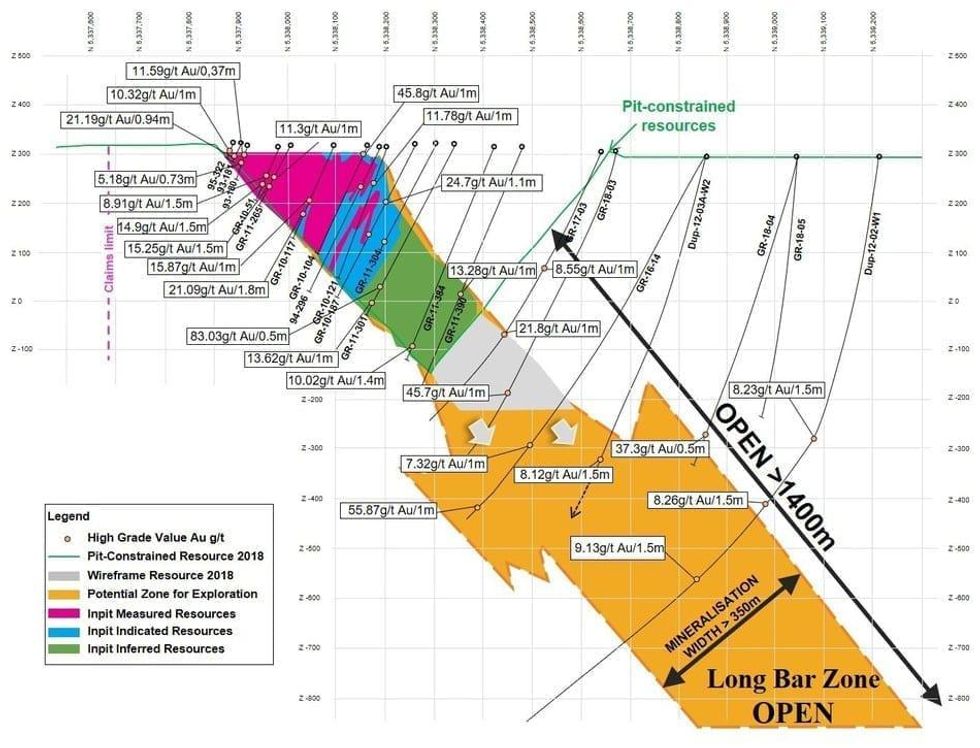

Showing High-Grade Intercepts and Prospective Zone for Future Exploration (Composite Section)

The 450-meter Fall, 2019 drill program focused on testing the gold grade continuity and variability within mineralized structures. The Granada Shear Zone and the South Shear Zone contains, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and half kilometers. Three of these structures were mined historically from two shafts and two open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 5 to 3.5 grams per tonne gold.

Highlights:

- 11.45 g/t in drill hole GR-19-A from 0 to 33 m core length including high-grade intercepts of 42.5 g/t from 0 to 1.5 m, 480 g/t from 8.1 to 8.5 m, and 70.8 g/t from 31.9 to 32.4 m. The horizontal width, based on outcrop, is about 9 meters and true width is estimated at 6.3 meters. The core length reported is estimated to have intersected only 15-20% of the entire thickness of the zone. However, it is a real known extent in that direction down dip of gold mineralization within the intersected length. Assays are uncut except where indicated.

- A further 50 m strike length of stripping uncovered a massive mineralized quartz zone exposing strong veining with visible gold on surface

Hole GR-19-A was drilled down-dip from a surface exposure of the mineralized zone composed of a massive quartz vein within a sheared and altered conglomerate adjacent to feldspar porphyry to the south. The entire mineralized zone has a 9-meter horizontal thickness in that sector. GR-19-A was drilled at azimuth 21 degrees North with a dip of 41 degrees in NQ core size.

Maps showing hole locations, stripping and full analytical results are available at www.granadagoldmine.com.

Frank J. Basa, P.Eng., Granada Gold’s president and chief executive officer, comments: “The current drill program has unlocked the high-grade, near-surface potential and shows that the Granada gold deposit resource may have been underestimated.

An ongoing drilling and stripping exploration program at Granada will focus on defining new zones of high-grade mineralization, both on surface and at depth. Numerous high-grade intercepts have been found from surface to below a depth of 1000 meters. It is open both at depth and on east-west strike for 5.5 kilometers.”

Granada Gold Mine High-Grade Intersections

The company has completed surface stripping over a 25-meter by 50-meter extent in the immediate area and has begun another short drill program to further test for near-surface high grade mineralization.

The company has retained the drilling services of MultiDrilling based in Rouyn-Noranda. The program was under supervision of GoldMinds Geoservices technical team.

Private Placement Closing

The Company has closed a private placement financing raising gross proceeds of $200,000. A total of 2,000,000 units were issued with each unit consisting of one common share in the capital of the Company and one share purchase warrant. Each warrant entitles the holder to purchase one share of the Company for a period of two years from closing at an exercise price of $0.15 cents per share.

All securities issued are subject to a four-month-and-a-day hold period expiring on May 10, 2020, in accordance with applicable securities laws. The private placement is subject to final TSX Venture Exchange approval.

The proceeds of the private placement will be used for surface exploration, trenching, and historical resampling of drill core on the Company’s Granada Gold Property in Québec and for general working capital purposes.

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc. member of Québec Order of Engineers and a qualified person in accordance with National Instrument 43-101 standards.

Quality Control and Reporting Protocols

All NQ core assays reported were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA (Atomic Absorption) finish or gravimetric finish at (i) ALS Laboratories in Val d’Or, Québec, Thunder Bay, Ontario, Sudbury, Ontario or Vancouver, British Columbia. The screen assay method is selected by the geologist when samples contain visible gold. All samples are also analyzed for multi-elements, using an Aqua Regia-ICP-AES method at ALS Laboratories. The drill program, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 12 samples for QA/QC purposes for this program in addition to the lab QA/QC.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop the Granada Gold Property near Rouyn-Noranda, Quebec. Approximately 120,000 meters of drilling has been completed to date on the property, focused mainly on the extended LONG Bars zone which trends 2 kilometers east-west over a potential 5.5 kilometers of mineralized structure. The highly prolific Cadillac Break, the source of more than 75 million plus ounces of gold production in the past century, cuts through the north part of the Granada property.

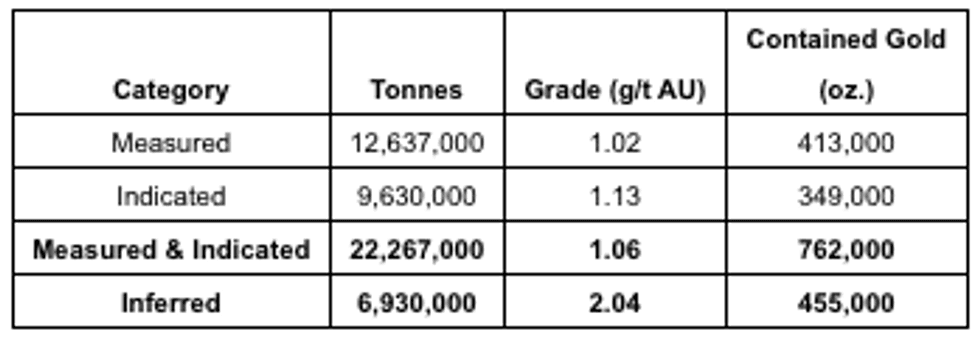

Pit-Constrained Mineral Resources at Granada disclosed on February 13th, 2019 Press Release prepared by SGS independent QP stand at:

Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

+ Open pit mineral resources are reported at a cut-off grade of 0.4 g/t Au within a conceptual pit shell. Cut-off grades are based on a gold price of US$1,300 per ounce, a foreign exchange rate of US$0.76, and a gold recovery of 95%.

The Company is in possession of all mining permits that are required to commence the initial mining phase, known as the “Rolling Start”, which allows the company to mine up to 550 tonnes per day. Additional information is available at www.granadagoldmine.com.

“Frank J. Basa”

Frank J. Basa P. Eng.

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statement

Click here to connect with Granada Gold Mines (TSXV:GGM) for an Investor Presentation