Getchell Gold Corp. Reports Data Review of Fondaway Canyon Gold Project Reveals Significant Project Upside and Looks Forward to Fall 2020 Drill Program

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) provided an update on its comprehensive review of the Fondaway Canyon data set.

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) (“Getchell” or the “Company”) a leading Nevada focused Gold and Copper exploration company is pleased to provide; i) an update on its comprehensive review of the Fondaway Canyon data set that covers gold exploration and production spanning the last 50 years; and ii) significant highlights from the most recent drill program that was conducted in 2017, as it directly underscores the positive assessment and significant potential of the Project.

Key Highlights:

- 7.69 g/t gold over 9.8 m and 5.28 g/t gold over 7.9 m within a longer interval of 2.83 g/t Au over 65.4 m and 1.77 g/t Au over 62.9 m intersected at the Colorado zone supporting the continuity and extent of the mineralization 250 metres down dip of the surface expression of the zone;

- Pack Rat zone extended 250 metres down dip by hole FC17-01 that ended in mineralization grading 1.29 g/t Au over 46.6 m and remains open to depth;

- Intervening 400 metre distance between and along trend of the Colorado and Pack Rat zones are open and underexplored;

- Half Moon zone extended 70 metres down dip by hole FC17-04 grading 1.01 g/t Au over 66.1 m;

- Drill Hole FC17-05 testing the South Pit area intersected 5.97 g/t gold over 6.1 meters within a longer interval of 3.48 g/t Au over 12.8 m. The hole ended in mineralization considered outside of the known extents of mineralization at Fondaway; and

- The 2017 drill campaign occurred after the completion of the historical mineral resource estimate conducted in 2016 and, as such, the results were not included in the historical resource estimate.

“The key highlights summarized above illustrate the extent of the gold mineralizing system and the upside potential at Fondaway Canyon.” states Bill Wagener, CEO Getchell Gold Corp.

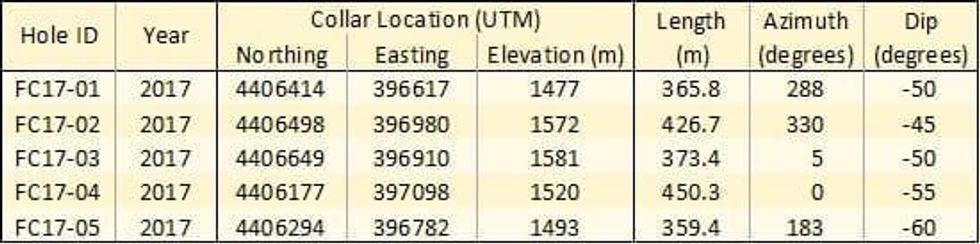

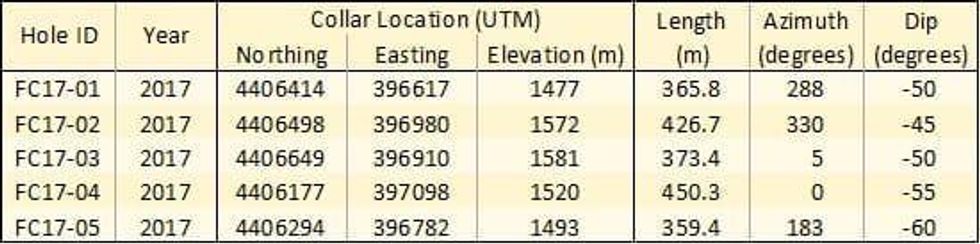

The most recent drill program at Fondaway, conducted in 2017 by a previous operator, consisted of seven drill holes broadly arrayed across a number of the more prominent gold zones. The objective of the drill program was to:

i. Confirm the substantial width of gold mineralization at critical locales;

ii. Test exploration gaps between known gold occurrences; and

iii. Test gold mineralization at depth.

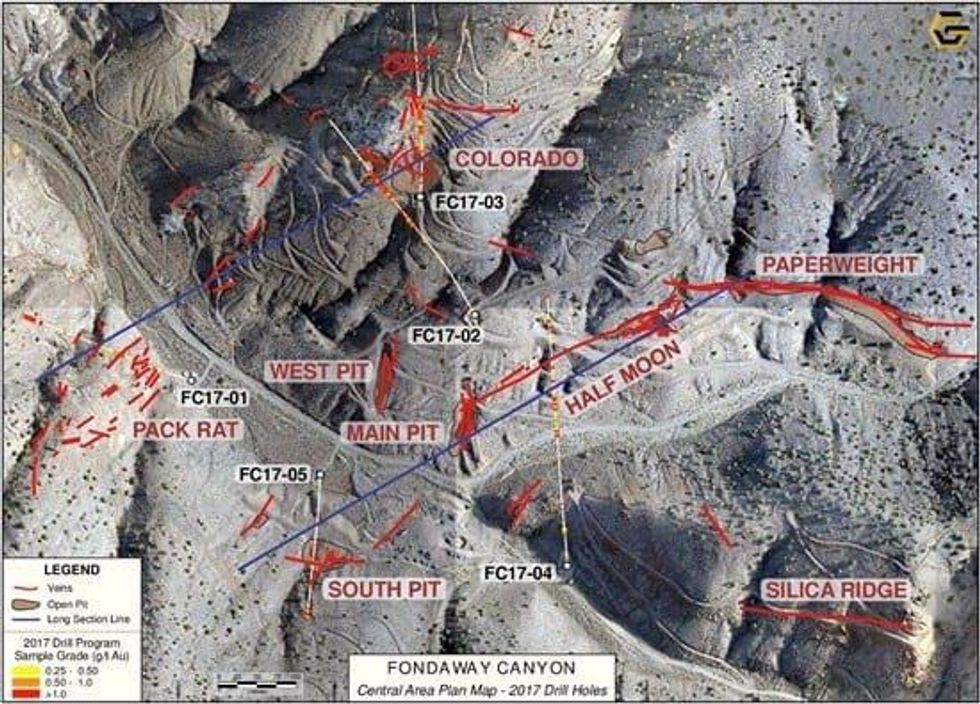

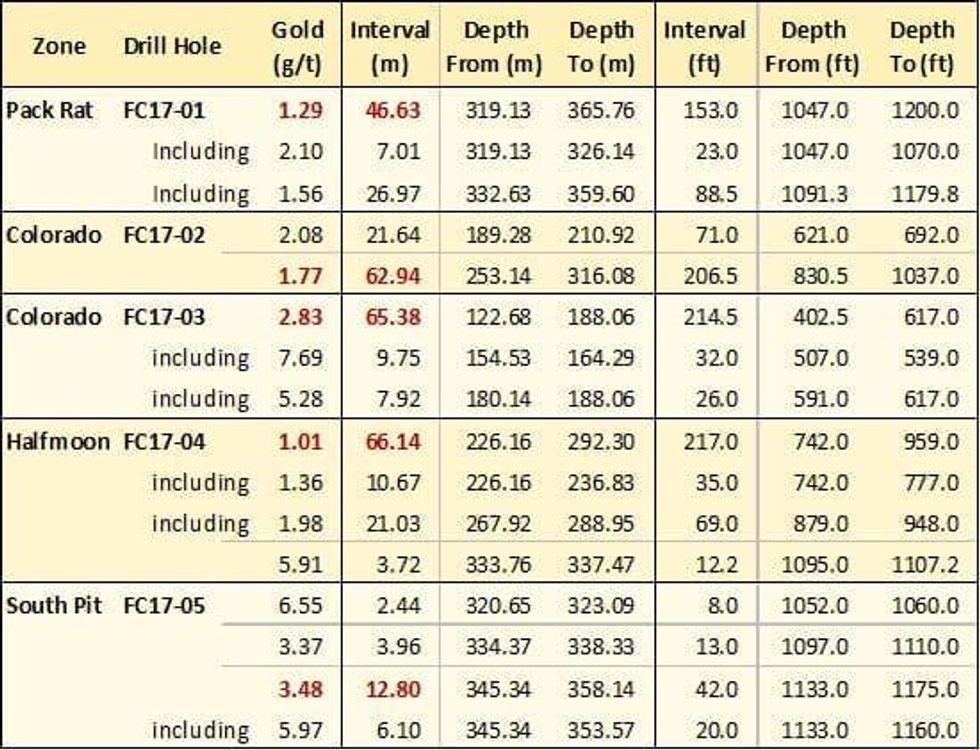

The 2017 drill program was highly successful in terms of supporting gold mineralization widths and grade, the continuity of mineralization along trend, extending the depth of the known mineralization and intersecting significant intercepts outside of the known boundaries of the mineralization. The following are selected highlights from the five drill holes, FC17-01 to FC17-05, that were drilled in the central area of the Project (Figure 1).

Figure 1: Fondaway Canyon Central Area Plan Map showing drill traces solely from the 2017 drill program

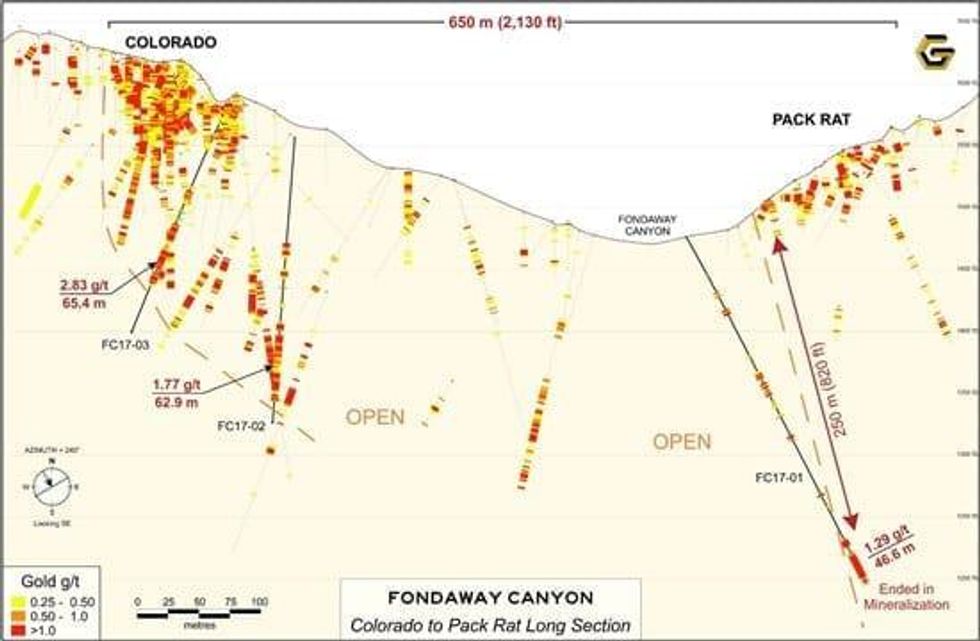

Two drill holes, FC17-02 and FC17-03, targeted the Colorado zone, the most northern and one of the more densely mineralized zones at Fondaway. The two holes intersected lengthy sections of gold mineralization reporting 62.9 m grading 1.77 g/t Au from 253.1 to 316.1 m and 65.4 m grading 2.83 g/t Au from 122.7 to 188.1 m respectively (see Table 1 and refer to Figure 2).

The 2017 drilling at Colorado supports the continuity and extent of the mineralization 250 metres (820 feet) down dip of where the zone is expressed at surface.

Figure 2: Fondaway Canyon Long Section, Colorado to Pack Rat Zone along 240° Az. looking SE

Drill hole FC17-01 targeted the Pack Rat zone at depth. The Pack Rat zone is located approximately 400 metres to the SW of Colorado along an extensional fault zone, the Pack Rat Fault, considered one of the many mineralizing structures at Fondaway. Hole FC17-01 ended in mineralization reporting a 46.6 m intersection grading 1.29 g/t Au from 319.1 to 365.8 m down hole. This intersection extends the mineralization 250 metres (820 feet) down dip from the historical shallow drilling and remains open to depth.

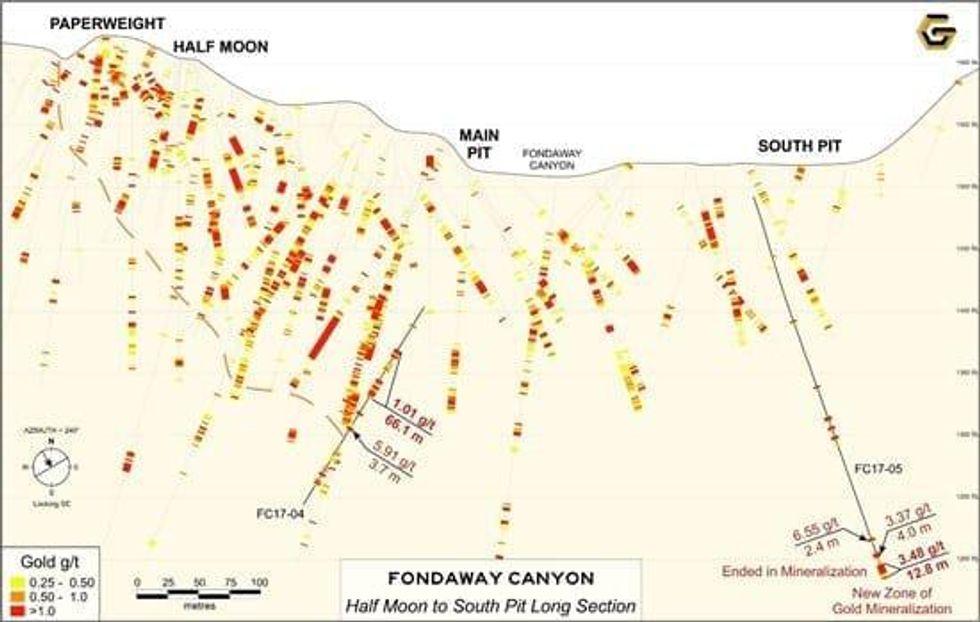

Drill Hole FC17-04 tested the northeast striking quartz-vein stock-work hosted shear zone down dip from the Half Moon gold zone. Hole FC17-04 reported a 66.1 m intersection grading 1.01 g/t Au from 226.2 to 292.3 m down hole and extending mineralization about 70 metres (230 ft) down-dip from previous drilling.

Figure 3: Fondaway Canyon Long Section, Half Moon to South Pit Zone along 240° Az. looking SE

Drill Hole FC17-05 tested the South Pit area that is situated at the southwestern extent, 500 metres (1,640 ft) to the SW of the start of the Half Moon zone (Figure 3), of an extensional fault zone parallel to the Pack Rat fault and also considered one of the many mineralizing structures at Fondaway. Numerous mineralized intersections were encountered, but of specific significance:

FC17-05 ended in gold mineralization grading 3.48 g/t Au over 12.8 m from 345.3 to 358.1 m down hole; and

the mineralization encountered at the bottom of the hole is a previously unknown gold zone outside of the known extents of mineralization at Fondaway.

“The results from the 2017 drilling support our initial assessment as to the opportunity and continue to add to the story at Fondaway.” states Bill Wagener, CEO.

Of special note, the 2017 drill campaign by a previous operator occurred after the completion of the historical mineral resource estimate conducted in 2016 and published in 2017 that stated Indicated resources of 409,000 oz. Au contained in 2,050,000 tonnes grading 6.18 g/t and Inferred resources of 660,000 oz. Au contained in 3,200,000 tonnes grading 6.4 g/t at Fondaway Canyon. Therefore, the results from the 2017 drill program were not included in the model that formed the historical resource estimate.

This historic resource estimate was completed by Techbase International Ltd of Reno, Nevada, and it is contained within a NI 43-101 report dated April 3, 2017 that was commissioned by Canarc Resource Corp of Vancouver, B.C., Canada. The resource estimate was compiled only from drill holes that could be validated (591 holes @ 49,086 m), a sufficient amount to deem the historic resource as reliable. Using Techbase software, a method of polygons was used along each vein. With a minimum 0.10 opt Au and 1.8 m horizontal vein width used as cut-off parameters, twelve veins had sufficient composited intercepts within the sulfide mineralization for the estimate. No capping or cutting of grades was applied. The historical resource estimate used classifications in accordance with NI 43-101 standards, namely, “indicated” and “inferred”. A review and/or re- calculation of the historic resource is required by an independent Qualified Person to confirm these as current resources as defined by NI 43-101. A qualified person for Getchell has not done sufficient work to classify the historical estimate as current mineral resources; and the Company is not treating the historical estimate as current mineral resources.

Table 1: Fondaway Canyon Central Area – Select Highlights from the 2017 Drill Program

Downhole sample interval lengths reported in this news release are not representative of true width and true width will be less than the reported core length intervals by a certain factor. Getchell has performed insufficient work to determine the attitude of the mineralized zones and an estimation of true width.

Table 2: Fondaway Canyon Central Area – Summary of 2017 Drill Program

Downhole sample interval lengths reported in this news release are not representative of true width and true width will be less than the reported core length intervals by a certain factor. Getchell has performed insufficient work to determine the attitude of the mineralized zones and an estimation of true width.

Table 2: Fondaway Canyon Central Area – Summary of 2017 Drill Program

The 2017 drill samples were analyzed by Bureau Veritas Minerals of Sparks, Nevada, an ISO-certified lab that meets the requirements of ISO/IEC 17025:2005 and ISO 9001:2015. The laboratory employed a QAQC protocol that included insertion of control samples at a rate of 1 per 100 feet of core, approximately 1 per 22 samples, and conducted duplicate analyses of core pulps and rejects. Control samples included a blank and four gold standards at various grades. A qualified person from Getchell has verified that the 2017 drill program results disclosed have been generated with proper procedures, have been accurately transcribed from the original source and are suitable to be used.

Dataset Compilation Update

The Fondaway Canyon dataset includes data from gold exploration and production conducted by multiple operators spanning the last 50 years. During this period, 735 reverse circulation and core holes have been drilled totaling 185,963 feet (56,682 meters) that has produced over 30,000 samples. In addition, to assist with the geological interpretation and modelling, approximately 2,800 core photos were indexed, and the majority of the drill logs have been converted from static paper copies to digital format with the significant geological attributes coded into a standardized database. This modernization of the data will facilitate the development of a 3D model that will be used to identify high profile targets for drilling.

Over the coming weeks the Company’s technical team will take the unformed data and perform a comprehensive interpretation by combining all of the geological attributes (e.g. drill intercepts, assay results, surface and underground sampling, lithology, alteration, structure and mineralization) into one database. The objective is to i) work towards the development of a new or revised geological and gold mineralizing model and ii) design and initiate a field exploration program.

Bill Wagener states that, “As the interpretation and modelling progresses, a greater understanding and more detailed geological insights will be formed. The Company looks forward to sharing those conclusions as they are reached.”

2020 Fall Exploration Program at Fondaway Canyon

There are numerous exploration targets with significant merits and blue-sky potential. It is anticipated that multiple drill campaigns will be required to determine and define the extent of the gold mineralization at Fondaway Canyon; especially considering that the known gold occurrences extend along an impressive east-west strike length of 3.5 kilometres, a perpendicular width of up to 800 metres and a vertical range of 670 metres from the higher elevations in the east to the range-front in the west.

The Company is planning for a Fall 2020 drill program at Fondaway Canyon. The drill program will be scaled accordingly with the intention to provide “high value enhancement relative to cost” and set the stage for the further advancement and development of the Project.

Scott Frostad, P.Geo., is the Qualified Person (as defined in NI 43-101) who reviewed and approved the contents of this news release and has verified the data disclosed herein.

About Getchell Gold Corp.

The Company reiterates that its near-term strategy to advance its assets is not impacted by the COVID-19 Corona virus. The Company continues to monitor the situation and is in compliance with all government guidelines.

The Company is a Nevada focused gold and copper exploration company trading on the CSE: GTCH and OTCQB: GGLDF. Getchell Gold is directing its efforts on its most advanced stage asset, Fondaway Canyon, a past gold producer with a significant in-the-ground historic resource estimate. Complementing Getchell’s asset portfolio is Dixie Comstock, a past gold producer with a historic resource and two earlier stage exploration projects, Star Point and Hot Springs Peak. Getchell has the option to acquire 100% of the Fondaway Canyon and Dixie Comstock properties under an agreement with Canarc Resources Corp. (see January 7, 2020 news release for further details).

For further information please visit the Company’s website at www.getchellgold.com or contact the Company at info@getchellgold.com.

Mr. William Wagener, Chairman & CEO

Getchell Gold Corp.

+1 303 517 8764

info@getchellgold.com

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release. Not for distribution to U.S. news wire services or dissemination in the United States.

Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the private placement and the completion thereof and the use of proceeds. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “will” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, use of proceeds from the financing, capital expenditures and other costs, and financing and additional capital requirements. Although management of Getchell have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.