VIDEO - Gareth Soloway: Passing This Trend Line Could Supercharge Gold

Gareth Soloway of InTheMoneyStocks.com also discusses his expectations for the upcoming US Federal Reserve meeting.

With the summer months now over, where is the gold price headed in the fall?

Speaking to the Investing News Network, Gareth Soloway, chief market strategist at InTheMoneyStocks.com, said he still thinks gold could reach US$2,100 per ounce by the end of the year.

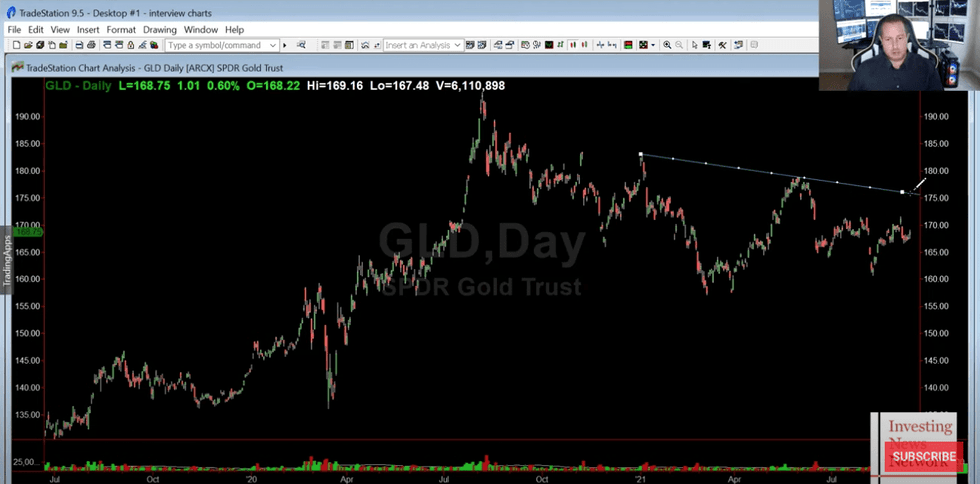

Displaying a chart of the SPDR Gold Trust (ARCA:GLD), he said he sees a bullish consolidation pattern that points toward upside, but also a bearish inverse head-and-shoulders formation.

“What I’m looking for here is when do we break this trend line? Because once you break this trend line gold should kind of get a supercharged move to it,” said Soloway.

“I think as long as you remain below this line it could be choppy in the near term, which may explain that kind of summer into fall period. But once we get above this trend line, maybe towards the end of the year, you could see a pretty dramatic move up in the yellow metal,” he added. If gold doesn’t break that trend line, the move to US$2,100 could get pushed out to the first quarter of next year.

Soloway’s GLD chart with trend line.

One upcoming catalyst for the precious metal could be next week’s US Federal Reserve meeting. When asked what he’s expecting from it, Soloway said he’s anticipating a more hawkish tone.

“I’m in the camp that they’re actually going to be a little bit more hawkish than the market expects,” he noted in the interview. “I don’t know if it’ll be enough to cause a bigger drop in the markets, but I do think you’re starting to see weakness in the charts, and I do expect downside in the S&P 500 (INDEXSP:.INX) and the NASDAQ Composite (INDEXNASDAQ:.IXIC).”

Although the Fed’s actions are closely watched, many market participants are beginning to ask whether the central bank can do what it says it plans to do. For Soloway, the question is an important one.

“I have huge doubts — I believe the Fed has basically boxed themselves into a corner where they can’t really taper too much. Now, I think they want to keep the perception that they have some control, so I believe that they will do a little bit,” he explained. “But we saw in 2018, as soon as they tried to raise rates the markets dropped 20 percent; they had to reverse and actually start easing more.”

In his mind, it’s possible that the Fed won’t even exist a decade from now.

“I do think the Fed will be the scapegoat. There’s no other way to do it — you’ll have to have a reset of debt and the currencies, and then you will see from that restrictions on whatever the new currency is … there’ll be some sort of restriction where the Fed cannot just willy-nilly print it,” Soloway commented.

He continued, “And then the same thing with the government. There will likely be restrictions so that the debt cannot just be run up relentlessly.”

Watch the interview above for more of his thoughts on gold, the Fed and market opportunities.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.