Drill Tracker Weekly: Pretium Continues Infill Drilling at Ultra High-grade Valley of the Kings Project

Pretium Resources released initial infill drill results from the 2015 program at its Valley of the Kings project at Brucejack Lake. On March 26, 2015, the company received a BC environmental assessment certificate for the project; it expects a federal environmental decision statement in Q3 2015.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Pretium Resources (TSX:PVG)

Price: $7.66

Market cap: $1,000 million

Cash estimate: $103 million

Project: Valley of the Kings

Country: British Columbia, Canada

Ownership: 100 percent

Resources: Proven and Probable: 13.6 Mt @ 15.7 g/t Au, 11 g/t Ag

Project status: Infill Drilling

- Pretium Resources released initial infill drilling results from the 2015 underground drilling program on its 100% owned Valley of the Kings (“VOK”) project at Brucejack Lake, in northwestern British Columbia. On March 26, 2015, the Company received the British Columbia Environmental Assessment Certificate and expects a Federal Environmental Decision Statement in Q3/2015. In April 2015, the Company signed a Cooperation and Benefit Agreement with the Nisga’a Nation.

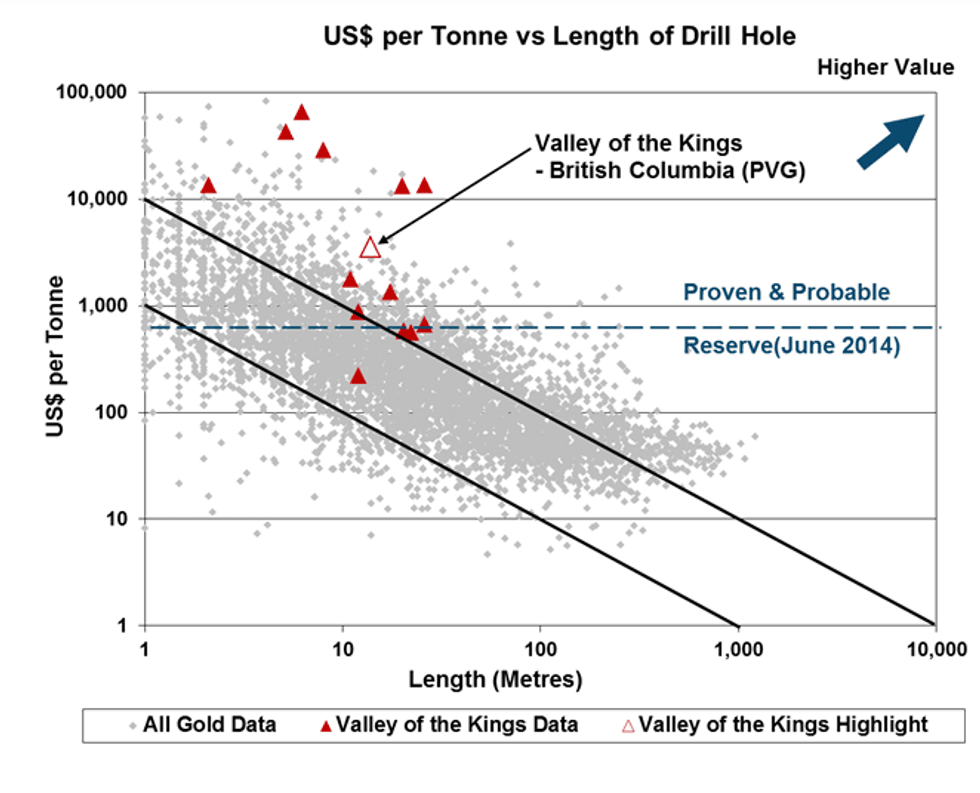

- Highlights from the current underground infill drilling in the VOK returned 13.80 metres grading 88.08 g/t Au and 97 g/t Ag. Using an unusually high top-cut of 540 g/t Au results in a cut grade of 55.76 g/t Au. The high top-cut is determined by evaluating the consistency of the ultra-high-grade mineralization in the VOK (several intervals over 2,500 g/t Au with highs up to 41,000 g/t Au).

- On June 19, 2014, the Company announced the results of an updated feasibility study. The study envisions an 18 year mine life, producing 504,000 ounces gold per annum over the initial five years, at a production rate of 2,700 tonnes per day. Using a $1,100 Au price and a $746 million capex, the project is projected to have a post-tax NPV (5% Discount) of $1.45 billion and an IRR of 28.5%. The all in sustaining cash cost is expected to be $448 per ounce Au.

- On January 2015, the Company closed a financing with Chinese based Zijin Mining Group for C$80.87 million giving Zijin a 9.6% equity position in the Company.

Discovery history (1960’s to 2009): Several companies and joint ventures trenched and drilled the Brucejack/Sulphurets project outlining isolated high-grade gold and silver

High-Grade “Discovery Hole” – Silver Standard: 1.5 metres @ 16,948 g/t Au (2009)

Current holes: 13.8 metres @ 88.08 g/t Au, 97 g/t Ag including; 0.5 metres @ 1,325 g/t Au and 0.5 metres @ 647 g/t Au

Risks Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

- The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies: Fission Uranium Corp. (TSX.FCU), Balmoral Resources Ltd. (TSX.BAR)

- Balmoral Resources Ltd. is currently covered at Mackie Research Capital Corp. by analyst Peter Campbell

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.