Continental Gold is Down 28 Percent - What Happened?

The company released an update saying it doesn’t know why its share price took a hit this past week. However, it looks like gold’s recent price drop may have been the issue.

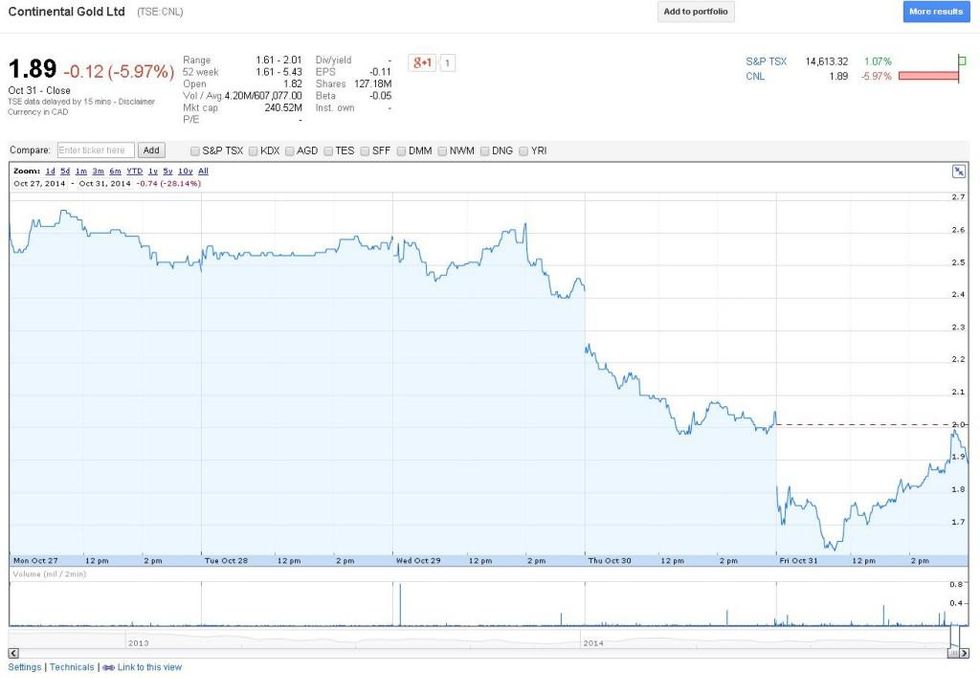

Continental Gold’s (TSX:CNL,OTCQX:CGOOF) share price sank 28 percent this past week, ending Friday at just $1.89. With no obvious reason for the decline, many shareholders are wondering what exactly is going on.

The company, whose focus is on its Colombia-based Buritica project, is also wondering. On Friday it put out a press release that simply states that it has “no material changes to report. The Preliminary Economic Assessment is on track for release in the fourth quarter and the environmental amendment to complete the permitting process is proceeding according to schedule.”

Indeed, none of the factors that usually cause share price drops are present. For one, the company hasn’t put any bad news out — though it released initial channel sampling results from the Veta Sur vein system at Buritica on Tuesday, its share price held steady all through that day as well as Wednesday.

For another, jurisdiction doesn’t seem to the problem. Companies often run into difficulties when issues occur where they are operating — that’s exactly what happened to Roxgold (TSXV:ROG), True Gold Mining (TSXV:TGM) and others when violent protests erupted Thursday in Burkina Faso — but if anything, the situation in Colombia is improving. News out of the country this week suggests that peace negotiations between the government and rebels are advancing, albeit slowly.

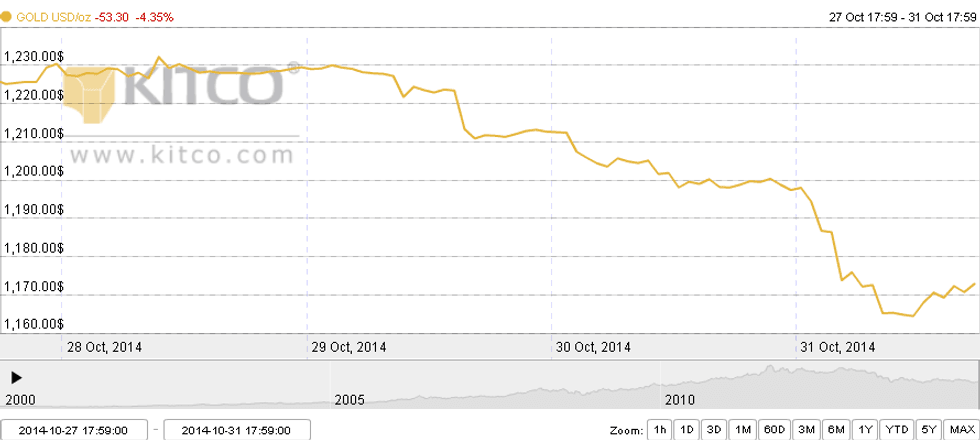

The best bet, then, seems to be that gold’s big price drop this past week is to blame for Continental’s misfortune. Indeed, a comparison of the chart below, which shows gold’s price activity from October 27 to 31, and the chart beneath that, which shows Continental’s share price movement over the same period, reveals that the behavior of the two looks very similar.

While of course it’s tough to say for sure that the company’s share price fell in reaction to gold’s drop — making assumptions is rarely a good plan for resource investors — it certainly seems likely.

What’s thus key for investors to remember is that even good companies can suffer when the markets take a turn for the worse, and in those cases the best bet can be to just hang in there. And of course, unexplained share price drops can also be an opportunity for new investors to jump in at a discount.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

State of Emergency Declared as Protests Erupt in Burkina Faso