Chilean Metals Inc. has closed as of today subscriptions and funds totaling $1,636,390 dollars.

Chilean Metals Inc. (TSXV:CMX, OTCQB:CMETF, SSE:CMX, MILA:CMX, FRA:IVV1, BER:IVV1).

The TSX Venture Exchange has not approved the closing of the transaction and the financing is subject to the review and approval of the TSX Venture Exchange.

Chilean Metals Inc. has closed as of today subscriptions and funds totaling $1,636,390 dollars. Of which, $1,171,590 was received under the $0.12 hard-dollar Unit financing which provided investors a share and a share purchase warrant. The warrant and $0.18 will entitle investors to acquire a common share at anytime over the next five years. An additional $465,000 of flow through units was sold. The Unit price was $0.16 which includes a share and a share purchase warrant. The warrant and $0.18 will entitle investors to acquire a common share at anytime over the next five years.

The Company intends to keep the offering open until the sooner of July 26th or its receipt of its original stated goal of $640,000 via flow through and $1,500,000 via direct unit investment.

Chilean has paid brokerage fees of $15,792 to eligible brokers and will issue 120,800 broker warrants in conjunction with the transaction. Each broker warrant will entitle the holder for the next 18 months to acquire additional units in the offering under the same terms and conditions as the $0.12 unit.

Proceeds will be used to fund exploration on the Companies projects in Nova Scotia and Chile and to pay the previously announced debt settlement of approximately $230,000 and to repay debentures of approximately $460,000.

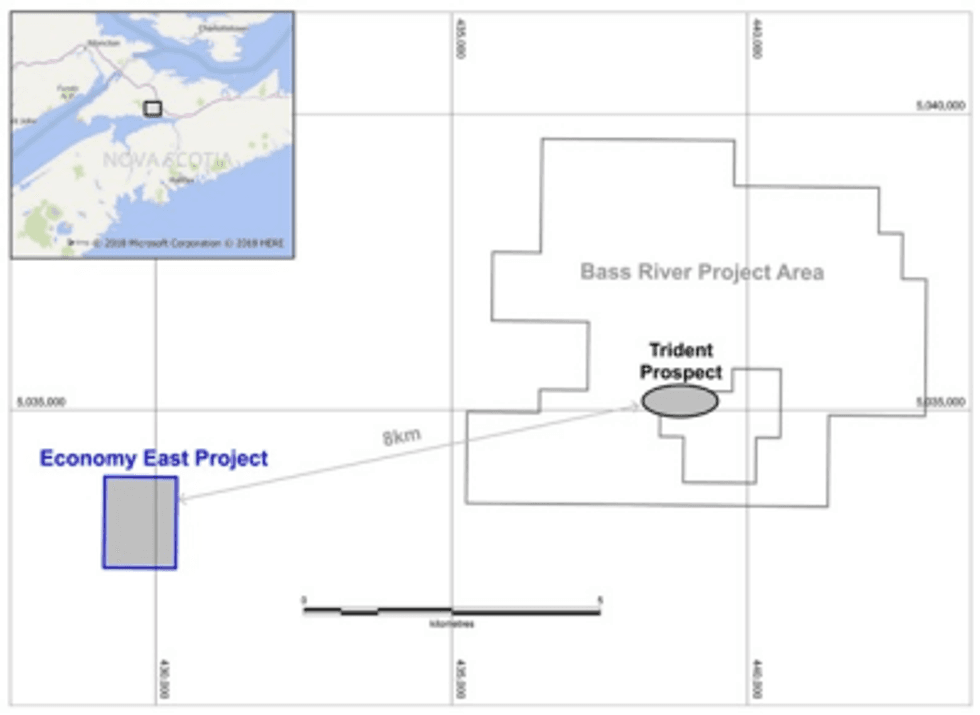

“This financing will clean up our balance sheet and enable us to fast track drilling and drilling decisions particularly on our Nova Scotia projects. We have completed Phase 1 drilling on initial project in Nova Scotia, the Bass River Castlereagh Project. Assays have been sent to Actlabs for analysis with an expectation of results in late July. In addition we have commenced airborne surveys over our recently optioned projects Trident (Bass River South) and Economy East. We expect to follow that up with ground IP later this summer and drilling in Q3.” commented Chilean CEO Terry Lynch

Click Image To View Full Size

About Chilean Metals,

www.chileanmetals.com/

Chilean Metals Inc. is a Canadian Junior Exploration Company focusing on high potential Copper Gold prospects in Chile & Canada.

Chilean Metals Inc is 100% owner of five properties comprising over 50,000 acres strategically located in the prolific IOCG (“Iron oxide-copper-gold”) belt of northern Chile. It also owns a 3% NSR royalty interest on any future production from the Copaquire Cu-Mo deposit, recently sold to a subsidiary of Teck Resources Inc. (“Teck”). Under the terms of the sale agreement, Teck has the right to acquire one third of the 3% NSR for $3 million dollars at any time. The Copaquire property borders Teck’s producing Quebrada Blanca copper mine in Chile’s First Region.

Chilean Metals Inc is the 100% owner of five Copper Gold Cobalt exploration properties in Nova Scotia on the western flank of the Cobequid-Chedabucto Fault Zone (CCFZ); Fox River, Parrsboro, Lynn, Economy and Bass River North respectively. It has also optioned two additional projects Trident at Bass River and Economy East. Chilean Metals is exploring, analyzing and drilling these properties in the summer of 2018.

ON BEHALF OF THE BOARD OF DIRECTORS OF

Chilean Metals Inc.

“Terry Lynch”

Terry Lynch, Chairman & CEO

Contact: terry@chileanmetals.com

Forward-looking Statements: This news release may contain certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical fact, that address events or developments that CMX expects to occur, are forward looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities and results. Although CMX believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

The Qualified Person for Chilean Metals Inc., as defined by National Instrument 43-101, is Mick Sharry, M.Sc. Consultant

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Source: www.thenewswire.com