Adamera Receives Approval To Drill Targets At Lamefoot South

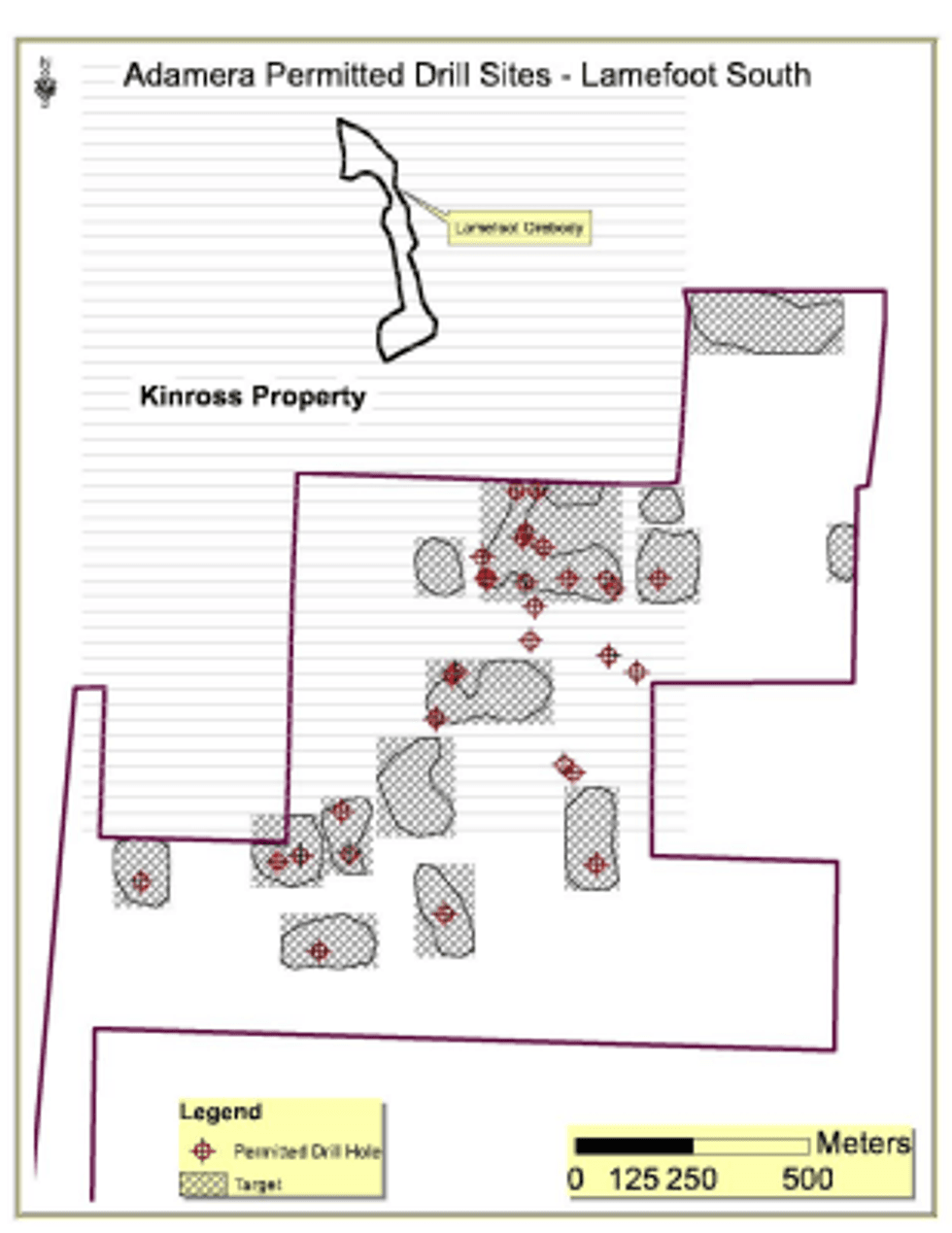

Adamera Minerals Corp. (TSXV:ADZ; OTC:DDNFF) announces the Washington State Department of Natural Resources (DNR) has granted approval of an additional 16 drill holes on the Lamefoot South property in Northeast Washington State. The 16 new drill holes increase the total number of permitted holes to 27 on this project.

Adamera Minerals Corp. (TSXV:ADZ; OTC:DDNFF) announces the Washington State Department of Natural Resources (DNR) has granted approval of an additional 16 drill holes on the Lamefoot South property in Northeast Washington State. The 16 new drill holes increase the total number of permitted holes to 27 on this project.

The Lamefoot South property is less than 300 metres south of the Lamefoot Gold Mine and along strike of the same structural feature that is believed to control the high-grade gold mineralization. Lamefoot was the largest and highest grade mine in the Cooke Mountain District. The ore from this mine was magnetite and sulfide-rich mineralization at the limestone-clastic contact. Gold also occurred as silica-sulfide veins in clastic rocks near the limestones. Overall, the silica-sulfide vein ore type was reportedly the dominant form of mineralization in the mine. Click here to view a short video on the Lamefoot South project.

Several targets have been delineated on Adamera’s Lamefoot South property. The priorityy targets are defined by strong magnetic anomalies coincident with induced polarization (IP) anomalies on the same or analogous limestone contacts as the Lamefoot Mine. Coincident gold and arsenic soil anomalism further supports these targets as possible mineralized zones. Click above for Video.

NE Washington has produced 6 million ounce of high-grade gold historically. In addition to Adamera’s potential discoveries, Adamera estimates that more than 2 million ounces of reported gold mineralization remains in the area on Kinross Gold Corp, Fiore Gold and Hecla owned land. The Lamefoot South project is approximately 11 km from the Kettle River Mill.

“We have developed a strong roster of prospective targets on this property. Given the proximity to the past producing Lamefoot mine, the similar geological setting, and the coincidence of anomalous geophysical and geochemical data, I consider these targets quite de-risked and ready for drilling. I think we offer an excellent discovery opportunity in a known gold province” says Mark Kolebaba, President and CEO of Adamera.

Click Image To View Full Size

The targets are defined by geophysical and soil geochemical data and are subject to change are new information is obtained.

Martin St. Pierre, P.Geoph, is a Qualified Person as defined by National Instrument 43-101 and has reviewed certain data associated with the project.

About Adamera

Adamera Minerals Corp. is exploring for a stand-alone high-grade gold deposit within hauling distance of an existing mill near Republic Washington. This area has reportedly produced over 6 million ounces of high-grade gold. Adamera is the dominant regional explorer in the area.

On behalf of the Board of Directors,

Mark Kolebaba

President & CEO

For additional information please contact:

Tel: (604) 689-2010 Fax: (604) 484-7143

Email: info@Adamera.com

Website: www.Adamera.com

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy

of this release. Statements in this press release, other than purely historical information, including statements

relating to the Company’s future plans and objectives or expected results, may include forward-looking statements. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in resource exploration and development. As a result, actual results may vary materially from those described in the forward-looking statements.

Source: www.thenewswire.com