Despite COVID-19, 2020 is shaping up to be a fruitful year for some diamond miners — here’s a look at the year’s biggest finds.

Few things are more dazzling and impressive than a large, glistening diamond. The valuable gems are one of the most beautiful and labor-intensive gifts from Mother Nature.

Of course, the larger ones weighing 100 carats or more are even rarer and more special.

If 2019 was a year of transition and growing pains for the diamond sector, the coronavirus outbreak has loomed large over 2020. Even so, it’s been a fruitful period for some diamond miners, with a number of companies bringing home major finds.

Read on for a list of 2020’s largest diamond finds to date, and stay tuned for new additions to the list.

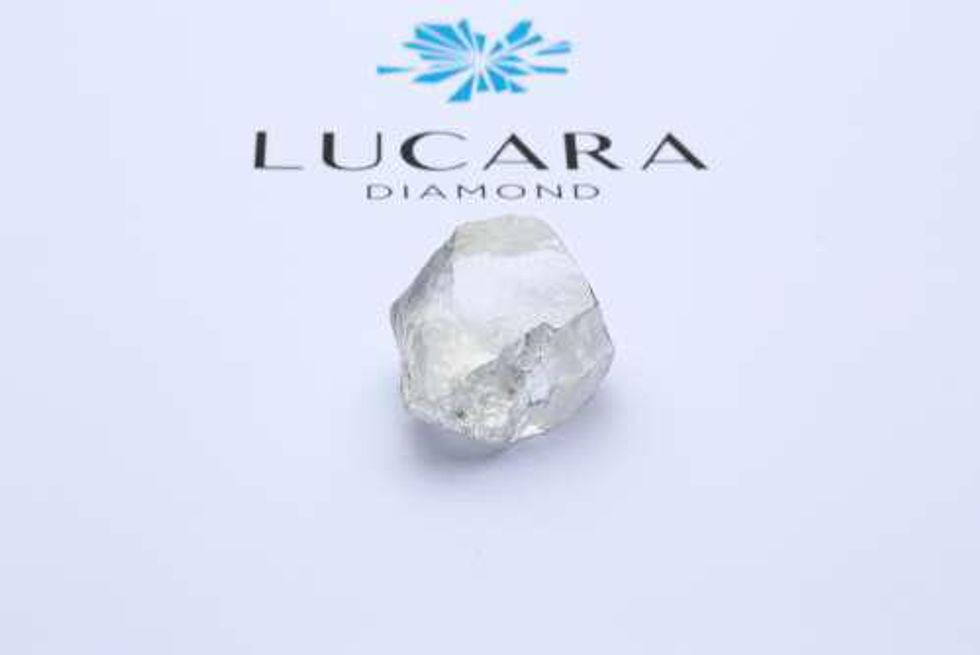

1. Lucara Diamond’s 549 and 176 carat diamonds from Botswana

Lucara Diamond’s 549 carat diamond. Image courtesy of Lucara Diamond.

In early February, Lucara Diamond (TSX:LUC,OTC Pink:LUCRF) recovered a 549 carat white diamond of “exceptional quality” from its Karowe mine in Botswana.

The exquisitely rare find came as a result of the company’s Mega Diamond Recovery XRT circuit, which allows for diamond recovery after primary crushing and prior to milling. The integration of technology to allow for the retrieval of larger stones is helping the sector rescue big diamonds that may have been crushed or broken in the past.

“New recovery technologies, including X-ray transmission, have resulted in less breakage of the largest stones in recent years. However, the recovery of these diamonds is still extremely rare on a relative basis,” diamond analyst Paul Zimnisky told the Investing News Network.

Lucara’s 549 carat diamond was captured from the same ore block that produced a 176 carat diamond earlier this year. The gem-quality stone and the 500+ carat white diamond are among four other 100+ carat diamonds the miner has already unearthed since the beginning of the year, with the most recent two being the most valuable.

“Lucara is extremely pleased to be starting off 2020 with the recovery of two, large, high quality diamonds that builds on the positive momentum generated following the completion of a strong fourth quarter sale in December and the announcement of our ground breaking partnership with Louis Vuitton on the Sewelô in January,” said Lucara CEO Eira Thomas.

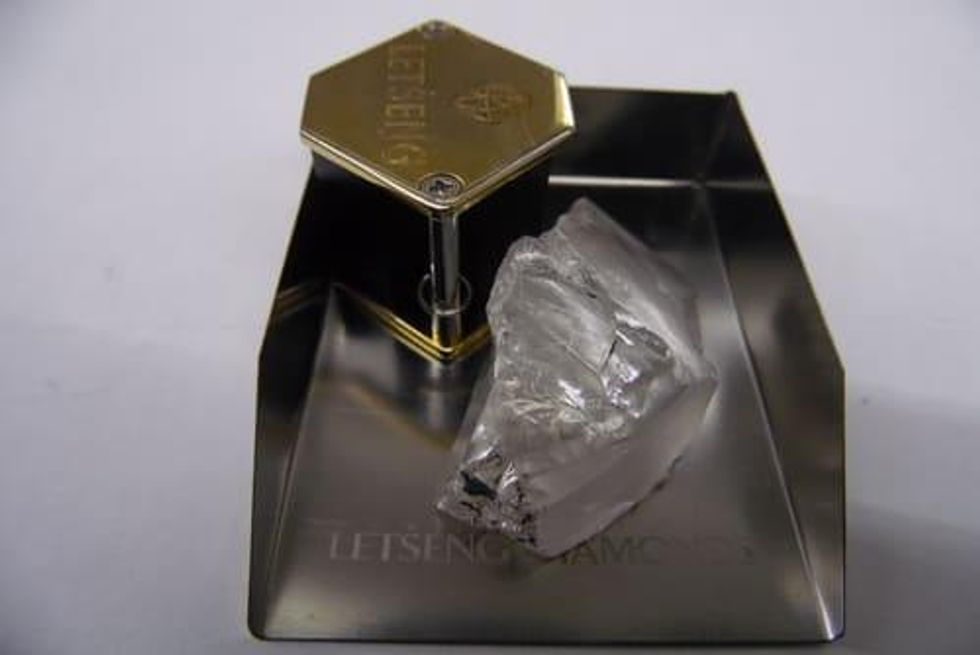

2. Gem Diamonds’ 183 carat diamond from Lesotho

Gem Diamonds’ 183 carat diamond. Image courtesy of Gem Diamonds.

In early February, Africa-focused miner Gem Diamonds (LSE:GEMD) discovered a 183 carat stone. The jewel is a type IIa diamond, the purest and highest valued of the classifications.

The diamond was discovered at the company’s renowned Letseng mine in Lesotho. Letseng is a large open-pit mine that has produced some of the largest diamonds ever, including the 910 carat Lesotho Legend, the 603 carat Lesotho Promise and the 550 carat Letseng Star.

Gem Diamonds also unearthed an 80 carat stone and another 79 carat diamond from Letseng on the same day. These smaller diamonds are described as high quality as well.

While all large recoveries are impressive, they are certainly not all of the same quality. Type IIa stones, colored gems and naturally shaped high-quality diamonds are all more valuable than an extremely large, low-quality stone.

“I estimate that there have been less than 20 gem-quality diamonds that are in excess of 100 carats recovered per year on average over the last five years,” said Zimnisky.

This extreme rarity only adds to the mystery and allure that diamonds possess.

3. Lucapa Diamond’s 171 carat diamond from Angola

Offering promise amid COVID-19 project disruptions is the first major find of Q2 2020.

Found by Lucapa Diamond (ASX:LOM) at the Lulo mine in Angola and weighing in at 171 carats, the white, gem-quality stone is the 15th discovery over 100 carats for the gem miner.

Unearthed in mid-May at mining block six of the alluvial mine, the 171 carat gem is the second stone over 100 carats recovered by Lucapa in 2020; it is the fourth in terms of all-time finds since the project entered commercial production in 2015.

“The recovery of this 171 carat gem-quality white diamond continues to underpin the potential of the kimberlite exploration programme as drilling of the high-priority kimberlites in the Canguige catchment continues,” said Stephen Wetherall, the company’s managing director.

In late March, the company suspended production at its Lulo mine and its Mothae mine in Leosotho due to country-led COVID-19 lockdowns.

On May 1, Lucapa restarted production at the Angola site in compliance with a presidential decree allowing essential services to resume activity with a 50 percent workforce reduction.

4. Lucapa Diamond’s 117 carat diamond from Lulo

2020’s large diamond haul was kicked off on the ninth day of the year when Australia’s Lucapa recovered a 117 carat gem-quality stone from its Lulo mine.

Commenting on the discovery, Wetherall announced at the time, “The recovery of this gem-quality 117 carat diamond represents a positive start for Lulo in 2020 as we continue rolling out our plans to increase production and revenues this year.”

The area where the miner unearthed the gem — mining block 19 — has been fruitful. Adjacent blocks six and eight have produced a dozen 100+ carat gems, including the largest diamond ever mined in Angola, the 404 carat 4th February diamond, which sold for US$16 million in 2016.

Lucapa Diamond’s 404 carat 4th February diamond, recovered in 2016. Image courtesy of Lucapa Diamond.

This is an updated version of an article first published by the Investing News Network in February 2020.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.