Wyoming is in the midst of a uranium mining renaissance at a time when governments at both the federal and local level are backing domestic energy production. A few of the uranium industry’s rising stars are gaining a strong foothold in the Cowboy State.

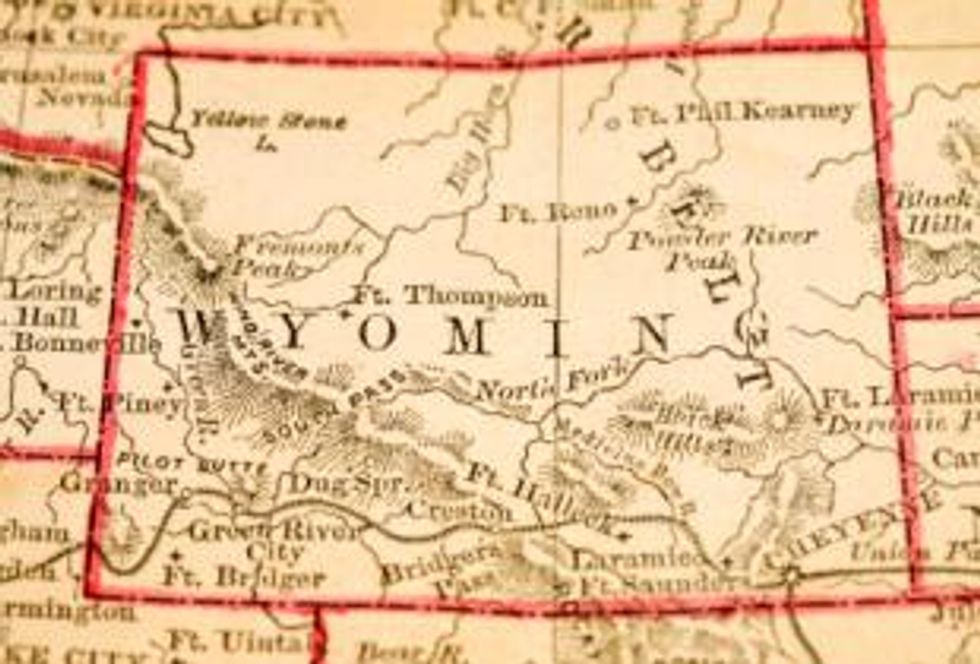

Uranium was first discovered in the state in 1949 and production during the early days centered on the Gas Hills district and the nearby Shirley Basin. Major deposits — including the famous Christensen Ranch and Smith Ranch deposits — in Wyoming’s most prolific uranium region, the Powder River Basin, were first discovered in the late 1960s. Since 1995, Wyoming has been the state leader in US uranium production, with two operating mines and an estimated 167,000 metric tons (MT) of U308, the largest known uranium ore reserves of any state. Several projects in the state are now at various stages of exploration and development and there are even a few near-term producers.

For now, Wyoming’s uranium is used to power nuclear plants elsewhere, but the state legislature’s Task Force on Nuclear Energy Production wants to start using the state’s uranium resources at home. Earlier this month, the task force voted to support a bill that will allow temporary storage of nuclear reactor waste — a measure needed to smooth the way for the approval of a nuclear power plant. According to State Senator Stan Cooper (R-Kemmerer), Wyoming’s largest utility company, Rocky Mountain Power, has voiced interest in constructing such a plant in the state.

Two of the United States’ five in-situ leach processing plants are located in Wyoming: the Smith Ranch-Highland operation (annual production capacity of 4 million pounds U308) and the Willow Creek project (annual production capacity of 1.3 million pounds U308).

Wyoming’s uranium producers

Both of Wyoming’s producing uranium mines are in the resource-rich Powder River Basin — a region that also straddles Montana and is known for its prolific coal deposits. Cameco’s (TSX:CCO,NYSE:CCJ) Smith Ranch-Highland operation includes the United States’ largest uranium production facility; it produced 1.4 million pounds U308 in 2011. The mine has proven and probable reserves totaling 6.6 million pounds U308.

Uranium One’s (TSX:UUU) Willow Creek mine commenced full production in May of this year following a 17-month pilot-production program. Operations at Willow Creek have a production capacity of 1.3 million pounds of U308; however, the company plans to expand that capacity to 2.5 million pounds per year. The mine’s opening caused a bit of stir in the US media given that the company is partially owned by Russian uranium giant ARMZ.

Juniors nearing production

A few of the uranium industry’s rising stars are gaining a strong foothold in the Cowboy State, including Colorado-based Energy Fuels (TSX:EFR), Uranerz Energy (TSX:URZ,AMEX:URZ) and Ur-Energy (TSX:URE,AMEX:URG).

Energy Fuels acquired the Sheep Mountain project in February through a merger with Titan Uranium and has brought the brownfields project through to the advanced permitting stage. The historically-producing mine is located in the Crooks Gap mining district of Wyoming, near Jeffrey City. The property was first developed by Western Nuclear in the 1950s and produced U308 up through the 1980s, when the bottom fell out of the uranium market.

Energy Fuels has completed an updated preliminary feasibility study on the project based on using both conventional underground and open-pit mining techniques along with heap-leach recovery. The mine has a maximum annual capacity of 1.5 million pounds U308 over a mine life of 15 years. The best case scenario shows a pre-tax internal rate of return of 42 percent with a net present value (NPV) of $201 million at a 7 percent discount rate and a NPV of $146 million at a 10 percent discount rate after an initial CAPEX of $109 million.

The company has submitted an operations plan to the Bureau of Land Management and has initiated the application process for a Source Material License from the US Nuclear Regulatory Commission. First production at Sheep Mountain is anticipated to commence in 2015.

Once in production, the Sheep Mountain mine, along with the company’s recently-acquired Denison assets in the US — the White Mesa uranium and vanadium mill in Utah and producing mines and exploration properties in Utah, Colorado and Arizona — will further secure Energy Fuels’ position as the largest US uranium and vanadium production and development company, responsible for nearly a third of the nation’s uranium production.

Uranerz Energy holds a large land position in Wyoming’s Powder River Basin and plans to be “America’s next ISR uranium producer in 2013” with the commissioning of its Nichols Ranch mine — potentially the state’s first new uranium mine since 1996.

On Tuesday, the company announced that the Wyoming Department of Environmental Quality has issued a deep-disposal well permit to the project, which is the last permit required to begin commercial uranium production. “The project is licensed for a production level of up to two million pounds of uranium per year with initial annual production targeted for 600,000 to 800,000 pounds after ramp-up,” the press release states. “The project will also serve as a platform to develop the Company’s other Powder River Basin properties with enhanced economics for adjacent and satellite projects.”

Uranerz will install two deep-disposal wells this winter while completing the remaining construction activities, with first production anticipated in early 2013.

Ur-Energy also received the green light this month for its Wyoming-based uranium play in the Great Divide Basin — the Lost Creek ISR project. On October 5, the Bureau of Land Management approved the project’s operations plan, marking the final regulatory authorization needed to initiate construction and production.

Over the next six to nine months, Ur-Energy plans to invest $30 million to $40 million toward making Lost Creek production-ready by the summer of 2013. Engineering for the facility is complete, and mine planning is at an advanced stage for the first two mine units. Once in production, the company expects the project will produce 1 million pounds annually for a total of more than 7 million pounds of uranium over the life of the mine. Total cost of uranium production is estimated at $36.52 per pound U308 and pre-tax lifetime net earnings are estimated at $283 million.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.