Energy Fuels Announces Initial Results of Test-Mining Program Targeting Vanadium at La Sal Complex; Update on Recent Positive Federal Actions

Energy Fuels Inc. (TSX:EFR, NYSEMKT:UUUU) (“Energy Fuels” or the “Company”) is pleased to provide the following updates on activities at the Company’s La Sal Complex of uranium/vanadium mines, in addition to recent positive federal government actions that affect the Company’s projects.

Energy Fuels Inc. (TSX:EFR, NYSEMKT:UUUU) (“Energy Fuels” or the “Company”) is pleased to provide the following updates on activities at the Company’s La Sal Complex of uranium/vanadium mines, in addition to recent positive federal government actions that affect the Company’s projects.

Initial Results of Test-Mining Program Targeting Vanadium at La Sal Complex

As previously announced, the Company has commenced a limited conventional vanadium mining program at its 100% owned and fully permitted and constructed La Sal Complex of uranium/vanadium mines in Utah. The purpose of the test-mining program is to evaluate different approaches that selectively target high-grade vanadium zones, thereby potentially increasing productivity and mined grades for vanadium and decreasing mining costs per pound of V2O5 and U3O8 recovered. After three weeks of test mining and evaluation, the Company is discovering areas of high-grade vanadium mineralization that were not previously mined due to the relatively lower uranium grades in the material.

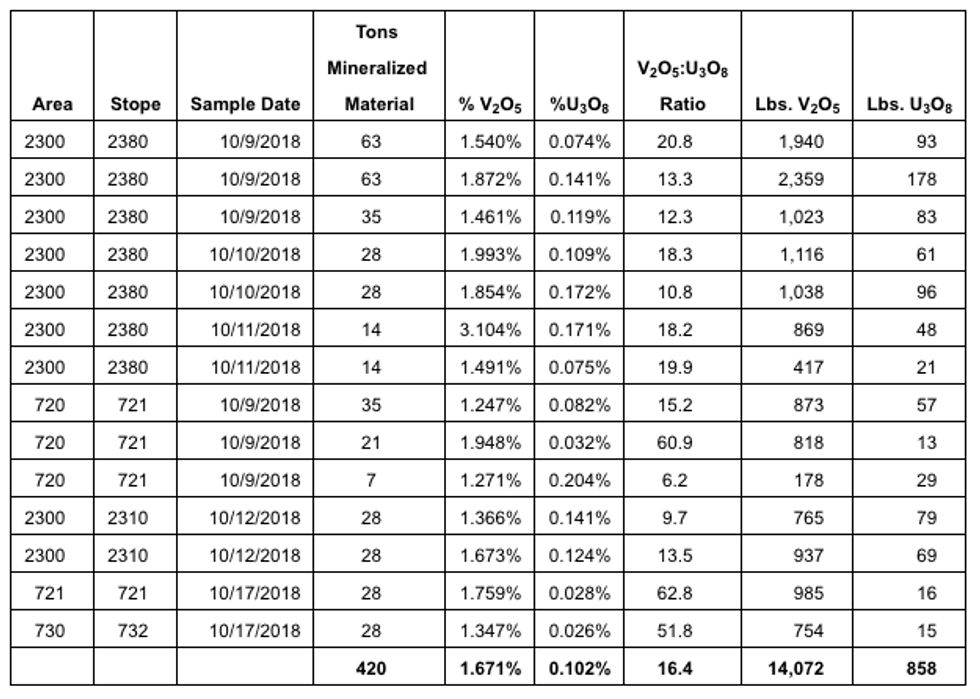

While the test mining campaign is still in its early stages, the Company is pleased to provide the following assay results from the initial 420 tons of material mined and sampled to date:

- All data presented in the table above are the result of the following mining, evaluation, and laboratory QA/QC procedures. Company personnel blast and remove the mineralized material from the mine, and transport it to an ore pad on the mine surface using a seven-ton truck. After the material is dumped on the stockpile pad, representative samples from various locations in each seven-ton pile are sampled randomly. The Company believes that blasting, mucking, transporting, and dumping adequately mixes the material in each pile, allowing for representative sampling. Approximately, ten pounds of sample material is collected from each seven-ton pile. All samples are analyzed at the Company’s White Mesa Mill using titration chemical analysis for vanadium and spectrophotometric analysis for uranium, in each case following the Mill’s standard quality assurance program and quality control measures.

Historically, when uranium was targeted for production at the La Sal Complex, the recovered vanadium-to-uranium ratio was approximately 5-to-1. By targeting vanadium, the samples in the above table show a ratio of over 16-to-1 vanadium-to-uranium, including an average vanadium grade of 1.675% and an average uranium grade of 0.102% U3O8. Assuming average historic recoveries at the Company’s White Mesa uranium/vanadium mill of approximately 95% uranium and 70% vanadium, using these results, the Company would expect to recover approximately 23.5 pounds of V2O5, and 1.9 pounds of U3O8, per ton of the mineralized material that has been mined to date under this program. Today, the uranium spot price is $27.75 per pound (TradeTech), and the vanadium price is $24.80 per pound (Metal Bulletin).

While not intended to represent a resource or reserve estimate or economic evaluation, this test mining program is demonstrating two key points to the Company. First, high-grade vanadium associated with lower grade uranium exists in the La Sal mine complex. This mineralized material was either not detected in the past or not mined due to its relatively lower uranium grade. Second, the Company now has the technology to identify this mineralization, which was not available historically. This material is attractive at current vanadium prices, and would have been attractive during previous mining campaigns had the vanadium grades been identified at those times. These two key points confirm the Company’s belief that further study is required to determine the extent of this additional mineralized material at the La Sal Complex and other uranium/vanadium mines owned or controlled by the Company, and the impacts such additional mineralized material may have on the mining costs per pound of V2O5 and U3O8 recovered from these mines.

The Company plans to continue the test-mining program and recover, sample, and evaluate a minimum of 5,000 tons of mineralized material. The Company also plans to conduct additional surface exploration drilling that targets high-grade vanadium mineralization at the La Sal Complex. Furthermore, as previously announced, the Company expects to resume vanadium production from tailings pond solutions, which result from past mineral processing operations, at its White Mesa Mill in November 2018, at an expected rate of approximately 200,000 to 225,000 pounds of V2O5 per month, up to a total of approximately 4 million pounds of V2O5, subject to market conditions, costs, and recoveries.

Mark S. Chalmers, President and CEO of Energy Fuels, stated: “Today, Energy Fuels is pursuing a number of exciting vanadium-related opportunities. In addition to resuming production from existing pond solutions at the White Mesa Mill in a few weeks, we are looking to build a longer-term vanadium production profile at our uranium/vanadium mines. While we’re still in the early stages of this vanadium test-mining program, we wanted to show the market some of the positive results we’re already seeing thus far. As we suspected, there may be large zones of high-grade vanadium mineralization in the La Sal Complex that were never mined in the past, because they contain relatively lower-grade uranium mineralization. If we continue to see similar results as the program advances, it is our hope that we can mine the La Sal Complex in a manner that targets vanadium during periods of elevated vanadium prices, even during periods of lower uranium prices. The ability to target higher-grade vanadium zones, separately and independently from higher-grade uranium zones in these mines may be, we believe, a true paradigm shift in the way these mines can be mined going forward. We will continue to pursue our test-mining program, and we look forward to providing the market with additional results in the future as these become available.

“Energy Fuels is pleased to be the only company in the U.S. that can provide shareholders with near-term exposure to both vanadium and uranium production, as market conditions warrant. The Company’s White Mesa Mill is the only mill in the United States capable of recovering vanadium from conventionally mined ores, and Energy Fuels-owned or controlled mines are the only vanadium mines that currently have access to the White Mesa Mill.”

Final Federal Approval for La Sal Complex Expansion Plan of Operations

The Company is also pleased to announce that the Manti-La Sal National Forest has issued their final approval for the La Sal Complex Plan of Operations Amendment. The Company is now fully authorized by the U.S. Forest Service (“USFS”) and Bureau of Land Management (“BLM”) to move forward with the expansion of mining operations, exploration drilling, and vent shaft construction at the La Sal Complex. This follows the February 2018 issuance of the Environmental Assessment (“EA”), Decision Record/Notice, and Finding of No Significant Impact (“FONSI”) approving the expansion of a large portion of the La Sal Complex, pending certain conditions including having the required reclamation bond in place. All of those conditions have now been fully met.

EPA Withdraws Unnecessary Proposed Rule

On October 19, 2018, the U.S. Environmental Protection Agency (“EPA”) officially withdrew its January 19, 2017 proposed rule that would have revised 40 CFR Part 192, “Health and Environmental Standards for Uranium and Thorium Mill Tailings.” This proposed rule would have primarily affected in situ uranium recovery (“ISR”) facilities, like the Company’s Nichols Ranch and Alta Mesa ISR Projects, and could have imposed unnecessary, duplicative, and expensive additional requirements on ISR facilities in the U.S. with no resulting benefits to human health or the environment. The EPA decision to withdraw the rulemaking was partially driven by their belief that “existing regulatory structures are sufficient to ensure the targeted protection of public health and the environment at existing ISR facilities.” The EPA’s decision removes a significant risk factor for the Company’s current and future ISR operations.

Mark S. Chalmers continued: “Energy Fuels is also pleased to see positive news on the federal regulatory front. The U.S. leads the World in the protection of human health and the environment, and Energy Fuels would not want it any other way. However at times, regulatory agencies may pursue misguided regulatory actions. We look forward to continuing to provide our input to regulatory agencies and make sure that the U.S. remains the leader in responsible uranium production.”

Mark S. Chalmers, P.E., is a Qualified Person as defined by Canadian National Instrument 43-101 and has reviewed and approved the technical disclosure, including sampling, analytical, and test data underlying the information, contained in this news release.

About Energy Fuels: Energy Fuels is a leading integrated US-based uranium mining company, supplying U3O8 to major nuclear utilities. Its corporate offices are in Denver, Colorado, and all of its assets and employees are in the western United States. Energy Fuels holds three of America’s key uranium production centers, the White Mesa Mill in Utah, the Nichols Ranch Processing Facility in Wyoming, and the Alta Mesa Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today and has a licensed capacity of over 8 million pounds of U3O8 per year. The Nichols Ranch Processing Facility is an ISR production center with a licensed capacity of 2 million pounds of U3O8 per year. Alta Mesa is an ISR production center currently on care and maintenance. Energy Fuels also has the largest NI 43-101 compliant uranium resource portfolio in the U.S. among producers, and uranium mining projects located in a number of Western U.S. states, including one producing ISR project, mines on standby, and mineral properties in various stages of permitting and development. The Company also produces vanadium as a by-product of its uranium production from certain of its mines on the Colorado Plateau, as market conditions warrant. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU”, and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR”. Energy Fuels’ website is www.energyfuels.com.

Cautionary Note Regarding Forward-Looking Statements: Certain information contained in this news release, including any information relating to the Company being a leading producer of uranium and vanadium in the U.S.; any expectations relating to potential increases in productivity and mined grades for vanadium and decreases in mining costs at the La Sal Complex or any other mines; any expectations about uranium and vanadium recovery rates and expected pounds of uranium and vanadium that may be recovered at the White Mesa Mill; any expectation that the Company plans to continue the test mining program and the tons of mineralized material that may be recovered, sampled and evaluated under the program; any expectation that the Company plans to conduct additional surface exploration drilling that targets high-grade vanadium at the La Sal Complex; any expectation that the Company plans to resume vanadium production from existing pond solutions at the Mill and any expected vanadium recoveries from such solutions; any expectations that high-grade vanadium associated with lower grade uranium exists in the La Sal mine complex or in any other mines, and the extent to which it may exist; any expectation that the Company now has the technology to identify higher-grade vanadium mineralization; any expectation about the attractiveness of higher-grade vanadium mineralized material at current vanadium prices or during previous mining campaigns; any expectation that the Company plans to build a longer-term vanadium production profile at its mines; any expectation that the Company may be able to mine its mines in a manner that targets vanadium during periods of elevated vanadium prices even during periods of lower uranium prices; any expectation that the Company can provide shareholders with near-tem exposure to both vanadium and uranium production as market conditions warrant, and any expectation that the Company may be the only company in the US that is able to do so; and any other statements regarding Energy Fuels’ future expectations, beliefs, goals or prospects; constitute forward-looking information within the meaning of applicable securities legislation (collectively, “forward-looking statements”). All statements in this news release that are not statements of historical fact (including statements containing the words “expects”, “does not expect”, “plans”, “anticipates”, “does not anticipate”, “believes”, “intends”, “estimates”, “projects”, “potential”, “scheduled”, “forecast”, “budget” and similar expressions) should be considered forward-looking statements. All such forward-looking statements are subject to important risk factors and uncertainties, many of which are beyond Energy Fuels’ ability to control or predict. A number of important factors could cause actual results or events to differ materially from those indicated or implied by such forward-looking statements, including without limitation factors relating to: the Company being a leading producer of uranium and vanadium in the U.S.; any expectations to resume vanadium production at the Mill; any expectations relating to expected vanadium recoveries from the Mill pond and cash flows; the Company being a leading producer of uranium and vanadium in the U.S.; any expectations relating to potential increases in productivity and mined grades for vanadium and decreases in mining costs at the La Sal Complex or any other mines; any expectations about uranium and vanadium recovery rates and expected pounds of uranium and vanadium that may be recovered at the White Mesa Mill; any expectation that the Company plans to continue the test mining program and the tons of mineralized material that may be recovered, sampled and evaluated under the program; any expectation that the Company plans to conduct additional surface exploration drilling that targets high-grade vanadium at the La Sal Complex; any expectation that the Company plans to resume vanadium production from existing pond solutions at the Mill and any expected vanadium recoveries from such solutions; any expectations that high-grade vanadium associated with lower grade uranium exists in the La Sal mine complex or in any other mines, and the extent to which it may exist; any expectation that the Company now has the technology to identify higher-grade vanadium mineralization; any expectation about the attractiveness of higher-grade vanadium mineralized material at current vanadium prices or during previous mining campaigns; any expectation that the Company plans to build a longer-term vanadium production profile at its mines; any expectation that the Company may be able to mine its mines in a manner that targets vanadium during periods of elevated vanadium prices even during periods of lower uranium prices; any expectation that the Company can provide shareholders with near-tem exposure to both vanadium and uranium production as market conditions warrant, and any expectation that the Company may be the only company in the US that is able to do so; and other risk factors as described in Energy Fuels’ most recent annual report on Form 10-K and quarterly financial reports. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law. Additional information identifying risks and uncertainties is contained in Energy Fuels’ filings with the various securities commissions which are available online at www.sec.gov and www.sedar.com. Forward-looking statements are provided for the purpose of providing information about the current expectations, beliefs and plans of the management of Energy Fuels relating to the future. Readers are cautioned that such statements may not be appropriate for other purposes. Readers are also cautioned not to place undue reliance on these forward-looking statements, that speak only as of the date hereof.

Click here to connect with Energy Fuels Inc. (TSX:EFR, NYSEMKT:UUUU) for an Investor Presentation.

Source: www.newswire.ca