US Gross Refinery Inputs Hit Record Levels for Four Consecutive Weeks

The US Energy Information Administration reported that the gross inputs to US refineries has exceeded 17 million barrels per day every week in the past four weeks, reaching a level not previously hit since the EIA began publishing the data in 1990.

The US Energy Information Administration reported that the gross inputs to US refineries has exceeded 17 million barrels per day every week in the past four weeks, reaching a level not previously hit since the EIA began publishing the data in 1990.

As quoted in the market news:

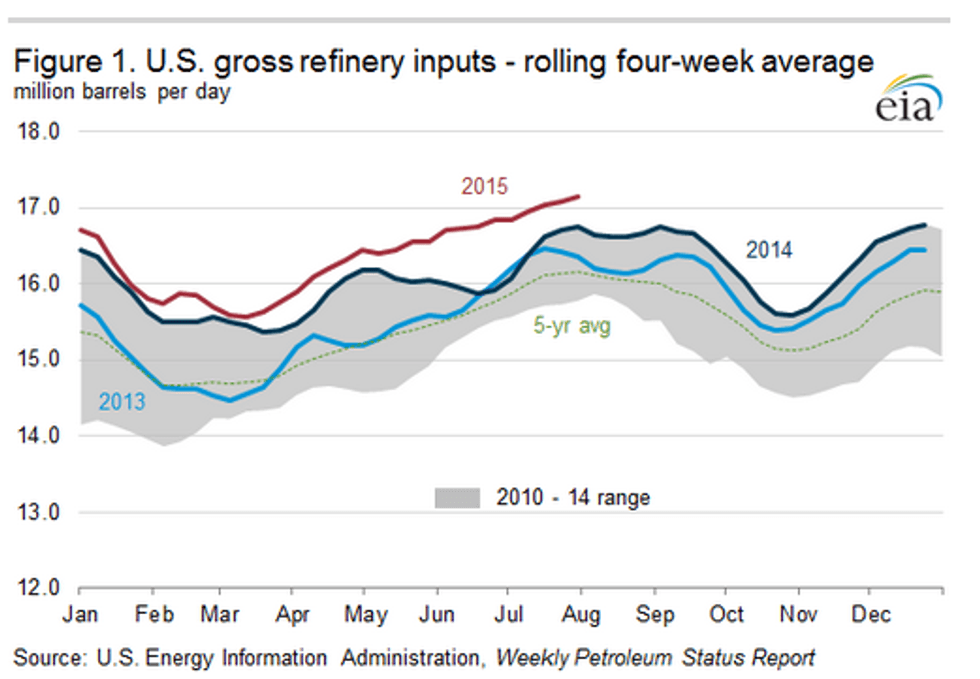

The rolling four-week average of U.S. gross refinery inputs has been above the five-year range every week so far this year (Figure 1). The record high gross inputs reflect both higher refinery capacity and higher utilization rates. Lower crude oil prices and strong demand for petroleum products, primarily gasoline, both in the United States and globally have led to favorable margins that encourage refinery investment and high refinery runs.

Gulf Coast refinery margins are currently supported by high gasoline crack spreads that reached a peak of 66 cents per gallon (gal) on July 8, a level not reached since September 2008 (Figure 2). For the past several years, distillate crack spreads have consistently exceeded those for gasoline, but since May this trend has reversed. From 2011 to 2014, distillate crack spreads (calculated using Gulf Coast spot prices for Light Louisiana Sweet crude oil, conventional gasoline, and ultra-low sulfur distillate) averaged a 24 cents/gal premium over gasoline crack spreads, but that premium has fallen to an average 2 cents/gal so far this year. Since May 20, Gulf Coast gasoline crack spreads have averaged 17 cents/gal higher than distillate crack spreads. Higher demand for gasoline is supporting these margins. Total U.S. motor gasoline product supplied is up 2.9% through the first five months of 2015, and trade press reports indicate that demand is also higher in Europe and India so far this year compared with 2014.

The U.S. average retail price for regular gasoline decreased six cents from last week to $2.69 per gallon as of August 3, 2015, down 83 cents from the same time last year. The West Coast and Midwest prices both decreased seven cents per gallon, to $3.48 per gallon and $2.52 per gallon, respectively. The East Coast and Gulf Coast prices each declined five cents, to $2.58 per gallon and $2.39 per gallon, respectively. The Rocky Mountain price decreased three cents to $2.83 per gallon.

Click here to read the full US Energy Information Administration report.